HarmonyCares: Working Together

A conversation with the nation’s largest house call primary care practice.

Remember when doctors made house calls? It’s not a thing of the past at HarmonyCares. The company delivers primary care services to frail and older adults wherever they live, including those residing at senior living communities.

Remember when doctors made house calls? It’s not a thing of the past at HarmonyCares. The company delivers primary care services to frail and older adults wherever they live, including those residing at senior living communities.

NIC Senior Principal Ryan Brooks recently talked with two executives at HarmonyCares: Jim Lydiard, Chief Strategy Officer; and Jennifer Slabinski, Marketing Director. They discussed how in-house primary care can improve resident health, appropriately extend length of stay, and make life better for families and their elderly loved ones. Here is a recap of their conversation.

Brooks: Can you tell us about HarmonyCares?

Lydiard: HarmonyCares is a 30-year-old organization headquartered in Troy, Michigan. We provide in-home health services for older adults and people living with complex health issues. HarmonyCares has several divisions, and our Medical Group division is the nation’s largest house call practice. We also have HarmonyCares Home Health (previously known as Pinnacle Senior Care) providing skilled home health care, and HarmonyCares Hospice (previously known as Grace or Comfort Hospice depending on the region). In addition to primary care, our medical group offers diagnostics, lab and mobile radiology services, as well as patient assessments. For select health plans, we also conduct wellness visits.

HarmonyCares is growing. We will open in our 13th and 14th states in July in New York and New Jersey. Our affiliated medical practices actively serve about 35,000 patients as their primary care providers of record on an on-going basis. Across all of our care teams, we will touch about 100,000 unique individuals per year.

Brooks: Some of our readers may know your organization as U.S. Medical Management (USMM) or Visiting Physicians Association (VPA), which was rebranded as HarmonyCares in the fall of 2022. Can you tell us about the rebrand?

Slabinski: The Company has grown through acquisition and de novo start-ups. We found that our patients didn’t always realize that we are affiliated companies. So, we made an active decision when new leadership took over to unify all of our active products and groups under one name. The new name simplifies the patient experience, and it also provides clarification for health plans and community-based referral partners. We didn’t want to present a disjointed brand because our care is anything but disjointed. The new name HarmonyCares is simple, clean, and speaks to the heart of what we do in the communities we serve.

The name has been embraced by patients and care partners alike. We have always had the capacity to deliver this comprehensive and coordinated care model. However, people didn’t see that the services were interrelated. Our name reflects that all our services are working together in harmony, which better represents us in a way we had not been able to do in the past.

Brooks: You’ve talked previously about the goal you share with senior housing operators to allow residents to age in place. How do you identify senior housing operators to partner with? How does that process work?

Lydiard: We serve patients wherever they call home. We don’t have clinics or a brick-and-mortar presence. It’s no surprise that a third of our patient population lives in senior housing settings. About 10,000 of our patients live in assisted and independent living, memory care, and continuing care communities, as well as some small board and care homes. The senior living residents requiring our care, because of their medical conditions, aren’t all that clinically different from our other home-bound patients. What’s different is the support model and resourcing. When delivering our in-home model to senior living communities, we think about how that community can help our patients live happier, healthier lives. Owners and operators want to move residents in sooner, take better care of them, and appropriately extend their length-of-stay. These goals are a great complement to what we do. Proactive primary care can allow the healthcare issues of residents to be addressed sooner and help slow disease progression. Senior living communities have great eyes and ears on our patients, which can help us respond quickly to changes in condition and acute episodes to avoid the high cost and avoidable experience of going to the hospital for something safely treatable at the patient’s home in the community. That’s just one example of what aligns us with senior living.

We look for assisted living communities that recognize they are a healthcare setting even if they don’t provide healthcare directly. Secondly, we want to know if they have an understanding of the healthcare needs of their residents. Do they appropriately track data? Do they know where they want to take the resident experience and how healthcare fits in? The last thing we look for is whether they are willing to invest in value-based healthcare models. Some communities may make great healthcare available for their residents, but their healthcare partners are operating under fee-for-service financial models which incentivize more visits and can result in higher cost of care. Value-based care is about offering the right visits, at the right time, and avoiding the need for high-cost care settings.

Brooks: Is there an awareness challenge that must be overcome? Do operators understand the value-based care model?

Slabinski: The awareness challenge begins with the consumer, in this case often caregivers. Not enough people realize when they move their loved one into a senior living setting that healthcare should rank among the top considerations. It’s not uncommon to pick a place based on the location or how it looks. But they should also ask about access to quality and convenient healthcare services. Otherwise, they will be taking their loved one to a lot of healthcare appointments and miss out on many of the benefits of community life.

Brooks: What does a good partnership with an operator look like?

Lydiard: A good partnership, heavily focused on consumer satisfaction, should yield an upside to the operator’s business, as well as resident experience. Operators need an understanding of value-based care. Value-based care is not an all or nothing proposition. Operators do not have to become a health plan to partake in value-based care. It’s rather about finding groups willing to partner in an arrangement where the healthcare partner is reimbursed for good outcomes rather than the number of visits.

Brooks: What does it take for a good partnership to take root between primary care providers and long-term and senior care operators?

