Focus on the Fundamentals: A Conversation with CareTrust’s Dave Sedgwick

As chief operating officer at CareTrust REIT, Dave Sedgwick has some thoughts on success.

As chief operating officer at CareTrust REIT, Dave Sedgwick has some thoughts on success.

Since its debut in 2014, CareTrust REIT (NASDAQ: CTRE) expanded its tenant roster to 22 operators, and grew its real estate portfolio to 212 net-leased healthcare properties and 3 operated seniors housing properties across 28 states, consisting of 21,520 operating beds/units, along with two preferred equity investments and two mortgage loan receivables.

NIC senior principal Bill Kauffman recently talked with Sedgwick about how the San Clemente, California-based company is strategically building a successful investment platform. What follows is a recap of their conversation.

Kauffman: Can you provide some background on your professional career and how you became chief operating officer of CareTrust REIT?

Sedgwick: My career in seniors housing and healthcare began 18 years ago as an administrator in training at The Ensign Group. I spent about 13 years there in a few capacities–executive director of five facilities, regional leader, and member of the senior management team as president of “Anti-Corporate” Services and chief human capital officer.

I can’t think of a better operations training ground than Ensign. Culturally, they strive to balance a decentralized structure that empowers local leaders with expert in-field and service center support. Their heavy reliance on the local manager to lead, problem solve, and know every detail of the operation exposed my weaknesses at a young stage of my career. I’m forever grateful for my dear friends and colleagues there and for their support.

I became convinced of several leadership and operational principles because of my time at Ensign. For example, no management scheme or decision can compensate for a weak culture that fails to value the talent, spirit, and goals of your people. Related to that, is the need to marry that commitment to culture with clinical and financial expertise. Ultimately, if there’s no margin, there’s no mission.

When Ensign decided to spin off its owned real estate into a REIT, Greg Stapley (Ensign co-founder and CareTrust CEO) asked me to join him to launch the REIT along with Bill Wagner (CFO) and Mark Lamb (CIO). After some soul searching, I decided it was the right thing to do for me and my family at the time. It has been a challenging, rewarding, humbling, and growing five years since CareTrust’s birth. One of the blessings in my life has been, and continues to be, the privilege of working with people I love and respect. I’ve had my current responsibilities from day one. I’m involved with new investments, asset management, new operator development, and investor relations.

Kauffman: How big is CareTrust REIT’s current portfolio? How many properties does it include and in how many states? How many operator relationships does it have?

Sedgwick: We spun out of The Ensign Group five years ago with 94 properties run by one tenant (Ensign). As of May 2019, we have grown by over $1.2B of new investments to 226 properties in 28 states with 22 operators.

Kauffman: Most of your portfolio is skilled nursing focused but do you also have any assisted living or independent living properties?

Sedgwick: Roughly 85% of our portfolio is skilled nursing. The remaining balance is some combination of assisted living, memory care, or independent living. We don’t have a target allocation between the property types. Given our operator background, we’re comfortable with the risk-adjusted returns from both skilled and assisted living and will continue to pursue great operators and opportunities in both types. On the surface, a healthcare REIT is an investor in real estate. But, the value of the real estate is intrinsically tied to the quality of the operator. So, our investment decisions really start and stop with who the operator will be.

Kauffman: How do you choose the operators you partner with? Are most of your new investments with existing operators?

Sedgwick: We run potential new operators through a lengthy vetting process that’s largely based on our experience as operators ourselves. It’s common to hear something along the lines of, “We’ve never been asked these things by a REIT before.” There’s only so much a spreadsheet can tell you about the capabilities of an operator. In addition to a standard credit review, we get into the “soft” stuff of leadership, culture, chemistry, and organizational structure. We dig into incentives, financial and clinical systems and reporting. We gauge scalability and adaptability to the ever-changing landscape. And maybe most importantly, we assess “fit” with a particular opportunity since local knowledge and relationships can sometimes make all the difference.

Our new investments are spread among existing and new operators. We’re still in the early innings of building up that operator bullpen across the country. We’re on the lookout for operators who combine a mission-driven approach with the sophistication necessary to come out as a winner in their local market and who are the right fit for the particular facilities and markets under consideration.

Kauffman: Given the occupancy challenges in skilled nursing, how did/has your skilled nursing portfolio performed?

