A Family Caring for Families: Chip Gabriel of Generations Talks with NIC’s Beth Mace

In a relatively young industry, not many senior living providers can trace their roots back 80 years. But the aptly named Generations is a family-owned enterprise that started as a commitment in the 1940s to house and care for the elderly. Executive Chairman Chip Gabriel now leads Generations, a senior living owner, developer and manager based in the Northwest.

In a relatively young industry, not many senior living providers can trace their roots back 80 years. But the aptly named Generations is a family-owned enterprise that started as a commitment in the 1940s to house and care for the elderly. Executive Chairman Chip Gabriel now leads Generations, a senior living owner, developer and manager based in the Northwest.

NIC Chief Economist Beth Mace recently talked with Gabriel about the evolution of Generations. As a long-time industry leader, he offers a unique perspective on the current state of senior living along with astute insights on the growing role of healthcare in the sector.

Here is a recap of their conversation:

Mace: Can you tell us about Generations and your role as executive chairman?

Gabriel: Generations is a private, family-owned business based in Clackamas, a suburb of Portland, Oregon. We have 11 communities, and just under 2,300 units. We own half of the communities and we’re third-party managers of the others for Blackstone and CNL Healthcare Properties. As executive chairman, I oversee the financial side of business, strategic partnerships with lenders and equity investors, and pursue new opportunities. My partner Melody Gabriel is CEO and runs the day-to-day operations of the business.

Mace: How did you get involved in the business?

Gabriel: Melody’s father, Wendell White, was developing the first assisted living facility in the state of Oregon when I was getting my MBA. I wrote the marketing plan for the assisted living property as a grad school project. When I finished school, Wendell hired me. The family has been involved in senior housing since the 1940s. Wendell grew up living on the site of a home for the elderly run by his grandparents.

Mace: The motto for Generations is “We are a family caring for families.” Can you explain this? Are your family members involved in Generations?

Gabriel: My sons are the fifth generation in senior housing. We truly are a family in the senior housing business. We take it one step further. We have the privilege of caring for our residents and the people who work for us. They are part of our family. We’re in a people business. Residents come to live with us at the most vulnerable time of their lives. We’re probably their last home and we have a responsibility to care for them like they’re family members. We try to live it.

Mace: How do you do that?

Gabriel: It’s about relationships. We have a rule that we don’t want to be the biggest, we want to be the best. We create a culture of caring for families. The only way you can create that culture is by being in the communities. How I treat someone is how I want them to treat someone else. We uphold the same drive for the well-being of employees as we do for residents. When our staff was out sick with COVID, our family and other executives were in the communities serving as executive directors and filling other roles. You have to be there.

Mace: What are the most significant changes you’ve seen since you joined Generations?

Gabriel: Generations has evolved along with the industry. Senior living keeps changing. Assisted living was followed by memory care and now we see the emergence of the active adult segment. Our industry includes a lot of entrepreneurs who want to meet the consumer’s needs. The other thing that has changed over the last 30 years is that the capital markets are now more sophisticated in terms of timing, leverage, and yields. NIC gets a lot of credit for that. Senior housing is an asset class valued by institutional capital, private equity, and other funding sources.

Mace: How have you adjusted to that?

Gabriel: Big institutional investors have certain reporting expectations. They want data on quality assurance and environmental, social and governance (ESG) issues and diversity, equity and inclusion (DEI) strategies. These are new metrics that are important to capital providers. We have to be good stewards. In several of our communities, we have solar installations. We measure water usage, and our buildings have low flow toilets and showers. We quantify workforce diversity. We’re purposeful about positions of leadership to make sure we are looking at all candidates and giving them opportunities to advance.

Mace: How do you measure success?

Gabriel: We survey residents yearly and ask if they would recommend us to their family and friends as a great place to live. And we ask our staff whether they would recommend us to friends and family as a great place to work. That’s the ultimate question.

Mace: As one of your responsibilities, you oversee strategic alignment, new business development, and partner relations. What do you look for in strategic alignment with your partners? What kind of alignment of interests are most important to Generations?

Gabriel: For us, the most important quality in a partner is whether they understand resident wellness and happiness, and whether they are committed to running a business that cares for people. If we take care of our residents and employees, then over time, we will hit our financial benchmarks. We have a long-term perspective. We once took over a community run by a large company, and they knew how many minutes a housekeeper should be in an apartment. But part of that housekeeper’s job is to take the time to understand the resident’s well-being and notice any changes. You cannot manage every detail at a macro level. You need the flexibility to give your executive directors the ability to run the community.

Mace: Who are your capital partners? What do you look for in a good capital partner? How have your capital partners responded to your needs during the pandemic?

Gabriel: We’ve grown with friends and family as our equity partners, and with loans from local banks. Our 50/50 joint-venture partner for our large campuses is Adventist Health, a big healthcare provider on the West Coast. They were great to work with during the pandemic and helped us to find personal protective equipment and other supplies early on. As our census went down, our capital providers and outside owners understood the importance of focusing on care. They know they’ll get their yield over time.

Mace: You describe your communities as a middle market product. How do you define the middle market?