Lydiard: A really clear division of responsibilities and good communication is key. What is the community’s role in the partnership? What is HarmonyCares’ role? Where do those roles overlap? We need clean and crisp goals that we develop together and partners who are equally dedicated to continuous quality improvement. We should also be open and willing to talk about what’s working and what’s not working. Maybe the wellness staff is overwhelmed trying to coordinate care with 30 different doctors. Or maybe the average length of stay is 30 months, and by providing quality services in the community, we could see patients live there more independently and for longer periods of time.

Brooks: How does HarmonyCares participate in value-based care?

Slabinski: We launched an accountable care organization (ACO) in the Medicare Shared Savings Program about eight years ago. And this year some of our medical groups started participating in the REACH ACO model. We also have several other value-based Medicare Advantage partnerships and a shared savings arrangement with a managed Medicaid plan. Our clinical and financial goals are only achieved through effective, evidence-based primary care with appropriate follow through that helps to avoid costly services and reactive trips to the ER/Hospital.

Brooks: Can you tell our readers a bit about the differences between the Medicare Advantage and the Accountable Care Organization products?

Slabinski: An ACO is a group of healthcare providers who come together to provide coordinated care to their Medicare patients. ACOs are not Medicare Advantage plans. ACO providers are generally reimbursed through the traditional fee-for-service Medicare model with potential opportunities to receive shared savings. Medicare Advantage plans are federally-funded private health plans offered by organizations that have contracted with the Center for Medicare & Medicaid Services (CMS) to provide benefits for Medicare beneficiaries that select that plan. Medicare Advantage plans often utilize a network of providers, and offer members lower cost sharing obligations along with more enhanced benefits than traditional Medicare.

Brooks: Let’s go a bit deeper into primary care ACOs if we can. What does success look like in the Medicare Shared Savings Program (MSSP), and how has HarmonyCares performed within the MSSP?

Lydiard: The MSSP program has upside and downside risk tracks. Medicare provides a baseline spend for beneficiaries. This benchmark is what Medicare calculates the provider should spend to treat these patients for all of their healthcare needs. For example, should overall claims for our 14,000 MSSP patients be lower than the benchmark and the quality scores meet certain performance standards, then we get a share of the savings. Our clinical teams perform quite well in this model. In the last reportable year, HarmonyCares was ranked the Number 2 MSSP ACO in per beneficiary savings per month by CMS.

Brooks: CMS added a new ACO model – ACO REACH (Realizing Equity, Access, and Community Health) – at the beginning of 2023 for individuals with complex medical conditions. Does your success in the MSSP program give you the confidence to add a high-needs REACH ACO to your offerings?

Lydiard: Yes, we determined that the changes made with the ACO REACH model would only help us provide better care for our participating patients. There are only 14 high-risk track REACH ACOs. The track our affiliated medical groups are participating in has a stricter eligibility criteria for beneficiaries compared to standard REACH ACOs, which are open for a general Medicare population.

Brooks: What are some of the benefits of the ACO REACH model for HarmonyCares?

Lydiard: We were attracted to the REACH ACO model because it helps our patients. We can choose benefits to enhance their experience. For example, our patients, upon meeting requirements for medical necessity, can go to a skilled nursing facility for rehab directly from home or an assisted living facility and bypass the three-day hospital stay typically required by Medicare. Also, through the REACH ACO’s Part B cost-sharing support, we have been able to eliminate or reduce certain cost-sharing obligations that our ACO REACH patients would typically incur for our primary care services in their homes. Since we are responsible for the ultimate outcome for our REACH ACO patients, we want them to welcome our services and not shy away from them simply because of the traditional 20% coinsurance.

Our REACH ACO has a preferred provider network that includes home health, skilled nursing facilities and specialists. Our patients still can choose providers outside of the network, but the REACH ACO network offers enhanced coordination of care and benefits. Another plus is concurrent coding. This means diagnosis codes, and subsequent revenue, is recognized at the time of diagnosis. In contrast, MSSP ACO benchmarking is done annually.

Brooks: What do the unit economics look like? What can be expected in terms of revenue in and expenses out?

Lydiard: Here are some illustrative mile markers. High-needs REACH ACO beneficiaries will generally have a much higher risk score than the average Medicare beneficiary. Generally speaking, this means they are very frail, typically with comorbid (or multiple) conditions. Based on the acuity level Medicare will grant a set amount per beneficiary per month to ensure the appropriate amount of funding is available to manage our patient population. We expect the blended healthcare expenses for the patient population to trend around 85% of the revenue allotted. The additional dollars cover administrative expenses and overhead costs. Any remaining dollars beyond that are sent directly to the REACH ACO. Likewise, the REACH ACO is on the hook for the downside as well. That’s accountable care. Numbers aside, the patients and families we support are as much a part of our success as any financial revenue. In this model, through the improved benefits, timely care, and network coordination, these high-needs beneficiaries are exposed to fewer hospitalizations and guided through our complex healthcare environment. That’s the real win.

As previously stated, senior living operators should be aware that ACOs are not printing cash. They are at risk. We work with operators that have a track record with residents to avoid unnecessary hospitalizations. We are increasingly exploring ways that eligible senior living providers can share in the savings if they commit to certain protocols that help improve patient care and outcomes.

Brooks: Say you’re speaking with an assisted living operator who’s interested in developing their value-based program. What’s at stake for the operator from revenue, length of stay, occupancy, and staffing perspective?

