Is Seniors Housing Getting Too Frothy?

Kevin McMeen of MidCap Financial Provides Some Perspective on Why Today Isn’t a Replay of 2007

Kevin McMeen of MidCap Financial Provides Some Perspective on Why Today Isn’t a Replay of 2007

Kevin McMeen isn’t afraid to take a calculated risk. After all, he co-founded MidCap Financial in 2008 during a deep recession to provide debt solutions for health care companies, including seniors housing. But his instincts, and timing, were right. Under leadership by McMeen and his partners, MidCap has grown quickly.

Since 2013, MidCap has undergone a recapitalization and expanded beyond its core health care focus, serving numerous general commercial industries. And today MidCap has more than $3 billion of commitments under management.

Based in Chicago, McMeen recently spoke with NIC about the changing debt market and its impact on the future of seniors housing.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: How would you characterize today’s lending environment?

McMeen: It’s aggressive, but not overly so. Everyone likes to compare today’s market to what was going on in 2007. But there’s a difference. Before the recession, aggressive leverage was fueling the market. There were a lot of aggressive lenders enabling aggressive transactions, and they were not pricing for risk. Today, asset prices are not being fueled by aggressive leverage as much as they are by the low cost of capital due to low interest rates.

We break down lenders into three markets: banks, agencies (Fannie Mae, Freddie Mac), and non-banks. The agency and bank lenders are similar in terms of where they lend from a loan-to-value perspective. You might see some incrementally more aggressive underwriting among banks and agencies to win a transaction, but they’re generally very rational. If they are more aggressive, it generally seems to be with existing borrowers. Overall, they have a good level of discipline.

NIC: What about non-bank lenders such as MidCap?

McMeen: It’s a different ballgame. There are fewer players in the non-bank market than there used to be in seniors housing and long-term care. There’s also a lot more variability among the non-bank lenders. Risk is in the eye of the beholder. For example, we might get aggressive on a transaction because we’re comfortable with a borrower, business plan or market that others see as having higher risk and they take a more conservative position. We often underwrite complicated business plans, such as acquisitions of properties that need capital improvements or re-positioning.

NIC: Has the recapitalization and growth of MidCap changed your operation?

McMeen: We expected that growth and a successful track record would improve our ability to build a more cost effective balance sheet, which it has. That, in turn, has enabled us to price more competitively over time and pursue larger transactions. We’re also expanding from a specialized health care finance company into a general commercial finance company.

NIC: What types of seniors housing deals does MidCap prefer?

McMeen: We’re not focused on any one particular asset type. We’ll finance memory care, CCRCs, skilled nursing and assisted living—anywhere across the country. We don’t provide construction debt, but rather focus on acquisitions and recapitalizations.

NIC: MidCap recently completed transactions for several memory care facilities. How would you characterize the stand-alone memory care market?

McMeen: We’re seeing memory care transactions with certain sponsors and operators that are attractive. But we’re also seeing some deals we would question. We’re aggressive with the deals and operators we like and that we think can weather softness in a market.

NIC: MidCap recently financed the acquisition of two CCRCs in Texas. Do you expect to see further improvement in the residential housing and CCRC market?

McMeen: CCRCs are complex transactions that require in-depth analysis. The housing market has improved in a meaningful way and that gives us comfort that there are opportunities in CCRCs. But we need the right sponsor and operator in order to be comfortable.

NIC: You started MidCap during the recession. Have the deals from that period performed as expected? Were there any surprises?

McMeen: Our loans have generally performed as expected. Some outperformed and some underperformed, but overall, we’ve been very happy with our portfolio. One surprise we noticed was that some of the moderate to affordable types of properties did not get traction the way we thought they would. There’s price sensitivity in the middle market and we saw those assets struggle more than we anticipated. Though the economy eventually improved, and occupancies improved, it took longer to build occupancy than we and the operators anticipated.

NIC: Any lesson learned from the recession?

