LCS: Not Just Another Senior Living Company A Conversation with CEO Joel Nelson

Widely known for its property management expertise, LCS is so much more. In fact, LCS is the parent of a family of five companies encompassing ventures from development, procurement, insurance, to real estate ownership.

Widely known for its property management expertise, LCS is so much more. In fact, LCS is the parent of a family of five companies encompassing ventures from development, procurement, insurance, to real estate ownership.

In a wide-ranging discussion, NIC Senior Principal Lana Peck, who started her senior housing career at LCS, recently had the opportunity to reconnect with CEO Joel Nelson. Here is a recap of their conversation.

Peck: LCS is a long-established company and has extensive experience serving seniors all over the country. Please share with our readers about the history of LCS and your role at the company.

Nelson: LCS just completed our 50th year serving seniors—a major milestone. I’ve had the good fortune to be with LCS for 35 of those years. And I’ve been privileged to serve as CEO since 2018. A little history on LCS: We have been viewed as a management company, but LCS started as a development company in collaboration with our parent company, Weitz Construction. The founder, Fred Weitz built his first CCRC in the 1960s in Des Moines, and then developed several others. Recognizing the need for senior living, he launched LCS in 1971. In the 1980s, he started an employee stock ownership plan (ESOP) and, in 1995, sold LCS to the employees. Our employee ownership speaks to the longevity of employees like me. In 2010, we launched our strategy to diversify and focus on owning more real estate. For the first time, we brought outside equity into the company through our partners, McCarthy Capital and Westminster Capital. We recently completed a planned recapitalization with Redwood Capital Investments. Redwood joined McCarthy Capital and LCS employee shareholders to strategically position the company for the next 50 years.

Peck: LCS is unique in the industry. You own and operate both for-profit and nonprofit senior housing and life plan communities (both entrance fee and rental). You are the nation’s second-largest senior living operator and an owner and developer. What other business lines does LCS offer its customers?

Nelson: LCS is the parent of a family of five companies. Over the years, we’ve built a complementary platform that is 100% senior-centric. Today, our companies include Life Care Services (our management company) and LCS Development. Our third company is CPS, our national procurement company. About 50% of its revenue comes from LCS managed or owned properties, and the other 50% originates from companies not managed, owned, or developed by LCS. We also own Hexagon, our insurance company which came about in the 1990s after Hurricane Andrew hit a community we managed in Miami. Insuring our properties provides better protection. Hexagon also shares the risk for the communities we own and those we manage, creating tighter alignment with our partners. In 2010, we established LCS Real Estate which has grown to over $3 billion in assets under management. Outside of those companies, we also established the LCS Foundation in 2017 to give back to the senior living industry. The Foundation focuses on scholarships, funds an employee relief program, and supports the Alzheimer’s Association.

Peck: Did CPS play a big role during the pandemic?

Nelson: Absolutely, CPS is highly resourced and provides excellent service. When COVID hit, the supply chain froze. We quickly mobilized to get personal protective equipment and other products to our communities and other customers, so they could focus on their residents.

Peck: How many properties does LCS own and manage?

Nelson: Today, we have just under 150 communities. We have an ownership interest in about one third of those. About 100 communities are for-profit and nonprofit life plan communities, and 50 are rental communities. New rental development is a key focus of LCS under two separate brand platforms. Both offer independent, assisted, and memory care services and are typically larger in scale–200+ units. We partner with Harrison Street and Ryan Companies on the Clarendale brand. Our Delaney brand is focused more on high barrier to entry markets and is developed and owned by LCS and partners. .

Peck: How will the recent recapitalization support the company’s long-term strategic plans?

Nelson: Our recapitalization strategy is focused on the next 50 years. We found a tremendous capital partner in Redwood and were honored when both McCarthy and our employee shareholders rolled their capital forward. Redwood supports the LCS philosophy of employee ownership and our vision of long-term investment. We are also well-positioned to meet the needs of the growing demographic of seniors over the next 7 to 10 years.

Peck: Coming out of the pandemic, how have LCS communities fared in terms of occupancy? Are any product types or care segments performing better or worse than others?

Nelson: Occupancy has rebounded. In March 2020, excluding skilled nursing, we had a total company occupancy of just under 90%, which included many of our start-up communities. At our lowest point, that number dropped to 81%, but today occupancy is around 85% and increasing every month. All segments have shown a strong rebound, including our skilled nursing business. While it took the deepest drop, it is now only 380 basis points off of March 2020 levels. Our rental company has also performed very well, setting record move-in numbers in 2021. As of the end of February, the rental company has grown occupancy nearly 500 basis points since March 2020. Our life plan entry fee portfolio is seeing very strong recovery on the independent living side of the business. Residents want to be in our communities. I look for us to surpass 90% average occupancy in 2022.

Peck: Are sales leads generally back up to pre-pandemic levels?

Nelson: Based on continued increases in leads and visits, we can see that customers trust in our sector. Beginning in March 2021, we were outperforming the previous four years in lead generation and initial visits. January and February of 2022 have also set records in lead generation, much of it driven by online leads, which have increased 50% since 2019. I’m expecting many good months ahead.

Peck: The pandemic has necessitated fundamental shifts in processes, workflows, and operational thinking to keep residents and staff safe. What changed at LCS? What worked, and what have you learned?

Nelson: If there is something positive to point to from COVID, it was that we were required to rethink how we deliver services while maintaining a high level of customer satisfaction. Almost every function in the company had to change. Our clinical teams were a huge help to our communities. Very early into COVID, we started planning for the future. We sought external resources and expertise, and launched a new signature program, EverSafe 360. This initiative has resulted in a Medical Advisory Board, supported by an Emergency Response Team. Additionally, new cleaning protocols were introduced, along with improved air quality and streamlined access to telemedicine. I would also add that COVID required a completely new strategy for marketing and sales. As a result, we are much more focused on connecting through digital and virtual channels. Seniors have also become more tech savvy. They’re more comfortable finding information online and taking virtual tours.

Peck: The cost of serving seniors is going up; labor and staffing, insurance, food, and utilities are squeezing margins. How are you weathering rising expenses?

Nelson: Our scale and diversification help immensely to weather rising expenses. We have the same problems as everyone else, but we can spread expenses across a greater pool. LCS benefits greatly from CPS, our national procurement company, giving us the ability to leverage scale and negotiate pricing.

We are also piloting certain technologies to help with efficiency and labor shortages. For example, we are deploying robotic vacuums for use in common areas. Telemedicine is an example on the clinical side. The key is to balance the technology with a high-touch approach. We don’t have a choice but to find better and more efficient ways to serve our residents because they have to be served.