Lydiard: We have not asked communities to take on downside risk, at least not yet. There’s no charge to the community, but we may need them to commit some resources and change their behavior a bit based on our value-based goals and care redesign. Operators don’t reimburse us. Operators receive indirect value by improving quality, which will lead to higher patient satisfaction, better health outcomes, reputational capital and longer tenant arrangements.

Slabinski: If we do our job as a value-based primary care provider, the staff’s burden is reduced, which helps to address staffing challenges. The community may not need an additional caregiver, as a sample output of this support. We don’t leave a stack of orders for the community team to administer. We have care navigators and coordinators who arrange transportation and authorizations. In other words, our care teams reduce administrative burdens.

Brooks: We know that there is a greater interaction between primary care and long-term care and senior housing settings. What does the future of primary care in senior housing look like?

Lydiard: Our perspective is that assisted living communities supported by clinic-led PCP’s should be a way of the past. Senior living residents need a mobile practice to deliver the right visit, at the right time, and in the right place. Mobile primary care teams are uniquely matched to meet the residents’ unique needs.

Looking at macro trends, we are the nation’s largest house call practice, and our market share is only 5%. The next largest practice is 2.5% of the market share. House call medicine is a fragmented business and that will change. Consolidation is on the way. Also, in my humble opinion, we are not far off from senior housing operators developing their own primary care groups. We will see major owners and operators make a splash and others will follow.

Brooks: Is there anything else you’d like to add?

Lydiard: We are here to raise the bar on primary care. Senior living communities work to support aged seniors in the last years of their lives. When we partner with senior housing operators, we are learning from them too. We help develop networks with providers already working in the community. We are looking to bring clarity, consciousness, adaptability, and a commonsense approach to the type of care that can and ought to be delivered. We cannot do this alone.

Two Hands: Pressures Mount in Commercial Real Estate (on One Hand) as Senior Housing Market Fundamentals Improve (on the Other Hand)

By Beth Mace, Chief Economist, NIC

Commercial real estate is a cyclical business. There are elongated periods of great price appreciation and growth and other less favorable periods of contraction and correction. Unfortunately, we are now in the latter part of the cycle, in a period of price adjustments due to several factors including the very rapid and large jump in interest rates in the past year—the largest and fastest increase in short-term interest rate since the early 1980s.

Commercial real estate is a cyclical business. There are elongated periods of great price appreciation and growth and other less favorable periods of contraction and correction. Unfortunately, we are now in the latter part of the cycle, in a period of price adjustments due to several factors including the very rapid and large jump in interest rates in the past year—the largest and fastest increase in short-term interest rate since the early 1980s.

Valuation Adjustments. Office valuations are garnering particular attention and have seen the largest changes to date, suffering from rising interest rates, relatively high and increasing vacancy rates, employee preferences to work from home, and new inventory still coming online. Reflecting this, appreciation returns have fallen 12.7% from year-earlier levels in the first quarter according to NCREIF’s Flash Report, more than twice the decline as the overall property index (NPI, -5.4%).

Announcements of high-profile office property defaults are becoming more common, with the most recent being Brookfield which walked away from $161 million of loans associated with a group of suburban office buildings near Washington, D.C. Earlier in the year, Brookfield had defaulted on $784 million of loans associated with two trophy office towers in downtown Los Angeles. Another large default which made a significant headline occurred in February by Columbia Property Trust, a large office landlord controlled by Pacific Investment Management Co (PIMCO) who defaulted on $1.7 billion of floating rate mortgage notes tied to seven buildings across the country valued at $2.27 billion in 2021 as its management teams struggled with higher costs of debt and refinancing costs. The firm is now working with its lenders to restructure its portfolio.

Other property types are also seeing stress and negative appreciation returns, even the darling of property types, industrial properties, which have seen a near 1% drop in its NCREIF appreciation return in the past year. For senior housing, NCREIF is reporting year-over-year appreciation declines of 2.4% in the first quarter, significantly less than the outsized declines seen in office but higher than the smaller negative capital appreciation returns seen in industrial properties. Commercial real estate property price and valuation declines are also being reported by Green Street, MSCI/RCA, and most brokers and valuation analysts.

Stress, defaults, and loan restructurings are also occurring in property types other than office, including senior housing, although because of the size and scope of the office defaults, they are grabbing the headlines. For example, in late March, the joint venture company of TPG Real Estate and Sabra Health Care REIT, which involves more than 150 senior living communities operated by Enlivant, was in the process of negotiating with lenders to restructure its financing, following certain failures to meet financial covenants and a notice of default.

The million-dollar question (literally) is how much further will values fall, when will they stabilize, and how many more property defaults and workouts will be announced across all property types.

What’s Selling Today? Very Little. The transactions market today is highly illiquid, with few transactions occurring and price transparency opaque at best. Bid-ask spreads remain wide. It’s a waiting game as sellers remain on the sidelines to see where pricing stands and as buyers also wait on the sidelines because they do not want to take a negative valuation adjustment once they purchase an asset. Once deal activity picks up, it is likely that transaction volumes will grow quickly as pent-up demand to sell properties becomes unleashed.

However, for this to become reality, debt needs to become available at pricing that allows deals to generate acceptable returns. Or said another way, valuations need to adjust to a point that leverage is once again accretive. Today, leverage is negatively accretive, and until leverage becomes positively accretive, debt financing may not make sense. As a result, many deals will remain cash only, with hopes and expectations that debt can be added later and again be accretive to overall returns. However, there are only a few buyers out there that can afford cash-only deals. Increasingly, cash is king and is often being hoarded to feed favored properties or purchase prized and treasured properties that offer cash flow and promises of future price appreciation.

