With over 2,400 registrations, the year’s most important senior housing and care conference proved yet again to be a ‘can’t-miss’ event for industry leaders. Despite a lingering pandemic, and strictly observed safety protocols, including required proof of vaccination, as well as hundreds of cancelled flights nationwide, ‘the NIC’ made a triumphant return to in-person networking and thought leadership. Attendees, nearly 70% of whom are in senior executive roles, were, for the first time in 20 months, able to convene to build relationships, make deals, and share the latest data and insights, in person and face-to-face.

Changes to the structure of the event, including the replacement of sit-down table service dining with more flexible, convenient, and safe ‘NIC Market Café’ offerings proved to be popular. Networking was facilitated not only with events, but with large, comfortable dedicated networking areas, featuring passed food and cocktails. Every day, smaller groups could be seen gathering throughout the beautiful Marriott Marquis Houston, where NIC had placed a multitude of convenient seating and working areas suitable for more intimate discussions.

There was no shortage of food, drink, and pampering throughout the event, which took full advantage of the entirety of the beautiful 5-year-old hotel located downtown, just a block from the Houston Astros’ baseball stadium, Minute Maid Park. Some attendees managed to find tickets for Game Six of the 2021 World Series, a coincidental, but, for baseball fans, exciting and memorable treat. Others found time to conduct business poolside, taking advantage of 80-degree sunny days, and a giant Texas-shaped lazy river, as well as an infinity pool with views of the Houston skyline.

A more streamlined program of educational sessions provided attendees both with more time to network, and a more focused program, defined by the most relevant and timely issues facing senior housing leaders today. Sessions were very well attended in a hall featuring a wide variety of comfortable seating options, as well as more productivity-oriented tables set up with ac power outlets and chargers. Many attendees enjoyed sitting in living room-style comfy chairs and couches. Live streaming areas provided additional options to take in the ten-session program. Below are a few highlights and quotes from the sessions, all of which were made available to attendees in high quality video.

As Monday’s first session, “The Investment Market for Active Adult,” kicked off the program, NIC President & CEO Brian Jurutka made a few remarks, saying, “Welcome back!” to a standing room only (but socially distanced) room. The highly anticipated discussion focused on an emerging property type gaining increased interest among investors and developers.

In “Capital for Operations: Aligning Incentives,” a panel of seasoned industry veterans discussed the importance of aligning incentives to manage increased costs, fund growth, and improve operating efficiencies, as well as the value of building relationships with quality operations teams. “The one thing investors know: the quality of services delivered in the facility is directly correlated to the financial performance,” said Brian Beckwith, CEO, Arcus Healthcare Partners.

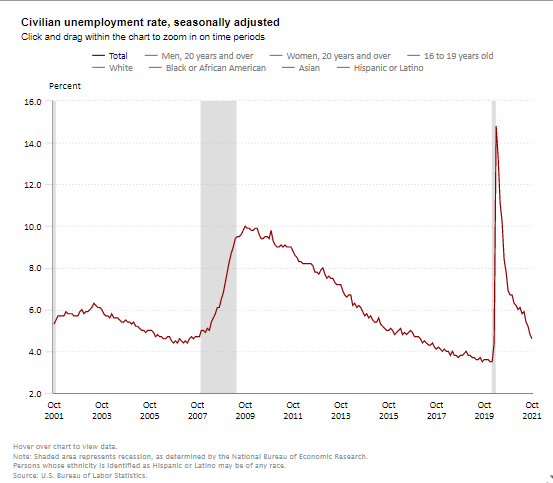

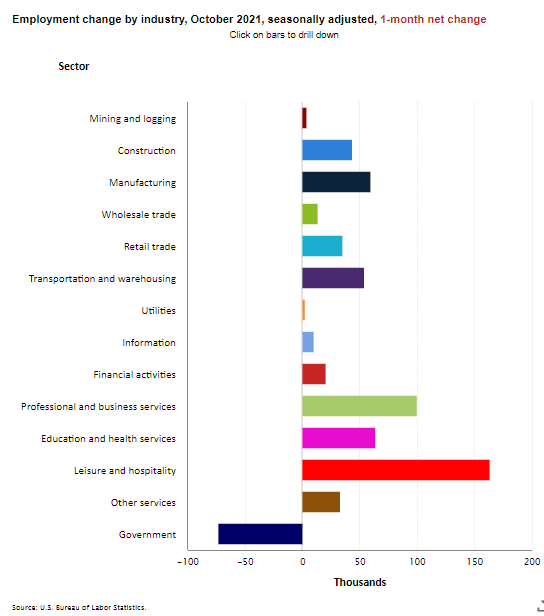

Two of America’s most accomplished and respected economists discussed macroeconomics even as the Federal Open Market Committee (FOMC) was meeting in Washington, DC. In “Macroeconomic and Capital Market Trends: A Conversation with Paul Krugman and Dr. Lawrence H. Summers” Nobel prize-winning economist Paul Krugman and Former Secretary of the U.S. Treasury Dr. Lawrence H. Summers delivered a master class, and a few opposing, but enlightening, views, on the state of the U.S. economy to kick off another day of relevant, actionable insights at ‘the NIC.’

