Shock to the System

NIC Conference Speaks to the Industry’s Coming Changes

This is “a time of rapid change. It’s a time of profound change,” said Dan Mendelson, CEO and founder of Avalere Health, in his keynote during the Opening General Session of the 2016 NIC Spring Investment Forum.

Understanding the opportunities and challenges that the changing seniors health care model will bring to seniors housing and care was the central theme of this year’s Forum. Over 1,500 attendees met in Dallas March 9–11 to discuss the rapidly changing seniors healthcare delivery and payment model and why those in the industry—from traditional private-pay seniors housing, to skilled nursing and post-acute, and their investors—must start thinking through their business and growth strategies now.

A Shock to the System

The changing consumer and the changing healthcare delivery and payment model will have an impact on the entire continuum of seniors housing and care, said NIC CEO Robert Kramer during the Opening General Session on March 10. The “push for care coordination for frail seniors who are high need and high cost” will focus attention both inside and outside seniors housing and care properties. “It means new partners, new payers, and new risk takers,” said Kramer, “and it means lots of opportunity but also significant challenges.”

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Keynote speaker Mendelson spoke to delivery system integration, managed care, and the implications for post-acute care and assisted living, being very clear that skilled nursing, long-term acute care, and post-acute care will have a role to play going forward. “However, these modalities are now going to need to fit better within the context of acute care,” he said. “They’re going to be paid for it differently, and things are really changing quite rapidly.”

Delivery System, Managed Care, and Their Implications

In terms of delivery system change, financial incentives are prompting changes in health systems. There’s an increasing federal spend on quality, as the government attempts to get out of the risk-bearing seat of healthcare. The goal is to move people out of the fee-for-service model so that 50% of payments are under advanced payment models (APMs) by 2018, putting the risk onus on to the provider. This has led to a dramatic growth in accountable care organizations (ACOs).

Also key is the growth of managed care. Medicare Advantage (MA) plans have experience 8.3% cumulative growth per year “at a time when a lot of health insurance markets are shrinking,” said Mendelson. He projects that MA plans will own half the market if they continue to grow at that rate. It’s important to pay attention to the move to managed care, even if you’re in a market where it has not been dominant, because it will change the way providers contract with plans. “It’s growing, and it’s coming.”

Ultimately, post-acute and assisted living providers need to figure out their place in the continuum of care and be clear on the value proposition they bring to the health plans. “Increasingly what a health plan wants and is going to expect of you, and what an integrated system wants and is going to expect of you, is not a big-picture value proposition but rather the value proposition for the patient when that patient is discharged from the hospital.” Those in assisted living will be required to identify the value they provide for the individual patient and be able to speak to it. And how they demonstrate value must “be consistent with the various ways that quality is measured and ultimately paid for among other providers,” Mendelson said.

The star rating systems in place today will likely continue, Mendelson told attendees. “It’s the prelude to pay-on-quality.” Measuring performance and reporting it accurately will be essential going forward.

The Industry Responds

Following his keynote, Mendelson was joined by Kramer and the chair and co-chairs of the 2016 NIC Spring Investment Forum Planning Committee: Doug Korey of LTC Properties, Inc.; Kenneth Segarnick of Brandywine Senior Living; Thomas Stanley of Cascade Living Group; and James C. Thompson of Synovus Bank.

How fast is change coming to skilled nursing, Kramer asked the panelists. Thompson of Synovus Bank said that skilled nursing “tends to be a little behind the curve,” but that some operators are developing relationships with hospitals and demonstrating where they can help hospitals reduce length of stay and increase profitability. Others seem taken aback by the shift of acuity, payers, and impact on their length of stay. What is clear for all of skilled nursing is that much uncertainty remains with the role they’ll play in APMs and the metrics that will be used to report and drive outcomes.

For Korey, the outlook is similar: operators are taking different approaches because the future is not yet certain. They’re sitting back and waiting to see how things play out. “But I wouldn’t want to call it behind the plan,” he said, because I don’t think the plan is quite refined yet.”

