“We Like the Challenge”—A Conversation with Formation Capital’s Brian Beckwith

Lately, Brian Beckwith feels a growing sense of comfort and even some optimism about the industry. As CEO of Atlanta-based Formation Capital, he thinks skilled nursing could be turning the corner and that savvy investors are poised to acquire challenged seniors housing properties and turn them around. NIC Chief Economist Beth Mace recently spoke with Beckwith about Formation’s successful investment strategy and its readiness to tackle the challenge.

Mace: Tell us about yourself and Formation Capital.

Beckwith: I’ve been with Formation Capital for eight years. I joined in April of 2011 after 14 years with GE Capital. All my time at GE was with their healthcare group in Atlanta, Bethesda, London and Chicago. My last stop with GE was with their healthcare real estate lending platform, and Formation was my biggest customer. That’s how I got to know Arnie Whitman, Formation’s Chairman, much better and how I ended up here. Luckily, Formation is based in Atlanta where I’m from; so after working in different places around the country and world, I was glad to be back home. It’s worked out nicely.

Mace: Formation Capital has been around since 1999. What does it do?

Beckwith: We are private equity investors in senior care. Our investing history started in skilled nursing real estate, and it was a little bit of a contrarian play in the 2000 timeframe because of legal risks and ultimately a wave of tort reform, both of which impacted values. Now, as a more diverse private investor in senior care, we focus on multiple healthcare real estate segments as well as service companies.

We also have a lending platform, Formation Lending Group, with a strong JV partner to fund higher leverage senior and mezzanine debt secured by healthcare real estate. Overall, our portfolio is pretty evenly split between operating companies and real estate-based investments. Finally, we have a few investments on the periphery of senior care including an investment in an intellectual and developmental disability company that is primarily Medicaid funded. We are expanding a little bit in the behavioral space, but most of what we do is senior care related.

Mace: How would you describe your investment approach?

Beckwith: Our investment approach always starts with the care that is being delivered by the operator or the management team providing that care. We have a group of nine clinicians on staff, former nurses, and other healthcare professionals, called Formation Healthcare Group, and that team helps us maintain our expertise through a proprietary database to track clinical performance, which is available to other owners, operators, and lenders. Every Formation transaction starts with an understanding of the quality of the clinical performance of the operator and the management team. We want to make sure the type of care that is delivered is the best for the resident, or patient. If we can check that box, which often leads to better financial performance, we can move to the flexible financial engineering to make sure we apply the right capital structure to allow for the efficient delivery of care to the population being served. We have a more clinical focus than others, and everyone at Formation has a significant amount of healthcare experience to make sure we are managing those risks when we find them.

Mace: Formation is a little different, financing operations and not just real estate. How do you look at that?

Beckwith: Our differentiator, and hopefully our competitive advantage, is understanding the risks unique to senior care, such as reimbursement, regulatory, and trends in the delivery of care, and how it is paid for. We understand those risks because of our experience and our clinical team, and that allows us to make more informed decisions. When we run into challenges, which are inevitable if you are invested in the senior care industry, we can react to them better. Our approach is to be focused on quality of care, maintain our expertise in the space, and leverage that expertise with our flexibility as a private investor to help everyone succeed.

Mace: NIC’s Spring Conference (February 20-22, San Diego) is focused on senior care collaboration. Does that fit your approach?

Beckwith: It fits our strategy very well, as we focus on aligning interests with our operators and management teams. With the sophistication that is increasingly required to be successful in senior care, collaboration with our management teams and collaborating with our unique expertise like FHG is more important.

Mace: When you are underwriting the operations of the business, what are you looking for?

Beckwith: About half of our investments are real estate based and the other half are traditional private equity structures in service companies. When we are looking at a real estate-based transaction, the cash flows derived from the operations drive the value, and we try to drill down on the riskiness of those cash flow streams by analyzing the trends, management teams, and clinical performance. Everyone will have a clinical issue during the operation of a facility, but the important thing is to understand the operator’s process and how they respond to issues. A property with high variability on clinical performance presents a higher risk to the facility’s cash flow stream. The risks can be everything from state fines to management team distractions or reputational issues in the market. We start there with our favorite operators and then apply a normal real estate analysis.

Mace: How do you choose operators?

Beckwith: It’s a lot about the culture of the organization and its track record. We look for responsible growth. Some operators in our industry recently have grown too fast and can’t perform to even the most basic standards that we expect. We are very interested in operators who are forward thinking about the trends in the industry whether it is risk sharing, partnerships or developing skill sets to add acuity to an AL or SNF. We also like someone who knows what they are good at and sticks to it. The delivery of healthcare in skilled nursing and assisted living facilities is still local and regional by nature. The national approach can be harder to execute, though it has some benefits. Our preference right now is to work with regional providers to make sure we have better understanding of the operations of a group of facilities. We want to circle the wagons around a manageable, regional geographic area.

Mace: How do you align your interests with operators?

Beckwith: The simplest way to describe our ability to create alignment is flexibility. Since we are able to use unique structures and not bound by a specific tax or legal structure, we can match the right type of lease or management agreement with the desire of the operator. We may be able to create a lease structure that allows us to share upside with operators, and that puts us in a position where we can better align ourselves with an operator. Because we are a private company, we have a little more flexibility to do that.

Mace: What is your typical investment time frame?

Beckwith: We have long standing and loyal institutional partners, and we often raise capital separately for each transaction, so we are matching the right capital partner to the transaction and their desired time horizon. We generally hold properties longer than three to five years, but we do not have a specific time horizon or a requirement. Raising the money individually gives us the flexibility to make sure we are clear with investors that this can be a long-term investment, and often times, that’s what our investors want. Overall, we are a longer-term holder.

Mace: How much equity has Formation invested?

Beckwith: We’ve invested $1.5 billion of equity since I joined the company. Our expectation is that we will put $200 million to $300 million of equity to work this year.

Mace: What is your expected annual return?

Beckwith: It depends on the transaction. We use a little more leverage than the REITs, but for an assisted living deal, we expect a high single-digit to low double-digit cash return on a leveraged basis. For skilled nursing, a 12% to 15% cash return is probably fair with leverage. On the lending side, we have some solid JV partners because of our team’s history as lenders, and that market is clearly a little lower return threshold as lenders.

Mace: Do you only invest in the U.S.?

Beckwith: No, one of our largest investments is HC-One, the largest social care home owner/operator in the U.K. They have been in our portfolio for 3-1/2 years, and we were lucky to have Justin Hutchens join 18 months ago as our CEO. He is an experienced operator and investor and is well known for his work in the industry here in the U.S. It’s been a great move for him and his family, and it has been a very nice mix of our collective expertise paired with our strong U.K. leadership team. It’s an interesting time in the U.K. because of Brexit and other factors, but the company is performing really well, and we will continue to invest in the U.K.