Both economists appeared concerned about the prospect of high inflation rates as they debated the impact of likely Federal Reserve Board responses. NIC has released a short video of the exchange on its LinkedIn and Youtube accounts, and every registrant is being provided with access to every session’s complete video recording.

The “Policy Impact and Outlook: A Conversation with Industry Leaders” session focused on policy with leaders of the industry’s key associations. “Overwhelmingly, COVID has not had an impact on the consumer’s likelihood to move into one of these communities. I think it is a testament to [our] ability to get out there and change the perception of what was really happening in these buildings,” noted the President of the American Senior Housing Association, David Schless.

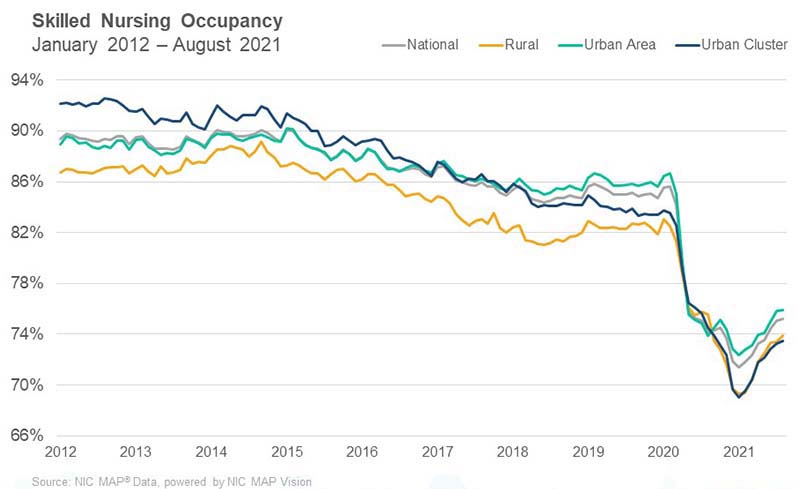

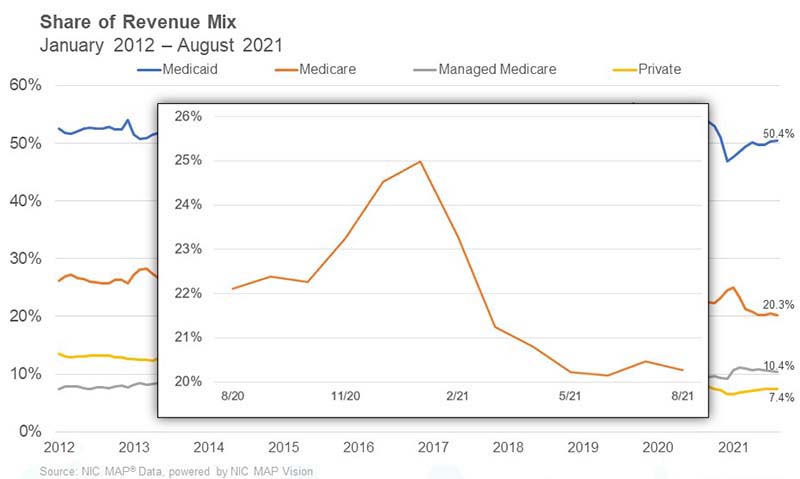

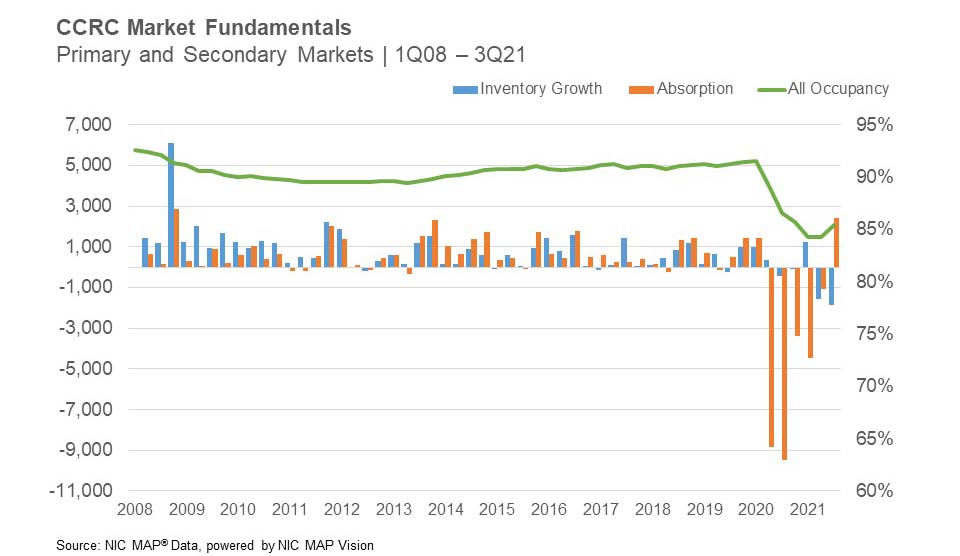

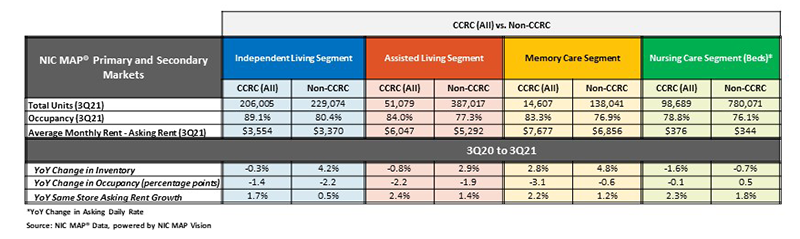

As the sector is beginning to experience anticipated occupancy growth, NIC brought a panel of experts together to discuss recovery. “Demand at your Doorstep: Who is Recovering Faster and Why?” featured a presentation of the very latest data and analysis from NIC Senior Principal, Lana Peck, revealing that, while a recovery does appear to be on the horizon, not everyone will necessarily get there at the same time.

Beth Mace, Chief Economist and Director of Outreach for NIC, led a highly anticipated discussion on “The Thesis for Investing in Senior Housing,” featuring Brian Sunday, Managing Director, AEW, John Moore, CEO, Atria Senior Living, and Steven Schmidt, National Director and Production Manager for Seniors Housing, Freddie Mac.

Despite acknowledging challenges, the panel provided plenty of reason to view the sector positively. “If you look at this industry, it was created for a need to take care of the elder population. That’s not going to change. There is a need for this product,” Sunday said, adding, “This industry has proven that it comes out stronger after disruptions.”

NIC’s middle day of sessions concluded with “Debt Market Trends and The Pace for Deal Making.” Lee Delaveris, Vice President, KeyBank Real Estate Capital; Imran Javaid, Managing Director, BMO Harris Bank; Kelly Sheehy, Principal and Managing Director, Artemis Real Estate; and moderator Aaron Becker, Senior Managing Director, Lument; discussed their expectations for inflation and interest rates, the pace of deal making in today’s market, how to look at performance, and the increased demand for bridge products.