Sedgwick: We expect occupancy ups and downs in the skilled nursing sector, particularly when looking at transitioning facilities. Every time you acquire a facility, the incoming operator’s new way of doing things can make for choppy water in the short run for employee turnover, regulatory scrutiny, and referral source relationships. Generally, with time, we see stabilization and gradual improvement to occupancy.

Kauffman: What do you attribute the successes to and, also, any failures?

Sedgwick: Broadly speaking, leadership. Skilled nursing performance is hyper-sensitive to corporate and local leadership. I see the greatest success in organizations and facilities that stay focused on the fundamentals of people, care, systems, relationships, and efficiency while simultaneously creating a compelling mission for their people to believe in. Failures often come when leaders lose sight of those fundamentals or they attempt some other shortcut or grow too fast for their capabilities.

From an occupancy perspective, many of our operators establish strategic relationships with their health systems and health plans in order to become preferred providers. Unfortunately, many health systems use the Five Star criteria to create their networks even though that criteria does a poor job of predicting whether or not the care will be faster, cheaper, or better. I’m encouraged to see some of our operators circumvent their low star rating by educating their health systems on the data that matters most: readmission rates by diagnosis.

From a labor perspective, I’m encouraged by our operators who invest time and money into becoming the employer of choice in their market. I’ve seen firsthand how implementing best practices for recruitment and retention sets you apart and sets you up to become the provider of choice as well. Getting the right people and keeping them is the key to success in this space. If you take your eye off of that, even for a month or two, you’ll pay the price soon enough.

Kauffman: What is your plan for growth? Where do you see opportunities?

Sedgwick: While we don’t have growth goals per se, we do expect to grow for the next few years in a similar fashion to our first five years. Our small size is actually an advantage for us because we can show good growth through stringing together a number of smaller deals that simply aren’t that interesting to larger buyers. And yet it seems like every year we’ve also had a larger portfolio deal as well.

Kauffman: What do you see as the possible challenges to achieving the growth plans?

Sedgwick: Just looking at the last couple years is instructive. Last year was a lower year for new investments for us. As a REIT, we prefer stabilized facilities that easily cover their rent payments out of the gate. In 2018 we saw a lot of distressed, turnaround facilities for sale that just didn’t fit our “box.” By the end of the year, we got close on a couple larger deals that rolled into 2019. It makes more sense to look at a rolling average of investment activity rather than year-over-year activity since the timing of deals can be pretty lumpy.

Kauffman: What gives a skilled nursing operator a competitive advantage in today’s market, if any?

Sedgwick: What we love about skilled nursing is just that–there’s a wide range of competence and advantages among operators. And, there are dozens of levers an operator can pull to optimize clinical and financial performance; they always go hand in hand. Those with a competitive advantage are those who invest in great people and systems at the local, facility level. This is a very local business. The operators who value their local leaders tend to be quicker to adapt. Adaptability is absolutely key in an always evolving playing field like skilled nursing.

Kauffman: From an investment perspective, what has changed as far as the due diligence/evaluation of a possible investment over the past few years?

Sedgwick: The breadth and depth of our vetting process of new operators has evolved. The underwriting math hasn’t changed much. If anything, today we would give away a bit of yield in order to gain coverage on new deals.

Kauffman: How do you balance the cost of capital for CareTrust REIT and the speed of capital allocation? How much of a factor is cost of capital for you in today’s market?

Sedgwick: Our cost of capital has improved tremendously over the last five years. We’re grateful for the support we’ve received from lenders and equity investors. Our leverage is low, and we have plenty of dry powder on our credit line, plus the retained earnings we enjoy from maintaining a low dividend payout ratio. We’ve been fortunate to be able to fund quite a bit of the smaller singles and doubles investments off our at-the-market offering and match-fund larger deals with overnight offerings.

Kauffman: With all the discussion around it, I have to ask about the Patient Driven Payment Model (PDPM). How are you and your team/operators thinking about it? What should we expect once it rolls out this year?