McMeen: The moderate income product is great because it appeals to a broad market. But those consumers don’t have the resources of people who live in a high-end building. Middle-market facilities can be a challenge in tough economic times.

NIC: What’s your outlook for lending to the sector?

McMeen: The lending market is in good shape. Lenders will continue to loosen underwriting as they compete for business. The market has another couple years to run before there’s a correction.

Interest rate will go up. The latest estimates are that they’ll go up this year. The rise will be slower than anticipated, unless the economy suddenly expands at a significant pace which doesn’t seem likely.

Everything happens in cycles. We’ve come out of the recession and we’ve had a positive economic environment for four years. At some point, the cycle will peak. I’m a little concerned about the volume of new construction in some markets. I don’t know if the next downturn will be driven by overbuilding, higher interest rates, or some “black swan” event. No one knows when that will happen or what the magnitude of the correction will be. But it’s a natural part of the economic cycle, and, in our view, represents a good opportunity. [/expand][cresta-social-share]

Thoughts from NIC’s Chief Economist, Interest Rates: When, If and What?

At its mid-June FOMC meeting, the Federal Reserve signaled it was moving closer to raising short-term interest rates later this year, perhaps as soon as September. The shift in policy would likely push the fed funds rate up in 25-basis point increments once or twice before year-end 2015. If this occurs, it would be the first time since 2008 (seven years!) that the Fed’s benchmark interest rate has not been zero, a significant sea change for both lenders and borrowers.

At its mid-June FOMC meeting, the Federal Reserve signaled it was moving closer to raising short-term interest rates later this year, perhaps as soon as September. The shift in policy would likely push the fed funds rate up in 25-basis point increments once or twice before year-end 2015. If this occurs, it would be the first time since 2008 (seven years!) that the Fed’s benchmark interest rate has not been zero, a significant sea change for both lenders and borrowers.

The Fed is only likely to pursue this path of action, however, if the economy appears to be strong enough to withstand the effects of higher interest rates. The Fed has also indicated that it will only shift away from its extraordinarily accommodative monetary policy if inflation moves back toward 2%. Many had thought that the Fed would announce an increase in rates at its June meeting, but a variety of measurements in the first quarter of 2015 indicated that the economy was weaker than anticipated, making many of the decision-makers at the Fed leery about raising interest rates. [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Changes in interest rates can impact seniors housing in a wide variety of ways, some negative and some positive. On the positive side of higher rates is the eventual effect on savings rates and earned interest income for consumers and residents of seniors housing properties. In a zero-interest rate environment, individuals had few options available for interest income generation that did not garner risk. Understandably, many were not willing to risk their hard-earned savings needed for day-to-day living expenses.

Higher interest rates also indicate that the Federal Reserve believes the economy has enough heft, strength and stamina to absorb the effects of a higher cost of capital. A stronger economy in turn will sustain the demand side of the seniors housing equation and help lead-generation, conversion rates and, ultimately, move-in rates, absorption levels and rent growth.

On the less positive side, higher rates will increase the cost of developing new seniors housing properties. All else being equal, a 100-basis point increase from 5.5% to 6.5% on a 10-year fixed rate $10,000,000 loan means a $5,000 monthly payment increase or $600,000 over the life of the mortgage–a 19% increase in costs for a 100-basis point change in rates. As rates rise, the economics of development will be affected and go-forward decisions on development activity likely will be paused or aborted. This will have many repercussions for businesses directly involved in development as well as for those with indirect ties to development activity.

For existing property operators, a pause in development may be perceived as a good thing if they are located in a metropolitan market that has high levels of new development, such as San Antonio, for example. For potential residents, a slowdown in development may be less positive if it means that fewer housing options are available to them.

Expansion and renovation projects may be less feasible in a higher interest rate environment as well. Moreover, for financiers, recapitalization opportunities may be less viable.

