Time to Lock up Low Rates: Erik Howard of Capital Funding Discusses the Lending Landscape

With interest rates still at historically low levels, borrowers that plan to hold their properties for the long term should take advantage of fixed-rate debt. That’s the advice of Erik Howard, managing director, real estate finance, at Capital Funding LLC. As a subsidiary of CFG Community Bank, Baltimore-based Capital Funding is known as a one-stop shop for healthcare facility owners and operators, with expertise in HUD loans, bridge lending, working capital loans, and commercial banking and investment advisory services through the CFG family of companies.

With a broad portfolio of loan products for a variety of property types, Howard recently spoke with NIC about the lending environment and the outlook for the seniors housing and care industry. [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: In your view, how is the seniors housing and care market performing?

Howard: The market is performing well, evidenced by a flight of capital to it over the past few years. The sector is a relative safe haven because it’s a needs–based industry. On the long-term care side, state budgets are continuing to solidify with a handful of exceptions, and Medicare funding seems to be back on track. That creates a better backdrop for reimbursement. On the seniors housing side, we see strength in the segment which has continued to perform well.

NIC: How would you characterize the overall lending climate?

Howard: It’s very healthy. We compete with a number of commercial finance companies as well as small, medium and large commercial banks. The appetite for both skilled nursing and seniors housing is continuing to increase. Lenders seem to be getting incrementally more aggressive in their leverage, rates and recourse. There’s a lot of capital on the debt side for owners and operators.

NIC: Your firm is active in the HUD 232 mortgage insurance program. What is the status of the program?

Howard: HUD changed some of its documents and policies about 18 months ago, but no major changes are on the horizon. Volume is down a little bit this year, as expected. One of the things we saw last year was a large spike in rate resets for existing HUD- insured mortgages which contributed to the high volume. We’re getting back to more traditional-type financings through HUD—refinancings, new construction and supplemental financing. But financing volume this year is still at about $2.0 billion and on pace to hit $2.5 billion. Those are strong numbers.

NIC: Capital Funding is active in the skilled nursing space. What is your take on the rapidly changing post-acute environment? Do you see potential opportunities to capitalize from the lending perspective, perhaps for replacement properties?

Howard: We think there are real opportunities on a number of fronts as skilled operators continue to enhance their capabilities. The sophistication of the industry continues to grow. That is a strong backdrop for consolidation. The industry remains relatively fragmented with smaller operators that may be unable to compete going forward, given the environment and the need to upgrade their post-acute type of product. The situation bodes well for replacement facilities since the majority of vintage assets are 20-30 years old. Those physical plants don’t always set up optimally for the post-acute type resident. Owners and operators looking ahead to the next 5-10 years will be making changes to their buildings’ physical plants to meet the needs of those residents. We think there will be opportunities.

NIC: Have refi’s run their course?

Howard: Two situations produce refis: New construction that is stabilized and hits its run rate, which leads to a refinancing. The other is acquisitions and bridge financing. We provide a tremendous amount of those as well. With continued activity on the development side, the replacement of skilled facilities, and acquisitions in general, a wave of refi’s will continue to work their way through the system.

NIC: Are there markets or property types you prefer or avoid?

Howard: We have historically focused on skilled nursing, assisted living and memory care. But there are no property types we categorically avoid. We focus on quality operators. We realize some markets are more challenged from a reimbursement perspective on the skilled side, but if you’re dealing with a good operator that understands the business and the market, they can do well anywhere.

NIC: What about bridge loans?

Howard: We did $400 million in bridge financing last year and expect to continue that pace this year. We offer a very competitive package and we’re very creative in terms of sizing loans.

NIC: You recently financed a $13.9 million bridge to HUD loan for a large facility in Redlands, Calif. What did you like about this transaction?

Howard: The deal had a strong borrower and a quality operator that saw potential for some upside at the facility. We were able to get comfortable with the operator’s plan and projections, and underwrite the deal on a pro-forma basis giving significant leverage to the borrower.

NIC: What should borrowers know about your programs?

Howard: We have prided ourselves on the concept of one-stop shopping to provide all types of capital a borrower would need rather than having to go out and find multiple sources of capital.

NIC: Many are predicting higher interest rates. What are you advising borrowers?

Howard: Obviously, there’s a tremendous amount of focus on the Federal Reserve which can have an immediate impact on the short end of the yield curve and short-term borrowers with variable rate loans. We look at the longer end of the curve, the U.S. 10-year Treasury note, which has shown some signs of running higher amid strong economic data. If the economy continues to create jobs, you’ll start to see the consumer come back which will push up prices and be followed by higher interest rates. There are always wild cards, but we are counseling clients to take advantage of fixed-rate debt now.

NIC: What’s your outlook for seniors housing and care?

Howard: We think the owners and operators who continue to re-evaluate the model will be successful. If you look back five or 10 years, there was a much different approach and that evolution will continue. It will be interesting as baby boomers move through the continuum to see what their needs and wants will be and how owners and operators adjust to remain competitive. Those operators and managers that can continue to redefine what they do, and provide good care will be the market leaders.