Sedgwick: There’s a fairly broad consensus that PDPM should be helpful for the industry at large. Most operators should see cost savings as they optimize their therapy to meet the patient’s needs irrespective of artificial thresholds for minutes of therapy. The ability to provide some therapy on a group/concurrent basis will also alleviate the cost of rehab. If I had a concern about PDPM, it’s that CMS underestimates operators’ ability to adapt to the new model, resulting in higher revenue than CMS expected. If PDPM results in higher costs for CMS than they expect I think we’d see a correction by CMS a year or so later. That possibility makes it hazardous for the investing community to pay full value for PDPM-related improvements next year.

Kauffman: From a more macro standpoint, do you think we as a country in the Unites States are prepared to care for the rapidly growing aging population? What is the number one issue you think we need to do to improve our care delivery for America’s elders?

Sedgwick: If the demographic wave hits as predicted, my biggest concern is that we won’t have enough caregivers to take care of the additional 300,000-plus patients that we have capacity for. Given the unemployment rate today, we can barely take care of the residents and patients we have today without agency usage. In 2007, I travelled to the Philippines for Ensign to recruit nurses to alleviate the shortage we were feeling then. I interviewed 150 nurses in one week and made offers to 95 of them. It was incredibly frustrating to see those exceptional U.S.-qualified nurses sit in the immigration queue for years. We need to open up the immigration doors for nurses now so that we can give better care now and into the coming years.

Kauffman: What do you see as both the greatest opportunity and the greatest risk for skilled nursing operators during the next 10 years?

Sedgwick: I see an acceleration and a deepening in the partnerships operators should have with their hospitals and health plans. Practically speaking, operators should become partners with their referral sources—creating value for them and their systems by taking care of higher acuity patients, managing length of stay, readmissions, and care planning as a team instead of in isolation. Data sharing and collaborative process improvement among providers will build trust and grow market share.

The operators most at risk for the next 10 years are those who do not invest sufficiently in their people or their local market relationships. Those operators who put their heads in the sand when it comes to working with HMOs or meeting the specific needs of referral sources will be left behind.

Looking Forward to 2019 NIC Talks

Attendees of the 2019 NIC Fall Conference have a lot to look forward to. There’s the networking, which is often cited as a highlight of the year. Attendees schedule meetings well in advance of the conference, as they look forward to advancing business goals while their prospects and partners are all in one place. Many work to avoid scheduling meetings that would overlap with the highly relevant, insightful, and thought-provoking educational sessions. One reliably engaging and entertaining fixture of the Fall Conference program, now in its fifth year, is NIC Talks.

Presented in two one-hour sessions, these dynamic, TEDx-style presentations are designed to educate, challenge, and inspire how people think about aging and longevity. Over the course of two days, thought-leaders and experts—from inside and outside the seniors housing and care industry—will share their insights, research, and provocative ideas by addressing the theme of “How Am I Changing the Future of Aging?” Topics will include applied technology, healthcare, caregiving, leading purposeful lives, and insights into aging and longevity in today’s world and the near future.

Leading up to the conference, attendees will receive updates on NIC Talks speakers and details about their Talks via email as well as NIC’s website and blog posts. For a first look, we would like to introduce you to five of this year’s speakers. Join us as we look forward with anticipation to another great season of NIC Talks.

Marc Freedman

Marc Freedman, president and CEO of Encore.org, is one of the nation’s leading experts on the longevity revolution. The Wall Street Journal named his newest book—How to Live Forever: The Enduring Power of Connecting the Generations (PublicAffairs/Hachette Book Group, 2018)—one of the year’s best books on aging well. An award-winning social entrepreneur, frequent media commentator, and author, Freedman is widely published in the national media and has been honored with numerous awards and fellowships, including the Eisner Prize for Intergenerational Excellence. Originator of the encore career idea linking second acts to the greater good, Freedman helped create Experience Corps, the Purpose Prize, and Encore Fellowships. Mr. Freedman’s NIC Talk will take a look at the unfortunate side effects from a half-century of segregating seniors from the rest of society, and how we can improve purpose and reduce social isolation and loneliness by reconnecting elders with the young, whether through programming or

co-location.

