Lessons Learned on the COVID Response: A Conversation with Andy Slavitt

If you’ve ever listened to the podcast, “In the Bubble with Andy Slavitt,” you know he isn’t shy about expressing his opinions. An outspoken commentator on the government’s COVID response, Slavitt offers the perspective of an insider. He is the former Acting Administrator of the Centers for Medicare and Medicaid Services (March 2015 to January 2017), and senior advisor at the Bi-Partisan Policy Center.

If you’ve ever listened to the podcast, “In the Bubble with Andy Slavitt,” you know he isn’t shy about expressing his opinions. An outspoken commentator on the government’s COVID response, Slavitt offers the perspective of an insider. He is the former Acting Administrator of the Centers for Medicare and Medicaid Services (March 2015 to January 2017), and senior advisor at the Bi-Partisan Policy Center.

Slavitt is a featured speaker at the upcoming 2020 NIC Fall Conference, joining a distinguished Main Stage panel to debate healthcare policy just prior to the election.

NIC President and CEO Brian Jurutka recently talked with Slavitt about where the industry is headed amid the COVID crisis. Here is a recap of their conversation.

Jurutka: A number of changes in payment policies at the Centers for Medicare and Medicaid Services (CMS) have made it easier to deliver telehealth services. What are the implications of these changes?

Slavitt: Telehealth is a great example of how a healthcare system can change quickly when it wants to and needs to. Once business models were threatened by the pandemic, everyone jumped into action. That tells us that if there is a crisis, the system can react and respond. There’s a pretty good consensus among all the major players that telehealth will continue to grow. Telehealth is good for patients, good for care providers, and a good way to keep people healthier whether there’s a pandemic, or not.

Jurutka: Will telehealth services continue to be used to manage the underlying health conditions of seniors?

Slavitt: We’re finding new digital ways to connect seniors to their healthcare providers. Most everyone sees the benefit in this. Patients like being able to talk to doctors and nurses over telemedicine, and practitioners like it too, which may be the most important piece for long-term adoption. And there are many more use cases than we first thought.

Jurutka: What about the government’s role in telehealth?

Slavitt: It’s unpredictable whether legislators will step in despite widespread support of telehealth because of the way things work in Washington. Legislators make trade-offs and popular initiatives often fall through the cracks. But I think there will be a lot of pressure to keep as many of these telehealth advances as possible with some exceptions. Medical societies may object to telehealth services that cross state lines. Issues might also reemerge on reimbursement.

Jurutka: Do you see permanent changes in the healthcare delivery system because of the COVID-19 pandemic? What are the most important changes?

Slavitt: I wrote a piece about this in the July 2 issue of the Journal of the American Medical Association. I break the question into tactical lessons learned, such as the need to stockpile personal protective equipment (PPE); and the profound, long-term lessons learned.

The most interesting question relates to the long-term lessons. First, people who are tethered to healthcare through employment suddenly became uninsured. Five million people lost coverage. Many more are at risk of losing coverage. The notion parallels the growth of new employment structures such as gig and contract jobs or multiple jobs. This does not impact seniors, but there is a spillover effect as employer-based coverage diminishes, putting pressure on margins for all providers.

Another long-term lesson relates to insurance companies that have collected premiums during the pandemic even though many people have not been going to the doctor. This will shine a light on the issue. One answer is capitation, paying a set amount for each patient tied to a quality outcome. All payors should pay the same rate. As a result, healthcare providers will consolidate, and small physician practices will likely go out of business.

The third lesson is the most important and relates to health equity and structural disparities in the healthcare system. Providers have been aware of this, and the American public is becoming more aware of the issue because of the COVID-19 crisis. Low-income seniors, immigrants, rural populations, and other marginalized groups receive poor care. The care experience needs to be restructured for each segment of the population. There should be more focus on less-resourced groups, such as older and sicker patients. I hope we can put these long-term lessons from the crisis to good use, but there’s no guarantee we will.

Jurutka: What are some steps the healthcare system can take to address inequities?

Slavitt: We must rethink the care delivery experience for those who face real barriers to stay healthy. Maybe they don’t have access to a car or can’t take time off work because they’re paid by the hour. We’ve built a healthcare system for the patient with an average or above average income. But if the health outcomes are vastly different between top earners and those at the bottom even though the groups’ underlying medical conditions are similar, we should focus on those at the bottom. We need to look at the complicating factors in their lives, such as employment and housing. If we build the system around a suburbanite with a decent income who speaks English, then we are going to deliver inferior results.