Indeed, higher interest rates have made it significantly more costly and difficult to borrow money to purchase new properties. Most loans today require recourse, face lower loan-to-value ratios, stricter loan covenants, and higher all-in rates. All-in fixed interest rates have doubled from where they stood during the pandemic to 5% – 6% or higher. In addition, with the failures of Silicon Valley Bank and Signature Bank, banks—and especially regional banks—are likely to exert greater caution with their lending as they experience more regulatory scrutiny. And the spotlight on regional banks has not gone away with the recent announcement that JPMorgan Chase struck a deal to buy the bulk of First Republic Bank’s operations, assuming $92 billion in deposits (uninsured and insured) and buying most of its assets including $173 billion in loans and $30 billion in securities. Even before recent weeks, there were both credit and capacity issues in lending. This is particularly concerning for senior housing borrowers since an estimated one-third of real estate lending stems from regional banks.

Further, underwriting positive occupancy patterns, as well as sufficient growth rates for rents and expenses, that will generate acceptable NOI levels and margins is difficult for many types of commercial real estate. For cap rates not to go up significantly and values to depreciate further, NOI growth is needed.

Margin Expansion Ahead? The good news for senior housing is this may be achievable. Market fundamentals are improving, unlike those for office and some other property types. And the better news for senior housing is that margin expansion is starting to occur, with staffing pressures starting to lessen, expense growth decelerating, and occupancy and asking rate growth strengthening.

- Average hourly earnings for assisted living have decelerated from a year-over-year growth pace of 11% in May 2022 to 6.0% in February 2023. While still very high, moderation is visible.

- The number of workers in assisted living has more than fully recovered to beyond the level that existed prior to the pandemic in February 2020 and stood at a record high of 476,000 as of February 2023, according to the Bureau of Labor Statistics.

- The overall occupancy rate for senior housing continues to improve, rising to 83.2% in the first quarter of 2023 from 82.9% late last year and 77.8% at the depths of the pandemic, according to NIC MAP data, released by NIC MAP Vision. While it still has further room to improve, occupancy too is on a positive trajectory of improvement, particularly considering supply pipelines that are being limited by the availability and cost of construction financing.

- Strengthening demand has also allowed operators to upwardly adjust asking rents to better offset rising costs associated with inflationary pressures on food, energy, and other expenses.

All these factors are contributing to NOI and margin improvement.

While we are not out of the woods in the immediate term, there is the proverbial light at the end of the tunnel for senior housing from both a market fundamentals perspective and an operations perspective. However, the coming months may be choppy, especially for those businesses that have floating rate debt maturing and need to refinance as the cost of servicing debt has gotten much greater. Rates are significantly higher than when those loans were initially issued, and many lenders are requiring a paydown on the original loan balance due to tighter standards and regulatory reviews, as well as downward valuation adjustments.

Further, the threat of operational reputation risk is growing. Negative performance at a few properties by a limited number of operators can hurt the entire reputation of the industry and create ancillary risks for all operators and their financial partners. This may especially be the case for the one-third of senior housing properties in the Primary Markets that had occupancy rates below 80% in the first quarter. The ability of the operators of these properties to service debt (in a more stringent debt environment), maintain margins (in an inflationary environment), grow census (in a competitive environment), and provide quality resident experiences (of utmost importance) is difficult. The combination of these factors will add further stress to operators despite two years of broad pandemic recovery.

Outside the Box. Now, more than ever, is a time to be thinking outside the box on creative ways to manage through near-term challenges to stronger days ahead. As mentioned at the beginning of this commentary, commercial real estate is a cyclical business, and while senior housing is much more than commercial real estate, it has enough features of that business model that it is not immune to real estate cycles. And just as we are in the downward part of the cycle today, the groundwork for a powerful recovery is starting to fall into place.

As always, I appreciate and welcome your comments, thoughts, and feedback.

10 Medicare Trends Operators Should Be Aware Of

How to jumpstart healthcare partnerships.

Recent trends in Medicare and Medicare Advantage have opened new opportunities for senior living operators to partner with healthcare providers. But where to start?

Recent trends in Medicare and Medicare Advantage have opened new opportunities for senior living operators to partner with healthcare providers. But where to start?

Two experts with deep knowledge of the massive federal healthcare programs for seniors conducted a lively back and forth discussion at the 2023 NIC Spring Conference in San Diego. They mapped out how senior living operators can leverage their position as housing and care providers not only to benefit residents but also to potentially boost the bottom line.

Leading the discussion was Kelsey Mellard, founder and CEO at Sitka, a virtual multispecialty physicians’ network. She was joined by Dr. Sachin Jain, president and CEO at the SCAN Group and SCAN Health Plan, one of the nation’s largest nonprofit Medicare Advantage plans. As former colleagues, they previously worked together to help launch the Center for Medicare & Medicaid Innovation, which tests new healthcare payment and delivery models.

What follows are 10 key takeaways from their discussion.

- Medicare Advantage programs are growing quickly. More than 50% of seniors now receive health benefits through a Medicare Advantage plan. Why does that matter? Unlike traditional fee-for-service Medicare plans, Medicare Advantage is a value-based care model that seeks to keep people out of the hospital by providing preventative care. That raises the question: Who is best positioned to watch over seniors and understand their health challenges? “No one is closer to the patient than the entity that houses them,” said Jain. “It’s an incredible opportunity for senior housing providers.”