Patricia Boyle

Patricia Boyle, PhD, is a professor of Behavioral Sciences and Neuropsychologist with the Rush Alzheimer’s Disease Center at Rush University Medical Center, Chicago, Illinois. Her research focuses on the prevention of cognitive and functional decline in old age. Her studies examine age-related changes in cognition, financial and health decision making, and psychological well-being, with an emphasis on identifying factors that promote health and resilience as individuals age. Dr. Boyle’s research has been funded by the National Institutes of Health for two decades and she has published extensively, with more than 200 publications. Dr. Boyle directs Research Education at the Rush Alzheimer’s Disease Center and serves on national advisory committees on aging and Alzheimer’s disease. Dr. Boyle will share surprising findings from recent research, indicating that leading a purposeful life is the number one factor in reducing cognitive decline, disability, physical limitations, and hospitalizations.

Tom Grape

Thomas H. Grape is founder, chairman and CEO of Benchmark Senior Living, a leading provider of senior housing in the Northeast. Established in 1997, Benchmark operates 58 senior living communities offering independent living, assisted living, memory care, and skilled nursing in Connecticut, Maine, Massachusetts, New Hampshire, New York, Pennsylvania, Rhode Island and Vermont. Tom has led Benchmark and its 6,300 associates to achieve $2.5 billion in company value and $450 million in annual revenue. The organization was selected by Fortune magazine for its inaugural 2018 Best Workplaces for Aging Services list, taking the number 16 spot on the list of top 40 senior housing companies and ranking third among companies with more than 40 communities. Benchmark has been named to The Boston Globe Top Places to Work every year of the 10 years the list has been published. Mr. Grape’s NIC Talk will explore how refocusing the mission statement at his company has completely changed everything in their business, from resident satisfaction to business metrics to staff turnover.

Tim Woods

Tim Woods is a founding partner of POCO labs, a product development and consumer research company. Woods is also the general manager of the Autonomous Vehicle Alliance, a 501(c)(6) collaborative research organization focused on consumers, business, and cities and the potential opportunities around L4 and L5 Autonomous Vehicles. Tim is a nationally recognized consultant with over 25 years of experience, working to drive innovation and the appropriate use of technology in everyday consumer products and services. He is a respected source of information to the media and has appeared on The Science Channel, Food Network, HGTV, CNN and other media as a resource to discuss the future and technology. Autonomous vehicles may soon be a key to the experience and practical realities surrounding aging in America. Mr. Wood’s NIC Talk will share new data, derived in part from the senior living industry, that supports a vision of the near future in which self-driving vehicles will revolutionize aspects of caring for elders.

Terry Fulmer

Terry Fulmer, PhD, RN, FAAN, is the president of the John A. Hartford Foundation in New York City, an organization dedicated to improving the care of older adults. Established in 1929, the Foundation has a current endowment of over $560 million and is world-renowned for philanthropy devoted exclusively to the health of older adults. She serves as the chief strategist for Foundation giving and is also the chief spokesperson for advancing the Foundation’s mission. She is the lead voice for the Age-Friendly Health System initiative which is transforming the way we think about care for older adults.

Nationally and internationally recognized as a leading expert in geriatrics,

Dr. Fulmer is best known for conceptualization and development of the national Nurses Improving Care for Healthsystem Elders (NICHE) program and research on the topic of elder abuse and neglect, work that has been funded by the National Institute on Aging and the National Institute of Nursing Research. Her recent effort with the Age-Friendly Health Systems initiative in partnership with Institute for Healthcare Improvement (IHI) is a potential game changer for how we think about care for older adults. Dr. Fulmer’s NIC Talk will focus on the 4 M’s of Age-Friendly Health Systems: what Matters (to the elder), Medication, Mentation, and Mobility, and how each of these factors plays out in a variety of senior-living scenarios.

NIC Talks will take place on Thursday, September 12 from 4:00 PM to 5:00 PM and Friday, September 13 from 10:45 AM to 11:45 AM. To allow for a more intimate and exclusive experience for audience members, the NIC Talks venue is located at the Loews Hotel, directly across the street from the 2019 NIC Fall Conference host hotel, the Sheraton Grand Chicago.

Check out previous years’ NIC Talks here.

Thoughts from NIC’s Chief Economist

Interest Rates: Which Way Now?

Interest Rates: Which Way Now?

