Brookdale CEO Salutes Frontline Workers in New Book: A Conversation with Cindy Baier

As CEO and President of Brookdale Senior Living, Lucinda (“Cindy”) Baier might never have imagined that she would author a book. Then again, she might never have imagined a crisis like the COVID-19 pandemic either.

As CEO and President of Brookdale Senior Living, Lucinda (“Cindy”) Baier might never have imagined that she would author a book. Then again, she might never have imagined a crisis like the COVID-19 pandemic either.

Inspired by the response to the pandemic, Baier has written a book: Heroes Work Here—An Extraordinary Story of Courage, Resilience and Hope from the Frontlines of COVID-19. It tells the story of the frontline heroes who saved lives and what it was like to run the nation’s largest senior living operator during the greatest public health crisis in more than 100 years.

NIC Chief Economist Beth Mace recently talked with Baier about her new book and the lessons learned that will drive the industry and Brookdale in the years ahead. Here is a recap of their conversation.

[This interview has been edited and condensed from a new episode of the NIC Chats podcast. Listen in to hear the complete interview.]

Mace: What inspired you to write this book?

Baier: I’ve worked in so many different industries during my career, but senior living is an industry that is very special and unique. The book highlights some of the heroes who helped save lives throughout 2020 and 2021. It preserves their important role in history by sharing behind-the-scenes information that can help others learn from our experience. At the same time, the book serves as a guide for leaders navigating unchartered waters to bring out the best in their teams for the good of their companies and the greater good of society. The book is both a keepsake for those who stepped up when it mattered most as well as a guide for other leaders to overcome whatever challenges they may face.

Mace: Tell us about the title and its meaning.

Baier: Brookdale’s response to the COVID-19 pandemic has really been unmatched within the senior living industry because of the heroes who work at Brookdale. I have never seen so many people willing to sacrifice so much for the benefit of others. At Brookdale, we have a culture of caring. We genuinely care about the people who work with us and the people who serve in our communities. We rally behind those in need. Our spirit of servant leadership is what led us to success and those lessons are universal. Telling Brookdale’s story celebrates our everyday heroes, and they really deserve to be celebrated.

Mace: As you look back now at the final published document and its rich content, what were some of the things that you learned that most surprised you about the pandemic and its effects?

Baier: I think the thing we learned most is something we always knew: The focus on the mission is vital. Our sense of purpose, creating a culture people want to be part of is at the center of everything we do at Brookdale. People want to be part of something bigger than themselves, and that’s something we saw during the pandemic. It’s also important to recognize the energy you bring into a situation. Negative energy saps the spirits of the staff and the company. Positivity creates energy and a sense of hope and optimism that we can do this. Every single person had an important role to play in the crisis and beyond. So, leveraging everyone’s strength was critically important. We knew that before the pandemic, but the intensity and complexity of the crisis brought that into clear focus for us.

Mace: How did you get everyone on the same page?

Baier: We did a lot of communication and solicited ideas from all levels of the organization. Go back to the beginning of the pandemic and think about how much had to change so quickly. The corporate office had the resources, and we were unmatched in our ability to manage processes like securing personal protective equipment when it was difficult to find. When it came to connecting with residents, we found the people who were closest to the residents often had the best ideas. They could understand what each individual resident needed in terms of engagement and their relationships. We created the structure to communicate broadly and used every type of communication imaginable. We also held forums where ideas could bubble up and best practices could be shared between the resident engagement teams and the executive directors. Creating those paths for sharing information really allowed the best ideas to get considered and put into action as quickly as we possibly could.

Mace: As CEO of the largest senior housing provider in the nation, how did the pandemic influence your corporate leadership style?