[/expand] [cresta-social-share]

Seniors Housing Occupancy Falls Again As Supply Growth Accelerates

Is Occupancy Nearing Its Peak for this Cycle?

Is Occupancy Nearing Its Peak for this Cycle?

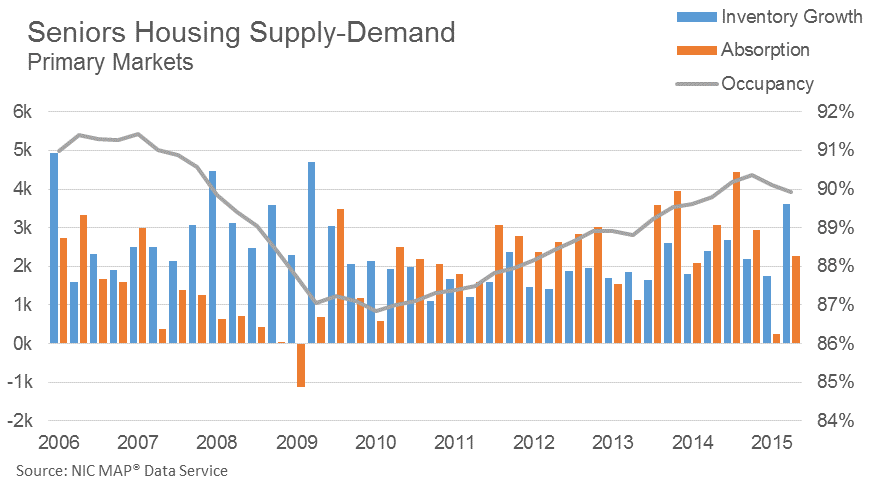

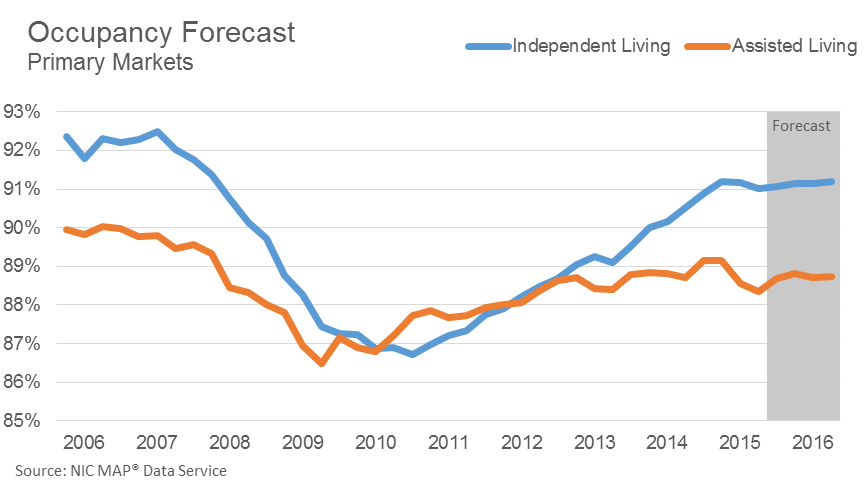

Seniors housing occupancy declined for the second consecutive quarter, but this time it was driven by supply. During the second quarter of 2015, occupancy in seniors housing was 89.9%, down 20 basis points from the first quarter. While occupancy fell 50 basis points during the first half of 2015, it is still slightly positive on a year-over-year basis.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Concerns about supply have been building for a couple years, but until this quarter had not yet materialized in the data. However, the second quarter finally saw it come through, as inventory grew at its fastest rate in six years. Inventory increased at a 2.7% annual rate during the second quarter – prior to this quarter, it had not exceeded 2.0% going back to the end of 2009. While the rate of absorption did accelerate from its anemic first quarter reading, it was still on the weaker side of where it had been trending previously and unable to offset the acceleration in inventory growth.

With the declines in occupancy this year, it continues to beg the question of peak occupancy. Prior peaks may no longer be appropriate benchmarks, as turnover rates are higher now than in previous cycles. Move-in rates will need to increase to make up for the increased turnover. As a result, peak occupancy during this cycle may be lower than what was seen in 2006 and 2007, i.e. 89% may be the new normal for assisted living. NIC forecasts that occupancy will remain somewhat flat during the next four quarters, with seniors housing occupancy at 90.2% by the second quarter of 2016, 30 basis points above the current rate. Most of that gain will come during the third quarter where there is typically a seasonal boost to occupancy, the following three quarters is forecast for occupancy to remain relatively flat.

[/expand] [cresta-social-share]

“The Next 25”—a Deep Dive into the Future of Seniors Housing & Care

Anniversaries typically recall the past, but the 25th NIC National Conference is a comprehensive look into the future of seniors housing and care.