Mace: Will you expand to Canada, Mexico, or Europe?

Beckwith: It is important not to over-emphasize lessons from the U.S. when investing internationally. I spent three years leading GE Capital’s healthcare lending and investing group in Europe. We will consider some investments in Germany, Spain, Italy, and France, but the cultural differences present some risk; so right now, we are more focused on the U.K. for our international investing. Closer to home, we certainly would invest in Canada but probably limit our scope to that.

Mace: Do you invest in assisted living, independent living, memory care, and skilled nursing?

Beckwith: We are primarily focused on assisted living, memory care, and skilled nursing. That’s where we are concentrated. We would look at independent living, but our investors have shown a desire to be a little further out on the risk/return spectrum. Our sister company, Formation Development Group, primarily develops independent living, assisted living, and memory care; so we do get involved in independent living through FDG. Also, we are open to other areas of healthcare real estate, with the best example being a portfolio company that provides services for those with intellectual and developmental disabilities. It is a mix of real estate and operations and has the similarities to some of our other investments, like Medicaid funding that we understand well.

Mace: Do you work with startups?

Beckwith: We do, and we are in discussions with several now. The valuation multiples for certain sectors in services have really grown, and we think there is a way to put money to work with some de novo activity or an experienced management team. Additionally, Arnie has developed an expertise in the technology space for senior care, and that lends itself to earlier stage and startup investing.

Mace: What is the source of your capital?

Beckwith: It starts with our principals, then some friends and family (high net worth individuals and family offices), and almost always includes our institutional partners that have invested with us for many years.

Mace: When you look at the sector, what are the opportunities and challenges? What are the best options and greatest concerns?

Beckwith: It’s always simple to start with concerns, because those are easier to identify. Clearly, skilled nursing has been challenged over the last two to three years, and we have spent a significant amount of time trying to make sure that our real estate investments are healthy and that our capital partners are happy with how we are supporting those investments to make sure we have adequate cash flow and coverage. I think skilled nursing has experienced a little bit of stabilization over the past four to five months from the recent past of some high-level stress. We’re not out of the woods, but there are some good signs. As far as opportunities, the collaboration and growing sophistication of operators and risk sharing plans create opportunity as well. We also think assisted living will be interesting, as it is market by market and is truly about the supply/demand dynamics. The supply coming online a couple years ago is having an impact in certain markets.

With respect to services, a focus for us in 2019, we are focused on where care can be delivered in the most cost-effective setting, like hospice and home health, and we are interested in developing some of our behavioral investments.

Mace: National seniors housing construction starts are slowing. Can you see a cycle there in terms of lessons learned?

Beckwith: It seems there has been a slowing of new development, and that is probably a good thing. People are getting the message because of the challenged performance of some new facilities. That might be an opportunity in 2019 and 2020.

Mace: Can you explain?

Beckwith: We are excited about the opportunities for assets that can be repositioned and more actively managed. Whenever you have a period of high activity, there will be operators and investors that do not do as well as others, and that creates an opportunity for us. That’s our skill set. We are good at, and even like, deals that require some flexibility. Also, we will continue to invest in the U.K. We see opportunity there. We have a good management team, and we will continue to spend time and money there.

Mace: Other thoughts?

Beckwith: We have an all-employee call every couple of weeks, and we recently talked about Formation’s 2019 goals and objectives. Over the past two years, we have made a lot of changes and improvements to our current portfolio, and when combined with the market direction, it creates a sense of optimism. We were ahead of the curve in addressing issues in some of our skilled nursing and assisted living investments, and we want to learn from those lessons and apply to new opportunities. With some of our new capital relationships, who are eager to put capital to work, I’m excited about the opportunity to pull that all together.

Mace: NIC’s Spring Conference is focused on senior housing and healthcare collaboration. Your approach is a little different. Any other comments on that?

Beckwith: We think there are lessons to be learned from the senior care industry that can be applied to healthcare in a more service-based environment, whether it’s behavioral health, hospice, home health, or addiction treatment. With our clinical focus, new capital and somewhat agnostic approach as to where the services are delivered, we are trying to make sure we are putting our dollars to work with the best operators in each of those segments.

The Boomer Hackathon: Creating Models That Work for Boomers and Investors

The upcoming 2019 NIC Spring Conference in San Diego, CA, will feature an innovative and exciting breakout session designed to harvest attendee energy, expertise and creativity. Titled “The Boomer Hackathon: Creating Models That Work for Boomers and Investors” (Thursday, February 21 from 2:30-3:45pm PST), the session focuses on addressing the reality that Baby Boomers will demand new solutions from the seniors housing and care sector.

While there is an obvious upside to the impending surge of aging Boomers, this demographic has a well-documented habit of changing nearly every industry they have encountered. Seniors housing and care is likely no exception. The spike in demand for seniors housing and skilled nursing properties, and associated services may be offset by the evolving demands, expectations, and desires of a generation that is used to shaping the world to fit its own worldview and needs, regardless of the status quo. Business as usual may result in missing out on the greatest demographic opportunity for the sector in decades.

The hackathon concept was first popularized by Silicon Valley, as a means to hammer out rough but functional software solutions, literally overnight. Facebook, for example, employed all-nighter hackathons to adapt its early platform to the needs of younger users, ultimately yielding solutions such as the “Like” button and the Timeline feature, which are now considered essential components of their success. The format’s ability to quickly pinpoint problem areas and develop practical solutions has been recognized in other industries since then. Today, hackathons can be found coast-to-coast in industries as varied as skin-care, life-sciences, broadcasting and the recording industry.

The Boomer Hackathon is scheduled for the 75 minutes immediately preceding happy hour. The environment will be casual. In place of traditional theatre-style seating, attendees will find a comfortable layout with couches, movable whiteboards, and plenty of space for audience members to move around. The session will encourage mingling and discussion that might look more like a cocktail party than a formal presentation.

After a brief presentation highlighting key challenges from NIC Founder and Strategic Advisor Bob Kramer, three small teams and their leaders, will be introduced. A panel of judges, all of whom are Boomers themselves, will also be briefly introduced. The problem posed to the teams will be to create a senior living model that works for Boomers, a business model that works for the investor (both debt and equity), and a business model that works for the operator. They will then be given 30 minutes to work. The audience is encouraged to listen in, move between groups and discuss their own ideas and perspectives.

At the end of the 30-minute working session, each team will give a 3-5-minute pitch. The audience, as well as the judges, will then have a question and answer session with the groups. Microphone cubes, which make audience participation easy, will be provided to encourage the audience to share their questions, concerns, and ideas. The session will close with a vote and the judges announcing a winning team.

NIC will select three small teams of hackers, along with their three team-leaders, in advance of the event. Aside from expertise and experience, NIC’s selection criteria is to achieve as diverse a group as possible in order to ensure that a broad range of perspectives and experiences will be represented, an approach that researchers have found to improve outcomes when brainstorming. Participation is open to conference attendees. If you have registered to attend the conference, look for an email from NIC with further information, or email Jessica Pearce of NIC to express your interest.