- Just Get Started. One of the biggest challenges facing independent and assisted living operators considering healthcare partnerships is getting started, according to Jain. Operators have discussions and dialogues with healthcare providers that often go nowhere. “You learn by doing,” said Jain. “My strong encouragement is to start partnering with a health plan.” Or, he added, senior living providers can build their own health plans, or partner with a local medical group to offer healthcare services on site. “Start to see how you can make one plus one equal three,” he said.

- More stakeholders want seniors to age in place. It’s important to recognize that all interested stakeholders share the same interest to keep the resident in place. Operators want to maintain occupancy. Risk-bearing medical groups and health plans want to keep patients out of the hospitals. “The single most expensive cost item for anyone managing population health is hospital bed days,” said Jain.

Win-win partnerships are possible and growing. The best healthcare partnerships are structured as a win-win arrangement. The healthcare provider and building operator both get something out of the relationship. The focus of the partnership should be to deliver a higher degree of service to enhance the offerings of the community. That has the effect of extending the resident’s length of stay, said Mellard. The SCAN Group operates an I-SNP, an Institutional Special Needs Plan. While Medicare originally intended these plans to serve nursing home residents, the SCAN model has opened services to those who live at home or in assisted living communities. “We’re expanding our I-SNP nationally,” said Jain.

Win-win partnerships are possible and growing. The best healthcare partnerships are structured as a win-win arrangement. The healthcare provider and building operator both get something out of the relationship. The focus of the partnership should be to deliver a higher degree of service to enhance the offerings of the community. That has the effect of extending the resident’s length of stay, said Mellard. The SCAN Group operates an I-SNP, an Institutional Special Needs Plan. While Medicare originally intended these plans to serve nursing home residents, the SCAN model has opened services to those who live at home or in assisted living communities. “We’re expanding our I-SNP nationally,” said Jain.- Innovative care delivery models help address the workforce challenge. The industry is facing a critical workforce shortage. Clinical and frontline workers alike are in short supply. But combining healthcare and housing in a value-based care model can produce workforce synergies and opportunities, according to Mellard. In a competitive labor environment, a good starting point is to be the employer of choice. “Build a culture that’s focused on empowering people, supporting them, and giving them a manageable workload,” said Jain. He added that it’s important to create a work culture that feels personal and allows people to feel valued in their work. This creates a sense of autonomy and purpose. Small or regional operations may be best suited to create a person-centered culture.

- New revenue. Potential sources of new revenue are emerging from partnerships with Medicare Advantage plans. These value-based care plans aim to deliver higher quality healthcare at a lower cost. Healthcare providers and potentially senior housing operators can share in the savings generated. But, Jain cautioned, “Start with the clinical model first.” Think about what experience you want to deliver to residents and what types of creative partnerships will help you reach that goal, he added.

- More care is being delivered where the resident lives. The next frontier is the delivery of healthcare services within the walls of the community, the speakers said. In-house care lowers the cost and provides a better resident experience compared to a clinic visit or a trip to the hospital. Jain suggested looking for creative partnerships. For example, if falls are a big issue in the community, seek partnerships with companies that help reduce fall risks. Partnership with a Medicare Advantage I-SNP is another possibility for delivery of on-site primary care. “What we all want is a fully integrated experience,” said Jain. He added that primary care services delivered to residents where they live would improve resident satisfaction and increase length of stay. “Senior housing has an opportunity to be part of the solution,” he said.

- New care options are emerging. The pandemic accelerated the growth of telehealth and other in-house services. Mellard’s company, Sitka, is a virtual specialty physicians’ network to collaborate with primary care providers on the front line. With a nationwide shortage of physicians, Mellard explained that mid-level practitioners will be delivering more care. “The challenge is that they don’t have all the resources that are needed to deliver high quality care to keep that resident in place,” she said. Her physicians’ network collaborates with primary care providers via text and video. Mellard added that consultation with a specialist avoids a referral to an outside practitioner 87% of the time. “We’re really proud of that.”

- Medicaid could be a factor. The industry needs more middle-market and low-income senior housing, noted Mellard. Can Medicaid play a role? Jain pointed to SCAN Connections, the group’s fully integrated dual eligible special needs plan, covering Medicare beneficiaries also eligible for Medicaid. “Benefits are fully integrated and delivered by one entity,” said Jain. “I think as an industry, we need to go more in that direction.”

- The share of beneficiaries in Medicare Advantage plans varies nationwide. Faced with an ever-changing healthcare environment, the speakers suggested that senior housing providers start at the local level. The best tip: Go to Medicare.gov. Enter the zip code of the community to find the Medicare Advantage plans that operate in the area. “Start talking to the plans,” said Jain. “The best odds of success are really working with a regional operator that truly understands the community.”

NIC MAP Vision 1Q23 Key Takeaways: Seventh Consecutive Quarter of Senior Housing Occupancy Gains

By Caroline Clapp, Senior Principal, NIC

NIC MAP Vision clients, with access to NIC MAP® data, attended a webinar in mid-April on key senior housing data trends during the first quarter of 2023. Findings were presented by NIC Analytics research team members. Key takeaways included the following:

Takeaway #1: Senior Housing Occupancy Rose 0.3 percentage points in 1Q 2023

- The occupancy rate for senior housing—where senior housing is defined as the combination of the majority independent living and assisted living property types—rose 0.3 percentage points to 83.2% from the fourth quarter of 2022 to the first quarter of 2023 for the 31 NIC MAP Primary Markets. This marked the seventh consecutive quarter of occupancy increases.