“The Next 25” is the theme of the National Conference this fall, exploring innovation, the aging revolution, and the quality metrics poised to drive the future of seniors housing and care, as well as key operational and investment perspectives. Programming will be presented in a variety of meeting formats, along with multiple networking opportunities.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Here are some of the conference highlights:

* NIC Boot Camp is a pre-conference session for industry newcomers. The two-and-a-half hour workshop is designed for analysts, underwriters, institutional investors and developers with one to three years of experience in seniors housing and care. Participants will learn the key ingredients of a valuable property: how it is built, leased and operated. The Boot Camp will be held Wednesday afternoon (Sept. 30).

* The opening general session will be a point-counterpoint discussion with two political party leaders, both with senior living experience, sharing their inside-the-beltway perspectives on the roles of the public and private sectors in meeting the housing and care needs of America’s elders. The speakers include Congressman John Delaney, (D) Maryland and co-founder of CapitalSource, a leading commercial lender in the health care and senior living space, and Congressman Jim Renacci, (R) Ohio, founder of LTC Management Services, an Ohio-based company that owned, operated and managed nursing facilities. The discussion will be moderated by Bob Kramer, NIC CEO and former Maryland state legislator.

* The keynote address will be presented at the Thursday luncheon by David Gergen, noted author and senior political analyst for CNN. Gergen will share his thoughts on the presidential race and what we may expect in the coming months as the campaign heats up with the primary season, the national conventions and finally the general election. In addition, he will share his insights into how both parties, and a new President, could focus on entitlement and tax reform, and how the ACA will be viewed.

* NIC Talks is new this year. NIC Talks is a series of individual 12-minute talks designed to spark conversation about the future of aging. The talks will be given by both industry insiders and outside disruptors who will offer their take on what will revolutionize the aging experience in the next 10 years. Speakers, among others, include Debra Cafaro, chairman and CEO at Ventas Inc., Dr. Bill Thomas of Changing Aging, and Arnold Whitman of Formation Capital, and Tom DeRosa, CEO & Director of Healthcare REIT.

* NIC Technology Innovation Challenge is another first-time program. Something like the “Shark Tank” television series, the session will feature technology start-up companies from the 2015 Aging2.0 Academy pitching their products and services to a panel of judges made up of well-known senior care providers. The judges will question the entrepreneurs to determine if their innovations are practical, relevant and scalable. Featured tech start-ups include:

- SingFit

- Cubigo

- LivWell Health

* Panel sessions and presentations will dig into the details of seniors housing and care. Some of the topics to be covered include NOI growth, development feasibility, the impact and import of quality on sustainable returns in skilled nursing, the changing payor landscape, decoding valuation, and seniors housing demographics and economics.

[/expand] [cresta-social-share]

FLC Participation Boosts Awareness of Industry Issues

Organizations nurture their new leaders through mentorship—one of the benefits of the Future Leadership Council (FLC), which gives its members the chance to learn from experienced pros.

As such, Melissa Owens, vice president of sales and marketing at Elmcroft Senior Living (FLC class of 2015) recently sat down with FLC alumnus and Vice Chair (2014) Bre Grubbs, vice president of new business with Leisure Care. They discussed how participation in the FLC has impacted Grubbs’ career and shaped her ongoing relationship with the National Investment Center for Seniors Housing & Care (NIC). [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Owens: What were you hoping or expecting to gain when you first joined the FLC, and how did that compare to what you actually achieved or how you benefitted?

Grubbs: When I joined the FLC, I hoped that I would be able to contribute to the NIC mission and expand my network of contacts in the industry. While I did those things, I underestimated the magnitude of the opportunity. The FLC provides members an unmatched opportunity to share ideas, think outside the box and contribute to the industry in the form of sessions, white papers and committees. It provides opportunities to meet and network with peers and NIC leaders, and a path to get and stay involved with NIC.

Owens: What insights or ways of thinking do you feel you gained that you might not have otherwise have been exposed to by being a member of the FLC?

Grubbs: As a member of the FLC, I gained greater insight into the goals and mission of NIC as a whole and how to effectively contribute. I also met people from all branches of the business, some of whom have become great friends, new business partners and incredible resources.

Owens: How did your involvement with the FLC impact your continued involvement with NIC?

Grubbs: My term with the FLC officially ended last September and I was fortunate to be invited to continue my involvement with NIC as a member of the National Planning Committee. At this year’s NIC national conference, there will be some innovative and interesting new session formats, including a two-and-a-half hour boot camp workshop led by the FLC. This session will provide an opportunity to introduce new entrants to seniors housing, whether underwriters, analysts or developers, to the full seniors housing cycle. The workshop will include an interactive simulation in which participants work with a team to make decisions that operators and owners face every day regarding development, financing, operations and divestiture. I’m so excited to continue my involvement with NIC, especially with such innovative programs.

Owens: What do you see as the biggest trend impacting senior living today?

Grubs: Throughout my time in the FLC, the question and concern about affordability has been discussed regularly. It’s a matter that impacts all aspects of the industry, from developers, to operators and capital providers. There are a lot of great ideas and I think that there has been some progress, but it’s an issue we will continue to face.

[/expand] [cresta-social-share]