On the private-pay seniors housing front, there’s an emphasis on the quality/cost dynamic, said Segarnick. “The objective for these models,” he said, “is not just to drive down cost but also, at a minimum, to maintain and hopefully improve quality at the same time.” Where seniors housing and other constituents agree is achieving higher quality and cost containment. But for seniors housing, it’s about hospitality as well as care. “And that not only will but should cause us to take a more measured, deliberate approach.”

Stanley pointed out that assisted living’s goal is resident happiness, which can be hampered by regulatory concerns. Assisted living operators are outliers that do not share in the revenue stream of an ACO and therefore are not certain of what is expected of them. “There’s so much uncertainty about what’s going to be expected from assisted living. We’re a square peg in a round hole.” In response, Mendelson stated that assisted living can add value to a health plan and suggested plans offer discounts to assisted living residents. “If you could show a resident was less likely to go to the hospital, why wouldn’t [health plans] want to give a discount and retain some of the upside for themselves?”

Hesitations to Change?

Kramer asked the panelists to discuss the hesitations seniors housing, skilled nursing, and post-acute might be feeling in proactively responding to the coming changes. For skilled nursing, said Korey, taking that “next leap of investment” is a mental barrier from a regulatory perspective and because buildings are much older. Some operators also are confused by aspects of the changes, such as CMS’ Five-Star Quality Rating System, or by ongoing issues with attracting a sophisticated labor force that can handle faster turnover.

Thompson agreed. “The real barrier is resources” for labor, IT requirements, and payment risks.

For seniors housing, there’s a growing tension between seniors housing’s focus quality of life and resident experience and health systems’ focus on quality of care and measurable outcomes. “You can’t separate this quality of outcomes discussion without talking about money,” said Stanley, explaining that doctors increasingly will be pressured to avoid readmitting patients rather than focusing on stabilizing them.

But there are common denominators between seniors housing and health systems, explained Segarnick, including balance, fall reduction, infection control, readmissions to the hospital, and depression within the memory care sector. “Having an alignment of interest between Brandywine as a seniors housing provider and the acute health systems we partner with is essential for reducing functional impairment so residents can enjoy their quality of life and stay out of the hospital.”

Forum Rewind

For full coverage of the 2016 NIC Spring Investment Forum, see the Forum Rewind.

[/expand] [cresta-social-share]

Managed Medicare on the Rise

NIC Releases First Report with New Skilled Nursing Property Data

Medicare Advantage (MA) plans are having a significant effect on skilled nursing properties, as indicated by the first NIC Skilled Nursing Data Report, which was released on March 10, 2016, during the 2016 NIC Spring Investment Forum.

A primary goal of the new report is to increase transparency, including the role MA plans are playing in the sector. “As baby boomers age, there will be a continual increase in Medicare Advantage and a growth in the number of plans offered,” explained Bill Kauffman, NIC’s senior principal of Research & Analytics.

The boom in MA plans is affecting managed Medicare rates. Data collected from October 2011 through December 2015 shows a 10.1% decline in rates, because increasing enrollment has given managed care companies the ability to better negotiate pricing with providers. The cumulative annual growth rate from October 2011 through December 2015 was -2.5%, with the pace of this decline increasing in 2015 as the number of MA plans and enrollees climbed.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

The report also shows that managed Medicare increased slowly within the patient day mix as a result of increased enrollment in MA plans. And this growth is expected to continue. During the period of time data was collected, Medicare rates oscillated, suggesting volatility in case mix as the rate hovered around $500 per day. Medicaid rates per patient day increased by 5.5% over the period, registering a 1.26% cumulative annual growth rate.

Finally, the data NIC collected indicated a decline in occupancy. From October 2011 through December 2015, occupancy dropped by 180 basis points, a decrease that can be attributed to increased turnover from a decline in average length of stay, especially for short-stay residents.

About the NIC Skilled Nursing Data Report

The NIC Skilled Nursing Data Report is published quarterly and provides a monthly, time-series collection of select metrics for the skilled nursing sector: occupancy, quality mix, skilled mix, patient day mix, and revenue per patient day by payor source. NIC’s report is the first to break out managed Medicare census and rates in such a timely fashion.