Jurutka: Healthcare costs are at 18% of GDP and Medicare is a huge component of federal spending. Is that an argument for value-based care?

Slavitt: It is an argument for value-based care. But I don’t think that value-based care is a silver bullet for costs. I get troubled when I hear people use value-based care as a substitute for cost reduction. We have a unit cost problem across the healthcare system. We have a utilization problem across the system, and we have an underutilization problem among certain groups who are not staying healthy.

Jurutka: In your view as a former CMS administrator, has the importance of delivering healthcare to seniors where they live changed the role of skilled nursing or private pay senior living providers?

Slavitt: We may be in the beginning stages of a reinvention process regarding the value proposition in senior living and skilled nursing. The crisis has given the public reason to question the safety at these facilities. It will be the job of the industry and regulators to change that perception. This is potentially a big threat to the industry, but also an opportunity. The industry can focus, redefine the value proposition, and demonstrate real value. But the industry must give credence to the challenges and talk about solutions. Regulators will step in if operators don’t address disparities.

Jurutka: If this crisis is an opportunity to rethink and reconfigure long-term services and supports, especially for high-risk elders, where would that funding come from?

Slavitt: Where it always does—the government.

Jurutka: NIC is funding a study right now to look at impact of COVID-19 on older Americans by care setting. The data will help us understand best practices.

Slavitt: It must start with an honest examination that can be communicated to the public. People need to be able to understand their options and see a solution.

Policymakers, business owners, healthcare practitioners, and service providers need to be part of the conversation.

Jurutka: How has the pandemic impacted services that support those in the broader general community?

Slavitt: Home services have gotten a boost because they allow people to be in comfortable settings and remain safer from infection. There are, of course, complicating issues. If you think it is hard to regulate safety in a nursing home, think how hard it is to regulate safety in hundreds of thousands of people’s homes. But it’s still what people want. I think that will be part of the solution.

Jurutka: Lately, CMS has announced an aggressive strategy for required testing in skilled nursing facilities, with significant fines attached to failure to meet protocols. Given the continued lack of availability of tests, delays in test results, and conflicting policy between local, state, and federal authorities, what advice do you have for providers?

Slavitt: I would love to see the industry ask for help and specify its needs. The industry could say we have an ongoing crisis, and we’re doing our best to care for people, but here’s what would help us. We need PPE. We need regular testing. We need help with building maintenance and on a number of other fronts. We will get through this and be better for this, but in the meantime, people’s lives are still at risk. The industry could articulate this in a letter to the American public in newspapers and on television. That puts the burden on everyone.

Along with that, the industry should become more transparent. The first time I hear the name of a nursing home should not be after 25 people there have died. That makes it look like the facility was hiding something. That’s probably not the case, but the public didn’t know there was a problem. Facilities could promise to report publicly on a weekly basis. It feels like a risky thing to do, but it’s a lot less risky than not being transparent.

Jurutka: Can transparency help build trust for investors, operators, policymakers, elders, and adult children?

Slavitt: One of the things that is coming out of this crisis is that the public is much less trusting of what they see and hear. They feel they were sold a bill of goods on whether the virus was real and on magic solutions. They didn’t get enough data about what was happening. The industry should be able to look back five years from now and say it is in a better place with the public because the crisis was used as an opportunity to really gain that trust.

Be sure to catch Andy Slavitt alongside Mark Parkinson, President and CEO of AHCA/NCAL in a Main Stage policy discussion moderated by award-winning journalist, Soledad O’Brien. Register now for the 2020 NIC Fall Conference.

The 2020 NIC Fall Conference: More Than Just a Webinar

The seniors housing and care sector’s most important annual event will be virtual – but don’t make the mistake of thinking it’s become just another webinar. While the 2020 NIC Fall Conference does share a few features with other events that many of us have attended in this year of virtual conferences, it stands apart as a truly interactive, socially engaging convening of leaders, full of opportunities both to share knowledge and to connect with peers.

In short, the ‘essential virtual experience’ is unique, powerful, and well worth your time. Here are just some of the features and experiences you can expect to encounter, as you and your team prepare to gain maximum value from the many opportunities offered at ‘the NIC’ this year. In many cases, the event incorporates virtual technologies that simulate in-person experiences while others are unique to an online environment.

In short, the ‘essential virtual experience’ is unique, powerful, and well worth your time. Here are just some of the features and experiences you can expect to encounter, as you and your team prepare to gain maximum value from the many opportunities offered at ‘the NIC’ this year. In many cases, the event incorporates virtual technologies that simulate in-person experiences while others are unique to an online environment.