It would be tough if you were Rip Van Winkle and fell asleep in October 2018 and woke up in June 2019, especially if you were a “Fed watcher” version of Mr. Winkle. In early November, the 10-year Treasury rate was 3.24%, with expectations from many interest rate prognosticators and Fed policy watchers that higher rates and tighter monetary policy would be the path forward through year-end 2018 and into 2019. Well, fast forward to June 2019, and on the 25th of the month, the 10-year slipped below 2.0% for the first time since November 2016, not exactly the expectation of most analysts. Further, anticipating the pressures of the trade war and its effects on economic growth, JP Morgan slashed its targets for the ten-year Treasury yield to 1.75% by year-end 2019, compared with its earlier expectation of 2.45%. It also now anticipates that the Fed will cut its key policy rate by 25 basis points in September 2019 and again in December 2019. While this view is not held by all analysts, it is a telling sign of the concerns about economic growth in the next year and how the Federal Reserve will respond.

The Economy: We Did It!

While mentioned in my last article in May as a strong possibility, it has now happened: the U.S. economy is officially in the longest expansion recorded since 1854, beating out the 10-year or 120-month expansion of the 1991 to 2001 period. In addition, this growth period is now more than twice as long as the 58-month average expansion enjoyed in the post war period.

Given this record and the relatively low interest rate environment that provided eight years of long-term rates under 3%, it may be surprising to some that the Fed appears to be shifting back to an accommodative monetary policy stance. To some analysts, a return to lower interest rates will further fuel potential asset bubbles in the stock market as well as in the commercial real estate markets.

Time will tell how this all plays out. The question now is how long will

growth continue—in the U.S.; around the globe? The business cycle has not disappeared. What factors could cause a slowdown or a reversal of fortune? Are we around the corner from a recession or an even longer prolonged economic expansion? Could lower interest rates mean further downward pressure on cap rates for commercial real estate including seniors housing? Could it mean that the cost of debt will remain low for the foreseeable future? Could it mean that the economy will remain strong through the election?

If only my crystal ball was omniscient, we could all just sit back and coast. Unfortunately, it is not. That means we all need to have our eyes wide open to look for indicators of which way will be forward.

Is the Skilled Nursing Sector Turning a Corner on Occupancy?

The skilled nursing sector appears to be more stable than it has been in some time. The NIC Skilled Nursing Data Report shows that the occupancy rate for the sample of properties tracked (roughly 1,400 properties across 46 states) has been flat since June of 2018 and started to show improvement since January of this year. This is a stark contrast to the pattern seen since early 2015 when the occupancy rate began a downward trend, falling 5.7 percentage points from 88.3% in January 2015 to 82.6% in June 2018. This pattern is evident in both urban and rural markets, although occupancy remains higher in urban areas at 84.9% in March 2019 than in rural markets at 81.9%.

The seven-year time-series data set also tells a specific story about patient day mix (actual patient days of each payor source divided by the total actual patient days) and revenue mix (total revenue for each payor source divided by the total revenue), with Medicaid the largest share of patient day mix at 65.8%, followed by Medicare at 12.2%, private pay (8.2%) and managed Medicare (7.2%). Due to the differences in revenue per patient day, however, Medicaid accounts for a smaller 49.2% share of total revenues (even though it has a greater share of patient days), followed by Medicare at 21.3%, managed Medicare at 12.1%, and private pay at 7.9%. This is because revenue per patient day is smallest for Medicaid at $210 while highest for Medicare at $520 per day.

Interestingly, revenue per patient day has been increasing since NIC began reporting this data for all payor sources except managed Medicare, which has been falling steadily and stood at $432 per day as of March, down $76 or 15% since early 2012. At the same time, managed Medicare continues to have a growing influence on the operator revenue, with its share of patient day mix growing from 5.3% in 2012 to 7.2% in 2019, and its share of revenue mix rising from 6.9% to 12.1% over the same seven-year period. It is notable that the impact of managed Medicare on operators is more significant in urban areas than rural areas, because managed Medicare penetration is higher in urban areas due to the density and managed care opportunity.

As always, I welcome your comments and feedback.

Beth

Demographic Shifts will Impact Seniors Housing Needs

The NIC-funded demand study entitled The Forgotten Middle, conducted by NORC at the University of Chicago and recently published in the print edition of the May issue of Health Affairs, draws much needed attention to a significant pool of demand, presenting new seniors housing and care investment and development opportunities.