For REITs with seniors housing exposures as well for REITs in general, higher interest rates may also raise their cost of capital. This is because REITs are required to pay out 90% of their taxable income in dividends. While this increases shareholder return, it also means that REITs are often unable to finance expansion from operating income, and instead often must issue equity and debt for expansion and growth. Relying on debt typically causes REITs to be sensitive to changes in interest rates. Many REITs mitigate this risk to some degree by well-laddered and lengthy debt maturity schedules, but the threat still exists.

Cap rates and values may also be affected by a higher interest rate environment. Conventional wisdom would say that an increase in interest rates will lead to an increase in cap rates. If this occurs and if cap rates go up in lock step with interest rates and if property level NOI does not adjust, property valuations have to decline for the integrity of Cap Rate = NOI/Value to remain in place. That said, values could remain stable if (1) NOI grows either through increased revenues or reduced expenses (note that the latter may be challenging in light of upward pressures on wages, as discussed further below). And values could remain stable if (2) cap rates do not rise in lock step with interest rates, thereby allowing the risk premium, or the gap between the risk-free 10-year Treasury yield and the cap rates for seniors housing, to narrow; today, the risk premium averages 550 basis points. The risk premium could narrow if the perceived risk of investing in seniors housing declines. And this outcome is entirely possible since institutional investor interest in the sector is quite strong, keeping downward pressure on cap rates.

Putting these outcomes aside for a moment, it is important to emphasize that the magnitude of interest rate increases currently being discussed by analysts, pundits and officials are not huge and any adjustment in rates move them off of historic lows. The expectation and hope is that the increases will be orchestrated in a smooth and systematic way and that the markets will not overreact. That said, it has historically been challenging, however, to orchestrate such a smooth outcome.

Wage Pressures Starting to Mount

Upward wage pressure is starting to occur in many industries and locations across the nation. This is due partly to tighter labor market conditions as evidenced by the falling unemployment rate (5.5% as of May at the national level and down from 9.9% in late 2009) as well as partly to the recent and planned increases in the minimum wage rate in many cities and states. Indeed, the compensation component of the employment cost index grew 2.6% from year-earlier levels in the first quarter of 2015, the largest increase since 2008. Other measures of wage growth are also starting to show gains.

Further pressures will mount as legislated mandates take effect. The most recent increase announced was for the nation’s second largest city, Los Angeles, which will see its minimum wage rise from $9 an hour currently to $15 an hour by 2020.

Meanwhile, the battle continues over efforts to enact the 2013 Labor Department rules regarding home care workers’ pay. In early May, oral arguments were held in a court hearing regarding the Labor Department rules. A federal three-judge panel is expected to rule by the end of June. If the law goes into effect, third-party employers will be required to pay at least the federal minimum wage and overtime pay to any direct care workers, such as certified nursing assistants, home health aides, personal care aides, caregivers, and companions.

Many Households Are Ill-Prepared for Retirement

A recent study conducted by the Federal Reserve showed that many individuals are not adequately prepared for retirement (“Report on the Economic Well-Being of U.S. Households in 2014”, Board of Governors of the Federal Reserve System, May 2015; http://www.federalreserve.gov/econresdata/2014-report-economic-well-being-us-households-201505.pdf). This of course raises many questions regarding housing and care options for these individuals when and if they reach retirement. The study showed:

- 31% of non-retirees have no retirement savings or pension, including nearly a quarter of those older than 45.

- Even among individuals who are saving, fewer than half of adults with self-directed retirement savings are either mostly or very confident in their ability to make the right investment decisions for their retirement savings.

Consistent with a lack of preparedness for retirement:

- 38% of non-retired respondents say that they either do not plan to retire or plan to keep working as long as possible.

- Among lower-income respondents whose household income is less than $40,000 per year, 55% plan to keep working as long as possible or never plan to retire.

As always, I welcome your thoughts, comments and feedback.