Peck: Specifically, how is LCS addressing labor force challenges? Is your culture a differentiator?

Nelson: People are our #1 asset, and we believe our culture is a true differentiator. We continue to focus on attracting, developing, and engaging top talent. Our diverse family of companies create an organization where employees can build a fulfilling long-term career. To develop talent, we have strategic partnerships with colleges and universities, robust internships, and a best-in-class professional development program. Another important element of our culture is an emphasis on diversity and inclusion. We have an active Diversity and Inclusion Council which focuses on providing educational opportunities for our employees to enhance the understanding of different perspectives. We welcome new and different thinking and believe greater diversity will help foster thought leadership across all company lines.

Peck: What is in your development pipeline today? How was development affected by COVID-19?

Nelson: We have several projects under development including two new large rental communities in the Northeast under the Delaney brand, each with 200-plus units. Similarly, we have two new Clarendales under development. We also have a $350 million life plan community development under way in New York called Broadview at Purchase College. Sales at the community in 2021 were some of best pre-marketing numbers we’ve had in years. Based on feedback from surveys, we continue to get affirmation that seniors are tired of isolation and look forward to living in a community.

In addition, we have 12 repositionings under way with a total capital investment of $593 million.

LCS is also expanding its third-party turnkey development services for clients who may have the management and ownership infrastructure in place, but do not have a development team. LCS Development brings 50 years of design and development execution to this market segment.

Peck: Where do you see development opportunities? How do you choose markets?

Nelson: We take a consumer-driven approach. In some markets, a rental community makes more sense, and, in others, a life plan community may be a better fit. We have a very robust market research team that analyzes regions and individual markets. We tend to gravitate to the larger primary markets.

Peck: How is LCS working to address the housing and care needs of what NIC calls “the Forgotten Middle?”

Nelson: Everyone has their own definition on “middle market,” but I believe we have a fair amount of middle market product, mostly in our third party, nonprofit managed life plan portfolio in secondary markets. These communities have been able to re-invest in their facilities yet maintain pricing with entry fees under $150,000 and monthly fees in the $3,000 range. Looking ahead, middle market development will need to pivot to fewer amenities and more a-la-carte services.

Peck: With the oldest baby boomers now 75 years old, how is LCS connecting with the boomer consumer? Is LCS considering engaging in the active adult segment?

Nelson: We do not have plans to enter that space. We think active adult is a good feeder to our product. We are also closing the gap between active adult and independent living. We can’t give up on our core product. We’re delivering new communities for baby boomers with more amenities, multiple dining venues, and the best technology.

Peck: I was still with LCS during the last national crisis, the great financial crisis of 2008, and I remember the challenges the industry faced, and its resilience. How does the COVID-19 pandemic compare to that time?

Nelson: Both were challenging, and let’s face it, we aren’t through the pandemic yet. We always knew a financial crisis could happen. So, LCS stuck to its principles of lower leverage with debt and balanced growth. But the pandemic cost lives, and that’s the tough part given our mission. I believe the industry has emerged stronger and more resilient. The future is bright. It all comes back to the core of people who are in this business for the right reasons.

Peck: Lastly, is there anything else you would like our readers to know?

Nelson: The senior living industry must win the talent battle. To do so, we need to collaborate in our efforts to attract talent and share our story. As an industry, we rallied together during COVID, and we have to rally together to conquer the workforce challenges to attract new, young talent and existing talent from other industries. This is a rewarding industry. We are positioned for strong growth and offer great opportunities. As we evolve to meet the needs of our seniors, we need our prospective employees and future leaders to understand the value of what we do, and how they can be a part of this mission-driven work.

2022 NIC Spring Conference Focuses on the Future - Three days in Dallas highlight “A New Day” for the industry

With more than 1,700 attendees, the 2022 NIC Spring Conference in Dallas surpassed turnout expectations as participants expressed a bullish outlook for the senior housing and skilled nursing sectors after a few challenging years.

The in-person conference was held March 23 to 25 at the Omni Hotel in downtown Dallas. Notably, the conference drew 500 first-time attendees and 72% of attendees held senior executive roles in their respective companies.

As a premiere industry event, the 2022 NIC Spring Conference engaged attendees in three days of results-oriented networking, information sharing, and educational sessions. Participants welcomed the opportunity to meet face-to-face. It was the first time NIC has held an in-person Spring Conference since 2020. The 2021 NIC Fall Conference was held in person this past November in Houston.

The Spring Conference theme — “A New Day”— highlighted the shift from the challenges of the pandemic to the upcoming opportunities for senior housing and skilled nursing. Timely educational session topics included rebuilding occupancy, boosting NOI, and how to recruit and retain workers, among other crucial issues.

In opening remarks, NIC President and CEO Brian Jurutka reflected on the pandemic’s two-year impact on the industry. He noted the heroism of frontline workers and the resilience of owners and operators as everyone joined together to protect the most vulnerable Americans. “It’s too early to say the pandemic is behind us,” said Jurutka. “But we are finding ways to live with COVID, and it’s a new day.” He added that recent data show an industry rebound is underway.

The 2022 NIC Spring Conference saw a number of innovations, including the welcome return of face-to-face receptions where industry stakeholders could socialize and strategize. A favorite of attendees was the NIC Café, a fresh market concept offering breakfast, lunch, and snacks throughout the day. Designed to create efficiencies for the attendees’ meeting schedules as well as eliminate congestion, the NIC Café was a convenient hub for meals and gatherings.

First-time attendees were provided activities and resources specifically geared to prepare for successfully navigating the conference, starting with a pre-Conference webinar to help them leverage their time in Dallas. First-timers also were welcomed on site with a well-attended special reception plus first-time attendee meet-ups each morning.

Another innovation was the introduction of a new educational session format. Several of the sessions included a panel of expert speakers followed by small group discussions among attendees to tease out the important details of the timely topic. The 75-minute session on the emerging Active Adult market included video clips of residents showcasing their perspective. Led by facilitators, attendees in small groups developed a working playbook of the opportunities and challenges facing the active adult model.

A NIC Skilled Nursing Boot Camp was held in person on site just prior to the start of the Spring Conference. (NIC also offers skilled nursing and senior housing boot camps online.) Designed for those new to the industry or for those who want to stay current on underwriting of skilled nursing facilities, the short course taught participants how to understand the unique risks associated with skilled nursing and how they may be mitigated. Participants engaged in the analysis of a case study to determine whether to buy, sell, or hold a nursing property.