While similar reports contain data that is 12- to 18-months-old, the NIC Skilled Nursing Data Report has data that is 60- to 90-days-old, providing operators and investors with timely, relevant information they need for competitive benchmarking and strategic planning. “It’s going to bring a lot of transparency to the capital markets…and to operators themselves,” said Kauffman.

The NIC Skilled Nursing Data Report is available through the link below. There is no charge for this report.

http://info.nic.org/skilled_data_report_pr

Currently the report provides aggregate data at the national level from a sample survey of skilled nursing operators with multiple properties in the United States. NIC will grow its base of participating operators in order to provide data at localized levels in the future. Operators who are interested in participating can complete a participation form using the link below. NIC maintains strict confidentiality of all data it collects and reports.

http://www.nic.org/analytics/nic‐initiatives/skilled‐nursing‐data‐initiative

[/expand] [cresta-social-share]

A High-Tech, High-Touch Approach to Integrated Care

Juniper Communities’ Connect4Life Program Individualizes Care for Residents

Capturing opportunities was a central theme of the 2016 NIC Spring Investment Forum. One of the Forum’s concurrent sessions focused on how assisted living can benefit from the new integrated health care delivery and payment model by providing on-site care services in the home-like environment most residents prefer.

It’s a concept that Juniper Communities has been practicing for some time. Juniper Communities is a New Jersey-based assisted living provider with more than 20 communities in Colorado, Florida, New Jersey, and Pennsylvania. Through its Connect4Life program, the company is pioneering the integration and coordination of individualized care and service.

Lynne S. Katzmann, Juniper’s president and CEO, spoke with NIC about Connect4Life and the benefits it’s offering the company, payers, and residents.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: Juniper Communities uses a “triple aim” approach to integrate care for senior living. Can you tell us how that works?

Katzmann: The triple aim of better care, better quality, and lower cost is a constant mantra. We started addressing this triple aim many years ago, when we began to measure quality with both clinical and customer quality metrics.

Soon after the Affordable Care Act (ACA) was passed, we implemented an electronic operating system, which facilitated a comprehensive care transition program. In 2013 and 2014, we added comprehensive rehabilitation, integrated pharmacy, and onsite primary care services. While many communities have pharmacy and rehab and some have a rounding doctor or nurse practitioner, Juniper’s providers utilize the same electronic health record (EHR) and a comprehensive communication protocol. Integration of these ancillary providers is what really permits coordinated post-acute care and “one-stop shopping” or “at home” services for our residents.

This program, which we call Connect4Life, is individualized for each resident and is both high tech and high touch. The high-tech component is the electronic operating system, which gives all providers real-time access to information and efficient communication and allows the measurement and reporting of outcomes. The high-touch component is the medical concierge, who provides the resident, family, other staff members, and ancillary providers with both coordination of services and communication. The concierge humanizes the additional onsite medical and health-related services so that the resident maintains his or her quality of life and continues to feel at home.

NIC: How does the Connect4Life program integrate the traditional assisted living care model with the healthcare delivery model?

Katzmann: We see us moving from a social model “pure play” to a medical model with a strong social conscience. Our communities are home, and as such should not look like medical institutions even when we provide a higher level of care. We offer the services people with complex chronic conditions and multiple functional limitations need. We keep it homelike in several ways, most notably by providing an option for either in-room medication or in our wellness center; our primary care clinic looks like a small doctor’s office and is a destination, and our rehab center is always associated with a fitness center.

NIC: What do you see as the greatest opportunities for this approach? What challenges have you encountered?

Katzmann: I see this approach as the future. It is both a defensive and an offensive strategy for us. Connect4Life meets the objectives of the triple aim, and as such not only differentiates Juniper from its competitors but also provides an entrance into several new potential markets. It also clearly demonstrates that assisted living can be an integral part of the post-acute continuum.

In terms of challenges, the primary challenge is interoperability of data and the willingness of providers, particularly those outside of our communities, to share information that impacts the wellbeing of our residents.

NIC: What are the financial effects you’ve seen as a result of the Connect 4 Life program?