Beth[/expand][cresta-social-share]

Health Care REIT Returns Underperforming Recently, Long-Term Case Positive

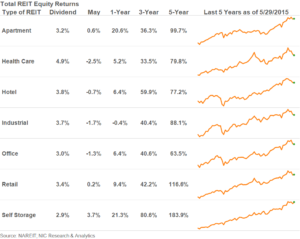

As rising interest rates are now a foregone conclusion, REIT equities returns have stumbled, as the demand for fixed-income products has diminished slightly. Health care REITs have lagged the market recently, as they tend to behave more like bonds than other REIT types due to their comparatively long lease structures. The rise of RIDEA structures should make health care REITs more competitive during rising interest rate environments, as they gain access to the operating profits, which are cyclical.

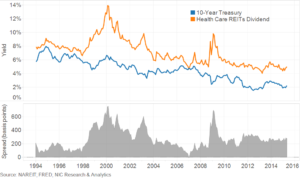

Since bottoming in February, 10-year treasury yields have risen from 1.7 percent to 2.3 percent, with health care REIT dividend yields moving in lockstep. While the spread to treasuries has hovered around 250 basis points recently, historically spreads have fluctuated quite a bit.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

This has contributed to their 1-, 3-, and 5-year returns drifting downwards to the lower end of the REIT spectrum. Despite soft returns recently, health care REITs have posted total returns of nearly 80% during the past five years, greater than that of hotel and office REITs. Among major REIT types, self-storage REITs have been by far the strongest performers, returning more than 180% in the past five years. The more comparable apartment sector has registered 5-year returns of nearly 100%, having benefited from a 21% gain during the past year.

While health care REITs returns haven’t been stellar in the past few months, the longer term investment outlook remains positive. Rising interest rates may be a determining force in the short-term, but the investment case remains compelling, with the inevitability of an aging population and strong sector fundamentals on its side. [/expand][cresta-social-share]

National Conference Looks Ahead to Next 25 Years Industry Veterans Reflect on Pivotal Advances

Perspective is a big advantage in business. It provides a narrative of how an industry has evolved and points to new directions.

As NIC approaches its 25th Anniversary, the theme of this year’s national conference is “The Next 25.” The conference is an opportunity for industry stakeholders to look ahead at emerging issues, such as shifting payment models, supply and demand dynamics, and affordability.

But NIC’s anniversary also provides a reason to look back and acknowledge how much the industry has grown and progressed. With that in mind, NIC asked former board chairs to share their reflections on significant changes in the sector and the product.

NIC spoke this month with William “Bill” Shine; Al Holbrook; and Randy Richardson. Here are their thoughts:[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

William “Bill” Shine is senior director, senior housing and healthcare group, Synovus Bank, Birmingham, Ala. The group is a significant provider of debt to the industry and has a portfolio of more than $1 billion. Shine served as NIC board chair from 1995 to 1997.

When we started in seniors housing, there were very few lenders in the space and it was a fragmented market. We put a lot of effort into creating a case for institutional investment in the sector. Based on the number of institutional investors in seniors housing today, I would say the investment case has been made. We’re seeing serious long-term capital in the industry on a repeat basis. NIC has achieved its primary promise: Not to be a trade group, but to provide information for investors to make decisions.

There’s more standardization in the industry now, and a common understanding of what constitutes an investment grade property among lenders, investors and the agency lenders—Fannie Mae and Freddie Mac. Twenty-five years ago, facilities were small and many looked institutional. Some weren’t purpose built. Skilled nursing properties had shared rooms and few private rooms. Today, facilities are bigger and have more amenities. They look more like high-end multi-family or condominium projects.

Consumer expectations have really matured too. They expect to see facilities in their home town that are not institutional and are designed more on a hospitality model. Seniors housing has become a well-accepted product due both to building design and focused caregiving.

Al Holbrook is chairman of Solomon Holdings and Trinity Lifestyles Management. Based in Alpharetta, Ga., the company owns and/or operates 22 communities, primarily in the Southeast. Holbrook served as NIC board chair from 1994 to 1995.

Al Holbrook is chairman of Solomon Holdings and Trinity Lifestyles Management. Based in Alpharetta, Ga., the company owns and/or operates 22 communities, primarily in the Southeast. Holbrook served as NIC board chair from 1994 to 1995.