The third and final day continued to draw attendees into three final sessions. Robert Kramer, Co-Founder & Strategic Advisor, NIC, and Founder & Fellow, Nexus Insights, began the “Rethinking Community: Places That Will Attract Future Older Adults” session with his observations on how and why the industry must adapt to meet the needs and expectations of a new generations of older adults. On the emerging active adult segment, he said, “Senior housing is care driven…a push market…you’re pushed into it because of your health. Active adult is a pull market.”

Following NIC Senior Principal Ryan Brooks’ presentation of the latest data on the ‘forgotten middle,’ innovators in the space discussed how they are developing solutions, in “Solving for the ‘Forgotten Middle’ Market.”

Tana Gall, President, Merrill Gardens and Truewood by Merrill, and Pilar Carvajal, CEO & Founder, Innovation Senior Living, shared how they are delivering care at reduced cost, renovating or repurposing existing buildings, achieving economies of scale, and more.

NIC concluded the final day of sessions with an entertaining, yet highly informative, take on the popular ‘Weekend Update’ segment of Saturday Night Live. “Property Valuations for Seniors Housing and Skilled Nursing,” featured co-hosts Ben Firestone, Executive Managing Director & Co-Founder, Blueprint, and Zach Bowyer, Managing Director, JLL, and a number of experts, all of whom came up to the stage one by one for ‘interviews’ on their particular perspectives.

Despite concerns over labor, Bowyer reflected a general sense of optimism, which could be felt through the entire program of educational sessions, and many discussions in hallways and meeting rooms. He said, “From an operational standpoint, the industry has transitioned from emergency response to recovery. Stabilized occupancy is rebounding. We’re seeing resurgence of demand, strong economic growth, and strong home sales.” Predicting occupancy rate re-stabilization within the next couple of years, he said, “that’s light at the end of the tunnel.”

Even as some attendees return home, NIC is planning its next major event, the 2022 NIC Spring Conference, to be held March 23–25, 2022, in Dallas, TX. Sign up to be notified when registration opens.

Subscribers to the NIC Insider and this blog will be able to read more in-depth articles and posts on key themes and discussions which occurred at the 2021 NIC Fall Conference. Subscribe today!