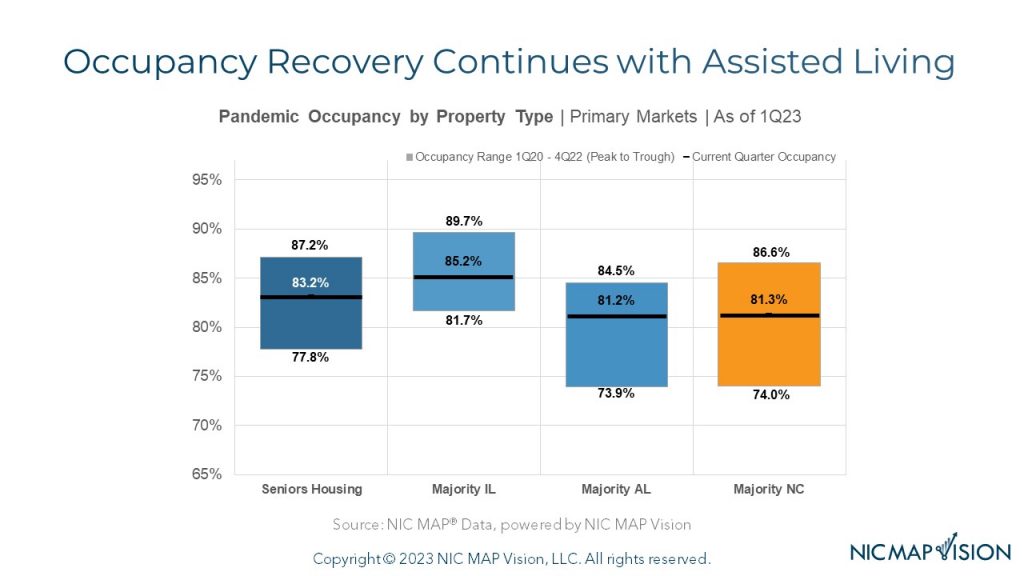

- At 83.2%, occupancy was 5.4 percentage points above its pandemic-related low of 77.8% recorded in the second quarter of 2021 and was 4.0 percentage points below its pre-pandemic level of 87.2% of the first quarter of 2020.

- Demand as measured by the change in occupied inventory or net absorption moderated in the first quarter, increasing by 3,927 units in the Primary Markets after having increased by more than 8,000 units in the prior three quarters, but it was still well above the historical quarterly average of 2,251 units. The robust positive demand that has occurred over the past eight quarters has helped occupancy to improve.

Takeaway #2: Occupancy Recovery Continues, Led by Assisted Living

- The chart below shows the pace of recovery to date for each property type and the gap remaining to reach pre-pandemic 1Q 2020 occupancy levels.

- Independent living occupancy was up 3.5 percentage points from its 2021 trough with 4.5 percentage points remaining to reach its pre-pandemic level.

- Assisted living occupancy was up 7.3 percentage points from its 2021 trough with 3.3 percentage points remaining to reach its pre-pandemic level.

- Nursing home occupancy was also up 7.3 percentage points from its 2021 trough with 5.3 percentage points remaining to reach its pre-pandemic level.

Takeaway #3: Annual Inventory Growth Rate Has Slowed Significantly for Assisted Living

- Annual inventory growth in the first quarter for independent living stood at 1.7%, near its pre-pandemic average of 1.6%.

- Assisted living inventory grew by a similar amount in the first quarter at 1.6%, but this growth was half the typical growth recorded for assisted living before the onset of the pandemic, which was 3.2% annually.

- This slower inventory growth stems from the slowdown in construction starts that we experienced during the height of the pandemic, a trend that occurred for both independent living and assisted living.

Takeaway #4: Occupancy Rate Improvements in 1Q 2023 Were Largest for Single Properties, Small Chains, and Large Chains

- The greatest occupancy rate improvements in the first quarter were for single properties (up 0.6%) and for small chains (up 0.6%) with 2 to 4 properties, followed by large chains (up 0.5%) with 10 to 24 properties.

- Single properties continued to have the highest occupancy rate at 86.1% with only 3.1 percentage points of occupancy left to recover to reach its pre-pandemic level.

- Meanwhile, medium chains of 5 to 9 properties and very large chains of 25 or more properties saw no change in their average occupancy rates from the fourth quarter of 2022 to the first quarter of 2023.

- Despite the unchanged occupancy rate, the smallest gap to achieve pre-pandemic occupancy was for the medium chains with 3.0 percentage points remaining to recover.

The very large chains still had the weakest occupancy rate at 79.5%, with another 5.2 percentage points still to be recovered.

