Download the Full Insider: February 2015 Issue

A Conversation with Christopher Merrill, co-founder, president and CEO of Harrison Street Real Estate Capital

Approaching its 10th anniversary, Harrison Street was co-founded by Christopher Merrill, who serves as the private equity firm’s president and CEO. The Chicago-based company has raised more than $5 billion in equity capital to invest in the education, storage and health care sectors, including seniors housing.

Harrison Street recently raised over $1 billion in discretionary equity capital over a three month time period, which translates into $3.5 billion of real estate purchasing power. NIC asked Merrill how the firm’s strategy has evolved, and how seniors housing fits into its plans.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: Harrison Street was founded in 2005. Has your investment strategy changed over the last decade?

Christopher Merrill: We started the business with a focus on demographic real estate by investing in real estate in which demand came from the education, storage, and health care sectors, including seniors housing. We wanted to find needs-based asset classes that were less cyclical than traditional assets. For example, regardless of economic cycles, it’s hard to take care of a parent with memory or health issues. As such, there is an underlying and consistent need for assisted living and memory care properties. While some may invest in market rate apartments for seniors, we tend to avoid those since there is more volatility as a result of swings in the economy. We don’t invest in skilled nursing because of the issues and potential swings in reimbursement. We focus on private pay, rental, assisted living and memory care, with some independent living. We feel that these assets classes will do well on a consistent basis.

When you look at how we invest, some call it a social infrastructure strategy given that the assets we buy and develop are part of the social fabric of our economy. Besides health care, we invest in student housing where only 20 to 30 percent of kids can be housed on campus. As such, there is a need, in good times and in bad times, for housing for students. Additionally, medical office properties are quite resilient, given the aging population, advancements in technology and more and more insured. The same goes for self-storage facilities given that people use these facilities in any market environment as it is a lost-cost way to store goods or run a business.

While we started the business in 2006, which some say was a difficult time, the downturn highlighted the soundness of our strategy. As we approach our 10-year anniversary, we still invest in the same segments. For instance we’ve invested in more than 430 properties in 40 states which translates into about nearly $10 billion in cost.

We’ve learned a lot about what makes each sector work—where there are risks and where mistakes are made. We continue to evolve and refine processes, and we think we have some of the best partners in the space which allows us to continue to find very attractive risk-adjusted returns.

NIC: How much of your portfolio is in health care?

Merrill: About 50 percent of our volume is in the health care space, both seniors housing and medical-related properties, including medical office, surgery centers and patient rehab facilities. In 2014, we completed over $1.5 billion of acquisitions or developments in these sectors.

NIC: What’s your investment strategy for seniors housing?

Merrill: We’ve always been focused on private pay, rental properties with independent and assisted living, and memory care. In the past few years, we’ve invested more in assisted living and memory care. We look for development opportunities in markets where there is a supply / demand imbalance. We are in numerous cities across the county and don’t have to be in the main gateway cities.

Our company has evolved over time. In addition to our opportunistic investment funds, we have established an evergreen core income fund. Having multi-funding sources allows us to invest across the entire risk spectrum within our asset classes.

NIC: How did your seniors housing properties fare during the recession?

Merrill: They fared well. A lot was due to the strength of assisted living and memory care market components. I would say not a lot of money was made during this time period but we preserved capital during the downturn, and it did highlight the strength of the assisted and memory care components. The downturn allowed institutional investors the ability to see that these asset classes have capital preservation fundamentals, and lower volatility than traditional asset classes.

NIC: Where are cap rates?

Merrill: Of course, it depends on the local market and whether the property is stabilized or in lease up. As a generalization, one can say that you’re seeing cap rates 100-200 basis points higher for seniors housing over multi-family properties. But seniors housing is a lower volatility asset class in our opinion. That’s where the arbitrage opportunity exists. These asset classes are highly fragmented and hard for investors to access. There’s a perception of greater risk with these assets than with traditional ones, which has created opportunities for firms like ours.

NIC: Has your investor pool changed over the years?

Merrill: It has expanded as investors see the arbitrage opportunity of these asset classes, but find it hard to access. We have corporate plan investors, insurance companies, endowments, and family offices. We’ve reached out to more foreign investors, including European and Asian pension funds. We have investors from seven different countries in our products.

NIC: What are investors’ perceptions of seniors housing?

Merrill: It depends on the investor. But investors who see the benefits of the senior market have been on the rise. We see this as we have sold a number of properties and the interest level has grown each year.

NIC: How much of your volume is new development?

Merrill: In seniors housing, typically 30-35 percent of our volume is ground up development.

NIC: Do you prefer portfolios when you are making acquisitions?

Merrill: Not many portfolios come to market. The fragmentation of the asset class doesn’t lend itself to many portfolio offerings. About 80-90 percent of our investments are single assets. Portfolios are expensive too. We see portfolios as more of an exit strategy after we create them.

We limit how much money we raise, so we aren’t forced to change our investment strategy to put the money to work. We recently closed our fifth opportunistic fund raising $850 million including a $160 million co-invest vehicle. We had interest above that hard cap because investors like these strategies, but we felt that if you raise too much money you have to change how you invest.

NIC: Are you concerned about overbuilding?

Merrill: It’s a market-by-market situation. We see less supply in assisted living and memory care than on the independent living side. You have to have great local partners who understand the local dynamic. We work with the best-in-class operators in the market who help us manage the risk associated with understanding the local market forces. During the downturn, supply was cut off, however, demand continues to grow. As such, we feel there is a still a strong imbalance in many of the markets we focus on.

NIC: How do you pick and underwrite operating partners?

Merrill: We look at their reputation in the market. We know the good operators because we’ve been in the market a decade. We participate in a lot of industry events and we have employees from the health care industry. Seniors housing is really a small community, so being a good partner, and doing what you say you’re going to do is important. We’re working hard to be viewed by operators and developers as a knowledgeable source of capital that’s responsive. We like to focus on long-term, symbolic relationships.

NIC: What are the challenges and risks of investing in seniors housing?

Merrill: There’s always local market risk related to new supply and the effect it will have on rental rates. At Harrison Street, we have developed a penetration analysis that helps us understand the local market demographic profile. This level of diligence is important to ensure the longstanding stability of the property. Finally, ensuring you have a strong local operator who has an established track record is key.

NIC: Looking ahead, how do you expect seniors housing to perform?

Merrill: We are very excited about the prospects in the senior housing market. The aging of our economy coupled with the lack of supply in years past has resulted in a very favorable supply / demand ratio. Unfortunately, as people age they have a great level of health and memory issues. These issues are going to drive a need for more assisted and memory care product. While demand is increasing, it is difficult to access this segment given the size and fragmentation of the market. We see very positive trends for the need for space over the next decade and are exited and fortunate to work with some of the best operating companies in the business to execute on this strategy going forward.[/expand][cresta-social-share]

Thoughts from NIC’s Chief Economist

Jobs, the Economy and Seniors Housing Demand

The outlook for the economy going into 2015 is good. A steadily expanding economy along with growing confidence by residents and their adult children will support further demand for seniors housing in 2015. The pace of absorption in 2014 reflected an improving national economy (with the strongest job growth in more than 15 years) and was the best pace of demand since NIC started collecting data in 2006. Further gains in absorption are anticipated.

However, demand could be threatened if the economy were to go into an unexpected and possibly quick downturn related to risks such as a sudden spike in interest rates, a significant slowdown in growth and the threat of disinflation in Europe or Japan, an expansion of wars in the Middle East or Russia, or other sudden exogenous shocks.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Foreign Capital Flowing

Capital flows into the U.S. remain strong as investors gravitate toward a relatively safe haven environment. Foreign investment in U.S. property alone totaled more than $47 billion in 2014, led by Canada, China and Norway, according to estimates by RCA. For seniors housing, capital is flowing in both directions: American money is flowing north to Canada as well as overseas, while foreign money is coming into the U.S. as well. Most notable of the inflows in 2014 was the Safanad/Formation Capital’s Extendicare and NHP deals. More capital is likely to flow into the U.S. in 2015, some of which will make its way in through private equity funds, non-traded REITs and the purchasing of U.S. REIT stocks.

Lending and Liquidity

Capital –both debt and equity–remains plentiful and relatively cheap. Most commercial real estate lenders are anticipating a strong year in 2015, with ample credit and capital available to meet borrower demand, according to a recent survey of Commercial Real Estate Finance Council (CREFC) members. Survey participants expect loan volume in 2015 to top 2014 levels as loan maturities rise and property fundamentals improve. This sentiment is in line with the results of last summer’s NIC/NREI survey which also showed an expectation of increasing seniors housing capital availability in 2015.

Our Changing Resident Profile

The profile of a typical resident in our seniors housing properties is changing as one generation makes way for the next. Until recently, the majority of today’s seniors housing residents hailed from the Greatest Generation, i.e., those born between 1901 and 1927, now age 88 and higher. As this group ages further, the Silent Generation or the generation known as the “Lucky Few” are moving into seniors housing and care communities and making their changing needs and preferences evident. This is a generation, born between 1928 and 1945, that birthed Warren Beatty, Jane Fonda, Gloria Steinem and Martin Luther King. This generation were pioneers of the Civil Rights movement. They are labelled as being savers, patriotic, religious, loyal and prefer healthier lifestyles than their predecessors. They are a generation that held onto jobs and experienced promotions within one organization until they retired. Many have pensions. They are considered a cohort that knows what they want and are willing to speak up to express their preferences. As this cohort takes root in our senior housing properties, the services, space configurations and socialization programs provided by operators will need to evolve.

Outliers

There are a few metropolitan areas that stand as outliers in terms of current seniors housing construction. At the top of the list is San Antonio, the third smallest market among NICMAP’s 31 primary markets. As of the fourth quarter of 2014, there were 11 properties under construction with 1,636 units coming on line. The entire inventory of seniors housing properties amounts to roughly 7,500 units, so the new units under construction represent 22% of the metro area’s inventory. Across the primary markets, the units under construction amounts to 3.5% of the existing inventory. Occupancy in San Antonio stood at 88.1% in the fourth quarter, while net absorption was actually negative. Combined, these trend metrics should raise a cautionary flag about future occupancy in San Antonio and the ability of operators to maintain market share and grow rents.

Three of the primary markets saw annual rent growth of 4% or better in the fourth quarter. These markets include Washington DC, Riverside and San Jose. Of these three, San Jose also had the highest occupancy rate in the nation at 94.9% in the fourth quarter, so it makes intuitive sense that it has the one of the highest rent growth rates. Washington DC also has a relatively high occupancy rate at 92.3% in the fourth quarter, well above the 90.5% rate of the primary markets. The flip side was Riverside, however, which had the lowest occupancy rate among the 31 primary markets at 86%. Such high rent growth in this case is a bit harder to explain. Riverside’s occupancy rate has been falling since mid-2012 when it reached a cycle high of 89.0%. The drop in occupancy initially reflected weak demand and more recently reflects new completions that have hit the market. Rent growth through this period was weak until most recently, averaging less than 1.5%. So the recent gain of 4.2% seems likely to be an aberration and will likely slip again. The majority of markets saw gains of 2.0% to 2.5% in annual rent growth

Transaction Pricing

My colleague, Chris McGraw, has conducted some interesting research of late related to peak pricing in seniors housing. He created a price index that takes into account the differing mix of properties that are sold from one period to the next by creating a “hedonic price index.” The index accounts for the type of property, the size of property, total purchase price, its geographic location and whether it was included in a portfolio sale. His research suggests that, while not quite at peak levels, pricing is near its highest level within the past seven years and has been strengthening throughout 2014. This seems to corroborate with anecdotal evidence from conversations with various investors. Ideally, the seniors housing sector will eventually have a repeat-sales index, but at this point, only about 100 properties have repeat sales with a qualified price since 2008, making construction of that type of index not yet feasible.

As always, I welcome your thoughts, comments and feedback.

Beth[/expand][cresta-social-share]

Sneak Peak: ‘The Latest in Seniors Housing Supply and Demand” at the Upcoming Forum

One of the sessions at the upcoming NIC 2015 Capital & Business Strategies Forum, “The Latest in Seniors Housing Supply and Demand,” will drill down on a hot topic in the sector at this time when there is both excitement and concern being voiced about the pace of development. Larry Rouvelas of Senior Housing Analytics will join me as a presenter at the session. Larry has broad experience within seniors housing and will bring a practitioner’s perspective to the table. He will touch on best practices and highlight some recent market studies he has completed.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Supply-Demand Forecast for 2015

The session will provide lots of data and overview current fundamentals, pinpoint where seniors housing stands in its cycle, and what’s in store for 2015. Most measures place seniors housing solidly in its recovery phase, and NIC’s forecast suggests that should continue through 2015. NIC’s current forecast is for occupancy to increase 60 basis points during 2015, reaching 91.1% by the fourth quarter.