The middle market—the subject of this first-of-its-kind research—includes a cohort of Americans who have too much in financial resources to qualify for government support programs such as Medicaid, but not enough to afford most private pay options for very long. Middle-income seniors are defined as individuals with annual financial resources ranging from $25,000 to $74,000 for people ages 75 to 84 and $24,000 to $95,000 for those ages 85 and older in the year 2029. The study’s conservative estimates reveal that more than half of the nation’s middle-income seniors (54%) will not have sufficient financial resources (which includes income and non-housing assets) to pay for projected average annual costs a decade from now of $55,000 for assisted living rent and $5,000 for out-of-pocket medical costs, even if they generate equity by selling their homes and commit all of their annual financial resources.

Over the next ten years, a variety of demographic changes will influence seniors’ care and housing needs. Shifts in race and ethnicity, higher education levels, lower marriage rates, fewer children, significant mobility limitations, health and cognition issues, and less access to caregivers will necessitate the need for a pioneering approach to serving this cohort. The study was not a “solutions” study per se, but rather a call to both the private and public sectors about the need to find solutions for the care and housing needs of this cohort.

In sizing the seniors housing demand for the middle market senior cohort, the study’s findings provide data to influence the seniors housing industry to broaden its target market by tapping a large, growing, and underserved portion of our aging society. To that end, detailing the socio-demographic characteristics of the middle-income cohort is an essential first step in driving innovation to create a new range of product and pricing options in seniors housing that will improve choice and access for our nation’s elders.

The Face of the Middle Market

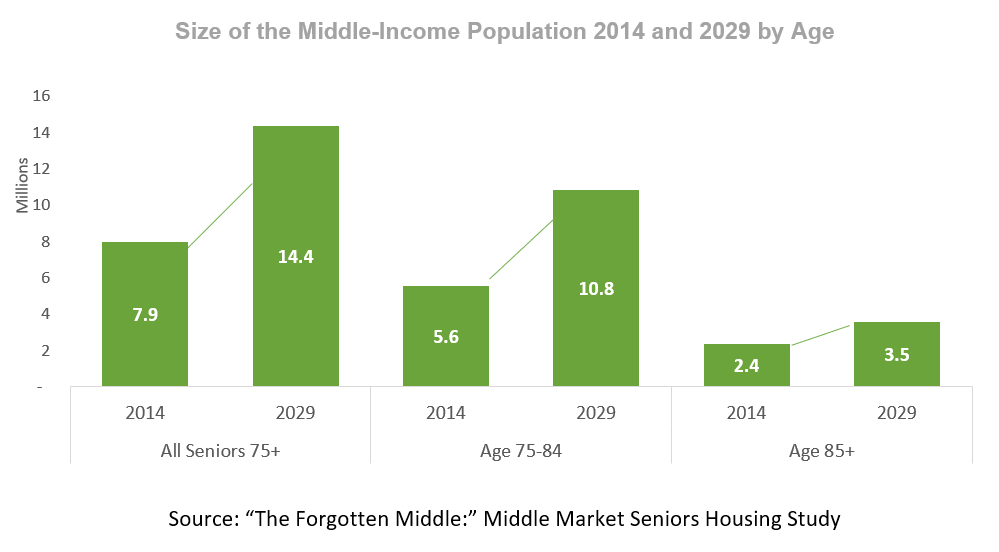

With the aging of the Baby Boom generation, the total number of middle-income seniors 75+ will grow by 82% by 2029. This is a large and rapidly growing subset of our population that will expand by more than 6 million seniors—from 8 million in 2014 to 14.4 million in 2029.

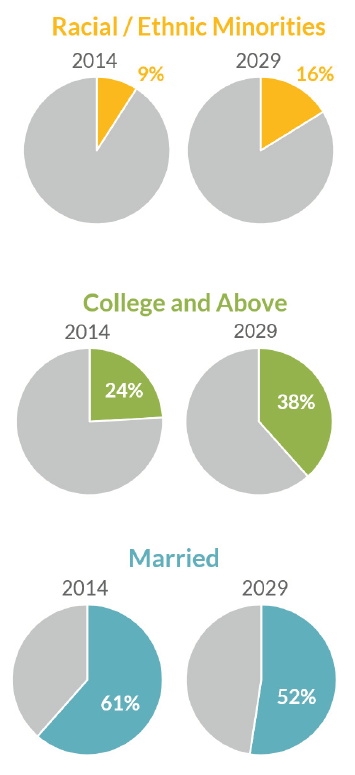

Demographic shifts will require seniors housing owners and operators to consider ways to make their properties more inclusive and appealing to a more diverse population. According to the research, seniors will be more racially and ethnically diverse, with minorities increasing from 9 percent of the population 75 and older today to 16 percent in 2029.