In addition to bragging rights, the winning team’s ideas will be featured in NIC articles and social media posts. The ideas will be shared with the NIC Conference Planning Committee, as they develop a program of sessions for future NIC events, opening the possibility that they may see further development. The hope is that this session will generate a lot of energy and continued conversations, long after the conference in San Diego has ended.

The 2019 NIC Spring Conference will be in San Diego, California, February 20-22.

What’s New on seniorcare.nic.org

As described in the January edition of the NIC Insider, the just-launched seniorcare.nic.org microsite is a platform both for NIC to distribute news and analysis on how the seniors housing and care sector will increasingly need to collaborate with the healthcare sector and for contributors to voice their perspectives on the topic. Although it was just launched, the site already offers hours of video, high quality case studies, curated presentations, the latest relevant headlines, links to events, and several original, in-depth blog posts.

For those who have yet to visit the site, or who haven’t had time to click through all the materials it makes available, below you will find a brief digest of what can be found there. For more detail, of course, you will have to visit seniorcare.nic.org. For a weekly update on the Housing & Healthcare blog, simply subscribe. NIC will periodically post a summary of the latest from the site here in the NIC Insider.

News

A growing number of headlines are documenting the fact that changing market conditions are already driving new strategic partnerships, a growing wave of mergers and acquisitions, and numerous innovations across healthcare and the seniors housing and care sector. NIC is curating relevant articles so that subscribers may stay on top of what’s happening in this area as easily and efficiently as possible.

The site links to numerous news organizations, including:

- McKnight’s

- Senior Housing News

- Healthcare Dive

- Skilled Nursing News

- Fierce Healthcare

- McKnight’s Senior Living

- Home Healthcare News

- Healthcare Insights

- McKnight’s Long-Term Care News

- Seniors Housing Business

- Health Leaders Media

- Forbes

If stories from the past year are any indication, not only industry media but also major mainstream publications will likely expand the above list, which only reflects a few months of news. Here are some examples of the articles that we recently posted on the site:

January 22, 2019 Senior Housing News New Medicare Advantage Changes Expand Senior Living Opportunities

Recently announced Medicare Advantage policy changes could open up new opportunities for senior living providers, further accelerating the transformation of the industry’s dominant private-pay revenue model.

January 17, 2019 Healthcare Dive More seniors may soon be sporting Apple Watches with MA partnerships

As Apple engages in talks with several Medicare plans, industry watchers see a good business move for Apple and a great opportunity for the insurers, who wish to encourage the use of wearable tech to help detect falls, alert users to atrial fibrillation, and more.

January 11, 2019 McKnight’s Senior Living United Church Homes, Ohio’s Hospice form joint venture

“This partnership will improve well-being for older adults who choose hospice and palliative care when they are seriously ill or approaching end of life,” United Church Homes Senior Vice President Chuck Mooney said in a statement. “It’s more compassionate to keep residents in a comfortable setting, with care teams they know, and provide additional services as needs change. This new coordinated care model also creates peace of mind for families who want to support their loved ones who are in declining health.”

January 9, 2019 Home Health Care News ‘Drive to Home,’ Medicare Changes Are Creating More Integrated Senior Care

In years to come, cross-continuum collaboration and the formation of integrated care delivery models that keep people away from hospitals will be the main catalysts for lowering U.S. health care spending. For seniors housing, assisted living, and independent living providers, in particular, that makes establishing relationships with home and community-based partners all the more important.

Video

NIC shares many videos, mostly produced at its events, featuring keynote speakers, breakout session presentations, and special presentations, such as NIC Talks, on its YouTube Channel. On seniorcare.nic.org, videos are curated for their particular relevance to the site’s central theme. More recent videos can be found on the resources page. Clicking through to the YouTube channel, users will find useful and informative playlists.

On the events page, visitors will find videos from recent keynote addresses at NIC events.

NIC is also posting videos from other organizations on the resources page, as part of its effort to disseminate thought-leadership and encourage the exchange of ideas. Currently, the site features presentations from the recent Aging2.0 conference that took place in November 2018. Look for more video presentations in the near future.

Case Studies

Case studies, based on real-world facts, data, and business initiatives, help decision-makers understand the issues–and innovations–that will shape collaboration between healthcare and seniors housing and care in coming years. The microsite’s Resources page currently features two in-depth, high quality case studies and a synopsis of a third, all of which look closely at innovations involving seniors housing and care and the healthcare system.

Produced by Anne Tumlinson Innovations, the “ATI Analysis of Juniper Connect4Life Intervention Results and Methods Memo” outlines a case study on an innovative integrated healthcare program run by Juniper Communities in New Jersey:

“Anne Tumlinson Innovations (ATI) modeled the aggregate and per capita 2016 Medicare fee-for-service (FFS) savings attributable to reduced inpatient hospitalizations if the rate of hospitalizations among a frail group of Medicare beneficiaries could be reduced to the level that Juniper Communities achieves for its resident population, through its integrated service delivery care model, Connect4Life.”

As additional relevant case studies become available, NIC will add them to the site.

Presentations

NIC is providing PowerPoint presentations, synced to audio recordings for many of the presentations and panel discussions from the 2018 NIC Spring Conference. Previously available only to event attendees, these sessions provide a wealth of insight, analysis, data, ideas, and frank discussions, including, in some cases, question and answer periods with attendees.

These presentations are stored in a playlist on NIC’s YouTube channel, which can be accessed from both the Presentations section of the Resources page and by clicking “Breakout Sessions” in the “Previous Conference Key Sessions” section of the Events page.

NIC will add materials from the upcoming 2019 NIC Spring Conference as they become available. Additionally, as other relevant webinar recordings and other presentation materials become available, NIC will post them to the site.

Events

While NIC hosts some of the most important events of the year for decision-makers in the seniors housing and care sector, its NIC Spring Conference now also draws interest from players in the healthcare sector who are interested in exploring opportunities to collaborate. NIC is not the only organization, however, convening thought-leaders and business decision-makers to address the need for new partnerships and collaboration across seniors housing and healthcare.

In addition to linking to information and registration pages for NIC events, the events page of seniorcare.nic.org features links to numerous other events that provide value for decision-makers. NIC will continue to inform site visitors of the options available, as events are announced.

Housing & Healthcare Blog

A core component of the site is the exchange of ideas and perspectives from across the landscape of seniors housing and healthcare. NIC created the “Housing & Healthcare” blog as a means to highlight thought-leadership, share ideas, and promote discussion. The blog features original articles, featuring new ideas, different viewpoints, particular challenges, opportunities, and opinions, from across the sector. While NIC staff will contribute regularly, other authors also are encouraged to contribute.