Gabriel: We define the middle market by price point. We don’t have entrance fees, so we are not the top end of the market. But we don’t accept Medicaid payments or Section 8 vouchers. There are great programs for the low end of the market, and there are products for the high end. The challenge we have is that the middle market includes the bulk of our aging population.

Mace: You are an active part of, and your family helped found the Oregon Health Care Association (OHCA). How has OHCA supported Generations and its goals?

Gabriel: The Oregon Health Care Association is a great group. I am past board chair. Our COO, Kathy Levee, is current board chair. The association represents a broad cross section of the industry: skilled nursing, independent living, assisted living and home health. Our members have been effective lobbying the state legislature, so we have a voice on government policy. We also have a group purchasing program. We’re all in this together. Skilled nursing doesn’t have to compete against community-based care for Medicaid dollars. The same goes for staffing and workforce issues. We’re collaborative.

Mace: Acuity by care setting has generally been increasing across the industry. Are you seeing the same in your portfolio?

Gabriel: In independent living, we are noticing a shorter length of stay because the people moving in are frailer. During the financial crisis in 2008-10, people didn’t move in because they couldn’t sell their houses. When people couldn’t have visitors during COVID, they figured it wasn’t worth it to move in. So, now we are seeing a frailer population. I suspect we’ll see a shortened length of stay for a year or two.

Mace: How does Generations fit into the healthcare continuum for older adults? Do you work with any Medicare Advantage programs?

Gabriel: Senior living is part of the healthcare continuum. One of our initiatives is investing in technology for data analytics. We’re tracking independent living residents, with their approval, around the social determinants of health. Our large campus in San Diego has 500 residents. I took the executive on tour who oversees geriatric care for the Kaiser Permanente health plan in Southern California. He had no idea we had 60 of his members living with us. The question is: How do we coordinate care for his members?

The only way to make housing affordable for seniors is to include healthcare. Health plans want eyes on their members every day and we already do that. But we need data to demonstrate our value to the health plans. I have a dream that someday people will move in and their healthcare coverage will be included so we can coordinate their care right there at the community.

Mace: How do you monitor the health of residents?

Gabriel: We notice changes in behavior. Maybe someone doesn’t show up for an activity. Or they don’t come to meals. We find out what’s going on. Avoiding a very expensive trip to the emergency room has real meaning to insurers.

Mace: How else do you encourage well-being?

Gabriel: We have a new initiative rolling out in San Diego in September and in Portland in October. We are working with the Blue Zones project. Blue Zones are places with a high percentage of centenarians in a community. Well-being experts work with us and the wider community to create a healthy environment using the Blue Zone power nine secrets to longevity. The goal is to help people live better, longer.

Mace: How did your communities fare during the worst of the pandemic?

Gabriel: Our founder, Wendell White is 83 and has been in the industry his whole life. He said the pandemic was the most difficult situation he had ever witnessed in senior living. The pandemic hurt us financially. Margins will take years to come back. But great leadership and an amazing staff has gotten us through this. We had people working 20-plus days in a row on multiple shifts. Our industry was brutalized in the press and our workers are heroes who showed up every day. Our census went down 13%. But we are halfway back to previous occupancy levels, and we are growing census at a good rate now.

Mace: Expenses across many line items are going up—insurance, labor and staffing, material costs, and more. All of these factors are squeezing margins. How are you withstanding these pressures?

Gabriel: We had a pretty significant rent increase. We communicated that to residents and did not have a significant fallout. We find ways to be more efficient. And we communicate with our capital partners that margins are not the same and won’t be. We have to deal with reality.

Mace: What are you doing to address labor force challenges?

Gabriel: Our core staff is still with us. We’ve had to raise pay and some of our markets are using agency workers. How do you create a culture of loyalty? You have to let employees know that they are part of something bigger than a job. It’s easier now that we can be together in person to create that physical connection with workers which helps to strengthen our culture.

Mace: Any other insights?

Gabriel: We’ve found that family members and friends like to work together. We see this especially among first- and second-generation immigrants. They tell their social circles that our communities are good places to work, and that we pay well and treat them fairly. They are good recruiters.

Mace: What’s in your development pipeline today?

Gabriel: We have building permits for a 375-unit campus in Carmichael, California. It’s an exciting intergenerational project adjacent to a private K-12 school. We’re looking at pricing. From last October to this March, we’ve seen a 15% increase in construction costs and interest rates are going up. We may have to hit the pause button. We have another project in Burlingame, California. It’s a wellness community with 225 units of age-restricted apartments. The innovative project is located in a mixed-use mixed-income healthcare district with lifestyle amenities and medical office space. It’s very exciting. We are still in the entitlement process.

Mace: With the oldest baby boomers now 75, is Generations looking at investing in the active adult segment?

Gabriel: On our bigger campuses, we have lots of independent living with unbundled services similar to active adult communities. But our independent living buildings are not stand-alone projects. They are part of a bigger campus. The Carmichael, California, campus will include 12 villas and 8 micro homes. We’re trying something different.

Mace: In wrapping up, what’s next and how are you positioning yourself for growth in the 2020s?