Furthermore, fewer middle-income seniors will have not completed high school, and more will be college educated. Growing levels of education result in a higher average income for future seniors. Rates of college education among seniors 75 and over are projected to increase from 24 percent in 2014 to 38 percent in 2029, while the proportion of seniors without a high school diploma is projected to decline from 12 percent in 2014 to 3 percent in 2029.

By 2029, the proportion of seniors that are married is also expected to decline, as fewer of these individuals are married today. Marriage rates are expected to fall from 61 percent of people 75 and older in 2014 to 52 percent in 2029. Spousal support provides additional income and enables many people to remain in their homes longer. Additionally, adult children ratios are falling, and coupled with lower marriage rates, more seniors may lack family caregivers.

Currently, sixty percent of middle-income seniors have adult children living within 10 miles of their current location, however this proportion is likely to decrease in the future due to declines in birth rates among Baby Boomers. A separate analysis originally conducted by AARP shows that the ratio of caregivers to seniors (those 45 to 64 relative to those over 80) will shrink from 7 to 1 today to 4 to 1 in 2030. While current research has not found a change in the amount of unpaid care that seniors are receiving, continuing trends could limit access to family caregivers in the future.

Currently, sixty percent of middle-income seniors have adult children living within 10 miles of their current location, however this proportion is likely to decrease in the future due to declines in birth rates among Baby Boomers. A separate analysis originally conducted by AARP shows that the ratio of caregivers to seniors (those 45 to 64 relative to those over 80) will shrink from 7 to 1 today to 4 to 1 in 2030. While current research has not found a change in the amount of unpaid care that seniors are receiving, continuing trends could limit access to family caregivers in the future.

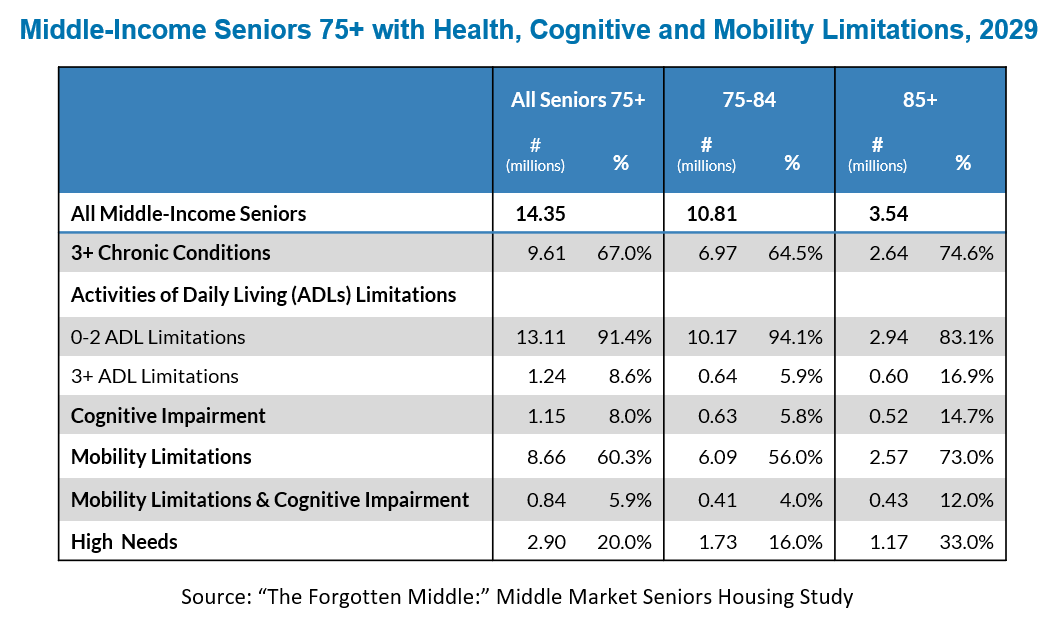

Additionally, cognitive impairments and mobility limitations may cause future seniors to need additional care. The onset or anticipated onset of health and mobility challenges is a common motivator for seniors to transition out of their homes to independent or assisted living. Two-thirds of middle-income seniors 75 and over are projected to have three or more chronic conditions in 2029, and 20 percent will have high needs—meaning they have three or more chronic conditions and at least one limitation in activities of daily living. Sixty percent of seniors are expected to have mobility limitations, which may make it difficult for them to navigate their homes independently.