Katzmann: We see Connect4Life as a differentiator that will protect or even enhance our market share. As a good example, we have shared outcomes from the program, as well as our communication protocols, with local skilled communities and have over the last year seen a significant uptick in inquiries and move-ins (MIs) from SNFs. In several cases, these MIs increased census more than 10%.

In addition, Juniper’s length of stay is higher than national averages. In fact, in our memory care communities, we are more than 20% above the national benchmark. Length of stay also contributes to census, and a full building generally means a better bottom line. While we are a private-pay operator (the medical services are funded by Medicare directly to the ancillary providers), Connect4Life gives us a means to consider accountable care organization (ACO) and Medicare Advantage contracting should we choose to do so.

NIC: What would you tell an assisted living provider to think about as it relates to integrated care?

Katzmann: The first step in playing in the new health economy means embracing technology and full implementation of an electronic medical record. And, if you chose to add only one new service, I strongly suggest that service be primary care. The primary care provider is really the integrator between your community and other health care providers.

[/expand] [cresta-social-share]

Beyond the Number

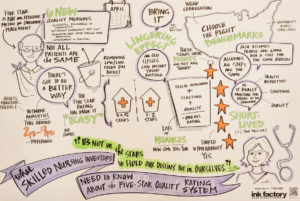

Decoding What CMS’ Five-Star Quality Rating System Means to Investors

Skilled nursing operators increasingly are being pushed to demonstrate the quality of care they’re providing. This focus on quality hasn’t escaped the notice of investors, who are turning to available measurements such as the CMS Five-Star Quality Rating System as a means of evaluating the properties in their portfolios and those in which they’re looking to invest.

But to use the Five-Star system effectively, they need a “decoder ring” that provides insight into what influenced the rating. That’s the opinion of Steven Littlehale, executive vice president and chief clinical officer of PointRight, a company that provides predictive analytics solutions to post-acute providers, hospitals, and health insurers.

Littlehale shared his perspectives on investors’ use of the Five-Star system during a much-discussed session at the 2016 NIC Spring Investment Forum earlier this month. Before the Forum, he joined NIC to offer insight into what investors should consider when using Five-Star as a means to evaluate skilled nursing properties.

[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

NIC: When you talk about investors needing a decoder ring when using the CMS Five-Star Quality Rating System, what do you mean? What do investors need to understand a property’s rating?

Littlehale: When I mention a special decoder ring, I’m talking about an algorithm of sorts—one that combines math with the ability to manage data and numbers.

It’s essentially the same concept of case mix management. If I don’t account for case mix, a skilled nursing building that specializes in incredibly sick people is going to look a lot worse than one that doesn’t. When I look at the Five-Star rating, I want to control for as many items as I possibly can to transform that metric from a blunt instrument into a fine, sharp, precise indicator.

When a REIT works with PointRight to evaluate and monitor what’s going on in their portfolio, there are many things that they will seek to get closer to the truth; and raw Five-Star scores are not it. However, by starting with the Five-Star rating and taking it a few steps further to control for things like case mix and geographic variation, while also adding additional adjustment to the quality measures that are used as part of this calculation, you can do a much better job of predicting outcomes.

I’ll give you another example. There’s very little correlation between the Five-Star system and re-hospitalization. Yet, many networks are using Five-Star as a gating agent to either allow a skilled nursing facility into their preferred network or exclude it. CMS is doing the same thing, whether they realize it or not, by requiring a facility achieve three stars or greater to access a very valuable waiver program that makes them a desirable referral site for a Model 2 bundle. The presumption is that if you’re a three-star facility or higher, you’re managing patients better, and you’re doing a better job at preventing re-hospitalizations. But if you take the Five-Star system and add additional insight to it—for example, by looking at some process measures that a facility employs, or at their staffing, or their case mix—you can actually create a better way of predicting the facility’s re-hospitalization rates. This approach enables investors to absolutely predict a facility’s viability for maintaining census, income, and other business critical factors in the future.

NIC: What differentiates a property with a high rating versus one with a low rating?