Baier: Connection is key. We made intentional efforts to connect with the team professionally and personally. This was a time that required strong leadership. We had to learn to be flexible, clear, and compassionate. Everyone in the organization, no matter their level or position, was impacted by the pandemic. We had to focus on our listening skills to determine where action was needed and empower people to act. We wanted to make as many decisions as close to the residents as possible. That part of leadership was amplified during the pandemic. And we had to do a lot of work to make sure the senior living industry was an attractive place for people to fulfill their purpose, to earn competitive compensation and benefits, and grow professionally. We were intentional to make sure our company was as attractive to potential team members as possible. One of the things I’m particularly proud of with Brookdale is, because of our size, we have more career options. We have communities all over the U.S. People can move from the corporate office to the field or from the field to the corporate office, or across the country for opportunities. That gives people added flexibility. We can leverage our size to provide resources for our residents and associates. We offer tremendous opportunities, and we provide support across all areas such as programming, dining, and asset management. Brookdale has a wealth of subject matter expertise. Also, we have great learning systems and processes which helped us onboard the many new associates we hired during the pandemic.

Mace: Did you find that the pandemic accelerated the use of technology?

Baier: The good news about the pandemic is that technology made us more efficient in terms of how to connect. It also gave residents a chance to connect with families in ways that they hadn’t before. There are so many stories of residents who were able to attend a granddaughter’s wedding or see a new grandchild through video conferencing. Telehealth is a game changer. Think how convenient it is to see your doctor in a video setting as opposed to leaving home and getting to the doctor’s office. It has improved healthcare and senior living, and I am grateful. Telehealth is one of the silver linings of the pandemic.

Mace: What traits did you see in others that helped them rise to the enormous challenges to support residents and staff?

Baier: We are united by our north star: the health and wellbeing of our residents and associates. The culture at Brookdale has four cornerstones: passion, courage, partnership, and trust. I think we leaned on our culture during the pandemic more than at any other time. I am grateful that the people who chose to work with us have a strong sense of purpose. They want to help seniors solve some of the challenges of aging. It took a lot of courage to step up and come to work every day when much of the country was sheltering in place. The partnership element relates to the fact that no one was alone. We were in this together. If someone was struggling and needed help, all they had to do was raise their hand. Our cornerstones were very helpful, and front and center during the pandemic.

Mace: How much of this is carrying over today?

Baier: A lot is carrying over. By facing the pandemic, we are stronger as individuals and as a team than we were before. When you face adversity and successfully overcome obstacles, it gives you confidence and trust in your team that you did not have before. The sheer number of challenges that we successfully overcame makes me think almost anything is possible. We have the confidence from our success to build on.

Mace: The pandemic was an example of crisis management to the highest degree. How did you manage crisis after crisis and uncertainty after uncertainty?

Baier: I have to say that you get by with a little help from your friends. At the beginning of the pandemic, we were lucky, and our former board member Jim Seward saw events unfolding in China before anyone here was paying attention. That knowledge and conversation with him gave me the chance to analyze the risk and what it might mean for Brookdale. So, we were able to take fast and focused action to help protect residents. We established a command center that gave us a central point for clear decisions and consistent communications. Having clear priorities is critically important during a crisis. We are grateful that we have an incredibly strong clinical leadership team. We relied on clinicians to create and build upon our strong infection control protocols, and our operations team to execute them. We have more than 40 years of experience in infection protection and being able to build on that is helpful. When we learned about the availability of vaccines to help stop COVID-19, we mobilized quickly to get three rounds of vaccine clinics at every one of our communities which helped to protect our residents. My advice: be a learning organization, mobilize quickly, have clear priorities, and ensure everyone knows the objective and they align around the objective. When you are clear about what you are trying to accomplish, you can overcome a series of events that individually may seem insurmountable.

Mace: Communications are key. What kind of communications internally and externally did you undertake to create better outcomes?

Baier: Throughout the pandemic, we created blogs, emails and videos, sharing information internally and externally to inform our associates, residents and families, and as many people as we could in real time. There was a constant cadence of communication. By sharing our knowledge, we became thought leaders that engendered trust and encouraged alignment in the organization which helped to calm residents and families, and gave our associates confidence. Communication is always important but never more important than in a crisis. If people don’t have the information, they’re going to make it up or fill in the blanks. We have a constant stream of communication that is open and honest, and for us it comes from the heart.

Mace: On a personal level, how did you manage the stress of the pandemic?

Baier: I’m lucky to be surrounded by an incredible team at Brookdale, and my husband has been very supportive. I’m a farm girl from Central Illinois. When I came to Brookdale, I really found my true purpose in life as well as an extended family. I knew some of the challenges I faced earlier in life led me to this moment. Managing stress is easier when you are involved in preparation and action. Those elements are essential because you’re trying to solve the problem, and you focus on what you can do, control and make better. Growing up on farm helps you do what has to be done.

Mace: What are some of the lessons learned from the pandemic that will shape the future of the industry?

Baier: The pandemic has highlighted that people want control, and there is a bigger need for flexibility. At the corporate office, we’ve learned to be nimbler. Some associates work remotely, and many are on a hybrid schedule. That’s good for the culture when it makes sense. There are also huge benefits from being together as a team. The most important thing is to focus on what matters most and eliminate what’s not important. Regardless of the position you’re in, there are always more demands on your time than hours in the day, so you have to be intentional about what matters and focus with laser-like clarity on that, and you are more likely to be successful.

Mace: Isn’t that hard to do?

Baier: You have to make time for the most important things regardless of what else is important. Block your calendar. Connect with the people who are most central. During the pandemic, we had regular updates with people at the center of organization, so we knew if we needed to pivot and take the company in a different direction. It takes a lot of discipline to not get distracted by the mass of information available and requests for time. There are huge benefits from staying focused personally and professionally.

Mace: It’s hard to say ‘no,’ especially for women who get pulled in many directions.

Baier: I have a saying that ‘no’ is my favorite word, and I can say it in different languages. It’s a tongue in cheek joke, but if you’re not intentional and conscious about what you’re going to do, then you are not in control of your destiny, and you get pulled in a direction you don’t want to go. If you’re clear about where you want to go and how to get there, it’s perfectly fine to say ‘no.’ In our communities, we have a focus on saying ‘yes’ to residents to support them in a way they want to be supported. Maybe they have a favorite meal or activity. You can have that tension of saying ‘yes’ to residents and saying ‘no’ to initiatives that don’t add value to the company, residents, or your personal life. ‘Yes’ and ‘no’ can peacefully coexist like yin and yang.

Mace: This is your first published book. What were the most challenging parts of writing this book?

Baier: The hardest part was to get personal and share information and stories about myself. I am a pretty good negotiator and tried to negotiate the model of the book, but the publisher Forbes was clear the book had to be a third on my personal life, a third on leadership, and a third on business. So, for me, being an introvert, sharing my personal story was the hardest part.

Mace: What are you doing with the proceeds from sales of the book?

Baier: All net proceeds from the book will go to our associates compassion fund. I’m incredibly proud of that. Our fund provides financial assistance to eligible Brookdale associates who are having a financial challenge through a catastrophe or a personal event that is no fault of their own. The book is really the story of our incredible associates, our everyday heroes. It’s only fitting that the proceeds from the book go back to support them when they need it most.

Mace: Any other thoughts or comments?

Baier: The most challenging times create the strongest leaders. As I like to say, heat and pressure turn ordinary carbon into diamonds. We are taking what we learned from the pandemic to drive a strong recovery. We saw that in 2021, and we are building on that even more in 2022. The work our industry does is critically important. We are not a discretionary purchase. We provide support to individuals who need help with the challenges of aging. We are going to take absolutely everything we’ve learned from the pandemic to drive us into the future.

This interview has been edited and condensed from an episode of the NIC Chats podcast. You can hear more from Baier and learn more about her new book.

Solving the “Forgotten Middle” Puzzle: Owner-Operators Share Middle-Market Strategies

With a growing number of seniors unable to afford much of the senior living product on the market, successful new strategies are starting to emerge to house and care for middle-income elders. Two speakers shared their middle-market strategies at the 2022 NIC Spring Conference in Dallas. Each speaker provided a different roadmap to success during a widely attended session, “The Forgotten Middle Market: Vision to Execution.”

The session was moderated by Diane Burfeindt, managing partner at Trilogy Connect. NIC Senior Principal Ryan Brooks kicked off the discussion, providing context on the middle market.

NIC first identified the “Forgotten Middle” in 2019. NIC funded a middle market research project conducted by NORC at the University of Chicago. The study showed that the senior middle market is expanding from 7.9 million seniors in 2014 to 14.4 million seniors in 2029. Many of these seniors do not have enough wealth to afford private pay senior living but do not qualify for government help, Brooks said.

The problem is compounded by the fact that middle-income seniors in the future are less likely to be married and will be short on savings, Brooks noted. They also will have fewer children to pick up the caregiving slack. “We want to create a dialogue around solutions,” he said.

Case Studies Highlight Challenges

Two speakers shared insights on their middle-market projects already under way. The examples demonstrate the complexity of workable solutions and the need for creativity and patience.

Sharon Ricardi is president at Northbridge Advisory Services, a division of Northbridge Companies. “I looked at affordable assisted living around the country,” said Ricardi. “We were trying to figure out what we could do.”

With a regional concentration in the Northeast, Northbridge formed a partnership with HallKeen, a developer of affordable senior housing with experience in the assembly of financing for affordable projects. Four new projects are planned. The first project, the Residences at Kenilworth Park, is scheduled to open this fall in Washington, D.C. Though 80% of the units are reserved for seniors who qualify for affordable housing, 20% of the units can be rented to middle-income seniors. Ricardi’s advice: “Make sure you have a tax credit advisor.”

Separately, Northbridge acquired three existing properties, in Maine and Connecticut, at a discount to serve the middle market. Existing, older properties are generally less expensive than newer ones or ground-up developments, lowering the overall price tag for residents. “The cost of acquisition is just the first step,” said Ricardi. “From there, you have to figure out how to operate the community.”

The residents are looking for value they can afford, noted Ricardi, so the communities can’t compromise on essential elements, such as programming. Revenue is maximized by converting some office space into apartments, by introducing levels of care pricing, and by bringing in more volunteers.

In one case, favorable press coverage of cutting-edge memory care therapies helped to fill expensive units which took the financial pressure off less expensive apartments. Expenses are cut in places where residents won’t notice the difference, such as in some food service options. “We keep everything that results in a high level of satisfaction,” said Ricardi.

Lowering Costs

The second speaker, Amy Schectman is president of the nonprofit 2Life Communities, which owns and operates six campuses. The organization introduced its “Opus” middle income housing option last year. The first project, a continuing care community, is located in the upscale Boston suburb of Newton, Massachusetts. The median home price there is $1.7 million. “Our goal is to serve those who are house rich and income poor,” said Schectman.

Half of the entry fees are below $500,000. Monthly fees are being kept relatively low, from $1,640 to $3,800, so residents don’t run out of money.

Strategies to reduce expenses include:

- All residents must volunteer 10 hours a month at the community to cut staffing costs.

- Locating near existing amenities. An adjacent community center offers amenities, such as a swimming pool.

- The campus director is shared with an affordable community next door also owned by 2Life.

- Rather than building a costly care center, the community will have on-site care navigators and partnerships with healthcare providers.

“Partnerships are critical,” said Schectman. Partners include a geriatric care practice, home care agencies, and PACE providers that work with seniors eligible for both Medicare and Medicaid.

How to Handle Staffing and Marketing

Both speakers addressed the challenges of staffing and marketing for the middle market product.

Ricardi said the staffing needs of middle-market projects are not that different from higher-end communities. “We have to provide good care,” she said. Northbridge is focused on workforce development. The company’s goals include higher wages; forming partnerships with high schools to recruit young workers; offering a career path; and developing answers to challenges such as childcare and transportation. New technology has yet to make a big difference in staffing costs, however.

At 2Life, staffers who take the overnight shift can stay rent free in an apartment. The volunteer requirement for residents has been very successful in helping to cut staffing costs. “It makes a big difference,” said Schectman.

The volunteer requirement also complements the particular kind of lifestyle being offered by the project. “We market the positive value of community,” said Schectman, adding that volunteerism is a big reason why people are attracted to the community.

In a break from conventional thinking, Northbridge puts pricing in their ads, most of which are digital. “We want people to know they can afford our communities,” said Ricardi. Transparent pricing also appeals to those who could afford a higher-priced community. “Even if they have money, they like to save it,” she said. Big picture, Ricardi added: “Think outside the box.”

Moving Forward, Together: Join Us in the Nation’s Capital for the 2022 NIC Fall Conference

Twenty-nine million U.S. adults will be age 75 or older by 2025 and will seek their own housing and care options. The senior living industry must adapt, innovate, and form connections and partnerships to meet the needs of this growing and aging population.

As such NIC is convening thousands of operators, investors, and care partners in Washington, D.C. for the most anticipated networking event of the year: the 2022 NIC Fall Conference. From September 14-16, leaders will share insights on today’s challenges and opportunities as well as the future of the senior housing and care industry.

The conference will be held at the Marriott Marquis in downtown Washington, D.C. There will be additional meeting spaces across the street at the Courtyard Washington Downtown and the Residence Inn Washington Downtown.

Save Now and Reap Ongoing Benefits

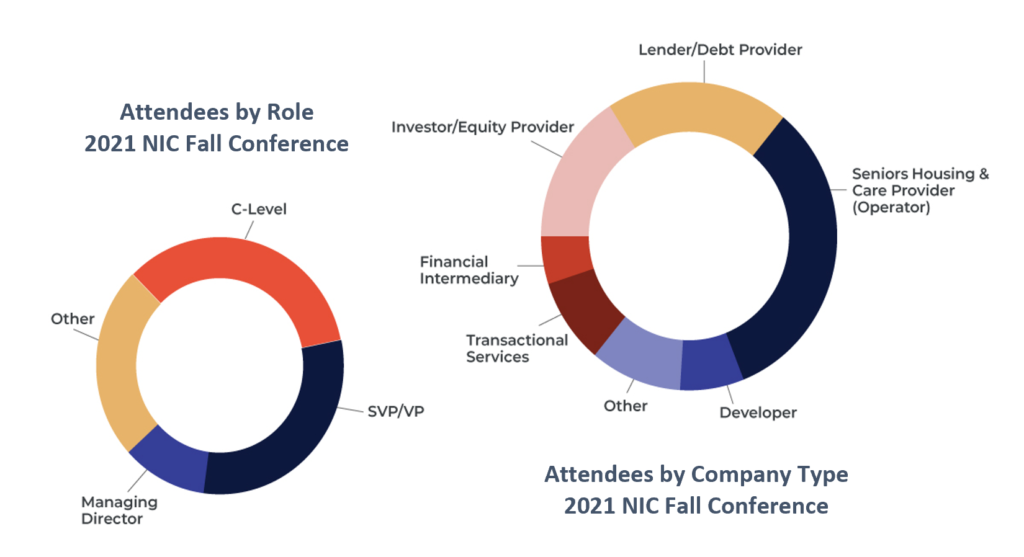

Thousands of senior housing and care leaders – over 70% of whom are senior-level executives – flock to ‘The NIC’ for the most productive, efficient, and impactful three days of the year. You can save up to $400 on Early Bird rates if you register by June 29, 2022.

‘The NIC’ is widely considered one of the most efficient and effective networking events of the year. It is intentionally and expertly curated to deliver a highly unique and dynamic environment to help attendees make and deepen relationships. Networking opportunities range from informal networking lounges and receptions to formal sponsored private meeting rooms and huddle spaces. Regardless of your preferred method, ‘The NIC’ provides multiple unique opportunities to make your next business connection. Don’t miss the opportunity to personally connect with the business relationships – and find critical insights – that will drive your business forward in a post-pandemic world.

Regardless of whether you have attended ‘The NIC’ 10 times before or are just considering joining us for the first time, the conference has something for everyone. NIC offers several activities and resources specifically tailored to help first-time attendees successfully navigate the conference, including an orientation webinar, a First-time Attendee Gathering, and First-time Attendee Morning Connections. Many first-time attendees comment that ‘The NIC’ is a helpful entrée into the senior housing and care space – and that the insights they learn and connections they make at the conference help propel their careers and businesses forward.

Be Part of the Solution

As the industry prepares for the eventual massive influx of baby boomers seeking care, it is more imperative than ever for capital providers and operators to stay on top of where the industry is headed.

Through 10 main stage educational sessions, attendees will explore the biggest challenges facing senior housing and care leaders today and discuss the latest insights and strategies for success. This non-concurrent session format was wildly popular at our previous Spring and Fall Conferences because attendees don’t need to choose between sessions.

By registering early, you’ll ensure that your organization is part of the solution to the most pressing issues facing the industry – including workforce recruitment and retention, the ongoing segmentation of the industry, valuations, and more.

“The conference was one of the most powerful, informative, and invigorating experiences of my career. The ability to foster relationships with peers, along with strategizing on the future of our industry was invaluable!”

– Eric Varin, OneDay

Stay Safe while Getting Connected

NIC seeks to promote healthy behaviors and maintain healthy environments to reduce the risk of the spread of COVID-19 while at the 2022 NIC Fall Conference. All attendees, speakers, and staff participating in the event must be fully vaccinated or show proof of a negative COVID-19 test (Antigen or PCR) that has been administered by an accredited lab, pharmacy, or clinic no more than 48 hours prior to badge pick-up. If you submitted your vaccination record for the 2021 NIC Fall Conference or the 2022 NIC Spring Conference, you do not need to resubmit the information. Check your confirmation e-mail for your vaccination card status after you register. Detailed, up-to-date safety information can be found on our website.

Moving Forward, Together

This is a time of disruption in seniors housing and care. Now, more than ever, leaders are looking for new partners, new ideas, and new approaches to caring for residents and supporting staff as they seek to offer new solutions in the wake of the pandemic.

Now is the time to pursue new contacts, deepen existing relationships, and strengthen your network. It is time to be there for your residents and their families, be there for your employees, and be there for your business.

Be part of the conversation as leaders share insights and explore new strategies to move the industry forward, together. Register today.

Lender Challenges in the Current Market Environment

by Ross Holland, Managing Director, White Oak Healthcare Finance

As we move into the second half of 2022, challenges remain plentiful for lenders and borrowers alike, with three standing out as particularly noteworthy. Rising interest rates have made acquisitions and recapitalizations more expensive and have cut into borrower proceeds. Federal and state level noise have muddied the waters of CMS reimbursement, as cuts at the federal level threaten Medicare rates and states sort through the mess of normalizing any temporary Medicaid rate increases while still supporting providers. Lastly, the continued expense pressure faced by all providers has made it clear that some “COVID-era” operating costs will remain, regardless of how much the virus wanes.

As we move into the second half of 2022, challenges remain plentiful for lenders and borrowers alike, with three standing out as particularly noteworthy. Rising interest rates have made acquisitions and recapitalizations more expensive and have cut into borrower proceeds. Federal and state level noise have muddied the waters of CMS reimbursement, as cuts at the federal level threaten Medicare rates and states sort through the mess of normalizing any temporary Medicaid rate increases while still supporting providers. Lastly, the continued expense pressure faced by all providers has made it clear that some “COVID-era” operating costs will remain, regardless of how much the virus wanes.

While many have been anticipating the eventual and inevitable rise in interest rates, it felt for a while that a sustained increase may never come. Sure, there was the occasional, isolated period of market volatility, such as the fall of 2018 when the 10-year Treasury yield crested over 3%, but the rate environment always found a way to re-stabilize. Not only did this make for an unprecedentedly affordable borrowing environment for many years, but it also drove investor money towards more operationally intensive, higher yielding asset classes like seniors housing and skilled nursing. As anyone who has been in the business over the last ten years knows, this led to an incredibly powerful combination of cheap debt and accessible equity; then came inflation, and with it, rapidly rising interest rates. The broad spectrum of price increases finally forced the Fed into action, as Beth Mace discussed in great detail in her May 2022 NIC Insider Newsletter article.

While whether or not the rate rise will relent is still unknown, the steepness of the increase has been more apparent than we’ve seen in previous spikes over the last few years: Since December of last year, the 10-year Treasury yield has risen approximately 1.75% as of the second week of May. From a lender’s perspective, this has changed how new deals can be sized, but also has led to a flurry of activity as borrowers feel a sense of urgency to move before rates spike further. Loan sizing issues have been less prevalent in skilled nursing, where higher cap rates that restrict valuation thus result in more debt service coverage cushion, but higher debt service payments can still exacerbate the operating challenges driven by reimbursement uncertainty and expense growth.

Along with the backdrop of the macro-economic environment, providers that rely on government receivables, primarily skilled nursing but also Medicaid waiver seniors housing properties, are faced with significant ambiguity. Much of the fanfare during the height of the pandemic was focused on direct stimulus funds distributed by federal and state governments. While these tools were powerful and critical towards keeping operators afloat, temporary Medicaid rate bumps, along with Medicare 1135 waivers (which give providers more flexibility to bill patients at Medicare rates), have also been an important piece to the puzzle. As we move into a more endemic phase of COVID, many states have begun the discussion of when, and how, to remove temporary rate support. In California, for example, providers have received a 10% Medi-Cal add-on, but this is scheduled to end in conjunction with the federal health emergency, which as of now runs through the end of July. Many states have instituted similar add-ons during the pandemic, and the decision to either end or extend the increased into perpetuity is a subject of much debate. At the federal level, CMS has proposed a reimbursement cut that will amount to several hundred billion dollars in order to account for overpayments that were primarily driven by PDPM implementation in 2019 and the ongoing pandemic. Not only does this add another variable to reimbursement uncertainty, but it also puts direct pressure on states to find ways to extend temporary rate bumps or find other creative ways to redistribute budget dollars to certain providers via quality based or upper payment limit programs. All the while, borrowers and lenders have had to constantly re-evaluate underwriting assumptions and balance the probability and timing of various top line impacts.

Lastly, a challenge that has been ever present dating back to even before COVID, expense pressure, keeps mounting. Macro level inflation impacting all industries has led to obvious cost increases, but general payroll pressure in addition to increased labor costs exacerbated by agency staffing continues to be a major issue for borrowers, and as such, for lenders. This becomes especially apparent when underwriting value-add transactions where operators are planning to overlay a staffing strategy that significantly reduces labor costs. Without question, some providers can be more efficient in staffing, whether it be due to regional footholds that lead to lean back-office support, or seasoned operating personnel that can tightly manage agency labor, therapy, and other highly variable expenses. That said, if a borrower is acquiring a community that has faced multiple years of expense increases, how can lenders best sort out what expenses were, and are they a function of execution versus new realities? There is of course no perfect answer; however, perhaps the most powerful metric is operator specific comps in the same or similar market.

In an industry as operationally complex as seniors housing and care, there will never be a shortage of hot button issues for the lending community, and these issues will ebb and flow as they always have. Today, however, the simultaneous onslaught of rising interest rates with top line uncertainty and continued expense increases has made for an especially challenging competitive environment, as some lenders will make more aggressive assumptions to win business, while others take a more measured approach. As is the case with all uncertainty, opportunity will present itself. Strong providers will be rewarded in the face of state Medicaid re-organization, and those capitalized appropriately to absorb the interest rate and expense environment will gain market share. All of this is to say that, ultimately, the sponsors and operators are what must drive the actions of the lending community. In a time when it’s impossible to have it all figured out, betting on those who have figured it out in the past and are prepared to withstand uncertainty is perhaps more important than any other criteria.