The Labor Department reported that there were 200,000 jobs created in the U.S. economy in January. This was above the consensus expectation of 180,000 jobs. This marked the 88th consecutive month of positive job gains for the U.S. economy. Revisions subtracted 24,000 jobs to the prior two months. For all of 2017, the economy generated 2.2 million jobs. This marks the second time on record that the economy has created at least 2 million jobs a year for seven consecutive years (the first time was in the 1990s). The 2.1 million increase was less than the 2.3 million gain in 2016, however.

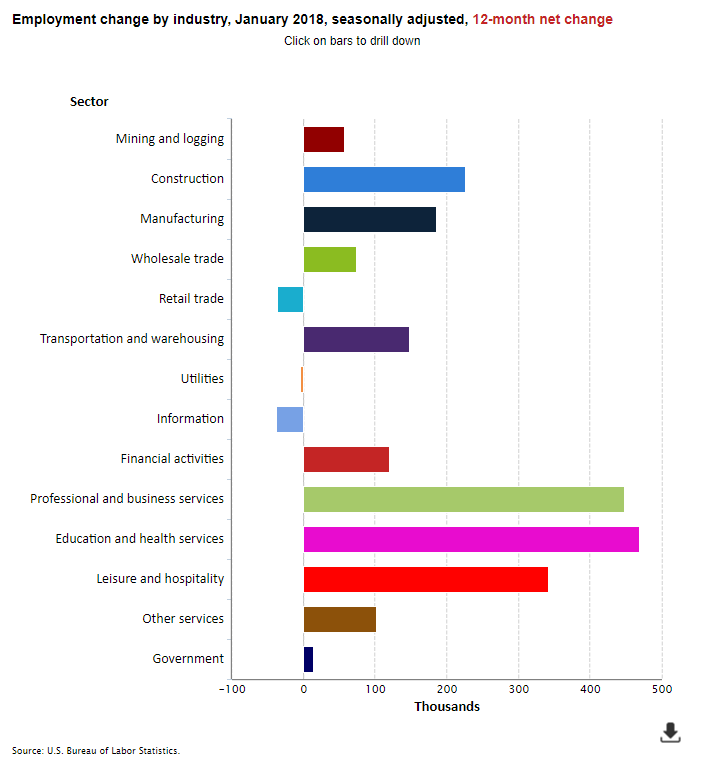

Health care added 21,000 jobs in January. In the past twelve months, health care added an average of 24,000 jobs.

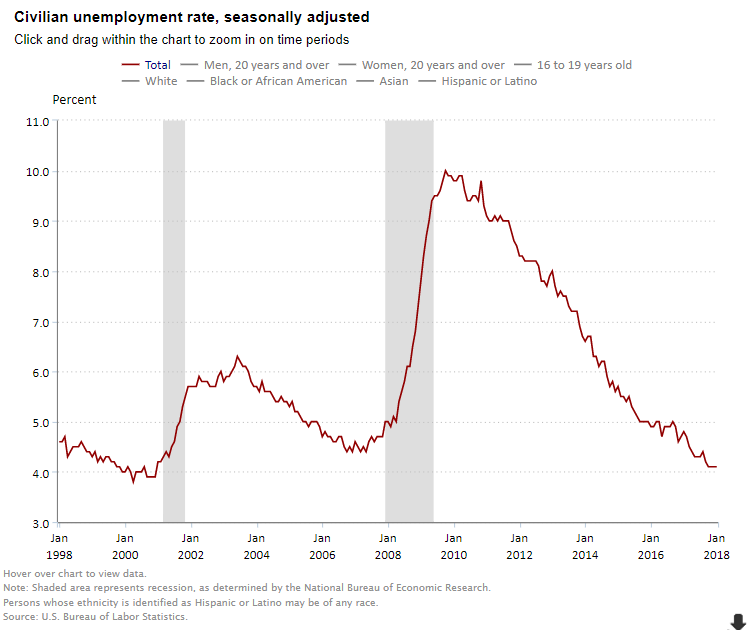

The unemployment rate remained unchanged for the fourth consecutive month at a 17-year low of 4.1% in January. This is below the rate of what the Federal Reserve believes is the “natural rate of unemployment” and suggests that there will be upward pressure on wage rates.

In fact, average hourly earnings for all employees on private nonfarm payrolls rose in January by nine cents to $26.74. Over the past 12 months, average hourly earnings have increased by 75 cents, or 2.9%. This is the most since June 2009. A separate report from the BLS this week—the Employment Cost Index report—showed that private sector wages and salaries rose by 2.8% in the last three months of 2017, compared with year-earlier rates. This was the fastest growth since the recession. It is also notable that 18 states began the new year with higher minimum wages.

The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.4 million and accounted for 21.5% of the unemployed. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—rose to 8.2% from 8.1% in December but was down from 9.2% as recently as December 2016.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work remained at 62.7%, near the lowest level since the 1970s. This measure has generally been very low by historic standards, at least partially reflecting the effects of retiring baby boomers.

Today’s report will support expected increases in interest rates through 2018 by the Federal Reserve, with the first 25 basis point increase likely happening in March 2018. The Fed has raised rates by a quarter percentage point five times since late 2015, and most recently to a range between 1.25% and 1.50% in December 2017, after keeping them near zero for seven years. This past week, Janet Yellen led her last FOMC meeting, paving the way for Jerome Powell to take the helm of the Federal Reserve.