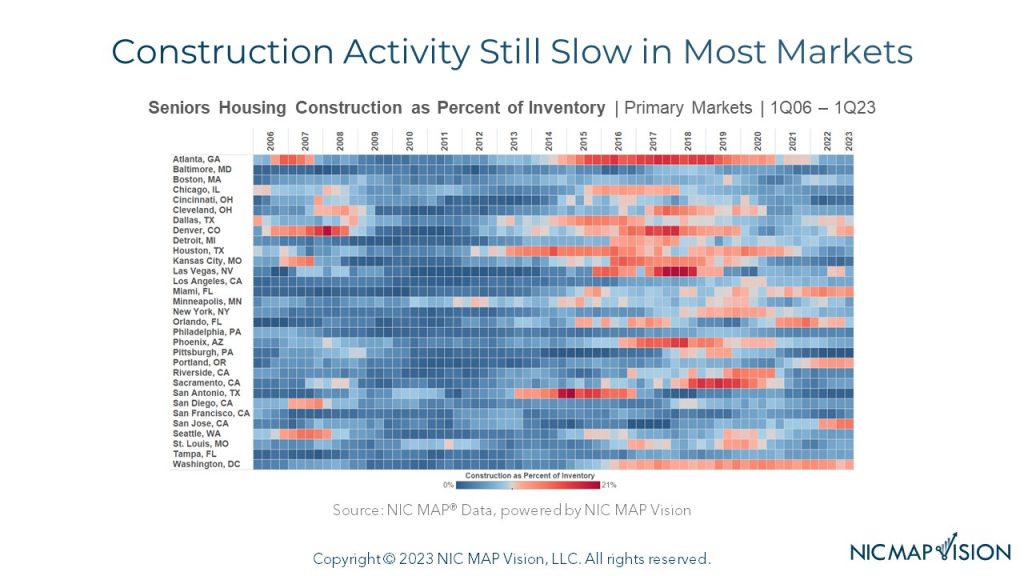

Takeaway #5: Construction Activity Still Slow in Most Markets

- The heat map below shows which markets were experiencing the most construction activity over time.

- For perspective, for senior housing overall, construction totaled 5.1% of inventory for the Primary Markets in the first quarter of 2023, down from a peak of 7.8% in 2019.

- The blue tones indicate that construction activity is relatively “cool” in most markets during recent quarters.

- The markets that are shaded brighter red had the most construction as a percent of inventory in the first quarter. This group was led by San Jose at 13%, followed by Miami at 11%, and Denver, Portland, and Washington, DC all at 10%.

- At the other end of the spectrum were markets where there was very little construction underway in the first quarter; this includes Pittsburgh at 0%, San Antonio at 1%, and Cincinnati, and Kansas City at 2%.

“DEI Work is Clearly an Area of Accelerating Interest for Institutional Investors” — A Conversation with Deborah Harmon

By Brandon Phillips, Vice President at Artemis Real Estate Partners

Investment managers and capital allocators are increasingly focusing on initiatives to improve Diversity, Equity, and Inclusion (DEI) within their organizations, and recognize that diversity can result in tangible improvements to investment returns. Senior housing operators alike should take notice and understand that fostering a diverse workforce, equitable practices, and inclusive culture can improve outcomes.

Investment managers and capital allocators are increasingly focusing on initiatives to improve Diversity, Equity, and Inclusion (DEI) within their organizations, and recognize that diversity can result in tangible improvements to investment returns. Senior housing operators alike should take notice and understand that fostering a diverse workforce, equitable practices, and inclusive culture can improve outcomes.

In this interview, Deborah Harmon, Co-Founder and Co-CEO of Artemis Real Estate Partners, shares her thoughts on building a real estate investment management firm with diversity as a guiding principle and striving for Artemis to be an innovator in DEI-related initiatives.

Phillips: Artemis senior leaders have focused since Day One on fostering diversity of thought and personnel as a precursor to outsized investment success. Can you tell me why?

Harmon: We founded Artemis to be a force multiplier for performance and purpose, with the belief that an intentional organization and culture could achieve both. We knew how challenging it was to break through as an underrepresented voice, as Artemis—to our knowledge—was one of the first majority women-owned real estate private equity firms when we started in 2009. Since raising our Fund I, we have repeatedly found that diversity of thought is accretive to the bottom line. We built Artemis to be diverse from Day One, from the ground up and the top down. Diverse teams are more challenging to build and manage. That said, in our experience, diverse teams have the potential to outperform when done right. They are more likely to recognize risks and opportunities for the business and less prone to groupthink.

Phillips: Fast forward. When did the Artemis capital-raising team first begin to hear interest from our investors related to our DEI strategy, goals, and measurable outcomes?

Harmon: Capital took an interest in our approach to diversity on Day One because that was part of our foundation. We took that interest to the next level in 2012 when we partnered with New York State Common Retirement Fund (NYSCRF) to build our emerging and diverse manager business. Across the Artemis platform, we have invested with diverse and emerging firms to help them develop a track record of success and increase their access to capital. We have raised $2.5 billion in capital to invest with these managers and deployed 95% of that capital. Overall, they have achieved meaningful outperformance beyond our target returns. Over the last several years, we have seen a new intensity in the spotlight that our prospective and existing investors shine on DEI efforts and outcomes. DEI work is clearly an area of significant and accelerating interest for institutional investors.

Phillips: How did Artemis go about structuring its current DEI strategy, and who did Artemis try to learn from to create this strategy?

Harmon: When we first set out to build Artemis, we started by seeking other women-owned firms to answer these same questions: where do we begin, and who has similar experience that we can we learn from? We found no women-owned firms at that time. Instead, Artemis developed our strategy in-house, developing a model that fit and subsequently informed our culture. We have seen several other firms step up to the plate and develop innovative models for diversity, equity, and inclusion over the last decade, some of whom we have had the privilege to partner with as diverse managers. One such partner is Basis Investment Group and Basis CEO Tammy Jones, who has consistently used her platform to bring others along in her footsteps. In the world of real estate, however, we may be better served by looking outside of our industry to other spaces for significant examples that have advanced further, faster. That is especially true for healthcare and healthcare real estate, where progress has been slow.