Gabriel: The key for new initiatives is to find ways to collect health data and show the insurance plans that it makes sense to integrate healthcare and housing. How can we partner with health plans and create value for them? Our integration with health plans will be our future.

Mace: Lastly, is there anything else you would like our readership to know?

Gabriel: As much as this is a business, we care for a vulnerable population and have a moral responsibility to put residents and employees first and to be disciplined on the capital side. When you hold the hand of a resident who has lost a spouse or a neighbor, and they’re scared of their own frailty you realize that’s the business we are in. We are caring for vulnerable people and we’re here for them.

Access to Capital in the Nursing Home Industry: A Resource on the Role of Policy and Implications for the Future

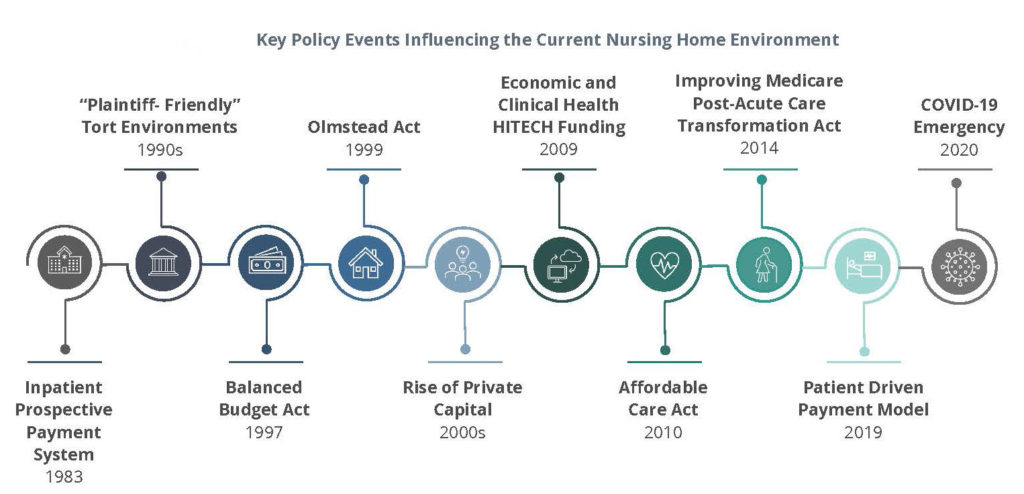

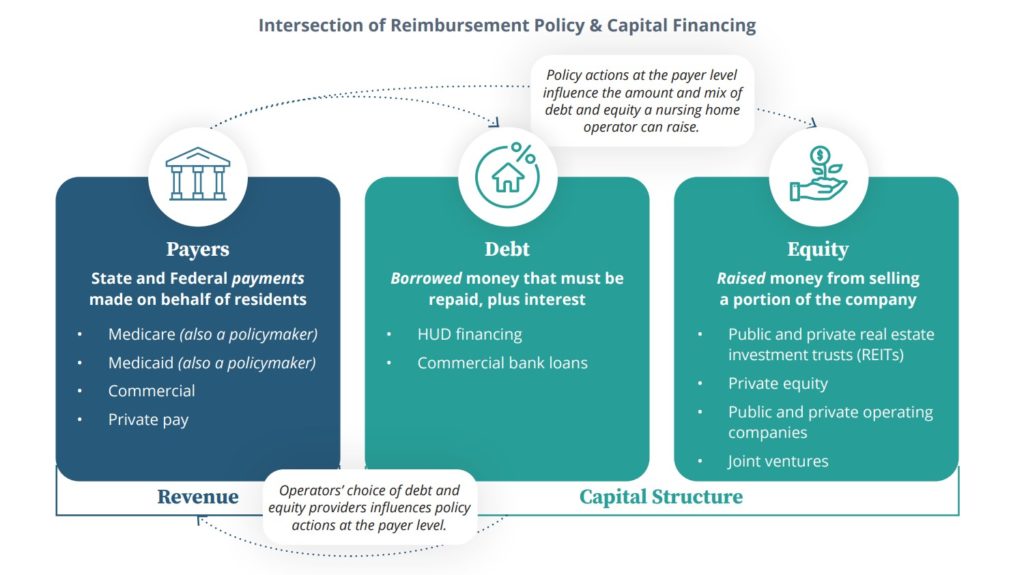

On June 16, 2022, ATI Advisory released a research paper titled Access to Capital in the Nursing Home Industry: A Resource on the Role of Policy and Implications for the Future. NIC commissioned the study to serve as an educational resource for skilled nursing stakeholders, including policymakers, on the persistent weaknesses of the long-term care system that were highlighted by the COVID-19 pandemic. With 10,000 people a day turning 65 years old and living longer with multiple chronic conditions, it is important to communicate the facts to enable the country to move forward and improve the system.

The paper includes: 1) an overview of the nursing home industry, 2) a summary of policy events that have shaped the current environment, 3) a closer look at nursing home capital market dynamics, and 4) key opportunities for policymakers to consider in their approach to nursing home reform. These sections of the paper are meant to collectively educate and inform the policy decision making process, regarding the factors to consider when making policy.