By 2029, the oldest Baby Boomer will only be 83 years old—more than half of Baby Boomers will not yet have turned 75. With massive demographic shifts on the horizon, seniors housing providers must, over the next ten years, seize the opportunity to expand private pay offerings and create greater access to seniors housing for an increasingly diverse and growing population.

For more information about the research, visit nic.org/middlemarket.

Building for the Middle Market

In this article, NIC Future Leaders Council members Elyse Hanson, director, investments, Blue Moon Capital Partners, LP, and Dennis Murphy, director, investments, Benchmark Senior Living, discuss some of Benchmark’s strategies for serving Middle Market seniors.

In this article, NIC Future Leaders Council members Elyse Hanson, director, investments, Blue Moon Capital Partners, LP, and Dennis Murphy, director, investments, Benchmark Senior Living, discuss some of Benchmark’s strategies for serving Middle Market seniors.

NIC’s Middle Market Seniors Housing Study (nic.org/middlemarket) has sparked many conversations about how to best solve the housing needs of this rapidly growing cohort of seniors. One Northeast-based developer/operator got a head start on forming a product for this market.

Benchmark Senior Living opened a community geared toward middle market seniors 18 months ago in North Attleboro, Massachusetts, and it is nearing 80% occupancy. Benchmark is opening two more projects in Massachusetts in the next six months—one in Marlboro and one in Framingham. Both properties are expected to perform similarly to the North Attleboro community.

Benchmark CEO Tom Grape spoke at NIC’s “The Forgotten Middle” Investor Summit in New York in May and talked about these properties. He told the audience that, at first glance, Benchmark’s middle market communities look like any other Benchmark properties; in fact, that’s a stated goal for this product. However, there are several key differences that allow Benchmark to keep rents in the middle market range of around $3,300 per month.

At the beginning, Benchmark focused on how to build this new “brand,” called The Branches, at a lower cost. The first step was choosing markets where land was available at a lower cost basis but where there was enough demand to support a middle market product. Given that this middle market product should appeal to a larger consumer base (NIC’s study estimates that the middle market cohort totaled 8 million people in 2014), operators may be able to be less restrictive on traditional market density and affluence targets when selecting sites.

The next step was reducing construction costs through efficient design. Benchmark focused on building shared units to allow increased capacity in a smaller building footprint. Additionally, they chose to build wood-framed buildings as opposed to steel. Common area and unit finishes are similar to other new products and not materially different to the consumer. These changes resulted in a building that was 20% less expensive to build per square foot when compared to a traditional Benchmark development.

Lastly, the operating model had to be adjusted. Benchmark devised a plan to reduce staffing costs while maintaining care and staffing ratios. Benchmark generated cost-savings by creating a new department head structure and adjusting non-care staffing in the housekeeping, dining, and programming departments. These changes resulted in cost savings without compromising the quality of resident care.

These reductions in the development and operations cost structures enabled Benchmark to lower assisted living rental pricing by 30% and memory care rents by 15% when compared to their pricing structure in a typical senior housing community.

With approximately 14 million middle market consumers expected by 2029, there certainly will be market demand for this product. Capital is ready to partner with those operators who have found a solution to this market and made this clear at “The Forgotten Middle” Investor Summit.

The biggest challenge likely will be that the operations are so labor intensive that reducing cost becomes very difficult, especially as it relates to memory care. As operators fine-tune their own middle market products, they likely will become more efficient in design, leverage technology, and streamline operations to build attractive middle market products. If you know of other operators providing housing and care to middle market seniors, please let NIC know of those communities. Let’s share ideas on how to address the needs of this burgeoning cohort.

1Wood-framed construction requires non-combustible building materials, extensive smoke detection, and full fire suppression sprinkler systems in order to comply with fire codes.