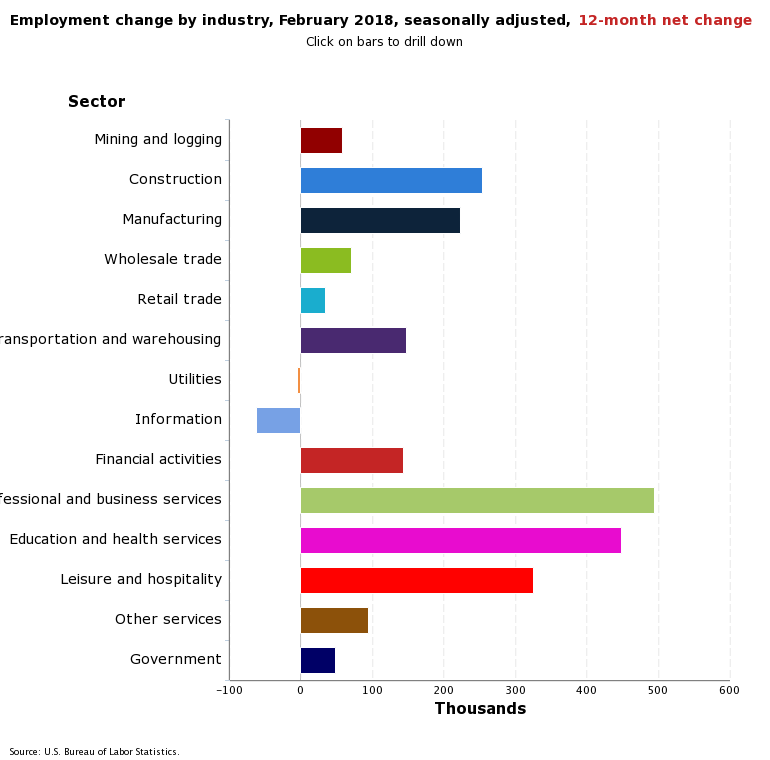

The Labor Department reported that there were 313,000 jobs created in the U.S. economy in February. This was above the consensus expectation of 205,000 jobs. This marked the 89th consecutive month of positive job gains for the U.S. economy. Revisions added 54,000 jobs to the prior two months.

The labor force participation rate, which is a measure of the share of working age people who are employed or looking for work rose by 0.3 percentage point to 63% as strong job opportunities seemed to draw unengaged workers back into the labor force. Nevertheless, this remains quite low by historic standards, at least partially reflecting the effects of retiring baby boomers.

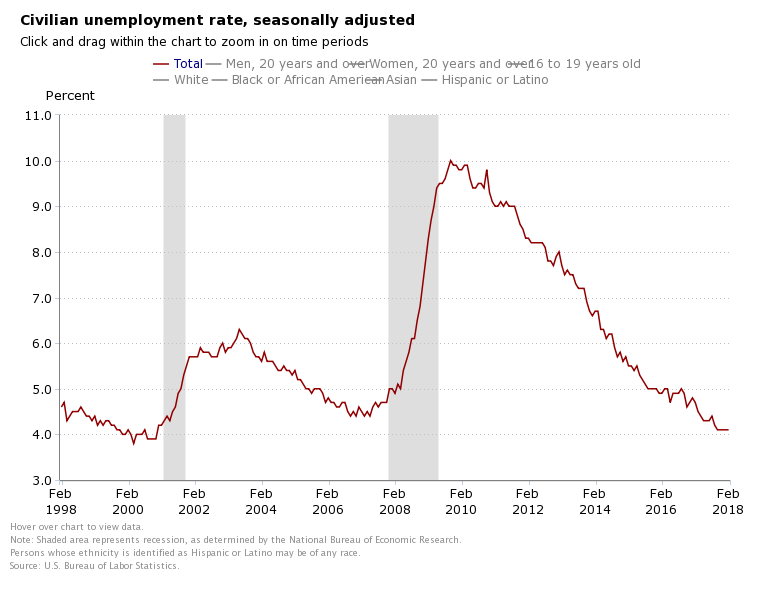

The unemployment rate remained unchanged for the fifth consecutive month at a 17-year low of 4.1% in February. This is below the rate of what the Federal Reserve believes is the “natural rate of unemployment” and suggests that there will be upward pressure on wage rates. The number of long-term unemployed (those jobless for 27 weeks or more) was little changed at 1.4 million and accounted for 20.7% of the unemployed. A broader measure of unemployment, which includes those who are working part time but would prefer full-time jobs and those that they have given up searching—the U-6 unemployment rate—was unchanged at 8.2% but was down from 9.2% as recently as December 2016.

Average hourly earnings for all employees on private nonfarm payrolls rose in February by four cents to $26.75. Over the past 12 months, average hourly earnings have increased by 68 cents, or 2.6%. This was less than the 2.9% increase seen in January, when markets became spooked about accelerating wage pressures.

Health care added 19,000 jobs in February. In the past twelve months, health care has added 290,000 jobs.

The February jobs report will provide further support for increases in interest rates through 2018 by the Federal Reserve, with the first 25 basis point increase likely happening at the March 20/21st FOMC meeting. The Fed has raised rates by a quarter percentage point five times since late 2015, and most recently to a range between 1.25% and 1.50% in December 2017, after keeping them near zero for seven years. If the Fed raises rates next week, it will be the first overt action by Jerome Powell, the new Chair of the Federal Reserve.