Inside the June Issue

Welcome to the June 2023 NIC Insider Newsletter. We showcase the work of Sabra Chief Investment Officer Talya Nevo-Hacohen and her thinking about the evolution of the industry, recycling underutilized properties, developing the next generation of leaders, and making better environments for residents and employees. Caroline Clapp provides valuable insights on the Active Adult market. Beth Mace shares considered thoughts on the economy and capital markets and the impact to the industry. Omar Zahraoui provides visibility to the labor market, and Aubrey Haenlein of Omega Healthcare Investors showcases technology solutions that help move the industry forward.

—–

Beyond Spreadsheets: A Conversation with Sabra’s Talya Nevo-Hacohen

Talya Nevo-Hacohen thinks big. As Chief Investment Officer, Treasurer, and Executive Vice President at Sabra Health Care REIT, she thinks about more than the numbers. She thinks about the evolution of the industry. She thinks about how to recycle underutilized properties. She thinks about mentoring young executives. She thinks about how to make buildings better environments for residents and staff alike. NIC Chief Economist Beth Mace recently talked with Nevo-Hacohen about how she helps turn big ideas into action at Sabra. What follows is a recap of their conversation.

Talya Nevo-Hacohen thinks big. As Chief Investment Officer, Treasurer, and Executive Vice President at Sabra Health Care REIT, she thinks about more than the numbers. She thinks about the evolution of the industry. She thinks about how to recycle underutilized properties. She thinks about mentoring young executives. She thinks about how to make buildings better environments for residents and staff alike. NIC Chief Economist Beth Mace recently talked with Nevo-Hacohen about how she helps turn big ideas into action at Sabra. What follows is a recap of their conversation.

Mace: As a leading healthcare REIT, Sabra owns and invests in real estate serving the healthcare industry. Can you please tell us about your many roles and more broadly Sabra Health Care REIT?

Nevo-Hacohen: I oversee and manage the company’s assets, direct new investments, and make decisions with my colleagues on the deployment of capital. But I see my role as broader than that to help this organization evolve over time to meet changing external conditions and internal needs. I was one of six people when this company started in 2010, and we now have more than 40 people. Growing pains are hard, and it’s possible to get complacent. I am always trying to push new ideas, better ways to invest, and improve our internal processes.

We have a fairly young team on the investments side. Part of my job is to make sure they are mentored and grow professionally. We have an obligation to teach junior executives how to think in real-world terms. Buying a property is more than understanding cash flows on a spreadsheet. We have to teach them how to identify and measure risk, understand the other party in a negotiation, and how to reach an agreement on terms.

Mace: Sabra has been investing in behavioral health since at least 2017. Why behavioral health? What types of real estate does it include?

Nevo-Hacohen: Behavioral health real estate includes psychiatric hospitals, eating disorder clinics, addiction treatment and counseling centers, and outpatient care facilities and more. These properties are very different from skilled nursing. We own a handful of psychiatric hospitals. But our investment push has mostly focused on treatment centers for substance use disorders. We take our obsolete or underperforming assets, invest incremental capital, and convert them to a higher yield use.

It’s exciting to provide real estate for this sector. Addiction treatment has changed in the last 10 years. Everyone is talking about mental health post COVID. There’s a greater awareness today about addiction and the demand for treatment is very large. But the supply of treatment centers has been mostly limited to destination locations where the patient could stay for months. That’s neither affordable nor accessible for most people. What changed was the enactment in 2008 of the Mental Health Parity and Addiction Equity Act. It requires insurance coverage, including Medicaid, for mental health conditions. The typical patient at our facilities is employed and has standard health insurance. We help make addiction treatment geographically and financially accessible.

Sabra is not an operator. We limit our investment to the real estate. We net lease the buildings to operators, like the way we contract with senior housing and skilled nursing operators. There are a lot of similarities between inpatient treatment centers and senior housing from the standpoint of the building layout. There are some differences too. Treatment centers need therapy rooms and more common areas. What’s nice is that many of the older properties we own are located in more densely populated places.

From an economic standpoint, the operators have contracts with insurers, and that drives their top-line revenue. Margins are generally higher and breakeven occupancy is generally lower than in senior housing and skilled nursing.

Mace: Are other healthcare REITs investing in this space? Is there other capital investing in this space?

Nevo-Hacohen: We are seeing other healthcare REITs tiptoe into the space. No one has a big initiative. For us, it is a differentiator. We’ve been doing this for over five years.

Mace: Is there an opportunity to vertically integrate these services with existing senior housing portfolios?

Nevo-Hacohen: We discussed this opportunity on a panel at the NIC Spring Conference. Our focus on behavioral inpatient treatment has not broadened to providing services in the rest of our portfolio, mostly because we are not a service provider. Behavioral health is clearly a service that could be utilized in any location. The pandemic has shown that these services are needed and can be provided via telehealth. I think senior housing and skilled nursing operators have been focused on so many other issues that behavioral health hasn’t come to the forefront. But the need is there.

Mace: Do you ever convert underutilized skilled nursing properties into behavioral health facilities? What’s involved with that?

Nevo-Hacohen: We already own skilled nursing properties, so that works out pretty well. Anything with an inpatient model works. It’s also a matter of scale. Skilled nursing, senior housing, and hospitals vary in size. So, it depends on the market demand and competition. Not every building can be converted. There can be issues around zoning, market demand, and whether the property works for commercial insurers.