Phillips: Can you give examples of Artemis initiatives to improve diversity and equity at a company level?

Harmon: First, our Artemis Summer Enrichment Program which has trained 216 students in the last decade. More than 85% of participants come from diverse backgrounds and 50% of participants have gone on to internships and jobs in banking, finance, and real estate. The program was recognized last year by Bisnow’s inaugural RISE Award.

Harmon: First, our Artemis Summer Enrichment Program which has trained 216 students in the last decade. More than 85% of participants come from diverse backgrounds and 50% of participants have gone on to internships and jobs in banking, finance, and real estate. The program was recognized last year by Bisnow’s inaugural RISE Award.

Second, we are intentional about our recruitment, hiring, and assessment processes – three critical elements of talent management. Artemis invests in diversity from top to bottom, enabling candidates to see people in leadership roles who look like them and emphasizing that diversity and inclusion are integral parts of our culture. Hiring diverse talent requires casting a wider net for sourcing, and we continue to invest heavily in our talent pipeline. Once we have candidates under consideration, we strive to create a hiring panel that reflects the firm’s diversity. As part of our annual review process, we ask current employees to consider their contributions to diversity and inclusion, establishing further channels of communication around this important work.

Third, engagement is critical to sustaining cultural norms, and we are committed to integrating our DEI efforts across teams. We have a DEI Committee of approximately 15 Artemis team members representing different teams, offices, functions, and diverse perspectives. We have implemented unconscious bias training over the last two years to assess our individual and structural biases from a neuroscience lens, developed peer buddies for new hires and formalized mentorship for our existing team, and introduced additional, differentiated perspectives through a firmwide speaker series.

Phillips: What high level recommendations would you give to small- and medium-sized businesses, such as senior housing operators and sponsors, looking to implement new DEI-focused initiatives?

Harmon: The differences between real estate and healthcare mean that some of the strategies we have created for Artemis don’t translate perfectly. The same is true for our lessons learned. But hopefully they are transferable enough to be useful!

The “time value” of talent and talent processes is crucial. Every day we work hard to build and manage a diverse firm, and we have been developing that capacity for more than a decade. Some of our corporate leaders most active in integrating diversity and inclusion throughout our firm started with me as junior hires. You must recognize that these changes will not happen overnight, and that shifts in corporate culture are exceedingly difficult to achieve.

To that end – intentionality is the most prominent ingredient in the recipe for success. Your decisions must be purposeful, and small choices add up over time. We like to say that you can’t manage what you don’t measure, especially when you are driving difficult, business-wide changes. You must understand your successes and failures to achieve meaningful outcomes.

I will add, not everyone will agree on the value of diverse perspectives. Whether it’s team members, partners, or investors, there is rarely full alignment. It is hard to talk about the value of diverse perspectives and not acknowledge that there will be disagreement on diversity itself. So, know your business case for investing in diversity, because it exists and it is material. When organizations remain homogeneous, your organization loses out on the proven value-add of diverse thought and perspective, which means losing business. Many investors, partners, members of the public, prospective residents and tenants do care about diversity, inclusion, and equity, and you are hurting the bottom-line if you are losing business because of your policies or practices. Finally, plenty of research reflects that firms with the ability to build diverse teams and leaders can outperform.

There is true power and opportunity in working alongside people with different life experiences, education, and knowledge. This is especially relevant in senior housing and care, where operators serve a melting pot of residents, families, and communities whose experiences and backgrounds are just as diverse as the team members working day to day in the communities.

Phillips: Can you speak to the power of partnership in furthering Artemis DEI goals?

Harmon: Artemis relies heavily on the power of partnership to establish change and drive impact. For most of the last decade, we have partnered with Seizing Every Opportunity (SEO) to open the Summer Enrichment Program (SEP) to SEO’s diverse students. SEO has a 50-year track record placing students in industries such as banking and law, and Artemis created a unique partnership with SEO to open access to the real estate industry through the SEP. In total, more than 40% of SEP participants have also been SEO students.

In 2017, the Pension Real Estate Association (PREA) formed the PREA Foundation, and I had the opportunity to join as the Chairperson. After Artemis’ experience with the SEO team and organization, we were excited to bring the framework of the SEP to the PREA Foundation as a possible model for a grantee partnership. In turn, the PREA Foundation, in partnership with SEO and other like-minded investment managers, created and funded the first-ever PREA/SEO Real Estate Track, which is now placing dozens of interns with partner firms nationwide every summer.

That was just the PREA Foundation’s first program. In partnership with board members, donors, and phenomenal grantee organizations, the Foundation has raised $30 million, made nearly $5 million in grants, and has an additional $2.5 million in disbursements in 2023. More than 200 PREA organizations have participated in the Foundation’s initiatives. Through the Foundation, we have collaborated with our partners to expose over 1,000 diverse high school and college students to careers in the institutional real estate industry, and we have created more than $16 million in economic opportunities through internships and job wages for young women and people of color.

No one organization can change all of real estate, but partnership can and must propel the industry forward. I invite NIC readers to be part of changing real estate and healthcare for the better, and I look forward to working with them to achieve that.