Littlehale: There is a definite, discernible difference between a one-star building and a five-star building. There’s no question about it—and any operator would tell you that, as well. In fact, I would say that there’s even a difference between a two-star and a four-star facility. But even at that range, it starts to get a little fuzzy, and it’s very difficult to see any discernible difference within a two-point spread. And that has to do with the integrity of the measure itself, the integrity of the survey process, and geographic inconsistencies.

From an investor perspective, I think the key thing is identifying buildings that are a three and above—and starting to ask important questions if they don’t have that rating. While it’s true that there’s not a big difference between a two- and a three-star property, the Five-Star system is a gating agent for many important activities.

As I said, Five-Star is used to gain entry into a preferred network, or to be part of a Model 2 bundle. A consistently performing one- or two-star property won’t be permitted to participate in that Model 2 bundle, which could impact their ability to get the referrals they want. Indirectly, the rating can challenge income and census, and hamper the facility’s ability to achieve landmark or superstar status that exists in the referral area.

There’s also a correlation between the Five-Star system and paid professional liability and general liability (PL/GL) claims. If the rating affects a paid claim, that’s a significant threat to the bottom line, a result that investors should be concerned about.

NIC: Can you tell us more about the geographic variation in the rating system? What can an investor take from knowing there are differences from state to state?

Littlehale: That you cannot compare North Carolina to Massachusetts. You need to do a same-book comparison when you’re looking at these kinds of outcomes.

Here’s an example. The total composite survey score is the number of points you earn through the survey process and it’s how your Five-Star rating for survey is calculated. If I were in North Carolina and earned a total composite survey score of 40, I’d be a one-star facility. In Michigan, if I earned 40 points, I would be a four-star facility. That goes to show that you can’t really look at a piece of the metrics and not take additional considerations into play when you’re comparing facilities from one state to another.

But I can take it even further. For example, when I look at Florida, I know it’s made up of several different survey districts. That means that there are five-plus survey teams that exist in Florida and each differs from one another in practice. If I don’t control for that statistically, I can be misled into thinking that one provider is superior or inferior to another. In reality, it’s based on how the surveyor is operating. When 70% of the Five-Star score is all about survey, the special decoder ring I talked about becomes a critical factor. The investor needs to be able to find truth within these metrics.

NIC: What insights could an investor look at to predict re-hospitalization rates or investment potential?

Littlehale: It depends on the case mix of the facility. For example, if a facility has a disproportionate number of people with diabetes coming in for post-acute care—if diabetes is their specialty, either knowingly or unknowingly—then we’ll need to put in other measures when looking at the Five-Star scores. We’ll want to put in measures for structure, process, and outcomes specifically related to diabetes.

We’d want to see a greater presence of dieticians on staff, and we’d want to see a greater presence of therapeutic diets. We don’t want to see specific f-tags, or deficiencies being cited for this facility that are associated with inadequate nutrition or inadequate assessment of patients’ nutritional needs. We don’t want to see diabetic skin ulcers as an outcome measure for this particular population.

So it gets very precise. And it will vary from how we look at a facility that has a disproportionate amount of Alzheimer’s or cognitive impairment or orthopedic rehabilitation or congestive heart failure. Any large proportion of specific types of patient can throw off the Five-Star rating and lead operators and investors down the wrong path. You can control for that by putting some other things into your modeling to see how they’re different and why they’re unique; now you have a very precise understanding about the facility, what they purport to do, how well they’re doing it, and how well they’re doing it in their marketplace compared to other facilities with similar kinds of populations.

At the end of the day, when left unplugged, Five-Star is not a sophisticated tool for investors, but it’s something. It’s easy to get your hands on, but with a little extra insight—by knowing what to look for—it actually can be quite a precise tool.

[/expand] [cresta-social-share]

Seniors Housing & Care Industry Calendar

April 2016:

19-21 ULI Spring Meeting, Philadelphia, PA

May 2016:

9-12 Argentum Senior Living Executive Conference, Denver, CO

18-19 Aging2.0 Global Innovation Summit, San Francisco, CA

June 2016:

7-9 REITWeek®: NAREIT’s Investor Forum, New York, NY

16-17 ASHA Mid-Year Meeting, Denver, CO

NIC Partners

We gratefully acknowledge our following partners: