Download the Full Insider: March 2015 Issue

Industry Veteran Kathryn Sweeney Discusses Her New Venture, Blue Moon Capital Partners

You might call Kathryn Sweeney an early adopter. She was among the first capital providers to enter the seniors housing and care sector in 1997, when it was just a fledging industry. After years at big investment companies, she recently started a new chapter by co-founding a firm to match institutional capital with best-in-class operating partners to fund the next generation of facilities.

Sweeney recently spoke with NIC about her role as managing partner of Boston-based Blue Moon Capital Partners, and her outlook for the industry.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: Since you’ve had extensive experience at established investment firms, why did you start a new venture?

Sweeney: Blue Moon Capital Partners looks to provide capital to forward-thinking operators, who recognize that the old ways of doing business may need to be tweaked and rethought. That’s harder to do in a large organization. We’re looking for operators focused on the mission and the margin. The mission is providing exemplary customer service and employee relationships. The margin means being able to roll that all up at a business level to optimize the economics. We have lots of discussions with our prospects about how they’re preparing for the future.

NIC: Tell us more about Blue Moon.

Sweeney: I started the firm with Susan Barlow. She was previously managing director and head of global client relations for RREEF, a global institutional real estate investment manager owned by Deutsche Bank. We met four years ago through mutual relationships with executives at CalPERS. We participated on a panel at a conference sponsored by CREW, the commercial real estate network for women.

Blue Moon is a woman-owned business and seniors housing is mostly a business about senior women. We really connect with the ultimate end user. We’re adult daughters and we have mothers in this zone. We have a sense of the complexities and see ourselves as providing solutions for seniors and their families through capital allocations.

Our team is experienced on the seniors housing capital and operations side. And Blue Moon is exclusively focused on seniors housing. That is a differentiator from other capital providers.

NIC: What are Blue Moon’s milestones to date?

Sweeney: We launched the firm in October of 2013. We closed our first equity investment in June 2014, a deal with LCB Senior Living—a fast-growing seniors housing company based in Norwood Mass.

We took a big step forward in December 2014 when we secured a $175 million commitment from the private equity firm, Hawkeye Partners, of Austin, Texas.

NIC: How will that capital be deployed?

Sweeney: Blue Moon has full discretion over the capital. Our investment strategy is to deploy 70 percent to new development to create modern, next generation properties. The other 30 percent will be used to reposition dated properties, but they must be well located and well operated.

NIC: What kind of investment structure are you seeking?

Sweeney: We’re seeking joint-venture relationships with operating partners that have the financial wherewithal to co-invest. We have a preference for operators who invest their own capital. If the operator is seeking their own co-investment partners, we need to understand the controls and decision-making processes in that relationship.

NIC: What’s your geographic target?

Sweeney: Our target markets are mostly the East and West coasts, and the Upper Midwest. We consider other markets where there is a clear unmet demand with a concentration of seniors and adult children. We’re not actively pursuing properties in Georgia and Florida, though we sometimes take a look. The demographics in Florida are hard to figure since it’s difficult to tell how many seniors will stay there, and how many will go back to where their adult children live. We are mindful, however, that more adult children are relocating to Florida and we want to see if the trend sticks.

NIC: What property types do you seek?

Sweeney: We prefer private pay rental properties with independent, assisted and memory care. We like the continuum because residents are showing up with more complexities, and couples often have different needs. A ground-up development with three product lines is a great way to accelerate absorption while not flooding the market with too much product. We would consider stand-alone memory care with a very experienced operator in a high-barrier-to-entry market where competitors are under serving the population. We would also consider a rental continuing care retirement community (CCRC).

NIC: What about property size?

Sweeney: Properties should have no less than 60 units, say, for a stand-alone memory care facility. The upper limit for a property with a continuum is about 180 units.

NIC: You mentioned that you’re seeking forward-looking operators. What specifically are you looking for?

Sweeney: We’re seeking an operator/developer with an innate sense of the local customer. Since today’s customers are complex and the lines are blurred between independent and assisted living, and memory care, we’re seeking partners that are thoughtful about their customers.

We like technologically current buildings with two sets of bandwidth. One bandwidth should be dedicated to handle the building’s systems which are integrated so the property can run efficiently. That includes keeping electronic medical records. The other bandwidth should be Wi-Fi enabled to allow residents to engage in activities.

NIC: What about the clinical component?

Sweeney: We look at that closely. We’re well aware of the regulatory environment in each state where we invest and we spend time with the clinical staff and property owners. We look at past history for issues to help decide which operators to partner with. If there was an issue in the past, we’re open to hearing about changes in policies and culture that have been made to correct the problem.

NIC: How do you judge culture?

Sweeney: Part of it is “boots on the ground.” We go into the community to get a sense of how policies are being put into practice. We also look at fact-based information: resident and employee satisfaction surveys; public records; violations; staffing levels; how staffing decisions are made; and the qualifications of resident care directors and how they interact with residents and families.

NIC: Property prices are high now. What’s your strategy on the acquisition side?

Sweeney: Some markets are hard to get into with ground-up development. We like underperforming properties where there’s pressure to make a change in the operator or capital partner.

But we love rising property prices. It validates our new development strategy. There’s a huge build vs. buy spread that becomes starker with every portfolio sale—as much as 400 basis points in some markets. We’ll take that bet any day.

NIC: You’ve been in the industry since 1997. How has the attitude of the institutional investor changed?

Sweeney: Years ago, institutional investors wanted to know why they should care about seniors housing, but they really didn’t care that much about the sector except for a few pioneers like CalPERS and the State of Michigan Retirement System. But NIC has been a catalyst for transformation in the industry. For example, NIC data from the recession has shown that seniors housing compares well to other commercial real estate assets. That has catapulted the conversation and learning curve on the institutional investor side. High net worth groups are entering the sector because they see the results as well. From my standpoint of raising capital, the work NIC does has been incredibly supportive.

NIC: What’s the industry’s biggest challenge?

Sweeney: Affordability. It’s really a challenge to meet investor return requirements in new developments and deliver a product everyone can afford. We continue to look for models to get there because that’s where the bulk of the demand is. In our deal with LCB Senior Living, 20 percent of the units are affordable. Rents are subsidized by a Medicaid program in Massachusetts. It’s a great program and the building’s population is mixed in every way. But there needs to be greater scale. Some operators are doing pilot programs on affordability and we’re watching those closely. What they’re doing is worthwhile and they may get the numbers to where they need to be.

NIC: What’s the outlook for the industry?

Sweeney: It’s an exciting time to be in this business. We launched Blue Moon on the belief that there’s a great future ahead for seniors housing and care. Our target market of seniors age 75 or older will increase 80 percent between 2010 and 2030. It’s a growth industry. And the fact that the industry has matured to the point where investors are attracted to it is a great professional value and satisfaction to me having been involved in the industry from the start. My outlook for the industry couldn’t be rosier.[/expand][cresta-social-share]

Insider Insights on Health Care Reform from Kathleen Sebelius: Part II

In part two of her interview with NIC, Kathleen Sebelius previews her remarks as keynote speaker at the NIC 2015 Capital & Business Strategies Forum, March 31-April 2, San Diego. (Click here for Part I)

Sebelius was the Secretary of the U.S. Department of Health & Human Services from 2009 to 2014, helping to lead the effort to pass the Affordable Care Act (ACA), and overseeing its initial implementation. She will speak at the NIC general session luncheon April 1.

What follows is a sample of what attendees can expect to hear:[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: What will the health care system look like in 10 years?

Sebelius: Part of the framework of the ACA was to move the public payment system away from a fee-for-service to a value-based proposition as quickly as possible. A lot of attention was given to providing access and affordable insurance to people who didn’t have it, and that was certainly one of the goals of the ACA. But reform of the delivery system—to align $1 trillion of public payments with quality and value-based outcomes—is more significant, especially for the elderly population. They have a guaranteed insurance product, and they were less worried about benefits and pre-existing conditions than the general population. But they are worried about getting the most bang for the buck, and providers are worried about the payment stream.

NIC: What is the timeframe of the rollout?

Sebelius: The Centers for Medicare & Medicaid Services (CMS) recently announced a target date of 2016 to move from having 20 percent of payments tied to a value-based proposition to 30 percent. Fifty percent of payments would be value-based by 2018. That’s a pretty aggressive target, considering we were at zero in 2011. If we’re 50 percent there by 2018, I think the market will take over and only the outliers will have fee-for-service payments. Hopefully, we’ll move entirely away from fee-for-service models in 10 years.

NIC: What else should providers know?

Sebelius: CMS also announced that fee-for-service payments would even be tied to quality measures. That’s a very significant shift from the past, and we’re already seeing some pretty remarkable improvements. Hospital-acquired conditions, such as infections, have dropped 17 percent. Preventable readmissions, which are key for seniors, have fallen significantly. The evidence around ACOs and coordinated care regarding new payment methodologies are already showing big dividends. There is also real evidence that while quality is improving, costs are being lowered and consumers are the beneficiaries.

NIC: How does that impact investors?

Sebelius: As investors look at care facilities such as assisted living and nursing properties, they’re considering which ones are doing the best job, what the most important metrics are, how those metrics can be replicated, and how their investment can drive those results. That’s what the future looks like.

In addition, we’ll hopefully dramatically reduce, if not eliminate, the number of uninsured. The big reason why that is important for NIC is that one of the largest cohorts of uninsured Americans are those age 55 to 65. A lot of people in that age group lost their jobs, retired early, or have pre-existing conditions. They couldn’t afford coverage or couldn’t get it. So they would have entered the Medicare system in worse shape than if they’d had insurance. If healthier people (with insurance) are entering the system, or if their chronic diseases have been managed, their conditions are less limiting. That’s potentially good news.

NIC: What would you like attendees to take away from your presentation?

Sebelius: This is probably the most exciting time for health care since the passage of Medicare and Medicaid. The opportunity for innovation and service improvements is huge. The industry can be at the front edge of a new era of how the largest population of elderly we’ve ever had in this country will receive the services and supports they need to remain independent, maintain better health, and live longer lives.

We’re at the dawn of something new. And it’s not just happening here. Every country in Western Europe, and Japan, is watching this because they’re dealing with similar populations. If we figure out models of success that work here, then every country will look to us. We’re at the edge of a revolution in terms of service and how to link technological advances for the elderly population. If the system works here, investors will have significant global opportunities.[/expand][cresta-social-share]

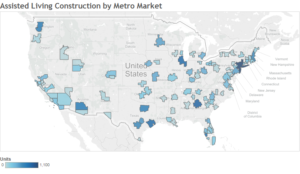

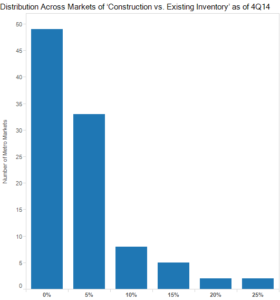

Potential of Oversupply in Only Select Markets

As the rate of construction for assisted living properties climbed during the past two years past 4%, then 5%, and neared 6% of the existing inventory, discussions of oversupply have become more commonplace. These national numbers certainly raise the question, as construction represented 5.5% of existing supply within the 99 metropolitan markets during the fourth quarter of 2014. For a somewhat mature sector, that represents a sizable but not insurmountable amount of new construction. The assisted living construction concentrations across the majority of markets are far less concerning.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

It’s not quite the 80/20 rule, but 20 metropolitan markets represented more than 60% of assisted living’s total construction during the fourth quarter of 2014. While spatial diversity has been on the rise, with more markets beginning to show activity, construction has remained concentrated. Construction collectively represented 8.7% of existing inventory in those 20 markets, compared to only 3.5% in the remaining 79 markets. This further highlights that the potential of oversupply is a risk in only select markets. However, this could possibly change as the sector continues to attract capital and some of which may opt for developing additional new properties over acquiring existing properties.

[/expand][cresta-social-share]

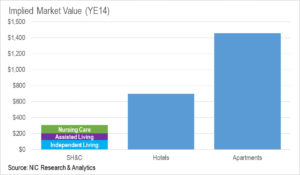

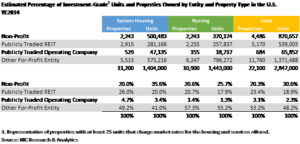

National Market Size Estimates Updated

Year-end 2014 Value of $305 Billion for Seniors Housing and Care Properties

Leveraging the census of supply for the top 99 metropolitan markets and updated demographics, NIC has updated its supply estimate models through year=end 2014. New estimates suggest the “investment-grade” market of seniors housing & care properties with 25 or more units contains more than 22,000 properties and 2.8 million units. In addition, recent transaction prices suggest the real estate has a market value of about $305 billion. As an emerging property type, seniors housing and care has a long way to go to catch up to the market sizes of the established property types.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

REITS Continue to Expand Their Footprint

The publicly traded REITs continue to become increasingly dominant players in the sector. Based on public disclosures and NIC’s size estimates, the publicly traded REITs owned more than a quarter of all seniors housing properties and more than a fifth of all nursing care properties. Their ownership shares increased from 2013, when the public REITs owned 19.2% of seniors housing properties and 17.6% of nursing care properties.

By comparison, the publicly traded operators own 4.7% of the seniors housing properties and only 1.4% of nursing care properties. Publicly traded operators held steady their share of seniors housing properties from 2013, but Ensign’s spin-off to CareTrust REIT dropped the share of nursing care properties from 2.2% to 1.49%.

[/expand][cresta-social-share]

Scholarship Program Joins Internships to Broaden NIC Outreach to University Students

Furthering its mission of leadership development in the seniors housing and care industry, NIC has expanded its outreach to universities, especially at the graduate level, with a scholarship program that brings select individuals to NIC conferences. The program offers interested students the opportunity to meet industry executives and attend presentations on the latest trends impacting seniors housing and care. The scholarship program complements NIC’s internship initiative. Both programs were developed by members of NIC’s Future Leaders Council (FLC), with oversight by the NIC Board of Directors.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

The NIC internship program pairs students from top-tier universities in highly-regarded specialized programs with leading firms in the seniors housing and care industry. The goal is to attract and develop talented individuals, increase the awareness within the academic community of the unique dynamics, challenges and opportunities within the seniors housing and care industry, and provide value to participating companies, interns and universities alike.

With opportunities available for both undergraduate and graduate students, the internship program is focused on assignments within the finance and/or operations departments at some of the industry’s leading REITs, investment banks, senior care providers, management companies, consultants and industry organizations. Interested students can access the program’s website at www.nicfutureleaders.org to view specific intern opportunities as well as learn more about the host companies.

A new online job search tool allows applications to be submitted electronically and updated in real time. More than 70 applications have been submitted for the 2015 internships, to date. “This new dynamic software program creates a highly efficient and paperless recruitment process that maximizes host companies’ efforts,” notes John Getchey FLC vice-chair and senior vice president at Health Care REIT. Companies interested in participating in the Internship program should contact Aron Will at Aron.will@cbre.com or John Getchey at Jgetchey@HCREIT.com.

Among the first recipients of the NIC scholarship, DePaul University MBA student, Jose Pizarro had the opportunity to attend the NIC National Conference in Chicago last fall.

According to Pizarro, he attended quite a few of the presentations and was surprised by the size and scope of the conference. “I was impressed with the knowledge of the panelists as well as the increasing level of competition for financing within the seniors housing industry,” said Pizarro.

“Attending NIC re-emphasized to me that the seniors housing market is continuing to grow and is on the verge of some very strong years ahead in terms of activity and growth. It certainly increased my interest in finding a career within the industry.”[/expand][cresta-social-share]