Bump into Friends and Say Hello via Video Chat

The “Essential Virtual Experience” event platform will enable you to see who’s in the room with you, allowing for the kind of chance encounters many attendees experience as they move through a traditional conference. See someone you know? Send a chat to say “hello.” Better yet, invite someone for a video chat to talk one-on-one for up to 10 minutes. You may run into attendees in the virtual Lobby, in the Connections Lounge, or in the Partner Spotlight Zone. You will also be able to see who else is viewing an educational session. Throughout the conference, you can also send and receive emails inside of the event platform, so be sure to check your inbox often.

Peer-to-Peer Connections

Join your peers to share perspectives on timely industry topics. The discussions within the Peer-to-Peer Connections are geared towards creating a community of dialogue on emerging ideas that can provide fresh perspectives and innovative approaches. Gaining insight on how fellow industry professionals are tackling hot button issues can make all the difference in how you navigate your business as you explore various options and potential paths forward. This forum is open to all interested participants.

The NIC Community Connector™

Perhaps the most exciting innovation tied to this conference is the launch of the NIC Community Connector. All attendees who complete the profile registration gain exclusive, complimentary access to NIC’s powerful new networking platform; a custom designed ‘LinkedIn’ style system built to suit the needs of capital providers, owners, operators, service providers, and other stakeholders across the seniors housing and care sector. The innovative online platform provides a means to search for potential new contacts, and to communicate directly with decision-makers.

While launching in parallel with the 2020 NIC Fall Conference, the complimentary NIC Community Connector will remain accessible to all attendees through the end of the 2020 calendar year. Subscribers will retain their access to a powerful set of tools that will streamline efforts to identify financing partners, seek property transactions, and build and grow networks.

The NIC Community Connector is now live. With a completed profile registration, you can now connect with others and access the Attendee Listing. Also, keep checking the platform, as more people sign up, the more powerful it will become. Look for new features, which NIC will continue to roll out this year, providing subscribers with ever-more sophisticated year-round networking capabilities.

Don’t Miss NIC Talks

Our popular NIC Talks series returns—featuring another group of uniquely qualified, passionate thought-leaders, including business leaders, academicians, and leading advocates, sharing their perspectives on the question, “How will COVID-19 impact the future of aging and aging services?”

Presented in the style of “TED Talks,” these popular sessions often pack a powerful punch. Attendees can look forward to viewing the presentations (available on-demand for convenience) in the first ‘Education’ Week of the conference. During the second ‘Connections’ Week, attendees can participate in Zoom calls, led by some of the NIC Talks presenters, for interactive group discussions.

Schedule Your One-on-One LinkedIn Consultations

Veteran attendees know that NIC conferences often feature a ‘LinkedIn™ Corner,’ complete with LinkedIn experts, to help them take their online networking platform to the next level. This year is no different. Book appointments with branding experts to receive one-on-one 30-minute live video coaching sessions to discuss how to maximize your LinkedIn profile to build your brand. Appointments can be scheduled now and will take place daily during Connections Week (October 13-15) from 1:00–5:00 p.m. EDT. There are only 48 slots available, so book early!

Virtual Rooms

The virtual environment mimics our typical in-person conference space. Just as you might familiarize yourself with the conference physical layout, we recommend you survey the landscape of our online event. Don’t worry, the space is intuitive and easy to navigate, well-signposted, and can be fully traversed with the click of your finger.

Lobby

The Lobby is your home base. It is the central hub from which you can access most of the rooms of the virtual event platform. Don’t forget to look around you and see if any acquaintances are there with you. In this environment, just as in person, you can wave and start a conversation.

Partner Spotlight Zone

Visit NIC’s Premier and Official Partners to connect with their company representatives in the Partner Spotlight Zone. Be sure to make those essential business connections. From here, you can also watch the short videos of Partner Highlights, well worth viewing, particularly if you’re engaged or considering engaging with them in your business.

Connections Lounge

An all-purpose networking space, the Connections Lounge is the place to go for a host of opportunities to see and be seen, and engage with peers during both weeks. This room hosts public chat sessions, video happy hours, one-on-one LinkedIn consultation scheduling (reserve an appointment early), and provides access to the NIC Community Connector and the braindate™ platform.