Drilling Down to Local Markets

It might be smooth sailing nationally, but there will be pockets of potential concern. Some markets will face significant supply pressures, but that doesn’t necessarily mean bad news for the existing stock. For example, according to NIC MAP data, Houston’s stabilized occupancy was able to increase 50 basis points during 2014, despite its inventory growing by more than 6% – an example where the rising tide is lifting all the boats. However, absorption will need to be strong to offset the new supply, especially in markets such as San Antonio where construction has reached more than 20% of existing inventory. Some markets will undoubtedly take additional time to absorb the excess supply and may face lower occupancy rates for during that period.

Fresh Views on the Data

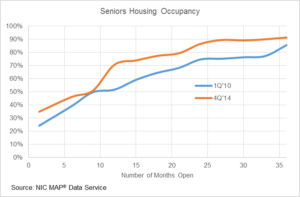

To add additional perspective on the data, we’ve decided to focus a bit on lease-up patterns in the upcoming NIC Forum session. We’ll see how these have evolved over time and how they vary by market. Even with the drastic increase in the number of properties leasing up, properties are filling faster than they have in years. On average, it currently takes about 24 months to reach 90% occupancy – compare that with lease-patterns in 2010, when it was taking more than three years (on average)!

In addition to presenting this session at the NIC Forum, I will also be at the Data Center with NIC MAP® Data Service hosting onsite data assessments and providing seniors housing research information. Check out the NIC Forum’s final program for times and location details.[/expand][cresta-social-share]

Insider Insights on Health Care Reform from Kathleen Sebelius: 1st of a Two-Part Interview

Former HHS Secretary Previews Remarks Ahead of NIC Forum

In the last five years, the industry has faced perhaps its biggest challenge yet with the introduction of health care reform. While the outlines of its impact are just beginning to emerge, seniors housing and care owners and operators already know that a dramatic shift is underway that will change the business.

As one of the key advocates for health care reform, Kathleen Sebelius will offer a close-up view of how changes will affect the sector as a keynote speaker at the NIC 2015 Capital & Business Strategies Forum, March 31-April 2, San Diego.

Sebelius was the Secretary of U.S. Department of Health & Human Services from 2009 to 2014, helping to lead the effort to pass the Affordable Care Act (ACA), and overseeing its initial implementation. She will speak at the NIC general session luncheon April 1.

In a recent conversation with NIC, Sebelius previewed her thoughts in advance of the Forum. Here’s a short recap of a portion of what attendees can expect to hear:

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: How is the ACA impacting seniors housing and care?

Sebelius: One of the primary goals of the ACA was to move the public payments system from a fee-for-service framework to one focused on quality and value-based outcomes. The industry has a real opportunity to look at the issues around health and wellness, and how to keep folks in good shape. The post-acute space is one of the key areas getting attention, which gives builders and equity partners a way to rethink how these services will look in the future. This comes at a time when the skilled nursing business is changing. About two-thirds of admissions are for short-stay, post-acute rehabilitation. A lot of the inventory of skilled nursing facilities is old and a relatively small number are being built. Whether or not that (supply) is sufficient even for more short-term stays is a question. But providers who are very good at bundling care in a different way will be out ahead of the pack.

NIC: Is there a role for assisted living?

Sebelius: Absolutely. As people begin to need more services, the option of having a graduated level of support is even more important. Clearly, people would like to age in place and stay independent as long as possible. The idea is to wrap care around people at the level they need, not forcing them to be totally independent or totally dependent. There will be a significant role for a diversified portfolio.

NIC: Assisted living is mostly private pay, and the CLASS Act, which was designed to provide a form of long-term care insurance, was dropped from the ACA. Do you foresee any changes on that front?

Sebelius: This is a conversation that is desperately overdue. Only eight percent of any kind of long-term care services is covered by insurance. There’s a huge gap. The notion that people end up on Medicaid, which is 100 percent government funded for many folks, is not a great bargain for the government. Having some intermediate steps that receive a stream of payments may be more valuable. But frankly, there’s not a lot of appetite in Washington to engage in that kind of conversation. It would be very timely for investors to open that dialogue with their Congressional representatives.

NIC: Quality measures are important under health care reform. What does this mean for providers?

Sebelius: There’s no question that transparency from care providers and measurements of quality will become more and more valuable. The Baby Boomers are tech savvy, and they want the ability to compare data in order to make good choices. Introducing a consumer voice into health care reform has been one of the lesser known, but key features of the ACA. The Centers for Medicare & Medicaid Services has pushed a lot of data into the public domain, and consumers are demanding that their providers measure up to high standards. This was not the case 10 years ago. [/expand][cresta-social-share]

Novel Networking opportunity features wide range of capital providers “pitching” their solutions to small and mid-cap operators at NIC Spring Forum

Small and mid-size building operators often face unique financing situations. Working capital can be a big problem for skilled nursing facilities that struggle with slow government reimbursements. Owners that want to expand may have limited balance sheet capacity. The transition of ownership to the next generation may require financing for a succession plan.