General educational sessions at the Spring Conference were well attended. Comfortable seating along with workstations that included power outlets were available in the main ballroom where the eight educational sessions were held. A live streaming option was also provided just outside the ballroom for attendees to watch the sessions.

Sessions Address Top Issues

What follows are brief highlights of the carefully planned educational sessions, all of which are available to conference attendees in high quality video recordings.

Addressing a critical industry concern, the first session took a deep dive into effective strategies to improve occupancy. The session, A Roadmap for Building Back Occupancy, included a panel discussion followed by small group discussions, where attendees exchanged practical tips based on their own experiences. The panelists shared their unique perspectives on changing consumer preferences amid the realities of a labor shortage. They agreed that it’s important not only to market to prospective residents but also to potential team members. “We, as an industry, are full-time recruiters now,” said Courtney Siegel, president and CEO, Oakmont Senior Living. “Our recruiting departments need to mirror our marketing efforts.”

In How to Increase NOI Today, Tomorrow, and Into the Future, a panel of seasoned executives shared their successful strategies. A much-discussed approach is to tap into health insurance reimbursement by creating a Medicare Advantage plan. “By having a primary care provider integrated in the community, we increased length of stay by 12%, and occupancy increased 4% to 5%,” said Lynne Katzmann, president and CEO, Juniper Communities. Other ideas addressed the importance of an efficient building design and the advantage of a strong brand identity.

Providing context on the business climate, two well-respected economists delved into market conditions during the session, Construction Trends and Macroeconomic Influences on Senior Care and Housing. NIC Chief Economist Beth Mace mapped out the complexities of the current operating environment as rising inflation collides with a labor shortage and rising interest rates. She also observed: “The senior housing industry is maturing with product diversification, segmentation of care levels, and as a part of the healthcare continuum.”

Leaning In and Leveraging Resources for Successful Partnerships highlighted the importance of establishing relationships with proven healthcare providers. Win-win partnerships can keep residents healthier longer and improve length of stay while easing the burden on staff to coordinate care. “From an investment perspective, if an operator has a coordinated approach to care, all of the benefits translate to the bottom line,” said panelist Sheryl Marcet, Arcus Healthcare Partners.

Capital providers have a bullish outlook on the sector. The session, Debt and Equity Trends in Senior Living detailed the objectives and concerns of lenders and investors. Panelist Elliot Pessis at Harrison Street said, “The sector has a lot of tailwinds. There is a need for high quality care.”

The ‘Forgotten Middle’ Market: Vision to Execution unlocked the secrets of success to house older middle-income Americans. Panelists on the forefront of the trend detailed the financial and operational pieces they have put in place to make the model work. Small breakout groups discussed the questions to consider when planning a middle market strategy. “Collaboration is hugely important,” said Sharon Ricardi, Northbridge Advisory Services. “Keep thinking out of the box.”

After an introduction, The Time is Now: Developing the Active Adult Playbook attendees broke into small groups to discuss the three key elements of the new product segment. Each group spent 15 minutes sharing ideas on people (consumer/marketing); product (design/amenities); and program (services/management). After each 15-minute block, ideas were shared with the entire audience. Participants grappled with issues such as aging in place and how to attract younger seniors. Attendees agreed liberal pet policies are a must but cautioned about adding too many frills. “You can’t amenitize yourself to success,” said Mitch Brown, Senior Housing Consulting.

The 2022 NIC Spring Conference concluded with a highly anticipated session, Fostering Meaningful Engagement: Industry Staffing and Labor Needs. An expert panel set the stage, providing context on the overall labor market, the importance of leadership, and how to tap non-traditional labor pools. “Things aren’t going back to where they were,” said Myra Norton, Arena Analytics. Small breakout groups engaged in lively discussions about what does and doesn’t work to recruit and retain good employees. One tip: Don’t confuse worker satisfaction with worker engagement. “Satisfaction is what I’m getting out of the relationship. Engagement is what I’m giving back,” said Craig Deao, Huron Consulting Group.

High-quality video recordings and the corresponding graphic illustration boards of each session are available to conference attendees in our ON24 platform. In addition to the video recordings and illustrations, presentations are still available in the mobile app for download.

Construction Trends and Macroeconomic Influences on Senior Care & Housing—2022 NIC Spring Conference Session Recap

Economists decode mixed market signals

Operating in the fog of today’s economy is a challenge. Inflation is rising. Wages are up. Expenses are climbing. Labor is in short supply. And now, there’s even talk of stagflation, high inflation coupled with slow growth amid the uncertain outcomes of a war in Europe.

On the plus side, millions of workers have rejoined the economy after the big pandemic job slump. The huge wave of baby boomers is almost ready for senior housing and care. An aging building stock offers opportunities for new development. And innovative market segments are emerging, specifically, active adult and middle-income properties.

Two expert economists sorted out the mixed economic signals for attendees at the 2022 NIC Spring Conference in Dallas. NIC Chief Economist Beth Mace was joined on stage by Ken Simonson, chief economist, Associated General Contractors of America.

The well-attended session, “Construction Trends and Macroeconomic Influences on Senior Care & Housing,” took a deep dive into the trends impacting the industry.

Inflation is top of mind. “A big concern a year ago was whether inflation was transitory or permanent,” said Mace. “For now, it’s permanent.”

The Consumer Price Index (CPI) was up 7.9% year-over-year in February. Mace pointed to a number of factors for the jump: supply chain disruptions caused by the pandemic; fiscal policies that contributed to overspending; and an easing monetary policy.

Rising construction costs are putting a squeeze on contractors and developers. Input costs for items, such as lumber and steel, are rising about 25% a year, according to Simonson. “Contractors need to pass on these costs,” he said.

Construction wages are up about 6% for the year. “Contractors are being hit on all sides,” said Simonson. He added that contractors can’t predict when a project will be finished or what it will cost. In just the last six weeks, some producers have introduced index pricing to calculate and refresh prices. That means pricing can change before the final product is delivered. The Associated General Contractors of America now issues regular construction inflation alerts to help owners understand the challenges.

Specific to senior housing and care, Mace noted the positive trends for new development. About 60% of the current building inventory in the primary markets is more than 17 years old. New designs will better serve the huge cohort of aging baby boomers. The emerging active adult segment offers new opportunities, along with the so-called “Forgotten Middle”—the 14 million middle-income older adults who need a housing alternative.

Mace warned, however, “Be careful where you develop.” Some markets still have a supply/demand imbalance. And in the last six months, independent living and assisted living starts are rising again, according to data from NIC MAP Vision. Some markets even have more building under way than in 2019 and 2020, specifically Washington, D.C.; Portland, Oregon; and Miami.

What could slow development? A combination of rising interest rates, uncertain delivery times, and higher materials costs are the biggest factors, according to Simonson.

Interest rates headed higher

In March, the Federal Reserve raised interest rates for the first time since 2018 by 0.25 percentage points. Both economists expect more hikes ahead. Simonson said the next two increases could be as much as a half a percentage point. Reading the signals, Simonson suggested the best approach may be to go ahead with projects before interest rates go higher even though material costs and availability are uncertain.

“Is stagflation a risk?” asked Mace.

“The Federal Reserve has a tough road to get inflation down without triggering a recession,” said Simonson.

Watch the yield curve, Mace advised. The inversion of the yield curve, in which short-maturity interest rates exceed long-maturity rates, is typically associated with a recession in the near future. She explained that the yield curve has started to flatten. Interest rates hikes could trigger a recession, though that might be the preferable course of action. “The Federal Reserve would probably want to err on the side of a recession rather than an inflation spiral,” she said, noting the dangers of a cycle where wages chase prices and prices chase wages.

Senior living owners and operators face three big concerns.

Net operating income (NOI) is under pressure. Expenses and labor costs are rising faster than rent increases.

Secondly, job growth is weak. Senior housing and care has not recovered the jobs lost from the pandemic. Total employment in assisted living is 7% below levels of February 2020. Skilled nursing jobs are down 15%. “The added pressure of higher wages is creating challenges for all of us in the industry,” said Mace.

The third concern is weak occupancy. Prior to the pandemic, senior housing occupancy was 87%. It fell to 78% at its low point, though the third and fourth quarters of 2021 saw occupancy rebound to 81%. “Demand was strong, but we have a long way to go,” said Mace.

Five trends to watch

Looking ahead, Mace identified the top considerations for the industry in the months and years ahead.

- Senior housing and care is maturing. Product diversification is evident in the emergence of ultraluxury and middle-market products, along with segmentation by care levels. Senior housing is also viewed as more of a part of the healthcare continuum.

- New supply. There are opportunities to develop new products, but there’s a lot of competition. “Be careful,” said Mace. “Roll up your sleeves.”

- The consumer is changing. The industry will be serving the baby boomer generation at the end of the decade. Expect more interest in the active adult segment as developers and investors aim to attract these consumers before they need traditional senior housing.

- Consumers have choice. The senior housing penetration rate is 11% of households among those age 75 or older. How can the industry capture more of those seniors? The value proposition of senior housing has to be demonstrated and marketed.

- Strategic marketing plans need to be expanded. The goal is not only to attract residents but also new workers.

The macro-outlook for the sector presents a mix of risks and opportunities, the economists said.

High gas prices at the pump are the number one thing on the consumer’s mind. How will they allocate their money?” asked Simonson. Threats outside of the country, for example in Ukraine, are another concern.

Global growth is slowing. Mace noted that the OECD, an intergovernmental economic organization, recently shaved a full percentage point off its global GDP projection. The Federal Reserve recently lowered its GDP projection for the U.S. to 2.8% in 2022 from 4.0%.

Labor force participation should improve. But the economists didn’t expect a change in immigration policies that would address the sector’s labor shortage, though the government recently announced it would accept 100,000 Ukrainian refugees.

At the same time, consumer wealth and income indicators are healthy, business profits are solid, and government revenues are in good shape. “Despite the mixed signals, I’m optimistic about the economy,” said Simonson.

Executive Survey Insights Wave 38: February 7 to March 6, 2022

by Lana Peck

NIC’s Executive Survey of senior housing and skilled nursing operators was implemented in March 2020 to deliver real-time insights into the impact of the pandemic and the pace of recovery. In its third year, the “ESI” is transitioning away from the COVID-19 crisis to focus on other challenges facing the industry. While some standard questions will remain for tracking purposes, in each new survey “wave,” new questions will be added. Let us hear your suggestions!

This Wave 38 survey includes responses from February 7 to March 6, 2022, from owners and executives of 67 small, medium, and large seniors housing and skilled nursing operators from across the nation, representing hundreds of buildings and thousands of units across respondents’ portfolios of properties. More detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

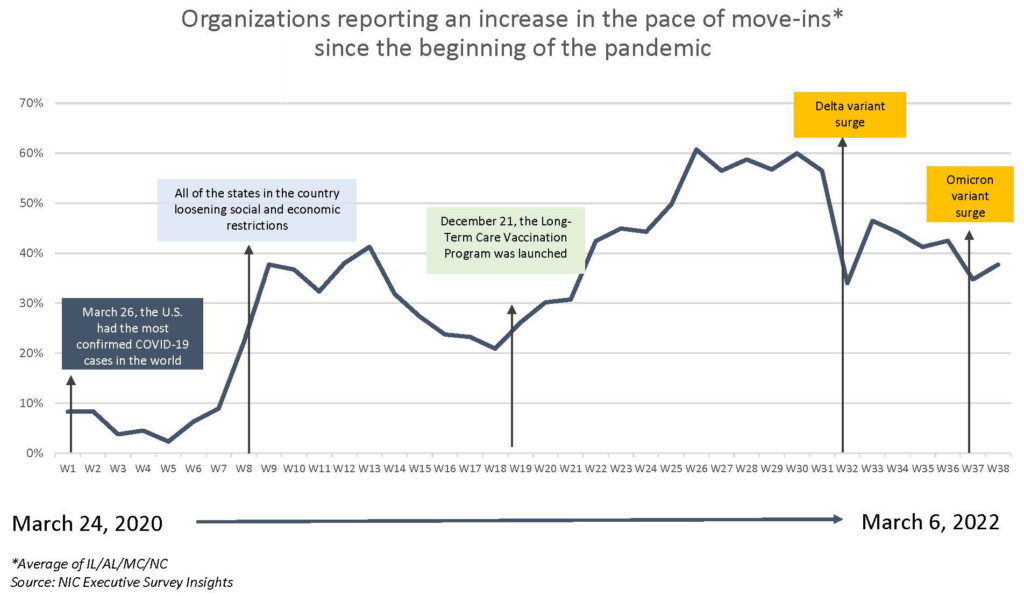

Across 38 Waves of the ESI, the pace of move-ins has closely corresponded with the broad incidence of COVID-19 infection cases in the United States. This is demonstrated in the timeline below that shows the share of organizations reporting an increase in the pace of move-ins during the prior 30-days. Data from the Wave 38 survey, which was conducted during the month of February, reflects an increase in the share of operators reporting acceleration in the pace of move-ins as the Omicron variant peaked and cases began to decline in the U.S. in the middle of January.