Main Stage

NIC will host our keynote sessions as well as a few entertainment offerings on the Main Stage. Don’t miss award-winning journalist Soledad O’Brien, moderating a discussion with Mark Parkinson, president and CEO, American Health Care Association (AHCA) and National Center for Assisted Living (NCAL), and Andy Slavitt, senior advisor for The Bipartisan Policy Center and former Acting Administrator of the Centers for Medicare and Medicaid Services. Here, household names and political commentators David Brooks and David Gergen will turn their considerable expertise and experience – and wit – to shed light on the factors to consider as November 3 approaches. This election has the potential to impact the seniors housing and care sector both directly and indirectly, and many attendees will be watching this discussion closely.

Concurrent Sessions

You will come to this room for educational sessions, peer-to-peer video connection sessions, wellness sessions, and NIC MAP® Data Service user group peer-to-peer discussions. You can also come here to see what sessions are coming up, and which ones are currently taking place. Most sessions are available on-demand once they have taken place. Simply visit this space and find the sessions you wish to review at your convenience. Session details and schedules are here.

NIC Resource Center

In the NIC Resources room, attendees can access NIC publications such as the just released NIC Investment Guide, Sixth Edition, and the Seniors Housing & Care Journal 2020. Links are also provided to access, and subscribe to, the NIC COVID-19 Resource Center, NIC Notes blog, and NIC Insider newsletter.

NIC MAP® Data Service

Come learn about the sector’s premier provider of seniors housing and care data, NIC MAP® Data Service, in this room. Attendees may schedule a meeting with a NIC MAP product expert, or simply chat about their needs and how the data service can help their business. Information will also be available for download.

Executive Insights

NIC has created important benchmarks on the impact of the COVID-19 pandemic on seniors housing and care that will allow the market to be better informed on a timely basis. Surveys are distributed on a biweekly basis. From the Lobby and the C-Suite lounge, attendees can access Executive Survey Insights – Market Fundamentals data and analysis on the impact of COVID-19 on occupancy rates, move-in and move-out rates, development pipelines, staffing, and supports for frontline community employees and staff.

Operators can also come here to participate in the survey – an important means to improve transparency, which builds trust, as well as to contribute to greater understanding of the impact of this pandemic on the industry.

NIC Actual Rates

The NIC Actual Rates Initiative is driven by the need to increase transparency in the seniors housing sector and achieve greater parity to data that is available in other real estate property types. The reporting by the NIC MAP Data Service of accurate data on the monthly rates that seniors housing residents are actually paying compared to properties’ asking rates helps the sector achieve this goal.

Enter this space to schedule a meeting or chat directly with a NIC Actual Rates representative to learn more about this important NIC initiative, or to download more information.

Take a Moment for Yourself

In keeping with traditional NIC events, the virtual experience offers opportunities for personal enrichment and relaxation. Take a break to focus on yourself and join in the fun for a special shared experience. There are so many opportunities to interact with peers, thought-leaders, and prospects, that it’s important to take these breaks before heading back into the fray.

Brand, Brain, and Being Sessions

This series of sessions offers attendees a chance to focus on themselves and gain expert insights on improving personal brand, productivity, creativity, and overall wellness. The ‘Brand’ session offers advice on improving your personal brand to showcase your best self. In the ‘Brain’ session, attendees will learn how to build life-changing habits and explore some of the apps and tools they can use to boost productivity, time management, creativity, and new ways to create value. The ‘Being’ session focuses on mental and physical health, featuring tips on well-being; advice on essential oils, how to avoid burnout, how to be happy, and self-love.

Hamilton and Young@Heart Chorus

The NIC always exceeds expectations, not only for pure business value, but among the best perks of the year. This year, allow us to transport you from live networking and industry thought-leadership (for an hour or so) with exclusive performances from Broadway’s most popular show, as well as one of the most unique, engaging, and inspiring groups performing today.

Hamilton

Go behind-the-scenes with stories from the already legendary show, and be transported, as Broadway and film cast members perform exclusive “Hamilton” songs that are simply not to be missed.

Spend some time with the Grammy Award-winning New York vocalist, Sydney James Harcourt, who played Aaron Burr on Broadway, featured in the Disney+ film, and also performed in the famous Obama White House performance.

Lexi Lawson made her Broadway debut replacing original cast member Phillipa Soo as Eliza Hamilton in 2016. Fans also know her from the leading role in the first national tour of “In the Heights,” as well as her portrayal of Mimi in the “Rent” national tour.

Young@Heart Chorus

Ranging in age from 77 to 92 years old, the Young@Heart performers prove that you can grow old without growing boring. With over 50 international tours under their belts, their musical careers were launched long after retirement.

Don’t worry. Like many sessions, these special entertainment break sessions will be available on-demand, to fit your busy schedule.