In an effort to facilitate the special financing needs of seniors housing and post-acute care owners and operators, NIC is holding a new networking opportunity, Capital Connections, at the upcoming NIC 2015 Capital & Business Strategies Forum in San Diego, March 31-April 2.

The networking session will feature 37 capital providers* selected to “pitch” their financial solutions to capital seekers. Three one-hour sessions will be held concurrently on the following areas: development and turnaround financing; mortgages and business loans; and equity, leases and other partnerships. Each session will include presentations from about 10 providers.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

“This is a very efficient way for a small/mid-cap operator to leverage its time,” says Torey Riso, president and CEO at Care Investment Trust, New York. “Capital seekers can evaluate in a short time a number of capital options from providers they may not have known even existed prior to the conference.”

Operators that know their near-term needs can select the session featuring the capital providers that offer solutions for those needs, explains Riso, who will present at the session on equity, leases and other partnerships.

For example, Care Investment Trust typically offers either triple-net lease or joint-venture structures for independent and assisted living, and memory care facilities. “We are looking to work with mission and culture driven operators that focus on serving residents.”

Finding the right finance option

The capital providers selected to make presentations at Capital Connections underwent a competitive vetting process by a planning committee and are among the top capital providers in their category.

The Private Bank will present at the session on mortgages and business loans. “We’re excited to participate and connect with operators who are new to NIC and may not be familiar with our bank and its focus,” says Ann B. O’Shaughnessy, managing director, commercial banking, The Private Bank, Chicago.

The sessions will allow capital seekers to find finance sources that meet their particular needs. For example, The Private Bank lends to skilled nursing, assisted living and memory care facilities. “We understand those businesses,” says O’Shaughnessy. One of the bank’s products is accounts receivable financing for skilled nursing facilities. “We recognize the challenges of Medicaid and Medicare reimbursement,” she adds.

Presenters at Capital Connections represent a broad sampling of finance companies in the seniors housing and care sector. The solutions to be presented are actively being offered.

Known for its wide range of financing products for specialty housing properties across the country, Red Capital Group will present a variety of solutions—all of which are available to small and mid-size seniors housing operators.

“We are participating with the objective of educating mid-size owners and operators about the products and services we offer,” says Adam Sherman, managing director, Red Capital Group, Columbus, Ohio. “As a subsidiary of a non-bank finance company, Red Capital’s clients benefit from partnering with a flexible source.” Red offers permanent loans through FHA/HUD, Fannie Mae, and CMBS. It also provides direct balance sheet investments including bridge, construction and mezzanine loans, along with advisory services.

Capital Connections will also offer an invaluable intangible—the ability to gauge whether or not a certain lender or partner is a good fit. “Operators can listen to the presentations of the capital providers to better evaluate the options available, as well as the personality, feel, and approach of the capital provider,” says Riso at Care Investment Trust.

Operators who attend the sessions will also have the opportunity to request a follow-up meeting with one or more of the capital providers.

*The selected capital providers include:

|

|

[/expand][cresta-social-share]

Avatars, Robots and Wearables. What’s Next?

How Technology Will Change the Industry to be addressed by Expert Katy Fike at NIC Forum

In the upcoming years, savvy building operators will increasingly rely on cutting-edge technologies not only to boost the bottom line, but also, and perhaps more importantly, to improve the quality of life of residents.

“We need to think about bridging the gap between technology and housing,” says Katy Fike, keynote speaker at the NIC 2015 Capital & Business Strategies Forum, March 31-April 2, San Diego. “The next wave of consumers will expect connectivity and transparency.”

Technology will play a transformative role in the seniors housing industry, says Fike, a Ph.D. gerontologist and co-founder of Aging 2.0, a consortium that aims to promote new technologies to help care for and improve the outcomes of our nation’s large and increasingly frail population of seniors. [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Fike will speak April 1 at the opening general session of the NIC Forum. In a preview of her remarks, Fike notes, for example, that technology can be used to collect and chart data on resident health in order to spot a decline before a crisis occurs. “Technology allows us to be proactive, rather than reactive,” says Fike. The need for the transparency of data will be increasingly important too, she adds, as families demand day-by-day progress updates.