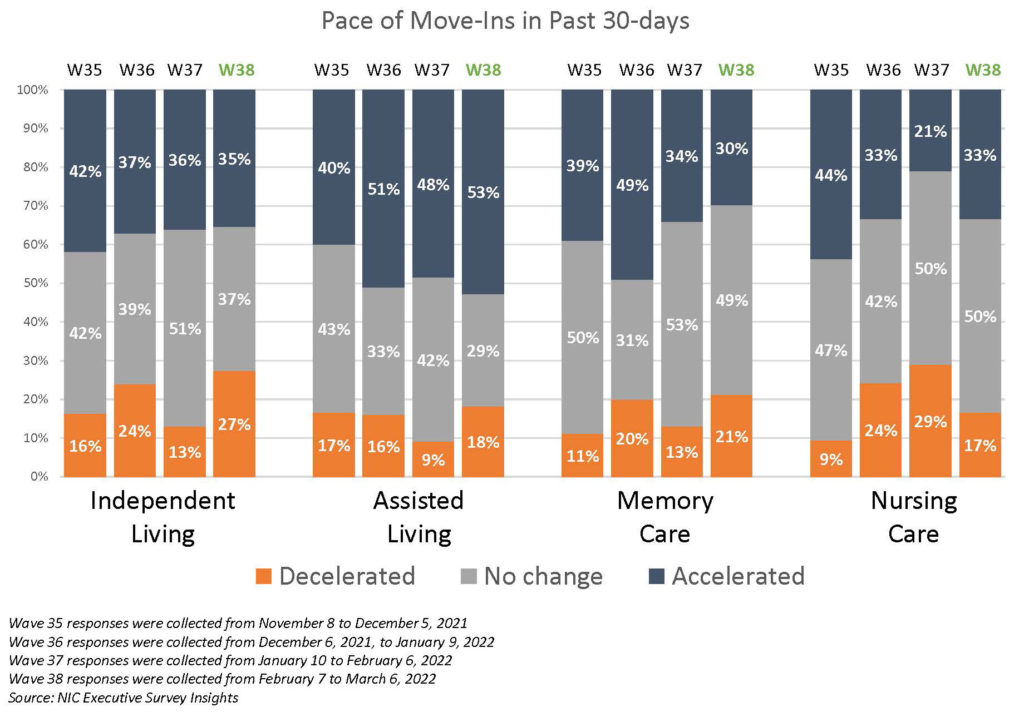

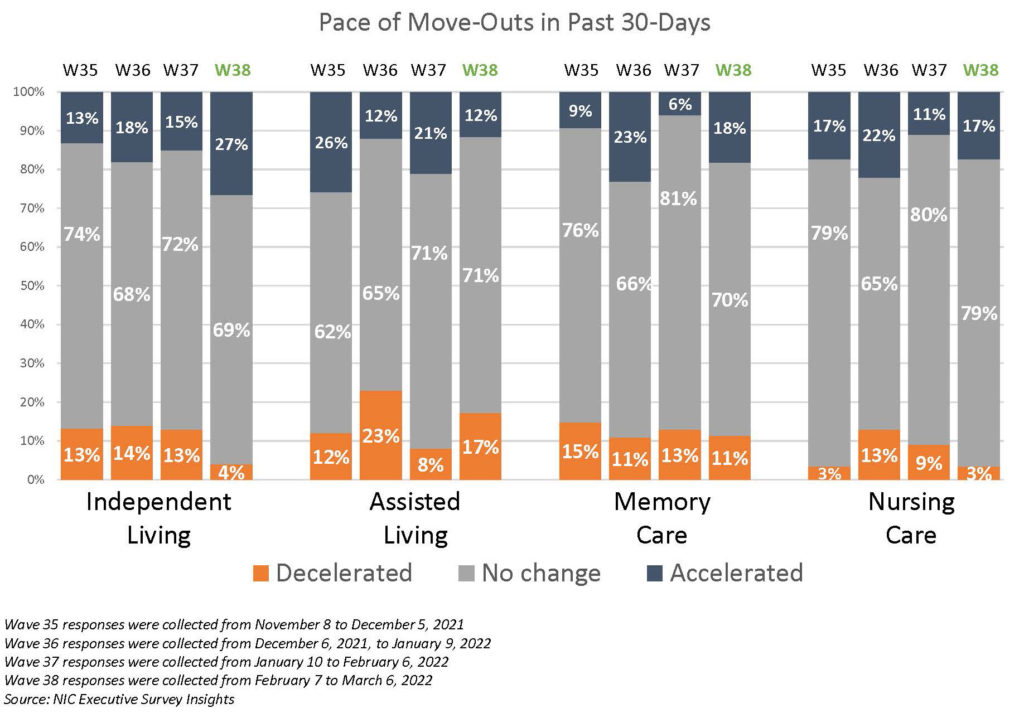

Since the Wave 36 survey (reflecting operator experiences in November), one-half of organizations with assisted living units reported an acceleration in the pace of move-ins. By contrast, the pace of independent living and memory care move-ins slowed. Likely, in part due to seasonality, Omicron, and residents moving to higher levels of care, one-quarter (27%) of organizations with independent living units reported a deceleration in the pace of move-ins since the previous survey (27% vs. 13%), and roughly equal shares of organizations with independent living units reported acceleration in the pace of move-outs since the prior survey (27% vs. 15%). The pace of move-ins in the nursing care segment reversed its slowdown trend in Wave 38. However, notably fewer organizations with memory care units reported an increase in the pace of move-ins since the Wave 36 survey. Reasons cited by respondents that observed deceleration in the pace of move-ins included “normal movements,” Omicron, “lack of available staff,” and the “slowdown of hospital admissions.” Regarding reasons for acceleration in the pace of move-outs, one-half (53%) of organizations cited residents moving to higher levels of care.