NIC is very pleased to have contributions from Jacqueline Kung and Lynn Katzmann on the site as well as the first of a regular series from writer Jane Adler. Look for other well-respected contributors to add their thoughts to the new blog in the coming weeks and months.

Complimentary blog subscriptions are available through the site, making keeping up on the latest from the blog as simple as opening a weekly email. With over a hundred subscribers in its first week, “Housing & Healthcare” promises to be a popular read for the investors, owners, operators, developers and, now, the healthcare players, who hope to partner with them in the coming era of collaboration.

Continuing Care Retirement Community Occupancy Performance

Key Takeaways

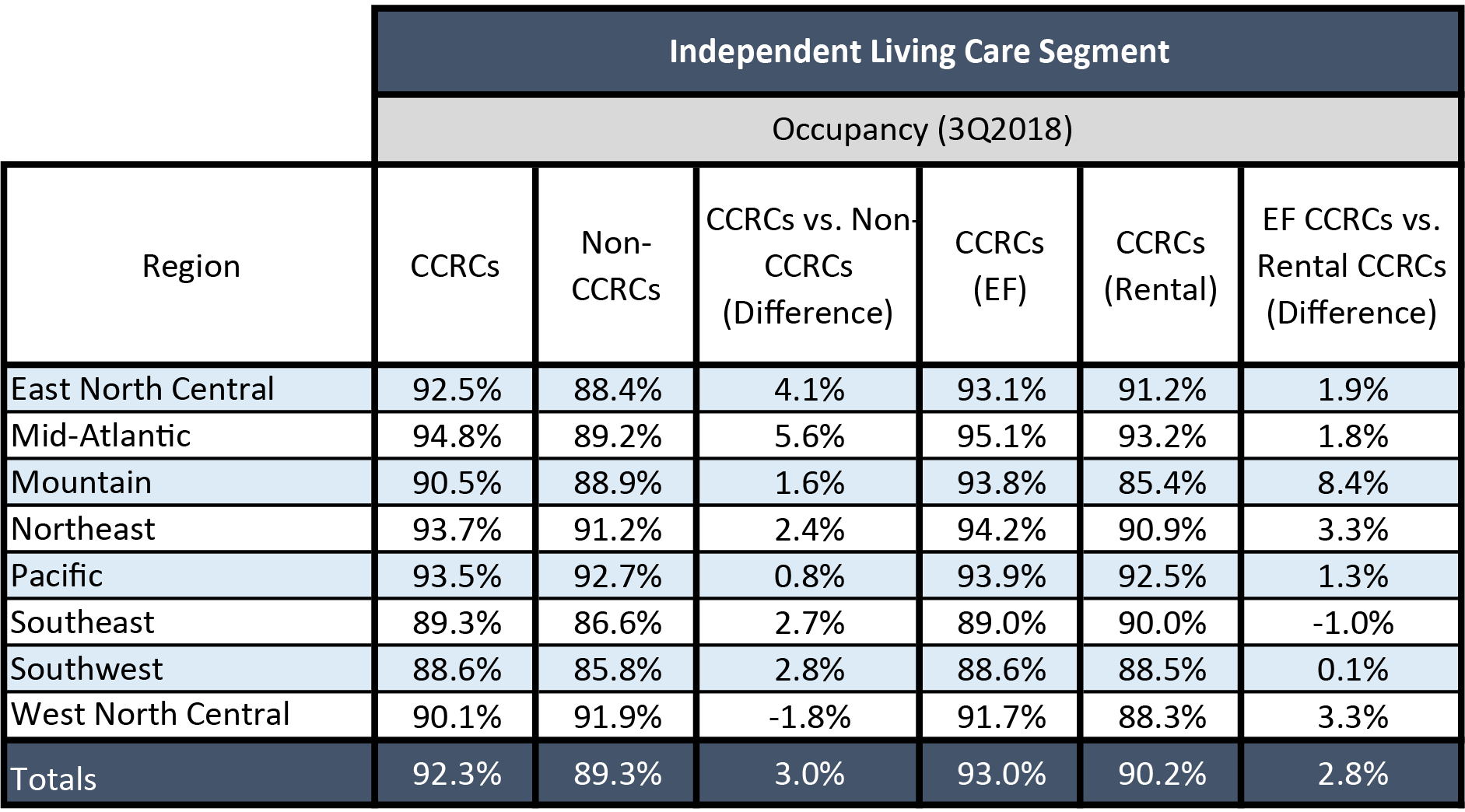

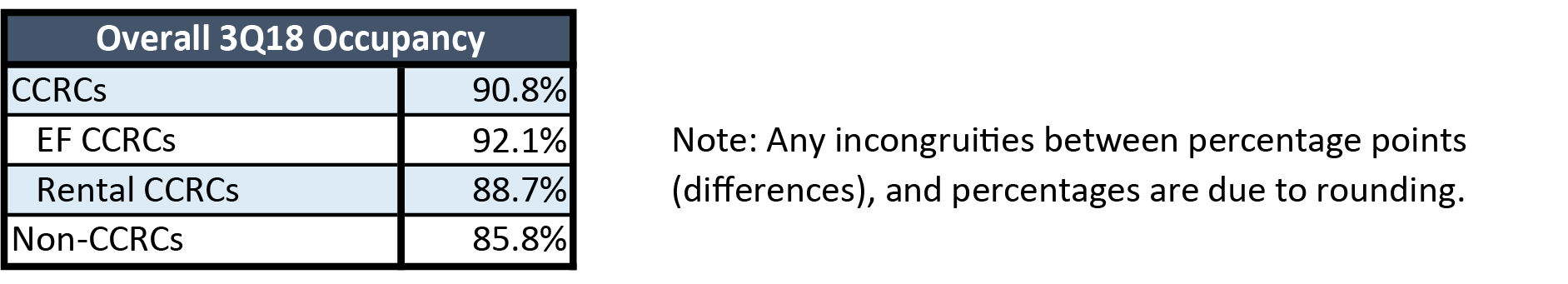

- In the third quarter of 2018, CCRC occupancy, which is inclusive of both entrance fee and rental payment communities, across the 99 Primary and Secondary Markets (i.e., metropolitan markets) tracked by NIC MAP® was 90.8%–five percentage points higher than that of non-CCRC communities (85.8%).

- Entrance fee CCRCs generally had higher occupancy than rental CCRCs, with some variability by care segment and by region. Entrance fee CCRC occupancy was 3.3 percentage points higher than rental CCRCs in the third quarter of 2018 (92.1% vs. 88.7%).