For further details on all the above, as well as schedule information, and other Conference-related resources, please visit the 2020 NIC Fall Conference website.

NIC Announces Future Leaders Council Class of 2023

The Future Leaders Council (FLC) Oversight Committee has announced its selections for the FLC Class of 2023, as well as the FLC Leadership Team for 2020-2021. Established in 2009, the FLC has come to represent the best and the brightest of the industry, continually attracting emerging leaders with fresh perspectives, innovative ideas, and an abundance of energy and drive.

The FLC for the 2020-2021 term is comprised of 25 professionals who were nominated for membership by companies in the seniors housing, skilled nursing, and finance sectors that have volunteered time and resources to support NIC’s mission. Members of the FLC contribute to the work of NIC committees and task forces, get the chance to develop volunteer leadership skills, and have opportunities to form meaningful professional relationships with current NIC leaders.

The selection of FLC members is a highly competitive process. Nominations originate from senior level executives within their respective companies. In its selection of members for the incoming class, the FLC Oversight Committee focuses on candidates with passion, commitment, strong leadership potential, the ability to think creatively and strategically, and five to ten years of relevant work experience. Membership in the FLC requires a three-year commitment, and attendance at quarterly group meetings.

In announcing the formation of the FLC back in 2009, Bob Kramer, who was NIC president at the time, said, “As demand increases for housing and care to serve an aging population, so does the need for fresh thinking to handle the unique challenges and opportunities it presents for our industry. In response, we developed the NIC Future Leaders Council to prepare tomorrow’s leaders to face what lies ahead, help grow the industry, and positively impact America’s seniors.”

While no one in 2009 could have foreseen all of the unique challenges presented by the COVID-19 pandemic, NIC’s vision for the FLC, then and now, is to offer emerging leaders the opportunity to hone their leadership skills, address critical issues that impact the industry through NIC’s initiatives, and develop a network of trusted associates and resources. Harnessing the substantial talent of the FLC remains an essential component of NIC’s overall effort to help seniors housing and care adapt, grow, and continue to improve access and choice for America’s elders, well into the future. Given the passion and enthusiasm of this new class of FLC volunteer leaders, the future looks bright for NIC and seniors housing and care.

FLC Leadership Team for 2020-2021

- FLC Chair:

Dana Scheppmann

Senior Vice President, Capital One Healthcare

FLC Class of 2021 - FLC Vice Chair:

Courtney Nickels

Senior Vice President, Artemis Real Estate Partners

FLC Class of 2021 - FLC Vice Chair:

Kari Onweller

Vice President, Invesque

FLC Class of 2022

Incoming FLC Class of 2023

- Craig Ahlstrom

Chief Operating Officer, Director of Development

Avista Senior Living, Mesa, AZ - Holly Ballarotto

Chief of Staff

Brandywine Senior Living, Mt. Laurel, NJ - Matthew Derrick

Senior Development Director

Confluent Senior Living, Denver, CO - Audrey Griffin

Relationship Manager/Assistant Vice President

Wells Fargo, Washington, DC - Samantha Medred

Director

Health Trust, Sarasota, FL - Emma Rosen

Director of Acquisitions

RSF Partners, Dallas, TX - Michael Segal

Managing Director

Blueprint Healthcare Real Estate Advisors, Chicago, IL - Jennifer Wong

Vice President, Acquisitions

AEW Capital Management, L.P., Boston, MA

Executive Survey Insights | Wave 11: August 17 – August 30

By Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector.

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector.

This Wave 11 survey sample includes responses collected from August 17 to August 30, 2020, from owners and executives of 56 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Key Takeaways

- Over the summer months, much of the southern and western portions of the nation experienced a surge in COVID-19 outbreaks. More recently, this has been followed by a flattening in the number of new cases reported daily. Although some areas of the country are seeing increasing cases of COVID-19, many seniors housing and care organizations are continuing to ease move-in restrictions.