Mace: What about the patients in a skilled nursing property? What happens to them?

Nevo-Hacohen: Most of the buildings that we’ve converted were already slated to be shuttered based on a decision by Sabra and the operator. We abide by all regulations to transfer patients to where they want to go. We don’t mix patient populations in the building.

Mace: What share of your portfolio is concentrated in skilled nursing and senior housing?

Nevo-Hacohen: As of March 31, 2023, skilled nursing comprised 56.7% of our portfolio based on annualized cash NOI. Senior housing represented about 25%, and 10.6% of that is leased. The balance is managed by third-party operators.

Mace: What do you see as the opportunities and challenges of investing in skilled nursing?

Nevo-Hacohen: We’re still bullish on skilled nursing. There’s no question that there’s a need, and many assets are coming out of service, especially post pandemic. The bad news is that COVID made skilled nursing an unfair target in the press. The pandemic highlighted the challenges of operating in a highly regulated revenue environment where costs are going up. But it also showed that the services were necessary. We’re now seeing more support on the revenue side. A lot of states have increased Medicaid rates. Also, the Centers for Medicare & Medicaid Services has issued a proposed rule for fiscal year 2024 that includes a 3.7% payment increase for skilled nursing facilities.

Mace: On May 1, Sabra withdrew and resigned its membership in the Enlivant joint venture with TPG Real Estate. Does this mean you will eventually transition senior housing properties that are currently operated by Enlivant to a new operator? Can you tell our readership more about this decision?

Nevo-Hacohen: We have two investments associated with Enlivant. We have 11 assets that Enlivant manages, and we continue to own those assets. We were in a joint venture with TPG on a portfolio of assets managed by Enlivant which is owned by TPG. We had a 49% interest in that joint venture. We withdrew from the joint venture because the underlying portfolio was a casualty of the pandemic and floating rate debt. That portfolio of assets is being addressed by lenders at this point. The portfolio had the same issue as many other borrowers; floating rate mortgage debt was used, and the borrower was required to buy interest rate caps. As rates rose, the caps became expensive at the same time that more cash was needed to service the debt. We don’t have this situation with the assets that we own that are managed by Enlivant, because we don’t use floating rate debt or rely on mortgage financing.

Mace: More broadly, are you shying away from senior housing in general?

Nevo-Hacohen: Our senior housing portfolio has performed well. We continue to buy assets from our development pipeline. We closed on a property last quarter. We continue to invest in Canada, and recently closed on a property there. We like the senior housing model. There are strong tailwinds on the demand side, depending on the product and location.

Mace: What makes a good investment opportunity for Sabra? What do you look for in your operator partners?

Nevo-Hacohen: We look for operators that tend to have a more regional presence as opposed to large national operators. We think market intelligence and knowing your audience are critical. At same time, we look for operators that are sophisticated in their view of how to build and operate a platform, and ones that are really interested in the evolution of senior housing. The senior housing we had 20 years ago is not the senior housing that I’m moving into eventually. My peers will want more choices and variety. Senior housing has to become a desirable place. We’re looking for operators who think about how to cultivate future residents and provide something they want and do it well. Senior housing is a complex business. It’s hospitality, healthcare, and relationships. The good news about skilled nursing is that if you move in, you’re hoping it’s a short-term stay. With senior housing, you’re hoping for a long-term stay. But senior housing is still a choice. The challenge is to make it appealing.

Mace: Who are your investors?

Nevo-Hacohen: They are institutional investors. Our stock trades on Nasdaq. We have similar ownership to that of other healthcare REITs.

Mace: ESG and sustainability are important values for Sabra. Can you tell us about that?

Nevo-Hacohen: The issues are important. Some of these issues are under the company’s control and some are not. Regarding the governance and social aspects of the ESG framework, we focus on our own organization. For environmental, we work on the assets we own. We have the ability and flexibility to make positive changes at our properties. When we look at a new investment, we consider the building structure, systems, and efficiencies. We also look at the opportunity for improvement, such as how to provide cleaner air which ties into the wellness of the residents and staff. As an industry, we sometimes forget that the staff spends a lot of time in the building, and the quality of the physical plant impacts them. Hopefully, with improvements, our staff will literally feel better which will enhance employee retention. The better the place is for residents and workers, the better off our products and services will be.

Mace: Is there anything else you would like to add?

Nevo-Hacohen: The healthcare world is evolving. COVID spurred a lot of changes around how we can improve the resident experience and that of the staff that supports them. Everything comes under that umbrella. COVID was a crucible. Places of congregate living were where the fires burned the most intensely. New ideas and approaches are emerging from that experience that won’t come from other commercial real estate sectors.

Active Adult Update

by Caroline Clapp, Senior Principal, NIC

Active adult recent events. NIC recently had the opportunity to present our research and findings, coupled with NIC MAP Vision’s data, in two events that were focused on the active adult property market: 1) the 3rd Annual InterFace Active Adult Conference and 2) the Urban Land Institute (ULI) Lifestyle Residential Development Council 55+ during its Spring 2023 Conference. Attendees at both conferences included investors, operators, architects, designers, and consultants. It was insightful to participate in conversations with various stakeholders within the active adult property market, and we appreciate the feedback on NIC’s research. Below is an update and some post-conference analysis on various topics related to active adult communities.