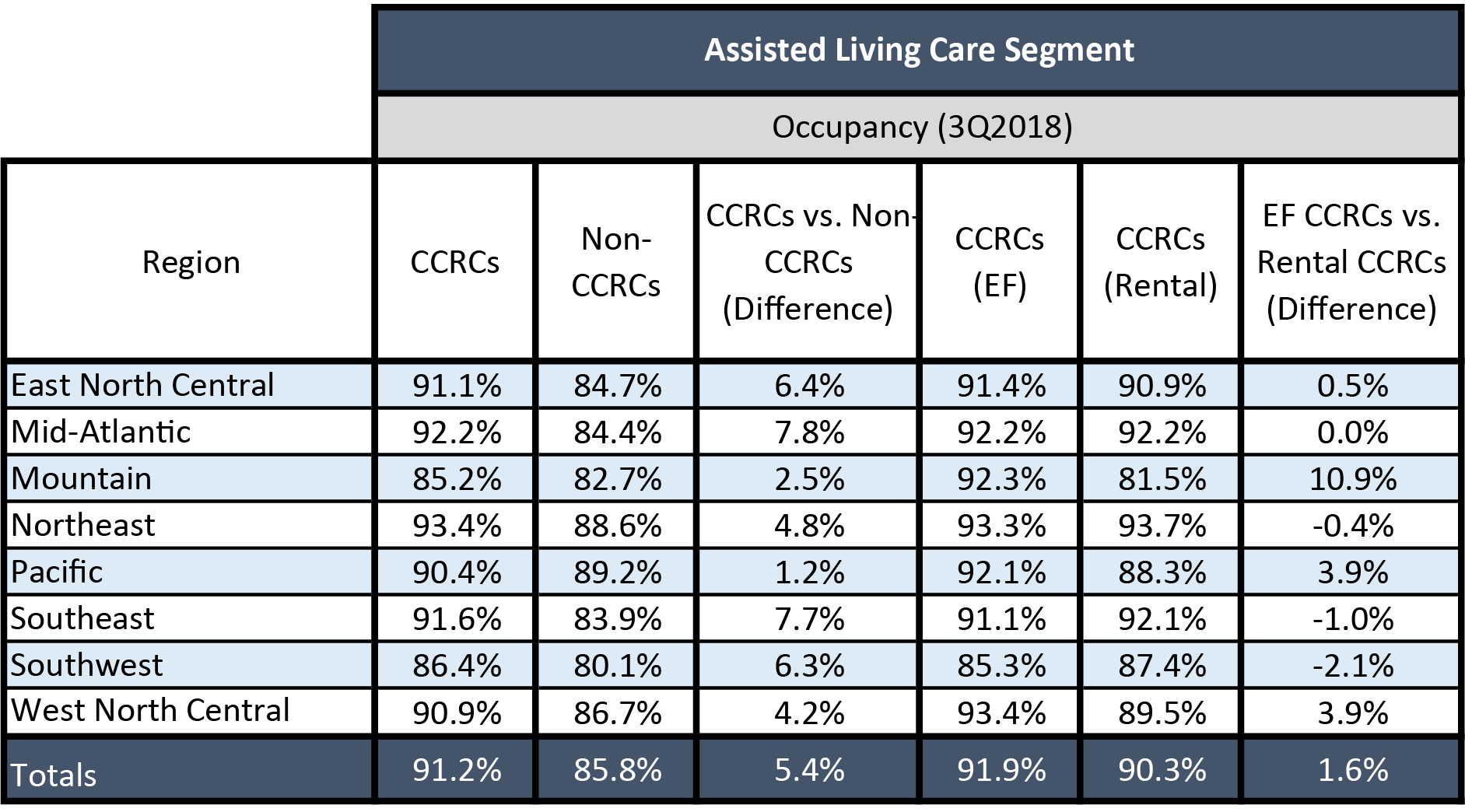

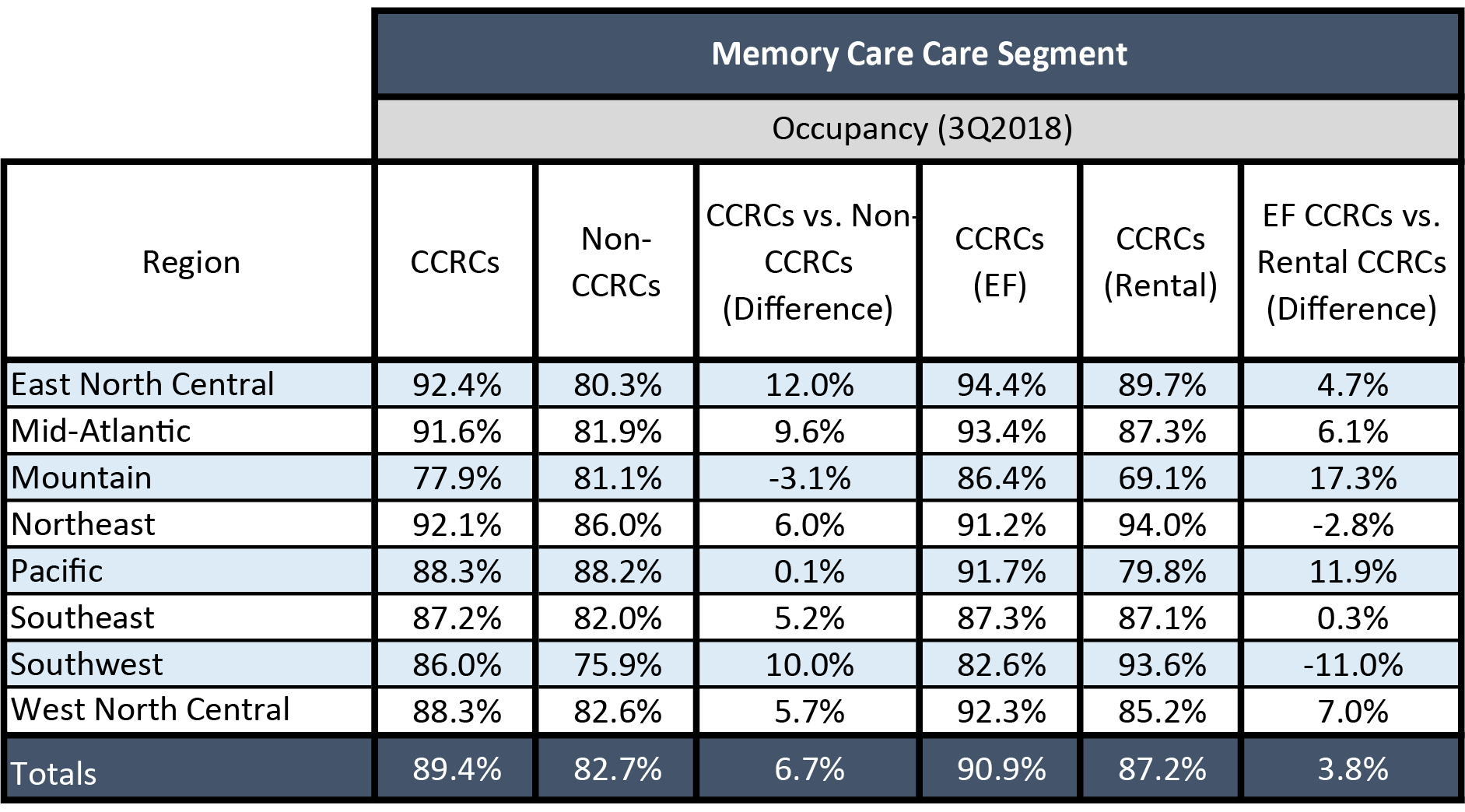

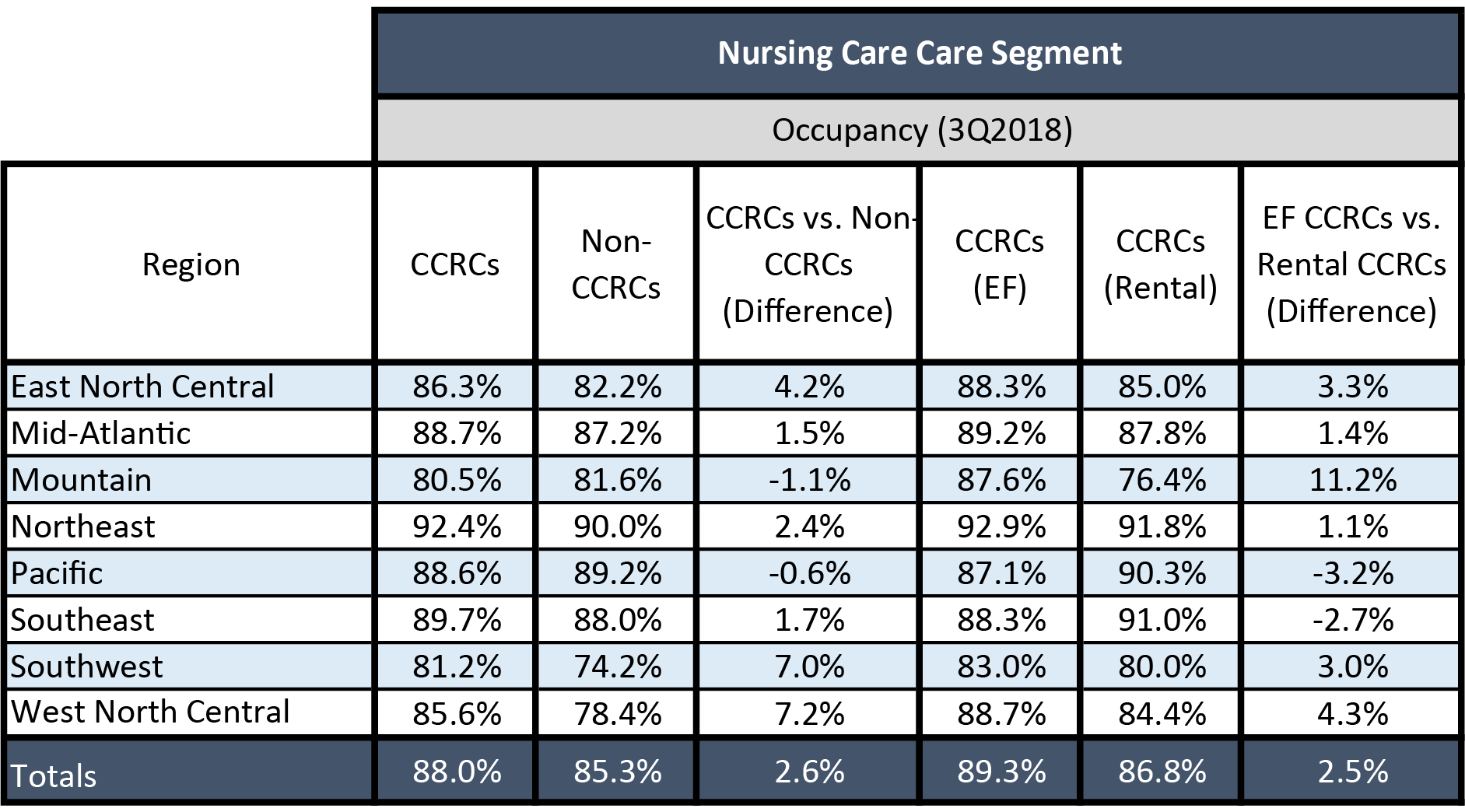

- The Northeast and Mid-Atlantic regions had the strongest CCRC occupancies across care segments, whereas the Mountain and Southwest regions performed relatively weaker.

- In general, across segment types, occupancy was strongest for independent living and weakest for nursing care and memory care.

Introduction

With the objective of making comparisons with non-CCRC freestanding or combined communities, and CCRC communities by payment type, this analysis is useful for understanding the relative occupancy performance of care segments within CCRCs.

The following commentary describes 3Q2018 CCRC occupancy in the combined NIC MAP 99 Primary and Secondary Markets, broken out across geographic regions. (Note that NIC MAP recently released data for 4Q2018). For the analysis, occupancy data for CCRCs—both entrance fee (EF) and rental payment CCRCs—and non-CCRC communities was considered. The occupancy rate used was the “all occupancy” rate which includes properties still in their respective lease-up as well as stabilized properties.

Findings Across Geographic Regions

Overall, the Northeast and Mid-Atlantic Regions had the strongest CCRC occupancy across care segments, while the Mountain and Southwest Regions’ rates were relatively weaker.

- By care segment, the Mid-Atlantic had the highest CCRC independent living segment occupancy (94.8%), followed by the Northeast and Pacific Regions (93.7% and 93.5%). The Southwest Region had the lowest CCRC independent living occupancy (88.6%).