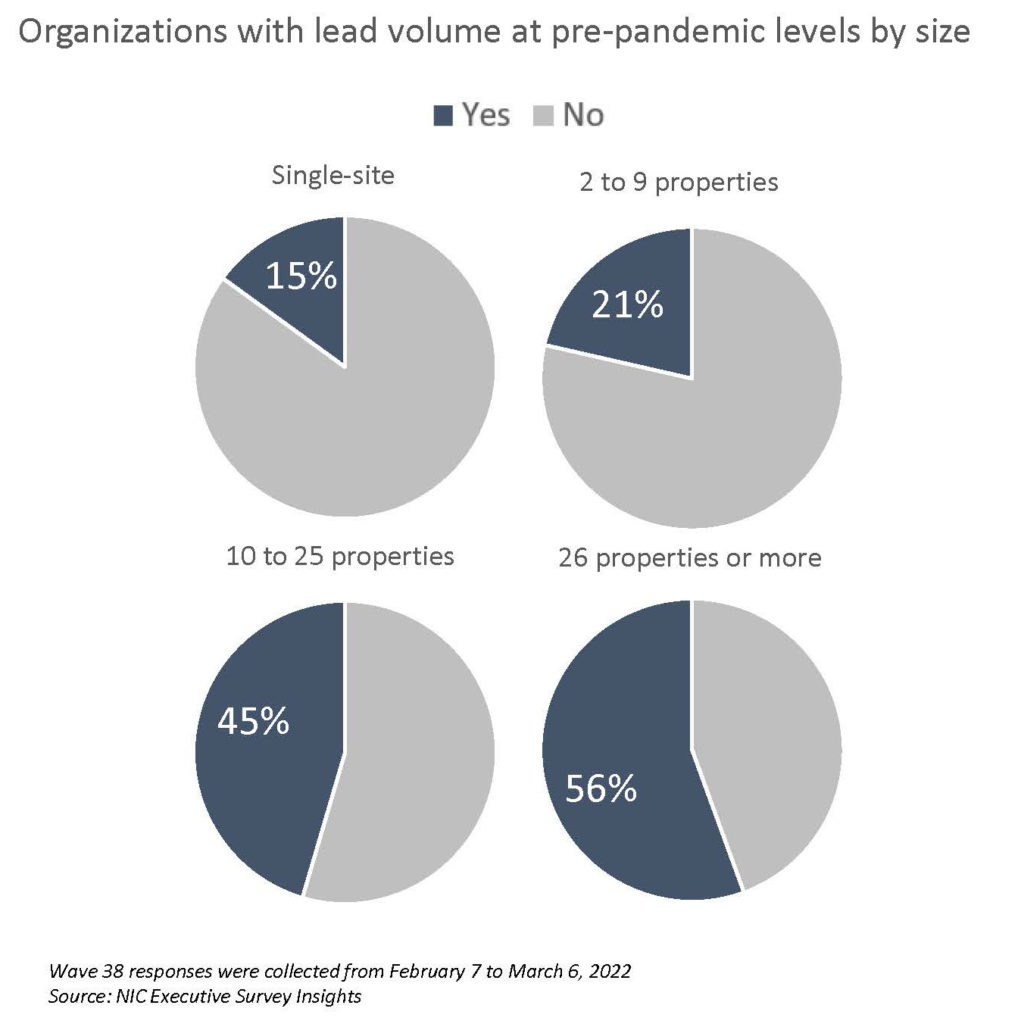

Smaller operators are less likely to have achieved pre-pandemic lead volumes than larger organizations in Wave 38. Given pent-up demand coming out of the pandemic and questions about the sustainability of historic and near-historic absorption rates during the third and fourth quarters of 2021 per NIC MAP Vision data, this measure in the ESI may be a leading indicator to watch with regards to occupancy recovery. As shown below, more than one-half (56%) of the survey’s largest organizations have reached pre-pandemic lead levels compared to only 15% of single-site operators. Potential reasons for this wide disparity in favor of larger organizations may include sizable sales teams and marketing budgets, sophisticated online and digital marketing capabilities; and geographic, demographic, and economic market diversity—all of which comes with scale.

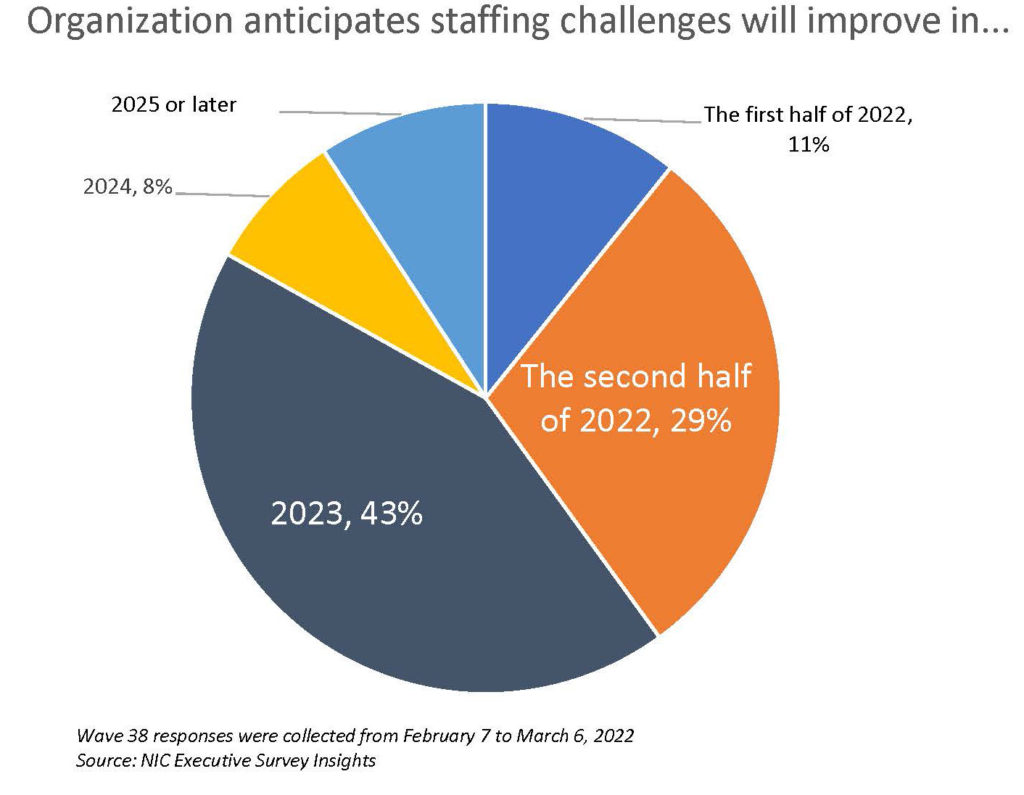

Staffing continues to be operators’ most significant challenge, but nearly three-quarters of respondents are optimistic that improvements are on the horizon. Since last July, nearly all operators (97% – 100%) responding to NIC’s Executive Survey Insights have reported staff shortages. Attracting community/caregiving staff and employee turnover remain the most significant challenges for survey respondents (86% and 60%, respectively). When asked about backfilling staff shortages, all of the respondents (100%) are paying overtime hours in Wave 38, and four out of five respondents are currently tapping agency or temp staff (81%). Of those organizations, about one-half (49%) do not expect their reliance on agency or temp staff to change in 2022; however, 40% anticipate it will decrease. As shown below, just under one-third (29%) expect staffing challenges to improve in the second half of this year, while 43% believe labor markets will ease sometime next year.