The current nursing home industry is struggling as it is increasingly serving a more complex patient population, facing a continuing staffing crisis which could become more difficult with new staffing mandates, and continuing to struggle with reimbursement as a result of growing Medicare Advantage penetration and value-based payment models.

A main takeaway from the paper, given the current state of the industry, is that the current public-private partnership for skilled nursing facilities is failing. To meet the long-term care and housing needs of extremely frail older adults, America needs a modern and high-functioning skilled nursing industry. The government alone cannot meet the needs of this population and without reinventing the public-private partnership, federal and state governments will fail in meeting the needs of this extremely frail population that requires 24-hour care. To meet the capital funding needs of the skilled nursing sector, partnerships must be rethought and restructured to better serve patients and the staff that care for them.

For public-private partnerships to succeed, the system needs to encourage much-needed innovation that would improve facilities and their operations for patients and staff. Due to policy changes over many years, operators have sought alternative sources of capital. For example, Medicaid reimbursement rates are no longer required to cover the cost of providing care, causing skilled nursing facilities in many states to rely on higher reimbursement from Medicare patients to subsidize Medicaid shortfalls. Furthermore, the current system does not encourage private capital sources to invest in modernizing existing infrastructure or operational improvements that would drive quality care for patients by supporting frontline staff.

The paper concludes with some important considerations and opportunities for policymakers, which are summarized below:

- Solutions require better distribution of funding. For example, Medicare funds Critical Access Hospitals in rural areas. However, there is no similar model in place for long-term care.

- Medicaid and Medicare are siloed programs and payers. The challenges with this model are particularly apparent within the nursing home industry as individuals may transition between payers. It is vital that federal and state payers collaboratively renew their responsibility to support the nursing home initiatives and proposals.

- While Medicare Advantage penetration has positively impacted the market by providing nursing homes with some control over costs and operating decisions, on the other hand, managed care has failed to deliver on innovation or incentivize quality in nursing homes.

- Value-based models have been disadvantageous for nursing homes. For example, the limited funds in a bundled payment model can lead to a downward trend in patient length of stay within nursing homes, making cost the driver of patient experience rather than patient need.

- Focusing on an operator’s outcomes without incorporating the nuances around their funding choices obscures the fact that poor outcomes can be linked to policymaking that has inadvertently restricted private and public capital financing options for operators. Policymakers should understand the benefits and drawbacks of the different types of public and private capital accessible to nursing homes, and consider why nursing homes have found it necessary to partner with specific sources. HUD is a continued source of capital for the nursing home industry and is well-positioned to drive growth and innovation within the nursing home industry. This could address the continued issue of the industry operators’ inability to secure capital to upgrade operations.

Bottomline, if America’s long-term care system is to succeed, new and innovative private investments in modern skilled nursing models must be encouraged and policies to improve skilled nursing facilities should incentivize investments for better patient outcomes and support staff.

For more information, download the analysis.

Sneak Peek: A First-Class Speaker Lineup at the 2022 NIC Fall Conference

Summer is a time when many of us kick back, relax, enjoy the weather, and spend time with family and friends. But business leaders know that conference season is right around the corner, which means excitement is already building for the most anticipated event of the year: the 2022 NIC Fall Conference.

For those looking to use the summer months to get a head start on fall plans, you’re in luck. The 2022 NIC Fall Conference Preliminary Program is now available so you can get a sneak peek at what’s in store this September 14-16 in Washington, D.C.

NIC Conferences are known for their unparalleled networking opportunities and their lineup of distinguished speakers – and this year is no different. Fall Conference attendees will join fellow senior housing leaders to soak in critical insights from renowned experts, including operators, economists, capital partners, and more. Read on for a sneak peek of the topics that will be discussed, as leaders share insights and new strategies for staying on top of where the industry is headed.

Forward Together: Join Thousands of Industry Leaders

Reflections on an Evolving Market

Conference attendees represent all shapes and sizes of senior living properties. That’s why the 2022 NIC Fall Conference’s marquee session features a panel of prominent CEOs whose companies reflect the evolving and diverse product offerings of senior living communities. In the session, “Visions, Insights, and Perspectives: A Discussion with Industry CEOs,” speakers will share their outlooks for the future of the sector, including the opportunities and challenges associated with meeting the needs of residents and addressing staffing dynamics. Hear from prominent industry leaders:

- Brenda Bacon, President & CEO, Brandywine Living

- Lucinda (“Cindy”) Baier, President & CEO, Brookdale Senior Living

- Sevy Petras, CEO, Priority Life Care

- Greg Smith, President & CEO, Maplewood Senior Living

Navigating a Challenging Economy

As the nation grapples with a bear market, senior living leaders need the latest data and insights to make smart business decisions. That’s why the 2022 NIC Fall Conference keynote session, “The Economic Outlook: Leading Financial Futurist Jason Schenker,” is not to be missed. Schenker is the President of Prestige Economics and Chairman of The Futurist Institute, which has been ranked by Bloomberg News as a top financial forecaster in 46 categories. His work has been featured in The Wall Street Journal and The New York Times, and he has appeared on CNBC, CNN, ABC, NBC, MSNBC, Fox, Fox Business, and the BBC. Schenker has authored 36 books, 15 of which have been #1 best sellers, including The Future After COVID, Recession-Proof, and Futureproof Supply Chain.