One of the biggest changes that’s taken place in the industry is the diversity of capital now available, and the institutional quality of the capital. When I co-founded NIC as national director of senior housing at Coopers & Lybrand with Bob Eramian, a partner with Bear Stearns in Atlanta with Tony Mullen and Bob Kramer 25 years ago, no one understood the industry or the products. But now we have a wide range of debt and equity sources. It’s exciting.

The product has changed too. Our product lines are morphing as we accommodate residents with higher acuities. We’re offering a full suite of services to those in independent living. The product is upscale with larger units and more amenities, such as bistros, spas, life enriching activities and as we like to say, “memories made daily.” We see the influence of the baby boomers. Most of them are shopping for their parents, but they’re the leading edge of the next wave of residents who want a nice product.

Another big change is that we’ve lost about 300,000 skilled nursing beds across the country. Many of those residents are now going to assisted and independent living, but there will always be a need for skilled nursing; most likely in a residential environment. But as nursing care creeps into the assisted living sector, the industry needs to address regulations that can drive up costs.

Looking ahead, the wellness movement presents a big opportunity for the industry. Residents are ready to try new therapies and they’re willing to pay for them. The prevalence of chronic diseases, such as diabetes, in the senior population creates a lot of opportunities for the industry to offer home care and home health services. But, in the end, it is a business with a mission and an important purpose beyond the bottom line—though it can achieve both.

Randy Richardson is president of Vi, a Chicago-based owner and operator of 10 continuing care retirement communities (CCRCs) with a total of 4,100 units in six states. Richardson served on NIC’s board for 11 years—the longest serving member. He was NIC board chair from 2011 to 2013.

Randy Richardson is president of Vi, a Chicago-based owner and operator of 10 continuing care retirement communities (CCRCs) with a total of 4,100 units in six states. Richardson served on NIC’s board for 11 years—the longest serving member. He was NIC board chair from 2011 to 2013.

If you think back to 1987 when Vi started as Classic Residence by Hyatt, the housing options for seniors were much more limited than they are today. One of the biggest changes was the emergence of free-standing assisted living. People who only needed a little help could live there, instead of having to move into a skilled nursing facility. Consumers have more options today and that’s been very good for the industry.

Today, adult children are helping their parents explore housing options and so the adult children are becoming more educated about the seniors housing options available. When they have a need, they’ll be more educated and more familiar with seniors housing.

As the housing market has improved, we’ve seen a recovery in the CCRC market and our sales have been robust. We have just begun an $80 million redevelopment of Vi at Bentley Village in Naples, Fla. The project involves replacing older living units circa 1985 with 72 new living units along with two new clubhouses and amenity spaces. In 2014, we had our best sales year ever and we have sold 70 of the new units. To me this is confirmation of consumer acceptance of the CCRC product.

The greatest NIC accomplishment during my time with NIC was the development of the NIC MAP data base. It was a significant accomplishment because it brought transparency to the industry allowing investors to have an understanding of what the sector was all about and make informed seniors housing investment decisions. [/expand][cresta-social-share]

Alternative Capital: A Discussion on EB-5 Funding

As seniors housing developers look beyond traditional institutional capital, REITs and private equity, several alternative capital resources have come to the forefront. EB-5 is one such opportunity currently making headlines as Congress looks to re-affirm and reform this increasingly popular source of funding.

The EB-5 Visa Program for Immigrant Investors was established in 1990 as a way to stimulate the economy by bringing in foreign capital and creating domestic jobs. The program allows foreign nationals who invest $1 million in an approved project (reduced to $500,000 in certain geographies), the opportunity to receive a permanent green card. The project needs to create at least 10 full-time positions for each investor. Since the Great Recession, the program has reached its capacity, averaging about $5 billion per year in invested capital.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

HOW DOES IT WORK?

Recently, Future Leadership Council (FLC) members Eric Mendelson with National Health Investors REIT, Trace Wilson with Prudential Mortgage Capital Company and Amy Coppens with Senior Resource Group spoke with experts to discuss this alternative source of capital and its potential use in the seniors housing industry. Participants included: David Bovée, Managing Principal with Zenith Capital, a financial services company specializing in alternative sources of senior living capital; Daniel Gorham, Partner with Fountain Square Properties; and Laura Reiff, Shareholder with Greenberg Traurig Immigration, Employment and EB-5 Group.

Why is EB-5 an interesting source of alternative capital for the seniors housing industry?

Zenith Capital: There is a certain harmony between the capital needs in seniors housing and EB-5 as an alternative source of capital. As compared with other sources of capital, EB-5 will be more patient – it cannot be repaid until the investor’s final immigration petition has been adjudicated, which generally occurs about 4-5 years after the time of the investment.

Fountain Square Properties: Traditional capital sources for seniors housing construction are still often not readily available in the marketplace and, if they are, are often times more limited than is desirable in terms of maximum leverage and cost of capital. EB-5, if done correctly, can be a fairly smooth process for the developer/owner, bring the capital stack to more than 85% of loan-to-cost and, including all of the costs associated with each stage and Regional Center), priced at a rate below 10%.

What are TEAs (Targeted Employment Area) and Regional Centers?

Zenith Capital: A TEA (targeted employment area) is a geographic area that meets the program guidelines for a reduced investment amount (under the current program requiring $500,000 rather than $1,000,000 from the foreign investor). Offerings within a TEA have shown to be more marketable, but achieving the same level of absolute investment requires twice as many investors, increasing the risk of raising the target.

An EB-5 Regional Center is an organization, designated and regulated by USCIS, which facilitates investment in job-creating economic development projects by pooling capital raised under the EB-5 immigrant investor program. Regional centers can be publicly owned, (e.g. by a city, state, or regional economic development agency), privately owned, or be a public-private partnership. Projects located in Regional Centers enjoy EB-5 capital raising potential based upon both direct and indirect employment (the trickle-down effect). Since seniors housing projects employ a large number of workers relative to the project costs, seniors housing projects are generally viable for EB-5 capital whether or not the project works with a Regional Center.

How does a Regional Center and a TEA Certification benefit a seniors housing developer or operator when looking at finance options?

Zenith Capital: The benefit of using a regional center, and the main driving force in creating a regional center, is that it allows for a project to use economic studies to calculate both direct, indirect, and induced jobs when formulating how many jobs will be created by a development project. Simply stated, not only can a project count the full-time positions it will create, but also the jobs that the project will stimulate within the community. Thus, a project can raise more EB-5 capital when adding all the direct, indirect, and induced jobs that the development will create.

Can EB-5 capital be used for acquisitions?

Zenith Capital: To use EB-5 capital for an acquisition, the community needs to be in distress and all jobs would be lost if not for the EB-5 investment. Additionally, all the jobs must be saved, thus using EB-5 capital for acquisitions works in only a minority of cases.

What role does EB-5 capital play in a capital stack and why use it for a development project?

Zenith Capital: The program requires that the capital be invested as equity and that the capital be at risk. A wide variety of structures may be employed. But when structured as equity, it lowers the leverage in a capital stack, reduces the interest-carry cost, and decreases the need for personal guarantees from lending institutions. With interest carry costs reduced, cash flow is increased during the initial lease-up period. Furthermore, when leverage is significantly lowered, banks compete for the loan, thus helping to ensure a successful outcome.

When placed as mezzanine debt, project sponsors will need to convince lending institutions that they will be able to cover the entire debt load and demonstrate an alternate source of capital should the EB-5 capital raise be unsuccessful, creating a higher hurdle for senior debt underwriters.

At Zenith Capital, we believe that the best approach when capitalizing a project using EB-5 is our 50-40-10 model. EB-5 investors like to see skin in the game and we believe that 10 percent sponsor equity is needed for investors to feel comfortable. Zenith then sources 40 percent of the project to EB-5 investors, leaving the remaining 50 percent to be sourced from senior lenders. When the project is capitalized to 50 percent, the low leverage is attractive to lending institutions and becomes competitive when bidding for the right lender.