Lease-up. Many stakeholders agreed with NIC’s findings that an active adult property size of 140-180 units provides appropriate scale for leasing up and maintaining occupancy. The goal for many developers is to achieve pre-leasing of 30-50% of rental units by the time the first units arrive online. Anything less than 30% is considered subpar, while some developers cited much higher pre-leasing statistics of 80% or more. To achieve target pre-lease rates, the sales office should begin marketing at least 15 months in advance. Many developers place a trailer at the construction site to host sales events. Alternatively, sales staff may host parties for potential residents at existing active adult properties to give residents a flavor of the lifestyle and an opportunity to speak with current residents. Overall, marketing must endeavor to paint a picture of an active adult brand and lifestyle well before construction is complete.

Operations and design. Developers, operators, and designers have been changing some footprints and offerings in recent months. For example, some clubhouses and pools are smaller partly due to higher construction costs, but offices are being added to many units to attract residents who are still working full- or part-time or who have had to return to work in the current economic environment. Continental breakfasts may somewhat exclude working residents, and as a result, some operators have diverted those funds into the more popular happy hours that are scheduled for 5:00 PM or later. Everyone agreed on keeping pickleball courts, and some found that their dog parks were too small due to their popularity and, thus, were expanding. Many residents have requested groceries on-site, and some communities are adding autonomous shopping that automatically charges a resident upon exit, e.g., while picking up snacks and drinks before heading to the pool. Automatic payment does not require an employee, and some properties are opening this autonomous shopping option to the larger surrounding community to increase intergenerational mingling.

Managing acuity creep. Many operators are implementing new programming that attracts residents closest to age-eligible entry and are eliminating services that do not, e.g., onsite rehab. Some stakeholders recommended making branding as universal as possible to increase the likelihood that people enter an active adult community upon reaching age-eligibility. Overall, it is important for designed space to look more like multifamily or hotel space than senior housing space, and it is important to keep service levels low.

Target market area. NIC’s research found that 70% of active adult residents come from within a 10-mile radius of active adult properties. Meanwhile, some conference attendees posited that the radius likely is smaller, e.g., a 5-mile ring, while some believed that a 10-minute or 15-minute drive time is a more accurate market area. Overall, market size and density and property location likely determine the target market area. For example, properties located within large metro areas may have a smaller radius from which to draw residents compared to secondary, tertiary, or rural markets. Meanwhile, properties located within a densely populated area or near a body of water may draw from a drive time rather than a radius.

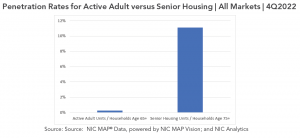

Penetration rates. Penetration rates are a comparison of housing inventory for older adults within a market to that market’s cohort of older adults. High penetration rates can be positive indicators of product acceptance and operator success and/or negative indicators of elevated competition. This rate can be calculated in a few ways. For senior housing, which is comprised of majority independent living and majority assisted living properties, NIC traditionally has used inventory in units as the numerator and households age 75 and older as the denominator. For active adult, NIC used households age 65 and older (rather than 75 and older) to better capture the demographic make-up of active adult communities in which residents are age-eligible beginning at, for example, 55-, 62-, or 65-years old, with an average resident age of 72-74 years old.

Upon presenting NIC’s current active adult penetration rate, some conference attendees commented that rather than including households age 65 and older, the calculation could instead include households age 65 to 85 given that most residents need care services by the time they reach their 80s and given that the average age for senior housing independent living residents is 82. This likely would result in a higher – but still quite low – penetration rate. In future quarters, we plan to expand upon this analysis and could, for example, narrow the age cohort for the denominator or include only occupied units in the numerator. Likely no single method is perfect.

Additionally, when comparing the very low active adult penetration rate of only 0.3% to the 11% senior housing penetration rate for the 140 metropolitan markets tracked by NIC MAP Vision, conference attendees commented that the more choice-based active adult inventory might not ever reach the penetration level of the more needs-driven senior housing inventory. Nevertheless, we believe that the very low penetration rate relative to traditional senior housing indicates that the active adult product type likely is still in its nascent stages with room for new supply from those vying to enter the space.

Operators. Given that several operators work within a larger ownership structure, many conference attendees suggested that NIC combine some of the operators under the Greystar name. As a result, below is an operator ranking that combines Greystar, Overture, Everleigh, and Album as overseeing the largest number of active adult units, as well as an expanded list of the largest operators beyond the Top 10.

Looking ahead. NIC appreciated the opportunity to participate and present in these recent industry events and are grateful for the feedback and insight provided by various active adult stakeholders. Going forward, NIC will continue to strive to provide data and analyses that are helpful in expanding the active adult property market to serve older adults who benefit from the value proposition of security, socialization, engagement, and wellness provided by active adult communities.

May You Live in Interesting Times: Curse or Blessing?

by Beth Mace, Chief Economist, NIC

“May You Live in Interesting Times.” It’s an English expression claimed to be based on a translation of a Chinese curse. A curse? Why a curse? It’s thought to be a curse because uninteresting times suggest a period of tranquility, a blessing so to speak, while interesting times may convey the opposite—a time of challenges and troubles. And by most measures, today’s time is better characterized by the latter rather than the former.

In this short commentary, I review “today’s times,” assessing conditions affecting the senior housing and care industry, and then near the end of the article, I highlight mid- and longer-term opportunities that lie ahead. Understanding near-term conditions and weathering today’s capital market turbulence is critical as industry stakeholders position themselves for a compelling set of promising and compelling prospects.

2020: The Year That Changed Everything. The COVID-19 pandemic that began in early 2020 was an earthquake that forever shook the senior housing and care sector. Few reminders are needed to remember the early days of the pandemic that held extraordinary fear and uncertainty, limited access to Personal Protection Equipment (PPE, who even knew that acronym?), caregiver shortages, rapid infection spread, illnesses, and deaths. Conditions changed rapidly once vaccines were introduced in rapid fashion in January 2021 with residents and caregivers in senior housing properties quickly benefitting. These results were subsequently studied and chronicled showing that those older adults living in senior housing properties were as safe or safer than those living in the community at large (see NORC COVID Phase 2 study results).

In addition to the medical and health care crisis caused by the epidemic, the immediate effects of the pandemic were a seismic shock to the global economy as whole service sector components of the economy shut down (e.g., restaurants, theaters, etc.), plunging the U.S. economy into recession as the jobless rate soared to 14.7% and hundreds of thousands of workers lost their jobs temporarily in some instances and permanently in other cases (i.e., 22 million jobs were lost in March and April 2020, or 14% of the nation’s job base).

While the economy has recovered remarkably three-plus years later, there remain several aftershocks that keep on shaking the underbelly of a resilient economy. Supply chain shortages as well as significant financial relief provided by the U.S. government (e.g., three stimulus checks totally $3,200 per person as well as other fiscal policies) translated into the highest rates of inflation since the 1980s, with the consumer price index (CPI) peaking at 9% on a year-over-year basis in June 2022.

Fed Steps In. In response to accelerating inflation, the Federal Reserve began ramping up interest rates in March 2022 and proceeded to push the federal funds rate up at the fastest pace in over 40 years. At the time of this writing, the range of the fed funds rate was 5.0% to 5.25%, up from virtually 0% fifteen months ago.

The result of this monetary policy tightening has (as hoped) decelerated the annual rate of inflation (4.9% in April 2023) and reduced the pace of economic growth (GDP growth slowed to a revised 1.3% annualized rate in Q1 2023 from 3.2% in the third quarter of 2022), although the job market has proven itself to be unusually resilient. In April, at 3.4%, the jobless rate once again stood at its lowest level since 1969. Some analysts ascribe this performance to employers’ reluctance to let go of workers in the aftermath of lengthy and formidable efforts to hire them in the first place. That said, recent labor-related indicators suggest that the labor market is now starting to show signs of a slowdown, including higher numbers of layoff announcements, lower quit rates, and fewer job openings. This is particularly the case in tech and financial services.

Next Shoe to Drop. As in most cases, there are often unintended consequences to rapid change, and this has become all too apparent in the aftermath of the five-plus percentage point hike in interest rates. The failures of Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank come top of mind. The once-thought irrefutable and inelastic savings deposit base of regional banks has been broken and given way to the enticing appeal of time deposits such as certificate of deposits, Treasury bills, mutual funds, and other higher-paying financial instruments. The ability to transfer individual savings deposits from a bank offering a 0% interest rate into a higher paying 4%-to-5%-time deposit by simply pressing a few buttons on an iPhone has been extraordinary as outflows of funds from smaller banks have occurred. And without demand deposits, the foundational business structure of regional banks may be forever altered: regional banks need deposits to issue new loans, and without a strong base of deposits, the ability to lend may be compromised. This is particularly problematic for small businesses and commercial real estate borrowers, who often use regional banks as a source of financing.

“There are often unintended consequences to rapid change, and this has become all too apparent in the aftermath of the five-plus percentage point hike in interest rates.”

Borrowers’ Dilemma. And therein lay the roots of the problem for borrowers. First, as fiduciaries, fewer banks are willing to lend. Regulators are applying pressure on financial institutions to be more cautious in their underwriting standards to prevent and limit loan losses. Hence, the availability of debt financing has shrunk. Second, the cost of debt has risen quickly and to very high levels. The higher cost of debt and debt service has been crippling for many borrowers. And third, borrowers with adjustable-rate debt face unsurmountable debt service costs as adjustable-rate mortgages are changing to significantly higher rates and often include a costly interest rate cap or hedge.

Higher debt costs have come at a difficult time for many borrowers, especially those senior housing operators who are still fighting to recover to pre-pandemic levels of occupancy—one third of operators in the NIC MAP Primary Markets have occupancy levels below 80%. Cash flows have already been hampered by rising costs associated with limited labor pools (average hourly earnings for assisted living employees were 6% higher than year-earlier levels in March 2023, although this does mark a significant slowdown from the 10% pace seen one-year earlier), rising food and energy costs, escalating insurance rates, and revenue growth that still has room for further recovery.

All of this is leading to excruciating pressure for some owners and operators, who have in some instances capitulated and been forced to negotiate with their lenders for more favorable terms, paydowns, and concessions, or give their properties entirely back to their lenders. This includes the 150 senior living communities operated by Enlivant that were recently in the news.