Mr. Schenker will share several themes and lessons from “The Future of Healthcare,” one of the many courses offered within The Futurist Institute, including his perspectives on new and emerging technologies and how improvements in data collection can be used to push innovation and improve outcomes. Takeaways from this keynote session will also include the major changes that are occurring in how people access their healthcare, use their health insurance, and receive medical entitlements including Medicare and Medicaid.

Deal or No Deal – Senior Housing Style

If you’ve ever watched the gameshow Deal or No Deal, you know players must decide whether to take the prize money offered to them or risk it all for a higher sum. This fall, NIC is debuting its own take in a session called “Deal or No Deal: Trends in Senior Housing Capital Markets.” Panelists will hear case studies on deals and need to decide on the spot if it is a good deal or not. Capital providers and operators alike will have a unique opportunity to learn about the cost of capital trends, especially coming out of the pandemic, and will get a front-row view into the deal making decision process. Learn strategies to maximize valuations and to lower the cost of capital as you play along. Would you take the deal?

Skilled Nursing

Year after year, the valuation sessions at NIC Fall Conferences are highly attended and among the top-rated, especially for first-time attendees. In a turbulent economy and a market that is still recovering from the pandemic, how are capital providers viewing and valuing skilled nursing? In this session, “Valuing Skilled Nursing and Sourcing Capital in a Turbulent Market,” both capital providers and operators alike can learn whether current cash flows justify valuation as debt and equity partners discuss different case studies.

Moving Forward Together

Connecting operators, investors, and care partners is crucial as the industry prepares for the next generation of residents and their families. Join the industry’s largest gathering in Washington, D.C. as we prepare to move forward together.

Learn More About the Educational Main Stage Sessions

Thoughts from NIC’s Chief Economist—Stagflation, Inflation, Recession: What’s Ahead?

by Beth Mace, Chief Economist & Director of Research & Analytics, NIC

Stagflation, inflation, recession…terms that have not been in the vernacular until recently and now they can be seen and heard in the news and on social media on a daily basis. The economy is in a tenuous spot as price increases stoke concerns about a change in consumers’ and wage earners’ expectations of permanent inflation and as the Federal Reserve seeks to tamp down these very concerns by slowing economic demand through a series of interest rate increases. Since early in 2022, short-term interest rates have been pushed up three times by the Fed to a range of 1.50% to 1.75% from zero percent earlier in the year, with further hikes anticipated that could ultimately push the federal funds rate to between 3.25% and 3.50% by year-end 2022. The problem is that the economy is like a large ship that takes time to shift course and the success and timing of an increase in interest rates is hard to predict and often results in too much demand being eroded, which could translate into a recession. Or possibly worse, inflation expectations stay high, economic growth wanes sharply and the unemployment rate rises quickly resulting in stagflation.

Stagflation, inflation, recession…terms that have not been in the vernacular until recently and now they can be seen and heard in the news and on social media on a daily basis. The economy is in a tenuous spot as price increases stoke concerns about a change in consumers’ and wage earners’ expectations of permanent inflation and as the Federal Reserve seeks to tamp down these very concerns by slowing economic demand through a series of interest rate increases. Since early in 2022, short-term interest rates have been pushed up three times by the Fed to a range of 1.50% to 1.75% from zero percent earlier in the year, with further hikes anticipated that could ultimately push the federal funds rate to between 3.25% and 3.50% by year-end 2022. The problem is that the economy is like a large ship that takes time to shift course and the success and timing of an increase in interest rates is hard to predict and often results in too much demand being eroded, which could translate into a recession. Or possibly worse, inflation expectations stay high, economic growth wanes sharply and the unemployment rate rises quickly resulting in stagflation.

The good news, however, is that today’s labor markets are tight. The record high 14.8% unemployment rate seen in April 2020 had fallen back to 3.6% by July 2022 and total jobs were merely 0.8% below their pre-pandemic level. The unemployment rate is just slightly above its pre-pandemic level of 3.5% which was a 50-year low. The stagflation era of the 1970s was accompanied by high unemployment rates as well as inflation. Each year from 1974 through 1982, inflation and unemployment both topped 5%. The combination of the two figures, which came to be known as the “misery index” peaked at 20.6 in 1980. For today’s economy, the jobless rate would need to be on a steady upward track and increase by at least 1.4 percentage points or more. The Federal Reserve, at its recent meeting held in June, updated its Summary of Economic Projections to an expectation of the unemployment rate to 4.1% in 2024, shy of the 5% stagflation jobless rate some analysts cite.

Other good news may be seen in households’ relatively strong balance sheet. Households built nest eggs during the pandemic, much of which has not been drawn down. Further, households are currently spending the smallest share of their income on debt-related interest and principal payments in over 40 years, providing them some cushion against higher interest rates. And lastly, there is a fair amount of pent-up demand from households due to shortages of goods and services during the pandemic.

Businesses too are in relatively solid financial shape, with low interest coverage ratios and the financial system (i.e., banks) is considered stable to strong, unlike during the Great Financial Crisis (GFC).