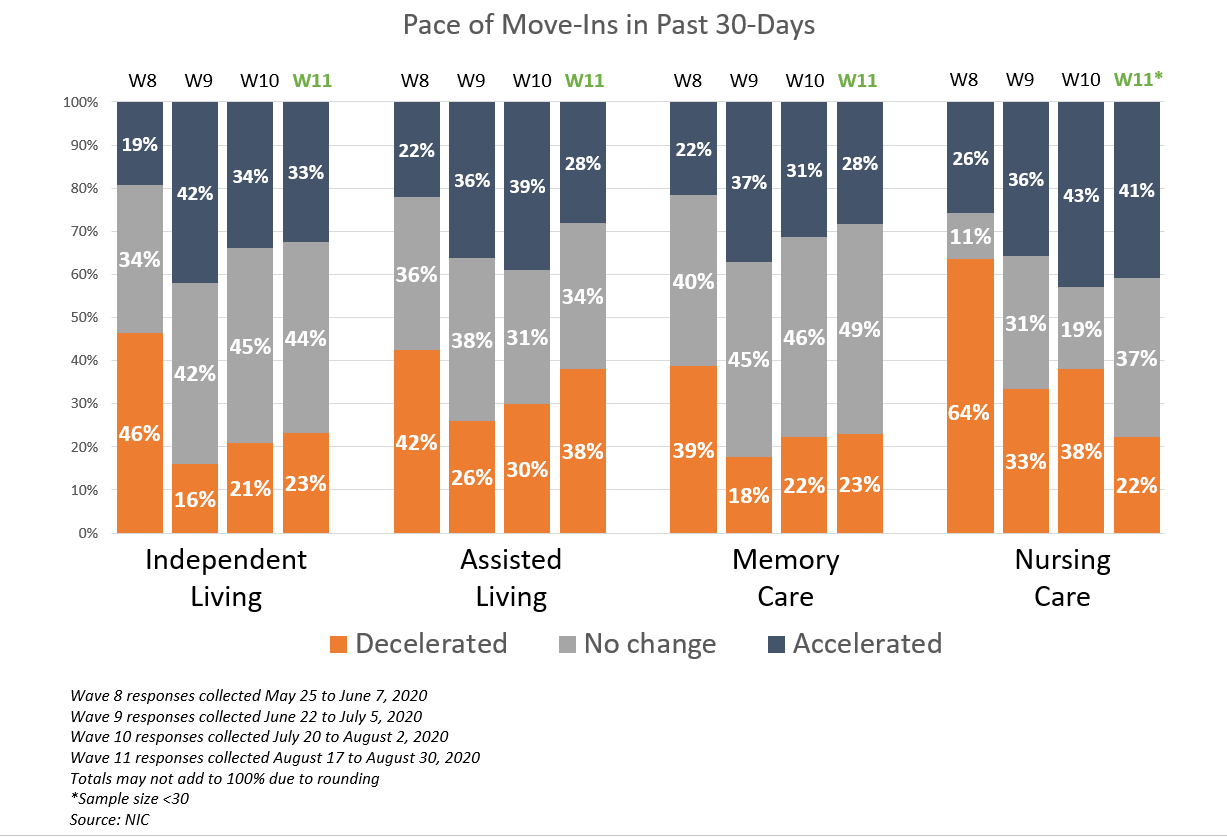

- The Wave 11 survey revealed generally little change in the pace of move-ins and move-outs in the past 30-days from Wave 10, and greater shares of organizations with higher levels of acuity in their properties—nursing care beds and memory care units—reporting month-over month and week-over-week improvements in occupancy rates.

- About half (48%) of organizations with independent living units and 40% with assisted living units reported no change in month-over-month occupancy. More organizations with assisted living units noted a deceleration in the pace of move-ins and fewer organizations reported an increase in occupancy rates than in Wave 10.

- Notably, more organizations in Wave 11 than in all of the prior waves of the survey cited resident or family member concerns (74%), presumably due to restrictions on family member visitation rules imposed by some states.

- Due to the pandemic most organizations (83% to 85%) have bolstered staffing deficiencies with additional overtime hours. Additionally, a growing percentage of survey respondents reported tapping agency or temp staff (48% in Wave 11 vs. 36% in Wave 3) adding to increasing costs since the pandemic began.

Move-In Restrictions Continue to Ease, Resident/Family Member Concerns Grow

Roughly two-thirds (63%) of organizations with multiple properties in their portfolios were easing move in restrictions in some or all of their geographies in Wave 11, compared to roughly half in Wave 10. Among single-site organizations, roughly half were easing move-in restrictions (47%), but none were increasing move-in restrictions.

The shares of organizations reporting accelerations and decelerations in the pace of move-ins in the past 30-days in Wave 11 of the survey remained similar to Wave 10 for the independent living and memory care segments. In Wave 11, fewer shares of organizations reported decelerations in move-ins within the nursing care segment, however, more reported decelerations in move-ins in assisted living.

- Regarding reasons for a deceleration in move-ins, resident or family member concerns reached its highest level to date in the survey time series. While notably fewer organizations in Wave 11 than in Wave 10 cited a slowdown in leads conversions/sales (48% vs. 70%), considerably more organizations in Wave 11 than in all of the prior waves of the survey cited resident or family member concerns (74%).