Further, in anticipation of growing challenges for borrowers, Fannie Mae, one of the largest lenders to the senior housing sector said in the fourth quarter that it has set aside $1.1 billion for credit losses, including $900 million for the company’s senior housing portfolio valued at roughly $16 billion. Further, it indicated that approximately 40% of the seniors housing loans in the company’s multifamily guaranty book as of December 31, 2022, were adjustable-rate mortgages.

Transactions Stall. There are other consequences to the changing interest environment including the impact higher rates are having on transaction volumes, cap rates, and property valuations. The transactions market today is highly illiquid, with few transactions occurring and price transparency opaque at best. In the first quarter, transactions volumes for the senior housing and care sector fell below $800 million according to preliminary data from NIC MAP Vision, a first-quarter pace well below that of any recent prior year. Bid-ask spreads remain wide as the reality of today’s markets becomes fully understood. It’s a bit of a waiting game as sellers remain on the sidelines to see where pricing stands and as buyers wait on the sidelines because they do not want to take a negative valuation adjustment once they purchase an asset.

Property values are falling, whether measured by lower prices per unit or by higher cap rates. Private sector appreciation returns are slipping, and publicly traded REIT values—which are often a preview into the private sector—fell sharply in 2022 and from year-earlier levels in the first quarter of 2023.

When Will It All Change? The question is when will markets stabilize and what must happen for this to occur. Most prognosticators concur that the Federal Reserve must stop raising interest rates and begin to show evidence that rates have stabilized and may in fact potentially decline. With worries of stress and contagion running high for regional banks, the Fed may pause or as the more recently used term “skip” a rate increase at its upcoming mid-June FOMC meeting, but inflation is still running higher than the Fed’s 2% preferred target, suggesting a potential future increase in rates.

Additionally, buyers and sellers must start transacting again to provide some transparency into how large a valuation adjustment may be appropriate. And, with all eyes on the office sector which could see valuation declines of up to 40% or more, there is less attention being paid to other commercial real estate sectors, including senior housing. A fuller reckoning needs to occur.

For senior housing, those equity providers with closed-end funds that need to execute due to the fund life terms of their contracts and those investors with open-ended core funds that have redemption queues may need to transact. In addition, there will be operators that can no longer meet their debt obligations and equity requirements and will be forced to sell, creating a distressed-sales buying opportunity for some investors, particularly opportunistic funds. However, the landscape will remain clouded by uncertainty, and a murky environment is not one that business decision makers generally like to operate within.

“The landscape will remain clouded by uncertainty, and a murky environment is not one that business decision makers generally like to operate within.”

Taken in its entirety, the next six to twelve months are likely to be bumpy. Beyond that, the impact of current events on future financing may be based on the memory recollection and amount of “pain” associated with today’s market conditions.

Reasons for Optimism. Once we move beyond this adjustment period, there are a host of compelling reasons to feel good about the future. First are the market fundamentals which are on a path of strengthening demand and limited inventory growth. REVPAR, as influenced by rent growth and occupancy rates, has strong tailwinds. Demand in turn will be buttressed by a steady influx of potential new residents as U.S. demographics support interest in active adult and independent living properties and as increased frailty levels among the “older old” cohort necessitates the need for assisted living. Tomorrow’s seniors will have fewer family caregivers—adult children and spouses—to take care of them. Few other commercial real estate sectors have these same positive secular trends for support.

The breadth of new product offerings and greater product segmentation also offers a plethora of investment opportunities as the senior housing sector diversifies in ways like the hotel industry 40 years ago. For senior housing, this differentiation will take place by price, location, and service offerings. Some operators will find success by specializing in a particular type of care, such as diabetes management, COPD support, and other focused disease areas.

“Today’s valuation adjustments will also lay the groundwork for a lower cost basis from which to provide more cost-effective and affordable care and housing options for older adults.”

As many NIC-published articles have previously explored, the “Forgotten Middle” is an opportunity with more than 29 million older adults needing affordable senior housing care by the year 2029. Long-term middle-market demand trends certainly outstrip supply offerings in the foreseeable future.

Further, with more than 60% of today’s senior housing inventory built prior to 2006, the need for upgraded and new products is very compelling. And last, but certainly not least, is the growing recognition of senior housing as part of the health care continuum and the role senior housing plays in social determinants of health, lowering health care costs, health care crisis prevention strategies, and federal government fiscal constraint as potentially rising costs for Medicare and Medicaid are contained.

Technology also offers promising solutions to today’s vexing challenges of staffing and labor shortages. Immigration reform, while a political third rail, is also a longed-for solution.

Lessons learned by operators during the pandemic regarding the importance of socialization, connection, and purpose are also shaping the future product offerings and acting as a lure to attract more older adults and ultimately support higher penetration rates as well.

As always, I appreciate and welcome your comments, thoughts, and feedback.

Competitive Labor Markets: A Review of Nursing Staff Availability and Wage Performance in Senior Living and Adjacent Healthcare Industries

by Omar Zahraoui, Principal, NIC

2022 Occupational Employment and Wage Statistics: Labor Concentration and Complimentary State Level Report

In this article, NIC Analytics provides a detailed overview of jobs and wages for nursing staff and aides, including registered nurses, licensed practical and licensed vocational nurses, nursing assistants, and home health and personal care aides across all U.S. states using data compiled from the recently released 2022 Occupational Employment and Wage Statistics (OEWS) data from the Bureau of Labor Statistics (BLS). The primary purpose of this analysis and complimentary state reports are to pinpoint where skilled nursing (SNF) and senior housing (CCRC and assisted living) jobs stood in 2022 compared with the competitive landscape (i.e., other industries & healthcare settings) across all U.S. states.