Nine out of ten respondents to the Wave 38 survey (90%) lend their support for a federal investigation of anticompetitive practices by nursing and other direct care staffing agencies. At the end of January, the American Health Care Association and National Center for Assisted Living (AHCA/NCAL) with the American Hospital Association (AHA), sent a joint letter to the White House’s COVID-19 Response Team Coordinator, requesting assistance due to reports of anticompetitive practices by nursing and other direct care staffing agencies. AHCA/NCAL asked that the White House “urgently devote” the federal government’s attention to these practices.

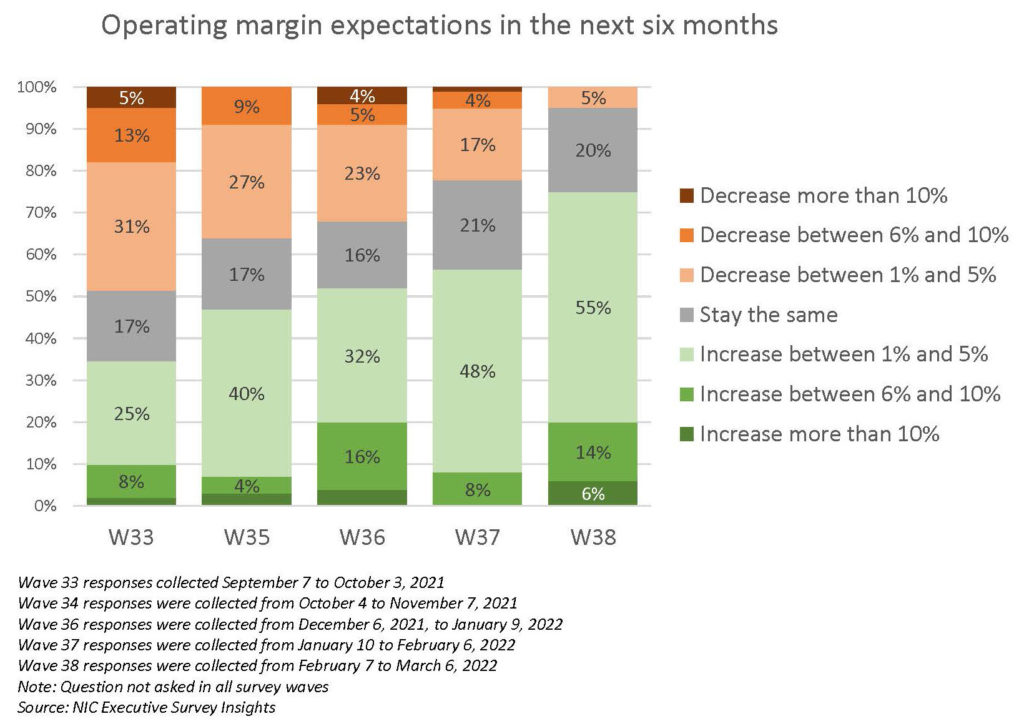

Rising operating expenses may limit the degree to which margins will grow in the next six months. As occupancy recovery progresses as the pandemic eases, operators’ margins may improve. In the Wave 38 survey, only 5% of respondents anticipate their margins will decrease over the next six months, while 75% expect margins to increase. The majority (55%) anticipate the increase will be between 1% and 5%.

Owners and C-suite executives of seniors housing and care properties, please help us tell an accurate story about our industry’s performance. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please get in touch with Lana Peck at lpeck@nic.org to be added to the list of recipients.

NIC wishes to thank respondents for their valuable input and continuing support for this effort to provide the broader market with a sense of the evolving landscape as we recover from the pandemic. This is your survey! Please take the Wave 40 survey and suggest new questions for Wave 41.

Spreading the Good Word on Senior Housing

by Cameron Bell, Vice President Portfolio Management, National Health Investors, Inc.

The senior living and long-term care industry is exceptional. Those outside the industry typically do not grasp or fully appreciate what occurs inside these communities—these residents’ homes. Therefore, those within the industry are responsible for sharing the positivity of what is accomplished. If it is not us, who? If not now, when? Unfortunately, terrible things do sometimes happen in this industry, but what sector is immune?

The senior living and long-term care industry is exceptional. Those outside the industry typically do not grasp or fully appreciate what occurs inside these communities—these residents’ homes. Therefore, those within the industry are responsible for sharing the positivity of what is accomplished. If it is not us, who? If not now, when? Unfortunately, terrible things do sometimes happen in this industry, but what sector is immune?

Over the course of my tenure at NHI, I have visited every building in our portfolio (and then some). Despite all the challenges, those recent and even before the obvious one, I have seen and interacted with extraordinary people. As I grinded during the toughest months of the pandemic, I could always lean into or think of those I’ve met who were dealing with so much. If they were not giving up, how dare I? That gave me strength to persevere. As I thought on an article to write for the NIC Insider, I could not have chosen a more opportune time than this to share some stories from a few remarkable people I’ve had the pleasure of encountering or working with. There are countless more, but I hope what you read below is encouraging and uplifting; that it reminds you not only of why you do what you do but also challenges you to reflect on your personal experiences, and to spread the good word on senior housing, particularly for the future workforce!

I trust you will enjoy, presented in the order of when I met each individual, the stories and perspectives of Justin Hutchens (Executive Vice President, Senior Housing, Ventas, Inc.), Andy Eby (Caregiver/Owner, Bickford Senior Living), Sara Mitchell (Vice President, Partner Relations, Solinity), Blair Quasnitschka (Vice President of Operations, Maxwell Group, Inc.), and Holly Ballarotto (Chief of Staff, Brandywine Living).

Why or how did you enter the long-term care industry?

Hutchens: I started as a caregiver working at an intermediate care facility when I was in college. I really enjoyed the job and working environment. I decided to pursue a management career in long-term care, as I was drawn to the altruistic nature and importance of the profession. I learned early on that no two days are alike. The challenges and opportunities seem endless at times, which can make for an exhilarating career.