That said, consumer confidence, an important demand driver for senior housing, is waning. Reports of a bear stock market, shock at the gas pump with prices topping $5 a gallon on average nationally, escalating food and energy prices and rising mortgage interest rates are spooking consumers. According to the June University of Michigan’s consumer confidence measure, consumer confidence dropped below the prior record low set in the depths of the 1980 recession. The index, which is centered on consumers’ financial conditions is depressed as inflation erodes individuals’ purchasing power and as stock prices remain well below where they started the year. Further, the expectations component of the index fell sharply as inflation expectations remain above 5%.

Mortgage interest rates are also on the rise, with the rate on a 30-year fixed residential mortgage floating above 6.3% in mid-June 2022, up from 3.75% as recently as late January and reaching its highest level since August 2008. This has resulted in a slowdown in mortgage applications and consequently the velocity of home sales. The pace of sales and price of homes often influence the decisions of older adults in choosing to move into senior housing. Hence, one further support for the pace of move-ins to senior housing may be weakened.

On the supply side of the equation for the outlook for senior housing, delayed or unfunded projects in 2020 are translating into reduced inventory growth today. In fact, inventory growth in the first quarter was the weakest since 2013 as the impact of the pandemic on development pipelines in 2020 became evident in the 2022 data. Meanwhile, the number of senior housing units under construction was the least since 2015. And starts are likely to linger at moderate levels and well below their peaks seen in 2016 – 2018 period. Starts may remain at moderate levels as rising materials prices and inflation, labor shortages in the building trade industries, plus the change in monetary policy which is translating into higher interest rates are collectively affecting plans for new development, as many projects increasingly do not pencil out for reasonable returns.

Looking ahead, there are reasons for cautious optimism for the sector, but the path forward may be a bit bumpy due to the prevailing winds in the broader economy. Inventory will continue to expand, although at a reduced pace in the near term which should act as a tailwind for occupancy improvement.

And while demand may be also affected by economic headwinds, the value proposition of senior housing–security, socialization, engagement, room and board, care coordination and lifestyle–remains in place and ultimately should win the day by attracting new residents for senior housing properties. In addition, the movement of many operators to incorporate wellness programs into their offerings has the potential to be a significant competitive advantage as potential residents seek communities that hold promise to improve the quality of their life through programs focused on the intellectual, physical, social, spiritual, vocational, emotional, and environmental dimensions of wellness as defined by the International Council on Active Aging (ICAA).

In addition, the increasing segmentation and differentiation of senior housing in serving the vast numbers of seniors in middle income cohort will add a large demand pool for operators to serve, as will the movement of “younger old” aging adults into the active adult segment. With an industry penetration rate of roughly 11% of U.S. households, the penetration rate does not need to increase dramatically for occupancy to rise to pre-pandemic levels. Further, in the not very distant future, the ratio of adult children family caregivers (those aged 45 to 64) that are available to take care of aging parents (those over 80 years of age) will continue to shrink at a precipitous pace from 7:1 in 2015 to 6:1 in 2021 to 5:1 in 2024 to 4:1 in 2029 and 3:1 in 2036. With fewer family members and spouses available for care, congregate settings will indeed get a further demand boost.

In wrapping up and as always, I appreciate and welcome your comments, thoughts, and feedback.

Two Cycles, Two Outcomes: A Comparison of the GFC and the Pandemic on the Senior Housing Sector

by Beth Mace, Chief Economist & Director of Research & Analytics, NIC

In this article, NIC Analytics presents a look at how the senior housing market performed during the 2007-09 Global Financial Crisis (GFC) and details how this has differed from the impact COVID-19 has had on senior housing market fundamentals using NIC MAP Vision data.

Economic Background. At the outset, it is important to acknowledge the very significant differences between this economic cycle and the last. The causes for the GFC were complex and related to financial deregulation, the use of derivatives and a crisis stemming from overleveraged financial institutions who had extended sub-prime residential home mortgages to those who did not qualify. This led to a large drop in housing prices (29%-plus), an explosion of single-family residential mortgages delinquencies (delinquency rates jumped to nearly 12% in January 2010), and a surge in joblessness (the unemployment rate jumped 5.1 percentage points from 4.9% in February 2008 to 10.0% in October 2009).

The COVID-19 recession stemmed from a health crisis and the actions taken to combat the spread of a deadly virus. There was an unparalleled lockdown of all “non-essential” workers as global and national government entities at all levels of jurisdictions sought to limit the spread of the very contagious COVID-19. The economic crisis started as a supply-side shock and then morphed into a demand shortfall that resulted in a surge in unemployment (the jobless rate jumped 11.3 percentage points from 3.5% in February 2020 to 14.8% in April 2020), limited retail sales and services activity, and an increase in the savings rate as consumers stayed at home. The immediate pandemic period is considered the worst global economic crisis since the Great Depression in the 1930s.