The competitive landscape includes six select healthcare industries that employ between 73% and 86% of the nation’s four occupations listed above (nursing staff and aides). These are: (1) skilled nursing facilities, (2) home health care facilities, (3) continuing care retirement communities and assisted living facilities for the elderly (CCRC & AL), (4) general medical and surgical hospitals, (5) individual and family services, and (6) offices of physicians. These industry groups are based on the Office of Management and Budget’s (OMB) standard industry classification codes known as the NAICS or the North America Industry Classification System.

Takeaways from this analysis include:

- Hourly mean wages in Northeastern and Western states are nearly one-and- a-half to double the wages of Southern and Midwestern states.

- In an era of rising costs, tighter operating margins, and capital market constraints, the variation in workers’ wages across different regions can be a significant consideration when determining the ideal location for future developments.

- Workforce attraction and retention are more about a mix of other factors than just workers’ pay.

- Despite offering competitive wages compared with other healthcare industry groups, both sectors face ongoing challenges in attracting and retaining workers, particularly in skilled nursing.

- Labor availability continues to be a major challenge for the skilled nursing and senior housing sectors, largely due to low unemployment rates, a shrinking labor force, the retirement of existing staff members, challenges in finding childcare and other pressing family demands for many staff, competitive industries offering equivalent wages for potentially a less stressful job, and immigration policies.

- If staffing mandates were to change, skilled nursing facilities in states where labor concentration and employment-to-bed ratios are low may be required to implement higher minimum nursing staff-to-resident ratios, and meeting those requirements could be challenging due to the lack of potential individuals qualified to fill those positions.

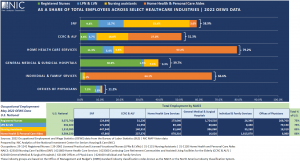

Skilled Nursing and Senior Housing vs. Select Healthcare Settings: Workforce Mix

- Four occupations, including (1) registered nurses, (2) licensed practical and licensed vocational nurses (LPNs and LVNs), (3) nursing assistants, and (4) home health and personal care aides (aides) accounted for roughly 59% of all staff within the skilled nursing sector and about 51.3% of all employees within the senior housing sector (CCRC and assisted living) in 2022.

- For other healthcare industry groups, these four occupations represented about 40% of all employees for general medical and surgical hospitals in 2022, 67% of all employees for individual and family services, and 79.2% of all employees for home health care services. This was the largest share across the select healthcare industries in Exhibit 1 below.

- The skilled nursing workforce mix had the largest share of nursing assistants and LPNs & LVNs compared with adjacent healthcare industry groups. The skilled nursing workforce comprised 33.4% of nursing assistants (totaling 447,940) and 12.7% of LPNs and LVNs (171,030).

- Registered nurses for skilled nursing had employment of 124,690 in 2022 in the U.S., representing 9.3% of all employees, while aides had employment of 47,860, accounting for 3.6% of all employees for skilled nursing.

- For senior housing (CCRC and AL), aides and nursing assistants comprised the largest shares of all employees, with 27.0% (237,370) and 16.0% (140,910), respectively, followed by LPNs and LVNs with 4.7% (41,350), and then registered nurses with 3.6% (31,230).

- Compared with skilled nursing, senior housing employed less nursing staff (registered nurses, LPNs and LVNs, and nursing assistants) but more aides in 2022.

- Home health care services employed fewer nursing assistants, but more registered nurses and aides compared with the skilled nursing and senior housing sectors in 2022. Home health care services comprised 57.2% of aides, equivalent to 878,310, and 11.3% of registered nurses (173,640), while nursing assistants represented 5.3% of all employees, equivalent to 81,640.

- General medical and surgical hospitals employed the largest number of registered nurses across all healthcare industries at 1,724,510, accounting for 30.9% of all employees and representing 56.1% of total national employment.

- Individual and family services had the largest number and highest proportion of aides across all healthcare industries, with 1,815,870, accounting for 64.1% of all employees and representing 51.8% of total national employment.

The complimentary state occupational employment and wages report at the end of this article provides state level data.

Exhibit 1 – Workforce Mix Within Select Healthcare Industries

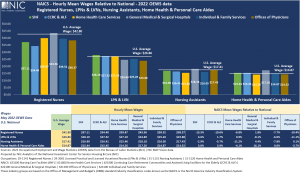

Skilled Nursing and Senior Housing vs. Select Healthcare Settings: Hourly Mean Wages

Other than registered nurses, skilled nursing and senior housing wage rates continued to be relatively competitive compared with the U.S. average wages and other healthcare industries (based on the vintage of the BLS data which is date stamped May 2022). This suggests that workforce attraction and retention are more about a mix of other factors than just workers’ pay.

- Registered Nurses. The highest paying healthcare industry for registered nurses was general medical and surgical hospitals, with an hourly mean wage of $43.56, 1.8% above U.S. average wage for registered nurses ($42.80). All other healthcare industries paid an hourly mean wage below the national average wage. Skilled nursing and senior housing were the lowest paying healthcare industries with $37.11 (13.3% or $5.69 below U.S. average wage) and $34.40 (19.6% or $8.40 below U.S. average wage), respectively.