Less Change in Independent Living and Assisted Living Occupancy Rates

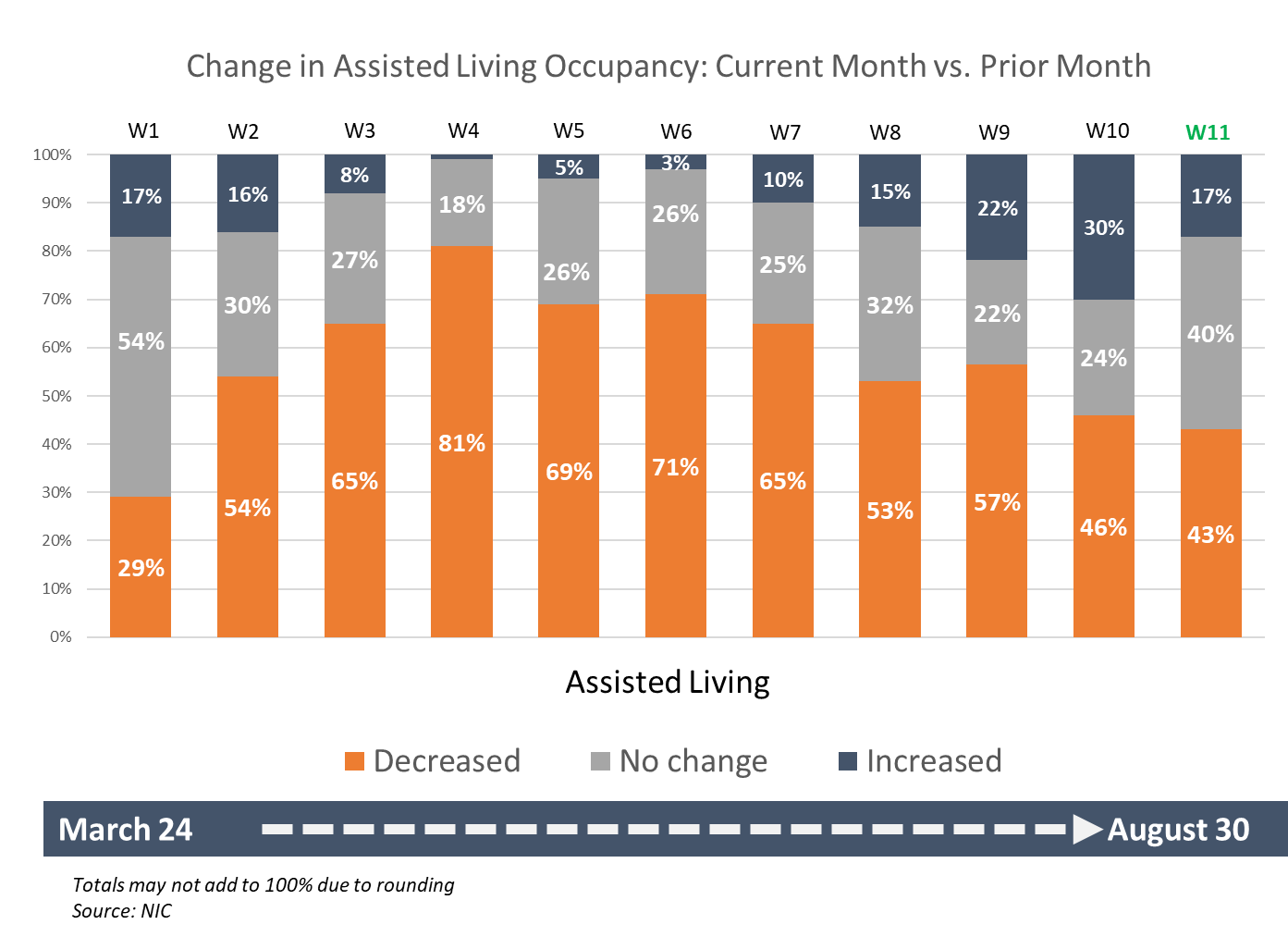

In Wave 11, about half (48%) of organizations with independent living and 40% with assisted living reported no change in month-over-month occupancy. Fewer organizations with assisted living units in Wave 11 than in Wave 10 reported increases in occupancy rates (17% vs. 30%), however, more organizations with memory care units noted increases in occupancy (40% vs. 20%). The nursing care segment had the largest shares of organizations with increasing month-over-month occupancy.