- The Northeast had the highest CCRC assisted living segment occupancy (93.4%), followed by the Mid-Atlantic Region (92.2%). The lowest CCRC assisted living occupancy was reported for the Mountain and Southwest Regions (85.2% and 86.4%).

- Regarding CCRC memory care segment occupancy, the East North Central and Northeast had the highest (92.4% and 92.1%), whereas the Mountain Region had the lowest memory care CCRC occupancy (77.9%).

- CCRC nursing care segment occupancy was highest in the Northeast (92.4%), while the Mountain and Southwest Regions reported the lowest CCRC nursing care segment occupancy (80.5% and 81.2%).

Deep Dive: CCRC vs. Non-CCRC Communities

3Q2018 CCRC occupancy, which is inclusive of both entrance fee and rental payment communities, across the 99 Primary and Secondary Markets (i.e., metropolitan markets) tracked by NIC MAP® was 90.8%–five percentage points higher than that of non-CCRC communities (85.8%). One potential reason for the difference may be due to the inventory mix in the overall CCRC aggregation. While 98.8% of the non-CCRC communities’ inventory was rental, the CCRC inventory was comprised of 63.3% entrance fee communities and 36.7% rental communities. Another potential reason may be due to the CCRC product offering, which tends to attract retirees who are “planners”—those who wish to make one move to a continuum of care, or perhaps because new CCRC residents are generally healthier than residents in other types of seniors housing, resulting in lower resident turnover in CCRCs.