What makes an EB-5 transaction a successful one?

Greenberg Traurig: While the pieces of the actual investment must be attractive, including the particular opportunity and its location, an experienced and knowledgeable team is essential to make an EB-5 transaction successful. A successful team includes people involved from the start of the transaction, most notably the EB-5 Immigration attorney, securities attorney, the EB-5 economist and business plan writer, and the “finder” that sources the investors in a particular country. It is imperative to have this team in place to navigate the various immigration and legislative requirements for an investor and an investment to qualify under the program. Relative to immigration, it is very important that a “finder” is reputable, appropriately vets each potential investor, and is able to track the source of funds through a transaction.

What are some of the potential challenges with EB-5 funding?

Zenith Capital: An EB-5 funding must navigate timing issues, funds not available from escrow until Visa milestones are met, upfront costs of a syndicated offering to foreign nationals, and securities law liabilities. The best way to insure success is to thoroughly vet the reputation and knowledge base of the EB-5 team. Not only should they understand EB-5 capital, but also the intricate issues with the seniors housing industry and the senior debt underwriting requirements. Do they have experience using EB-5 to finance seniors housing?

Greenberg Traurig: EB-5 transactions can be complex but, as mentioned, having the appropriate team in place is crucial. Some countries are actually licensing EB-5 “finders.” However, even within those countries issues can arise. For instance, if an investor does not qualify under the program (for example, is a member of the Chinese Communist Party) or the sources of funds the investor is utilizing to make the investment comes into question (for example, funds not appropriately documented or derived from illegal sources) it could compromise the entire investment. The inability to demonstrate where the investment capital comes from is the largest issue most often encountered. The other big issue that arises, and this is in the initial stages of the project, is substantiating the job creation methodology used by the economist to show the indirect, direct and induced jobs that will qualify for use in the EB-5 program in the first place.

What are some potential political or legislative issues facing the EB 5 program?

Greenberg Traurig: The first, is that the program for Regional Centers (CLARIFY) is a pilot program and is set to expire in September 2015. This, however, is a recurring issue since the program’s inception in 1992 and it has been renewed since that time. A simple renewal is not expected this year and complex bi-partisan reform packages have been introduced in both the U.S. House of Representatives and the Senate.

One significant issue has to do with numerical limitations for the EB-5 program. There are only 10,000 visas allotted to the program. Unfortunately, these visas have not been allocated only to investors, but also to their family members. This means that less than 4,000 visas actually go to immigrant investors in the EB-5 category. Another issue impacting foreign investors is the per-country quota limits on how many investors are allowed into the EB-5 program and subsequently how many obtain U.S. immigrant visas. Therefore, the amount of investors from particular countries that could qualify under the existing program is beginning to be limited. This is most notably a problem for Chinese investors as it is estimated 80% of the EB-5 investors are Chinese and there are over 300,000 Chinese that would like to apply for the program. Legislative reform proposals that have been introduced are contemplating changes to these visa number issues as well as other significant reforms.

Another interesting thing to note about the EB-5 program is that it seems to have avoided the national immigration debate. Those with interest in the program have been able to characterize it as an investment and job creation program, rather than anything that may be perceived as being related to standard immigration issues.

This is not necessarily a significant issue, but the current minimum investments of $1 million (or $500,000 if in a high unemployment area) for an individual investor have been in place for over 25 years and an increase of those minimum investments is likely. Most think that the minimums will be increased to $1.2 million and $800,000 if the project is located in a targeted employment area (TEA).

For more information from Zenith Capital or to contact David Bovée, log onto https://www.ZenithCap.net. For more information, contact Greenberg Traurig at http://www.gtlaw.com or see the EB-5 blog site at EB-5 Insights | Business Immigration & Compliance Attorneys | Greenberg Traurig

[/expand][cresta-social-share]