Eby: I have heard it said that people who are the most alive and fulfilled are those who seek to live a life in service to something greater than themselves. I can say that this has been true with me. The pursuit of a meaningful life led me to leave a promising NFL career to join this industry. When I made this decision, everyone said I would regret it. They couldn’t have been more wrong. Not only have I lived a more fulfilling life, I have awakened to who I am at my core and the contribution I am here to make.

Mitchell: Six years ago, I was looking to transition out of journalism, where my routine was dictated by breaking news, the next sports game, and countless hours of travel to and from games. I certainly enjoyed being a sideline reporter with SEC-ESPN and later an anchor for a CBS affiliate, but I was missing purpose in my work. I first learned of the industry when I was invited to participate as a media relations volunteer for an endurance cycling event that was raising funds for Alzheimer’s research. I accepted and my career trajectory changed on that 12-day, 1,000+ mile cycling event that later became Pedal for Alzheimer’s, Ltd. That opened up conversations with the founder of Solinity, Josh Crisp, who included me in the launch of the new brand. I joined as Director of Communications, and over the next few years, our team, influence, and portfolio has grown.

Quasnitschka: Senior living is a second career for me, but with groundwork laid by my father who served seniors for 20+ years as a nursing home administrator. My brother and I often went to work with him when we were young, helping out in recreation or maintenance, and developed a comfortability and appreciation for seniors early on. My college studies guided me towards the sports industry, and while working for the PGA in Virginia, I had decided to move back to Connecticut with no real professional plan. I was having the “what do you want to do with your life” discussion with my mother, and for no apparent reason, I blurted out “maybe I should get into what dad used to do…” (he had passed at the age of 49). After making the decision to pursue management in senior living, many industry peers of my father suggested I seek out an administrator named Jim Malloy – Jim was a college fraternity brother of my father who started him on the path to nursing home administration when my father came back from the Vietnam War. I wound up doing my Administrator in Training hours with Jim just as my father had done 35 years before! Looking back, I recall an interaction I had with a complete stranger at my father’s funeral, and it puts into perspective the amazing influence he had on me and the ability we have to impact those we serve in the industry. His comment to me was: “You do not know me, but I knew your father for 15 minutes in the space of time when he cared for my mother – you should feel fortunate you had him for 15 years, he was that special.”

Ballarotto: I started my career in hospitality and always intended to stay in that industry. But, after a chance meeting with Brandywine’s leadership at a conference, Brenda Bacon, Brandywine’s co-founder, opened my eyes to the senior living industry. Almost nine years later, I cannot imagine working in another field. That experience has made me passionate about increasing industry visibility to the next generation of our industry’s future leaders.

What motivates you to keep going as the industry faces numerous challenges?

Hutchens: I’ve spent my career on the operating side and on the real estate capital side of the business focused in the U.S., U.K., and Canada. I really enjoy interacting with the best and brightest leaders of senior housing companies, and my colleagues at Ventas all working together to navigate the macro environment, create a value proposition attractive to seniors, and provide peace of mind to their loved ones. There are always challenges; however, this is a battle-tested resilient sector with very strong net demand prospects moving forward.

Eby: Motivation is important for those who are working typical jobs or building typical careers. Those who feel called to this work, operate from a higher, more sustainable energy. Adversity, setbacks, and failures are table stakes, just part of the game. The glory consists not so much in winning, but in playing a poor hand well. Those of us in the long-term care industry do this work because we love it. It is an honor to be the caregiver who is willing to do whatever it takes for our residents’ happiness.

Mitchell: The people. The industry has an amazing group of passionate people who bring me energy. Conversations inspire and motivate me to continue bringing my best to help better teams and organizations that we serve. As a senior living marketing agency, it’s my responsibility to push the envelope with new and improved marketing and advertising ideas and strategies. It is exciting and motivating to hear the stories, passions, and ideas of the people in this great industry.

Quasnitschka: My motivation is the excitement I get to lead and connect with others. As any business, there is a bottom line to meet, but that bottom line is not sustainable without connection and relationships rooted in empathy and respect. As difficult as the industry is, quality leadership and developing tomorrow’s leaders is critical; I’m driven to contribute to that.

Ballarotto: It’s easy to get caught up in the day-to-day challenges of operating senior living communities. But if you step foot into any of our communities, you see the true heroes working there and the lives they touch every day. Knowing that our team’s work changes people’s lives is incredibly motivating.

What are you excited about as you think about the future of senior housing/long-term care?

Hutchens: I am most excited about the forward-looking supply/demand fundamentals. The underlying demand is growing at a pace we have not seen before. The opportunity for net absorption in the senior housing sector is supportive of recapturing the financial losses suffered during the pandemic. There is also tremendous room for innovation, through the use of consumer facing and operational technological advances and lifestyle offerings will evolve as we start to serve the baby boomer generation. Exciting times ahead, indeed.

Eby: Without question, the last two years have been tough. We have gone through a crisis of epic proportions unlike anything we’ve ever seen or could possibly imagine. But I am grateful that we’ve experienced these challenging times, because I can see and feel something new and better emerging. I believe we have the opportunity to create a movement that radically recasts a vision for how we care for America’s seniors. This will require us to un-learn senior care as we know it so that we create space for a new, more transformative model. I feel the energy of my peers ready to champion the change our seniors deserve.

Mitchell: I’m most excited about the new and innovative ways that we’ll deliver information to future residents. The industry is designing and building communities for the future resident, and I’m excited to see how we will also match the online marketing for how the resident wants to discover the information. I think this will be a heavy emphasis on digital marketing (website, email, social media) and communication with consumers will move towards a focus on the way they want to receive information (text messages or email over a phone call). I’m excited to push existing communities, and new brands too, to a new virtual, digital, custom delivery of marketing and messaging.

Quasnitschka: The evolution of senior living excites me. This will never be a stagnant landscape to operate in. People will always age, and there will be evolving expectations, technology, culture, living options, and workforce trends. Couple that with the upcoming generation influx (baby boomers and beyond), our commitment to serve will be needed more than ever.

Ballarotto: As our product has become more visible and accepted, our customer has also become much more discerning. We’ve seen a flight to quality. There is an excellent opportunity to return to pre-pandemic operating margins and beyond by winning market share, attracting and retaining top talent, and carefully managing the impact of rising inflation without degrading quality or service. No one said it would be easy; nothing worth doing ever is.