Across overall care segments, occupancy at CCRCs was higher than that at non-CCRC communities (non-CCRCs). By care segment, the greatest differences in occupancy rates for CCRCs compared with non-CCRCs were reported for the memory care segment (6.7 percentage points), followed by the assisted living segment (5.4 percentage points), and the narrowest for the nursing care segment (2.6 percentage points). Independent living segment occupancy was three percentage points higher for CCRCs than non-CCRCs.

- By region, the largest differences in CCRC independent living segment occupancy compared with non-CCRCs were reported for the Mid-Atlantic Region (5.6 percentage points) and the East North Central Region (4.1 percentage points).

- The largest differences in CCRC assisted living segment occupancy compared with non-CCRCs were found in the Mid-Atlantic and Southeast Regions (differences of 7.8 and 7.7 percentage points).

- The largest difference in CCRC memory care occupancy compared with non-CCRCs was reported in the East North Central Region (12.0 percentage points), the Southwest Region (10.0 percentage points), and the Mid-Atlantic Region (9.6 percentage points).

- The West North Central and Southwest Regions had the largest differences in CCRC nursing care segment occupancy compared with Non-CCRCs (7.2 and 7.0 percentage points).

Digging Deeper: Entrance Fee CCRCs vs. Rental CCRCs

In the 99 Primary and Secondary Markets, occupancy at entrance fee CCRCs was higher than that at rental CCRCs by 3.3 percentage points in 3Q2018. By care segment, the greatest differences in occupancy rates for entrance fee CCRCs compared to rental CCRCs were reported for memory care (3.8 percentage points), followed by independent living (2.8 percentage points), and nursing care (2.5 percentage points). Assisted living care segment occupancy in entrance fee CCRCs was 1.6 percentage points higher than in rental CCRCs. Note: the referenced percentage point differences were rounded.

- By region, the largest differences in independent living segment occupancy between entrance fee and rental CCRCs were reported in the Mountain Region (8.4 percentage points). Independent living segment occupancy was slightly higher in rental CCRCs than entrance fee CCRCs in the Southeast Region.

- The largest differences in assisted living segment occupancy between entrance fee and rental CCRCs were reported in the Mountain Region (10.9 percentage points). Rental CCRCs had slightly higher assisted living segment occupancy than entrance fee CCRCs in the Southwest, Southeast and Northeast Regions.

- The largest differences in memory care segment occupancy between entrance fee and rental CCRCs were reported in the Mountain Region (17.3 percentage points) and Pacific Region (11.9 percentage points), where entrance fee CCRCs occupancy was higher than that for rental CCRCs, and in the Southwest, where rental CCRCs occupancy was 11.0 percentage points higher than that for entrance fee CCRCs.

- The largest difference in nursing care segment occupancy between entrance fee and rental CCRCs was noted in the Mountain Region (11.2 percentage points). Rental CCRCs had slightly higher nursing care segment occupancy than entrance fee CCRCs in the Pacific and Southeast Regions.

In the third quarter of 2018, entrance fee CCRCs generally had higher occupancy than rental CCRCs, with some variability by care segment and by geographical region. Higher occupancy in entrance fee CCRCs may be due, in part, to higher rates of resident turnover in rental-model CCRCs, according to data from ASHA’s State of Seniors Housing, 2018 database. While communities with rental payment plans (i.e., non-CCRCs and rental CCRCs) offer monthly or annual leases for housing and services, entrance fee CCRCs include contract stipulations such as refund percentage and timing of refund, which may help retain residents who put down a sizable up-front fee to reside in a CCRC. An additional reason for higher occupancy rates in entrance fee CCRCs may be due, in part, to the fact that the majority of entrance fee CCRCs are nonprofit organizations (72.6%). According to NIC MAP, nonprofit CCRC occupancy in the Primary and Secondary Markets has exceeded that for for-profit CCRCs by more than four percentage points since 2Q15.

However, product differences are unlikely to tell the whole story. Further analysis is needed to more fully explain CCRC segment occupancy performance by payment plan and by region, and in comparison to non-CCRC communities. Contributing factors that could be explored include economic drivers such as industry mix, cost of doing business and living costs, employment growth, and the health of the residential housing market, specifically as it relates to entrance fee CCRC occupancy performance since often CCRCs target upfront fees to local home sales prices near or around the median to enable consumers to fund a move with a near one-to-one exchange. Other considerations include income levels, inflation-adjusted purchasing power, prospective resident educational profiles, product acceptance and familiarity as well as penetration rates, longevity of seniors housing product in the area, and cultural differences.

Behind the Scenes: Inside NIC’s Data Group

Hundreds of businesses, including capital providers, developers, owners, operators, service providers, and others, rely on the NIC MAP® Data Service as they research, analyze, and assess their markets and prospects across the country. Clients know they can trust the accuracy of the data NIC makes available as they leverage the ever-expanding utility of NIC’s online platform; but they may be unaware of what happens behind the scenes in order to produce such quality data.

In fact, since its earliest years NIC has invested heavily in its data collection and quality assurance practice, to achieve its mission for improved transparency into the seniors housing and care property markets. NIC’s efforts have helped propel the sector to its current status as a leading property type in the commercial real estate industry. Quality data has increased access to capital, lowered costs, and ultimately, helped improve access and choice for America’s seniors.

Today, NIC supports a talented and experienced in-house data group dedicated to producing the finest quality data available, and enjoys close, long-term alliances with some of the industry’s leading vendors of data collection services. In 2018, 22 people, employed both in-house and by vendors, produced four quarterly data releases, two Seniors Housing Actual Rates Report releases, all of the data for the Fifth Edition of the NIC Investment Guide, and many custom data requests, both for internal and external clients. All the while, the group worked daily to collect thousands of data points, assure quality across its entire platform, add new data from new sources, research and analyze trends, streamline processes, and develop new reports and new features.

To shed light on what it takes to produce the quality and volume of data that NIC offers, NIC convened the leadership of its data group to discuss their approach–and share how NIC’s data investments are providing value to clients, and the sector overall–every day.

Dan Raney, Director, Product Solutions & Technology, started off by explaining that NIC collects data from a number of sources: “Many of the larger contributors are able to give us detailed reports from their property management systems, but we also work closely with the ProMatura Group, who gets information directly from properties over the phone. They have a team of 15 people dedicated to data collection for NIC, and don’t work on anything else.“

The in-house group that manages NIC’s data is divided into several distinct teams. There is an internal research and data collection team that focuses just on construction data. Two associates are responsible for researching projects in the pipeline, from the early planning stages through construction starts. They comb through a complex collection of resources to identify and track proposed and planned construction in 140 U.S. metropolitan markets. Once a project breaks ground, the ProMatura Group tracks the property through its opening day.