Where to start

While the quickly growing array of technology-based offerings can easily overwhelm building owners and managers, Fike recommends a simple first step, such as installing Wi-Fi throughout the community. Nurses and assistants can provide information about the resident on a wireless device in real time that families can access through an internet portal. Residents can be taught how to use tablets to communicate with their family and staff.

Other promising technologies Fike plans to highlight at the NIC Forum include:

- Products worn by residents that count steps, gauge activity, provide location information, and act as an emergency call system.

- High-tech concierge. A device that gives verbal reminders and also takes verbal requests from the resident to order transportation, call a relative, or get help.

- One product, for example, features a dog avatar shown on an iPad that provides remote companionship by speaking to the resident. The dog’s voice is translated from text created by a single caregiver who can converse with as many as 12 residents.

- Robots. Though expensive and impersonal, they could be preferred by residents for some caregiving duties, such as incontinence help.

Fike will also discuss how building operators can defray some of the costs of new technology by creating new revenues streams. She’ll encourage attendees to “dive in and start trying things.” The pace of technological advances won’t slow, she says. It’s better to get involved early in the process and even volunteer to be part of product pilots.

As a gerontologist, Fike feels those who work with seniors have been too concerned about having everything figured out before introducing new technologies to residents. But she’s found that older adults like being part of the development phase of a program and providing feedback. “It draws them in,” she says. “We don’t have to have all the answers to get started.”[/expand][cresta-social-share]

Housing – Data Update and Its Implications for Seniors Housing

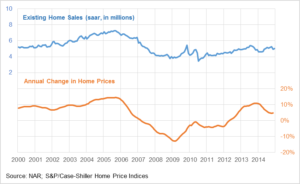

Housing data is often difficult to interpret and its implications for seniors housing possibly even more so. According to National Association of Realtors, existing home sales remain 30% below peak velocity, but that’s versus an unsustainable rate – it was a bubble. Sales are actually fairly close to pre-bubble levels, a far more reasonable rate of sales.

While sales slipped 3% in 2014[1], there was some positive, although modest, momentum in the second half on the year. Monthly comparisons will likely continue to exhibit some back and forth movement, but there does seem to be modest upward trajectory underlying the volatility.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

The recent fall in mortgage rates may entice some buyers into the market, especially with interest rates presumably set to rise sometime later this year. On the other side, the dearth of inventory may continue to hold back sales, as even the run-up in prices has not been enough to entice potential sellers to list their homes. Those opposing forces will probably balance out for the most part, tilted maybe a little to the upside in the near-term.

While price appreciation has been slowing recently, prices were still up about 5% year-to-year as of November[2]. The data has seemed to stabilize around that level since September. Most economists expect home prices to hover in this vicinity throughout 2015, but there will probably be some volatility in the monthly readings.

What does this mean for seniors housing? It’s hard to say. Surprisingly, there is not much of a quantitative relationship. Home sales from aged 75+ households make up less than 10% of overall sales, so the relationship likely gets distorted from the other 90% of the data[1]. Housing has been a directionally consistent indicator though, so continued price appreciation and decent sales should be favorable for seniors housing in the near-term.

[1] National Association of Realtors

[2] S&P/Case-Shiller Home Price Indices

[/expand][cresta-social-share]

Submit manuscripts to an Open Source Publication Before April 6

The call for papers for the 2015 issue of Seniors Housing & Care Journal is now open. I hope you will submit your research, best practice, or commentary for this peer-reviewed annual publication published by Mather LifeWays and The National Investment Center (NIC).

The Journal, which focuses on applied research and best practices in the fields of seniors’ housing and services, attracts reputable users and readers, including researchers, academics, CEOs, long-term care administrators, professionals, and investors in the senior services industry.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Submitting your paper is your unique opportunity to:

- share your findings with experts in an industry that is growing quickly

- be published in an open access publication at no cost to you

- get a quick decision on your manuscript. You’ll hear within 60 days of your submission date

Open access means users are allowed to read, download, copy, print, search, or link to the full texts of the articles without asking permission from the publisher or the author.

In addition, editors will select one manuscript for special recognition as the Outstanding Research Paper that comes with a $5,000 award. Eligible authors may also apply for the New Investigator Award ($2,500).

Please note that the deadline for submissions is Monday, April 6, 2015.

For more information about Seniors Housing & Care Journal, including details about the New Investigator Scholarship Award, visit www.matherlifeways.com/shcj.asp.

[/expand][cresta-social-share]