- LPNs and LVNs. At $28.10 per hour on average, LPNs and LVNs within skilled nursing were paid the highest among the select healthcare industry groups, $1.24 or 4.6% above the national hourly average wage of $26.86. For senior housing, LPNs & LVNs were also paid above national average at $27.32 (1.7% or $0.46 more) and better than all other healthcare settings including home health care services (at $27.10 – $1 less per hour than skilled nursing and $0.22 less than senior housing) and general medical and surgical hospitals (at $24.69 – $3.41 less per hour than skilled nursing and $2.63 less than senior housing).

- Nursing Assistants. Wages for nursing assistant workers in skilled nursing and senior housing were also competitive at $16.90 and $16.41, respectively. Nursing assistants in skilled nursing and senior housing were paid slightly lower than the national average ($17.41) and about $1.50 less per hour than in general medical and surgical hospitals ($18.18), but better than those in home health care services ($15.46) and individual and family services ($16.05).

- Home Health and Personal Care Aides. Average hourly earnings for aides in skilled nursing ($15.44) and senior housing ($15.45) were also competitive compared with the national average ($14.87) and other industries and healthcare settings, including individual and family services ($14.87) and home health care services ($14.26), which employed the largest number of aides across all healthcare industries.

The complimentary state occupational employment and wages report at the end of this article provides state level data.

Exhibit 2 – Wage Rates in Senior Housing, Skilled Nursing, and Select Healthcare Industries

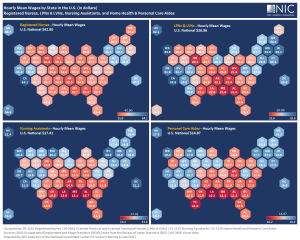

Hourly Mean Wages by State in the U.S. for Registered Nurses, LPNs & LVNs, Nursing Assistants, and Aides

Exhibit 3 below shows that hourly mean wages vary significantly by state. The states colored in blue have hourly mean wages above the national average while the states colored in red have hourly mean wages lower than the national average.

Across the four occupations – Registered Nurses, LPNs and LVNs, Nursing Assistants, and Home Health and Personal Care Aides – most of the states in the Northeast and West regions reported hourly mean wages higher than the national average. Some of these states include New York, Massachusetts, New Jersey, Connecticut, Washington DC, California, Oregon, and Washington. Conversely, most of the states in the South and Midwest regions reported hourly mean wages lower than the national average. Some of these states include Florida, Texas, Georgia, Alabama, Ohio, Michigan, Indiana, and Wisconsin.

In certain cases, hourly mean wages in Northeastern and Western states are nearly one-and-a-half to double the wages of Southern and Midwestern states.

While the phrase “location, location, location” emphasizes the importance of selecting a well-suited location for senior housing and skilled nursing properties to ensure various essential factors, including accessibility to amenities, community engagement, support networks, and proximity to family. In an era of rising costs, tighter operating margins, and capital market constraints, the variation in workers’ wages across different regions can be a significant consideration when determining the ideal location for future developments. This factor acknowledges the importance of balancing operational costs and potential labor availability while ensuring the financial sustainability of new projects.

Exhibit 3 – Hourly Mean Wages for Registered Nurses, LPNs & LVNs, Nursing Assistants, and Aides

The relationship between labor and resident or patient demand for the senior housing and skilled nursing sectors is critical. Despite offering competitive wages compared with other healthcare industry groups, both sectors face ongoing challenges in attracting and retaining workers, particularly in skilled nursing. The employment levels in skilled nursing remain below pre-pandemic levels, and the unavailability of labor hinders the admission of new residents in some instances.

Labor availability continues to be a major challenge for the skilled nursing and senior housing sectors, largely due to low unemployment rates, a shrinking labor force, the retirement of existing staff members as they age in place, challenges in finding childcare and other pressing family demands for many staff, competitive industries offering equivalent wages for potentially a less stressful job, and immigration policies.

NIC’s complimentary state occupational employment and wages report provides other measures of job intensity or concentration: (1) labor concentration ratio, where the ratio is defined as the number of employed workers in a specific occupation per 100 persons aged 80 and older, i.e., how many workers are employed per older adult, and (2) employment-to-bed ratio (EB Ratio), where the ratio is defined as the total number of persons employed in skilled nursing by a specific occupation per 100 certified beds. Both the EB and labor concentration ratios are an important distinction in the context of policy discussions currently underway regarding staffing mandates. For example, if staffing mandates were to change, skilled nursing facilities in states where these ratios are low may be required to implement higher minimum nursing staff-to-resident ratios, and meeting those requirements could be challenging due to the lack of potential persons qualified to fill those positions. See the complimentary state occupational employment and wages report at the end of this article for more details.

This article has highlighted the state of the labor market for nursing staff and aides in skilled nursing, senior housing, as well as adjacent healthcare industries. In addition, NIC Analytics compiled 2022 data from the Bureau of Labor Statistics (BLS) to provide a detailed overview of occupational employment and wages by state and across different industries and occupations, available to download below or on our website. For questions about the complimentary state occupational employment and wages report, please contact us at analytics@nic.org.