NIC’s systems have built-in checks designed to flag and block any data that sits outside given parameters. The three-person Quality Assurance team looks at thousands of records daily in order to assess whether the data has errors in it–or whether indeed they point to actual shifts in the market. “Our teams are constantly reviewing quality assurance reports throughout each quarter. They are very detailed in their inspection of the data, diligently examining the nuances of each data set (skilled nursing, actual rates, etc.). Although each data set is unique, we’ve put together a common quality control process that ensures the accuracy of all data before it is reported to our clients.” said Raney.

Research Manager Brian Connolly’s group is responsible for initial data collection and quality assurance. Many sources provide data constantly, while others provide periodic updates. Some data sources are one-time downloads. In the case of ProMatura’s contribution, Connolly says, “ProMatura is calling the same properties in the same markets every quarter. They’ve been able to build relationships with these communities and have built a lot of trust with the people they’re talking with to provide the detailed data points that NIC requires for its reporting. They’re speaking the same language. Every quarter they call about 13,000 properties. This past quarter they finished 96% of those calls, meaning they’ve entered all the relevant data reporting into our survey instrument and submitted it for our review and publishing. Again, should any data they report fall outside our thresholds, it is flagged for review. We review those records every day, as they come in.”

“ProMatura has worked with us for over ten years. They understand how this data is used in the industry, and how important it is to everyone out there that it is accurate and complete. We have an excellent partnership with them. They also manage data that some of our corporate contacts enter into workbooks, which they then enter into our system, which then can be reviewed for quality along with all the other data.”

“We also get data directly from corporate partners at the property level, which is now a somewhat automated process. There’s a separate QA process for this type of electronic data submission. The systematic computerized process makes it much easier for these partners to submit their data to us and reduces the strain on our own resources as well.”

All property data is collected by Connolly’s group, and combed and checked for accuracy. He explained the purpose of NIC’s multiple checks prior to analysis: “The point is to have some redundancy in the way we review all the data. It means we have numerous eyes on every data point, with numerous checks throughout each quarter. The thresholds we use are based on historical trends for that property. We can use them to benchmark the data we’re collecting and make sure there are no surprises sitting so far out of the trend that we need to look at it more closely and clean it up. After the collection period ends, in the data finalization process we run all of our checks repeatedly to make sure the data is clean before it is turned over to our analysts for reporting.”

A team of three full-time analysts is responsible for processing the data from the Quality Assurance team and completing quarterly reporting on it. The team also produces specialty reporting throughout each quarter, such as the Seniors Housing Actual Rates Report and the Skilled Nursing Data Report. They also support all of NIC’s presentations and webinars with accurate, current data, analysis, and visualizations.

Working in collaboration, the Quality Assurance and the Data and Analytics teams jointly execute each quarter’s data finalization process. Data and Analytics Manager Leighann Garcia explains, “The two teams bring two different perspectives to the data. In the Quality Assurance department, they tend to have a property-level expertise, while the Data team looks at it from a higher level, looking at broader trends over time and at the aggregate, rather than at individual properties. Combining those perspectives works well when we’re finalizing the data before reporting on it. From there, we produce about 45 different reports each quarter.”

Connolly added that, “The delineation between the Quality Assurance team’s property-level view and the Data Team’s aggregate view is deliberate. It frees up the Data Team to view the data without any bias that might come from looking at a particular property. On the flip side, the QA team can look at the property level without any bias that comes from the aggregate. We put that in place on purpose. That’s why the partnership between the teams works so well. Both teams find important nuggets, and as a group, we are better able to direct our data collection efforts as a result, particularly as we identify long-term trends that might need clarification. When the Analytics Team looks at the finalized data for publishing and reporting, they know it’s reviewed and as clean as possible. When they see trends, they can be confident they’re not just seeing something that was missed in the QA or data collection process.”

Connolly’s team conducts regular audits, to further ensure nothing is overlooked. “We review the entire database, auditing each market individually versus state data. We’ll go to a given state’s department of health, for example, and find all their lists and compare them to our database. That’s one way for us to proactively research each of the markets outside our normal process of data collection and make sure our database is as complete as possible.”

With clean data in hand, Garcia’s team generates reports throughout every quarter. “Reports fit into one of several categories,” she explained. “The first of these is reports that go to clients who have requested a customized report. We also generate reports that get uploaded to the NIC MAP Client Portal. Some reports are for internal use. For example, we provide our marketing department with data for their content and generate a few specialized reports for our senior leadership. We also work very closely with our Outreach Team, providing data for their webinars and presentations. We’re closest to the data, and often call out trends from the very beginning of the process.”

NIC is careful to spread out the collection of data points for each metropolitan market throughout the quarter. The way they structure their agreements with data providers–and execute their own collection processes–ensures that no metropolitan market’s data is collected within a single month, for example. All of NIC’s data collection occurs as evenly as possible throughout time and across markets.

Partnerships with leading software vendors in the space have streamlined processes by which NIC receives data. Customized reports, designed to automatically feed data to Connolly’s team, have significantly boosted efficiency, while helping to reduce human error. Because NIC either talks to or receives data from nearly every property in its database every single quarter, accurate and efficient data collection processes are essential.

Reports are generally built in three different ways. Some are custom developed in SQL, others use the data tools in Excel, while still others are coded in a programming language called R. Using these tools, the team generates reports, some of which are complex and very time-consuming. Once generated, every report goes through a quality assurance process to be validated.

“One key role we play is subject matter expertise on our data,” added Garcia. “While we don’t advise on strategy or make predications, we can help clients if we know what they’re trying to achieve with our data. A client that’s running 14 reports manually in every one of their subscribed markets might come to client services and ask if we can save them time, for example. We’d be able to help them with a custom report.”

Looking ahead, the data group plans to expand the database to include, among other things, seniors housing financial benchmarking data. NIC’s Seniors Housing Financial Benchmarking Initiative will create a time series database that allows for consistent financial benchmarking of select property-level operational revenue and expense categories. “This will be another way our clients can benchmark their communities,” said Connolly.

Through everything they do, NIC’s data teams share a passion for accuracy. “NIC is really focused on getting the numbers right,” said Raney. “It’s personally offensive to us if the numbers are wrong, even for a single property. I really believe that the care we invest on data accuracy at NIC is second to none.”

“And also, our transparency in the event that we have an oversight,” added Garcia. “Those things do happen. There have been errors, but we’re very forthcoming and transparent when that happens. I believe our customers appreciate that.”

New initiatives, new sources of data, and new reporting products will all be executed by NIC’s dedicated data group, on top of the considerable effort that goes into daily, weekly, and quarterly data collection, QA, analysis, and reporting output which NIC clients have come to rely on, year after year.