Remarkably, the US economy bounced back quickly. At its worst, real GDP fell by a whopping 31% in the second quarter of 2020. However, by the third quarter of 2021, real GDP had exceeded its pre-pandemic level. The recovery in jobs was slower, but also remarkably strong. The record high 14.8% unemployment rate seen in April 2020 had fallen back to 3.6% by July 2022 and total jobs were merely 0.8% below their pre-pandemic level.

However, the quick bounce back in demand from consumers (helped by three stimulus checks totaling $3,200 provided by the federal government during the pandemic to many individuals), accommodative monetary policy, as well as extreme shortages of workers and materials, shipping backlogs and supply chain bottlenecks across the global network has resulted in an unanticipated 40-year jump in price inflation. With a gain of 8.6% increase in May on a year-over-year basis, the spike was the strongest jump in the CPI since December 1981.

At the time of this writing, the outlook for the US economy has shifted once again as the higher interest rates currently underway by the Federal Reserve will slow growth sharply and possibly lead into a recession or stagflation in 2023/2024.

Senior Housing Occupancy Losses. The timing of the GFC coincided with a period of relatively strong inventory growth in senior housing which resulted from flush capital markets and low interest rates. While high by today’s standards, the yield on the 10-year Treasury bill was at then-historic lows of less than 4% which fueled borrower’s appetites for development capital. Development deals that had been financed during the months leading up to the GFC broke ground and continued to be constructed, resulting in multiple years of strong supply growth at the worst possible time because demand was also slowing sharply as the recession took root.

Indeed, the recession caused demand for senior housing residences to slow as jobs were lost, consumer confidence eroded, home equity disappeared, and home sales volume across the country collapsed. The inability or loss of desire to sell homes bled over into weakened demand for senior housing as would-be future residents had little choice but to delay placing their homes on the market. In fact, senior housing net absorption turned negative in early 2009, one of the only times this had occurred until the pandemic.

During the GFC, the senior housing market experienced a prolonged occupancy decline for two and one-half years according to NIC MAP Vision data. In fact, the 31 NIC MAP Primary Markets’ occupancy rate for senior housing properties fell 3.9 percentage points from a near-record high of 90.8% in 3Q 2007 to a then-record low of 86.9% in 1Q 2010.

By contrast during the pandemic, the occupancy rate for senior housing properties fell 9.2 percentage points from 87.2% in 1Q 2020 to a record low of 78.0% in 1Q 2021. The 9.2 percentage point decline during the pandemic was more than twice as severe as the occupancy drop during the GFC. Moreover, the precipitous drop in occupancy occurred quickly over the course of one year as opposed to two and one-half years during the GFC. Further, at 87.2%, the occupancy rate fell from a relatively low starting point to begin with.

Like the GFC, development going into the pandemic was strong for senior housing, with inventory growth in 2020 being the second highest in the time series since 2006 and comparable to the strong growth seen in 2019 (2018 was the strongest year). Compounding this was the unprecedented loss in demand, with four consecutive quarters of negative net absorption. The drop in demand was a result of lock-down measures self-imposed by some operators as they sought to limit the risk of contagion to their residents and staffs as well as a patchwork of government regulations that restricted move-ins. Also, prospective residents and their adult-children influencers were cautious of moving into congregate settings given the perceived risks of vulnerability and contagion as well as visitation limitations.

During the COVID-19 crisis, between 1Q 2020 and 1Q 2021, 45,000 senior housing units were vacated or placed back on the market on a net basis in the Primary Markets. Combined with 18,500 units that opened during the same one-year period, the occupancy rate fell 9.2 percentage points. By contrast, during the GFC, a mere 736 units were placed back on the market on a net basis during 1Q 2009. Moreover, for the one-year period of 2009, there were a positive 5,000 units absorbed.

Independent Living vs. Assisted Living. There were disparate effects on independent living and assisted living during the GFC and the pandemic. During the GFC, the crushing drop in home prices and home equity dissuaded would-be residents from moving into a choice-based, hospitality-focused care and living option. In contrast, because assisted living is generally a more need-based option and less choice-based, it may have been less sensitive to the economic cycle in 2008 and 2009. Independent living is perceived as less need-based and more choice-based, so it may be more easily postponed. This may have been particularly the case during the Great Recession, since that recession was largely housing-related and significant amounts of home equity were eroded, reducing the dollars available to move into a preferred housing option.

As a result, during the GFC there was a larger drop in occupancy rates for independent living (IL) than for assisted living (AL). For assisted living, the occupancy rate in the Primary Markets fell 2.7 percentage points from 90.6% in 3Q 2007 to 87.9% in 2Q 2009, a then-record low rate of occupancy. Once the recession officially ended in the second quarter of 2009, occupancy for assisted living began to improve as those residents with pent up demand for activities of daily living (ADLs) and instrumental activities of daily living (IADL) support could no longer delay a move into senior housing.

Independent living lost 4.4 percentage points of occupancy during this same period (91.9% in the 3Q 2007 to 87.5% in the 2Q 2009) and continued to slip further until 3Q 2010 when it fell to a low of 86.9% for a total decline of 5.0 percentage points. Hence, independent living, a more discretionary housing choice than assisted living, saw occupancy drop over a longer period, and the decline was more significant than that of assisted living.

In contrast, during the pandemic, the occupancy loss in assisted living exceeded that of independent living. Between 1Q 2020 and 1Q 2021, occupancy fell by 8.0 percentage points from 89.7% to 81.7% in independent living, while it fell 10.4 percentage points from 84.6% to 74.2% in assisted living. These are both record low occupancy rates. Said another way, one in four assisted living units were vacant as of 1Q 2021 and for independent living one in five units were vacant.

Indeed, during the pandemic, assisted living occupancy suffered more than independent living. This is likely because the pandemic was more than just an economic event—it was a health event that was most dangerous to the oldest and most frail seniors and those who reside in assisted living. Nevertheless, the 8.0 percentage point in occupancy in independent living was huge by any measure, just less severe than for assisted living.

The Recovery. In the aftermath of the GFC and by Spring 2010, senior housing occupancy took steps toward recovery as rising demand exceeded new supply, reflected by 17 out of 23 quarters of relatively higher demand between 2010 and 2015. The senior housing market saw positive absorption of 64,000 units over this period. Inventory grew by a lesser 54,000 units, which allowed the occupancy rate to climb 3.0 full percentage points to 89.9% by 4Q 2015.

Since late 2015 and up until the time of the pandemic in 1Q 2020, the senior housing occupancy rate had been pressured lower as supply generally exceeded demand (this was especially the case for assisted living). Net absorption totaled 55,000 units, while inventory grew by a larger 81,000 units, pushing the occupancy rate down 2.7 percentage points from 89.9% in 4Q 2015 to 87.2% in 1Q 2020.

Hence, when the pandemic started, senior housing was already in a stressed position in terms of aggregate occupancy for the Primary Markets. Notably, not all markets followed this pattern as the supply and demand dynamics varied across the nation.

During the worst of the pandemic and its aftermath, occupancy hit bottom in 1Q 2021, having fallen 9.2 percentage points to 78.0%. Since reaching its nadir, occupancy had increased to 80.6% in the first quarter of 2022. This marked the third consecutive quarterly improvement, according to NIC MAP Vision data. This was especially encouraging considering the highly contagious omicron variant that was rampant during the early months of 2022. And it is a testament to the success of the COVID-19 vaccines and to the infection control policies operators of senior living properties have put in place to keep residents safe.

Further, occupancy was 2.5 percentage points above the pandemic low of 78.0% reached in the second quarter of 2021. With positive net demand for four quarters, 59% of the senior housing units vacated during the pandemic had been re-occupied by 1Q 2022.

That said, first quarter 2022 occupancy was still 6.7 percentage points below its pre-pandemic first quarter 2020 level of 87.2%. Hence, market fundamentals still need significant improvement.

One tailwind that has helped support improving occupancy rates has been weak recent inventory growth which reflects the slowdown in construction starts that occurred in 2020. At that time, lenders became cautious in issuing new debt for development projects due to the great uncertainty associated with the pandemic. According to the NIC Lending Trends Report, debt issuance for new construction hit bottom in the first quarter of 2021 and began to increase thereafter.

Delayed or unfunded projects in 2020 are translating into reduced inventory growth today. In fact, inventory growth in the first quarter was the weakest since 2013 as the impact of the pandemic on development pipelines in 2020 became evident in the 2022 data. Meanwhile, the number of senior housing units under construction was the least since 2015. And starts remain at moderate levels and well below their peaks seen in 2016 – 2018 period.

What’s Ahead? Looking ahead, there are reasons for cautious optimism. Inventory will continue to expand, although at a reduced pace in the near term because of the on-going pandemic-related supply chain challenges. Further, rising materials prices and inflation, labor shortages in the building trade industries plus the change in monetary policy which is translating into higher interest rates are collectively affecting plans for new development as many projects increasingly do not pencil out for reasonable returns.

On the demand side of the equation, there are some challenges in the near term. A slowing economy, a bear stock market, higher mortgage interest rates and its impact on selling a home, and the effects of accelerating inflation on consumer confidence are all headwinds. However, the value proposition of senior housing–security, socialization, engagement, room and board, care coordination and lifestyle–remains in place and will ultimately win the day by attracting new residents for senior housing properties. The pandemic created an atmosphere of isolation for many older adults and the lure of living in a community with others will further support demand for senior housing. The segmentation and expansion of senior housing in serving the vast numbers of senior in the so-called “Forgotten Middle” cohort will add further strength to demand. And finally, strengthening demographics will support the sector’s recovery. Based on the most recent U.S. Census Bureau projections, the 80-plus population cohort will increase by 325,000 persons in 2021, to 500,000 in 2025 and by 1 million 80-plus older adults in 2027.

That said, it is important to remember that all markets do not behave the same and some markets continue to have a significant supply overhang. For a full recovery, the demand lost during the pandemic must be recouped, the inventory that was added to the market during the past year must be fully absorbed, and the pipeline of new properties currently in development have to be matched by equally strong demand and move-ins.

Summary. Taken in its entirety, during the GFC, the senior housing industry proved that while it was not recession resistant, it was recession resilient. This was particularly the case for assisted living. As we move through 2022, we will soon find out if this statement continues to hold true or if a refinement is deserved.