Complimentary State Occupational Employment and Wages Report (PDF)

Complimentary State Occupational Employment and Wages Report (Excel)

Innovation in Senior Living Improves the Lives of Residents & Staff

by Aubrey Haenlein, Vice President, Acquisitions & Asset Management, Omega Healthcare Investors

How can technology be used to improve resident outcomes, improve resident engagement, reduce staff burnout, and create efficiencies that improve the bottom line for an organization? These are questions Omega Healthcare Investors has been asking in recent years. There have been many exciting innovations in the senior living and care space that have the potential to be enormously impactful to resident outcomes and the quality of life for residents. Additionally, there are secondary benefits to many of these technologies that benefit staff and even provide safeguards for liabilities operators face when adverse events occur.

How can technology be used to improve resident outcomes, improve resident engagement, reduce staff burnout, and create efficiencies that improve the bottom line for an organization? These are questions Omega Healthcare Investors has been asking in recent years. There have been many exciting innovations in the senior living and care space that have the potential to be enormously impactful to resident outcomes and the quality of life for residents. Additionally, there are secondary benefits to many of these technologies that benefit staff and even provide safeguards for liabilities operators face when adverse events occur.

“At Omega, it is important for us to support our operating partners by finding technologies that are easy to use and have an immediate impact to operations and the lives of the residents our operating partners serve. For these reasons we are thrilled to partner with companies like SafelyYou, Neteera, TSO Life, and Sentrics,” said Vikas Gupta, Senior Vice President of Acquisitions and Development when asked why technology has become so important to Omega in the past few years.

Omega’s senior leadership team believes that care-based technologies that serve as an augmentation to human care will be the most impactful for our operating partners and the residents they serve. For this reason, Omega has partnered with companies like Safely You and Neteera.

SafelyYou’s artificial intelligence (“AI”) enabled video monitoring goes a step beyond fall detection to fall prevention. As many as 94% of falls in senior living settings are unwitnessed. AI-enabled cameras, used with consent, only record when there is a fall event and immediately notify care staff. SafelyYou’s expert support team understands the root cause of falls which results in the reduction of 40% of falls and 80% of ER visits. Ultimately, if a resident with dementia lowers themselves to the floor but is unable tell staff how they arrived there, the staff can review the footage captured by the AI that tells them how to effectively respond to the situation and evaluate the wellbeing of the resident. By avoiding a costly visit to the ER, the families of the resident save time and money. Additionally, the limited footage that is saved from a fall event can protect the operator from liability as there is concrete evidence that their staff responded appropriately.

Neteera offers image-free continuous contactless monitoring that senses vitals through clothing and integrates into existing electronic medical record software. This technology reduces clinical blind spots by using AI to analyze trends, predict outcomes, and generate alerts, while ultimately reducing staff burnout from repetitive vital sign collection tasks. As the level of acuity of residents in all care settings continues to rise, virtual care models augment the care provided by overtaxed staff, resulting in better resident care and liability risk mitigation.In an environment where operators are flooded with new technologies and margins are thin, Neteera can quite literally pay for itself as it can be submitted as a reimbursable expense for Remote Patient Monitoring.

Resident outcomes shouldn’t be limited to clinical outcomes. As residents enter senior housing or higher acuity settings like skilled nursing, it’s important to ensure that they are offered the highest possible quality of life within these settings. For these reasons, Omega has partnered with TSO Life and Sentrics.

TSO Life’s mission is to build happier, more connected senior living communities using voice-to-text technology and AI to build resident profiles. This allows intake managers to replace the process of verbally going through a survey with a clipboard and a pen then manually entering the data with conversation that is recorded and transcribed using voice-to-text technology. Data is aggregated and used for friend matching based on shared interests and life experiences, event recommendations, and more tailored activities based on resident interests. Updates about a resident’s community participation can be automatically delivered to their families and used to track their quality of life and engagement levels over time. The data collected from residents can improve marketing insights that enable communities to attract new residents within key demographics.

Sentrics offers a suite of solutions for senior living but Omega and its operating partners have concentrated on their solutions for resident entertainment and engagement. Entertain360, a Sentrics product, is an easy-to-use platform that integrates resident TV, internet, and voice services seamlessly. Intuitive, in-room entertainment options are selected by the community to match resident interests, and larger-button voice-enabled remotes are designed for seniors. Bundled services for TV programming, secure internet, and voice coupled with 24/7/365 live support ensures ease of use for communities and simplified management of these services.

Huge opportunities for new products and innovation remain in senior living. One example is improving the resident’s physical environment including air quality, lighting, and temperature control. As a secondary benefit, many of the solutions that currently exist within this space also increase the energy efficiency of a facility which has a direct impact on utility spend. This is particularly beneficial to older physical plants, which is the case for many skilled nursing facilities as many are decades old. Elderly people, especially those with dementia, have increasing difficulty regulating their circadian rhythms. Solutions such as spectrally optimized circadian LED lighting can help regulate sleep and wake windows while also potentially reducing depression and agitation in residents with dementia. Zone temperature control and monitoring can be utilized to identify issues and improve energy efficiency while also ensuring residents are comfortable within their environment.

Many technologies exist today that can improve the resident experience and outcomes. As AI continues to be enhanced and new applications are developed for the sector, it will be wonderful to see how it can continue to improve the quality of life of those we care for in our communities and those who dedicate their lives to serving our residents.