The chart below shows the entire time series of assisted living care segment month-over-month occupancy change data for each wave of the survey between March 24 and August 30, 2020. The data is illustrative of effects of the pandemic on seniors housing occupancy rates during the pandemic, and the trend is similar to the NIC MAP® Intra-Quarterly Snapshot data reported beginning in March.

Indeed, the new Intra-Quarterly database shows that the largest decline in assisted living stabilized occupancy occurred early during the second quarter in the April reporting period, the first full month of the COVID-19 pandemic in the US. In the April reporting period (defined as the February-March-April rolling period), occupancy for assisted living for the Primary Markets fell 1.8 percentage points to 86.0%. The decline in May was less at 0.8 percentage point (to 85.2%), and the decline in June was even less at 0.6 percentage point (to 84.6%). However, in July, the drop in occupancy accelerated to a full 1.7 percentage points to push the overall rate to 82.9%. Total occupancy was even lower at 80.5%, a new record low. This decline, after two months of seemingly better occupancy patterns, likely reflects the recent growth in COVID-19 cases in many parts of the country.

In Wave 4 of the Executive Survey (responses collected April 20-April 26, 2020) four out of five organizations reported occupancy declines from one month prior (81%). Occupancy rates began to improve in Wave 8 (responses collected May 25-June 7, 2020), with the highest shares of organizations reporting increases in occupancy in Wave 10 than at any other time during the survey (30%). In Wave 11, the largest share of organizations with assisted living reported no change in month-over-month occupancy (40%) since Wave 1 of the survey when about half indicated no change (54%).

The Executive Survey Insights is the longest running pulse of the industry survey since the start of this pandemic. We’re asking for your input. By providing real-time insights you can help ensure the narrative on the seniors housing and care sector is accurate. By demonstrating transparency, you can help build trust.

“…a closely watched Covid-19-related weekly survey of [ ] operators conducted by the National Investment Center for Seniors Housing & Care…”

— The Wall Street Journal | June 30, 2020

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the Executive Survey Market Fundamentals, please send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space.

NIC Skilled Nursing COVID-19 Tracker

By Omar Zahraoui, Data Analyst, NIC

As part of NIC’s continued efforts to increase transparency of the sector and provide timely data in an easy-to-use format, we recently launched a new COVID-19 tracker. This interactive tool available in the NIC COVID-19 Resource Center provides insights into the rate of virus spread within skilled nursing properties and offers a way to better understand where cases are spreading, slowing, or remaining flat. NIC’s Skilled Nursing COVID-19 Tracker¹ captures and reports three different metrics—(1) new COVID-19 confirmed cases per same store properties, (2) new COVID-19 confirmed cases as a share of residents, and (3) occupancy rates (based on CMS Data). In addition, the Tracker lists the incremental week-over-week change rate in all three metrics in same store² skilled nursing properties across regions, sub-regions, states, and counties. The ability to drill down to a smaller market or a specific property can also be done.

The data³ used in NIC’s Skilled Nursing COVID-19 Tracker is taken from the CMS website and is based on data regularly reported by nursing homes to the CDC’s National Healthcare Safety Network (NHSN) system COVID-19 Long Term Care Facility Module. The CDC started to report data on May 24, 2020. However, numbers for that week include reporting for any time from January 1 through May 24, 2020. The Tracker reports data starting from May 31 to better capture the incremental confirmed cases on a week-over-week basis.

Key Takeaways

New COVID-19 Confirmed Cases Share of Residents

Based on the CMS data depicted in Exhibit 1, the share of residents with newly confirmed COVID-19 diagnoses decelerated from 0.85% to 0.47% for the reporting weeks from May 31 through June 21 across skilled nursing properties. Subsequently, this share then reversed its direction for five consecutive weeks to reach a new high of 0.87% in late July before returning to 0.57% in the week ending August 30.

EXHIBIT 1

*Exhibit 1 – Source: NIC Skilled Nursing COVID-19 Tracker

Data from Johns Hopkins depicted in Exhibit 2 show that the overall new confirmed cases across the country followed a similar pattern of peaking in late July and then slipping back more recently, but remained above the low points seen early in the pandemic. Indeed, new confirmed cases decreased during the reporting weeks of May 31 through June 14, then accelerated dramatically to reach a single-day record of 77,255 new cases on July 24.

EXHIBIT 2

*Exhibit 2 – Source: Johns Hopkins Coronavirus Resource Center

By looking at Exhibits 1 & 2 together, it becomes apparent that the incidence of COVID-19 in skilled nursing properties loosely follows the pattern of incidence in the broader population within the U.S.

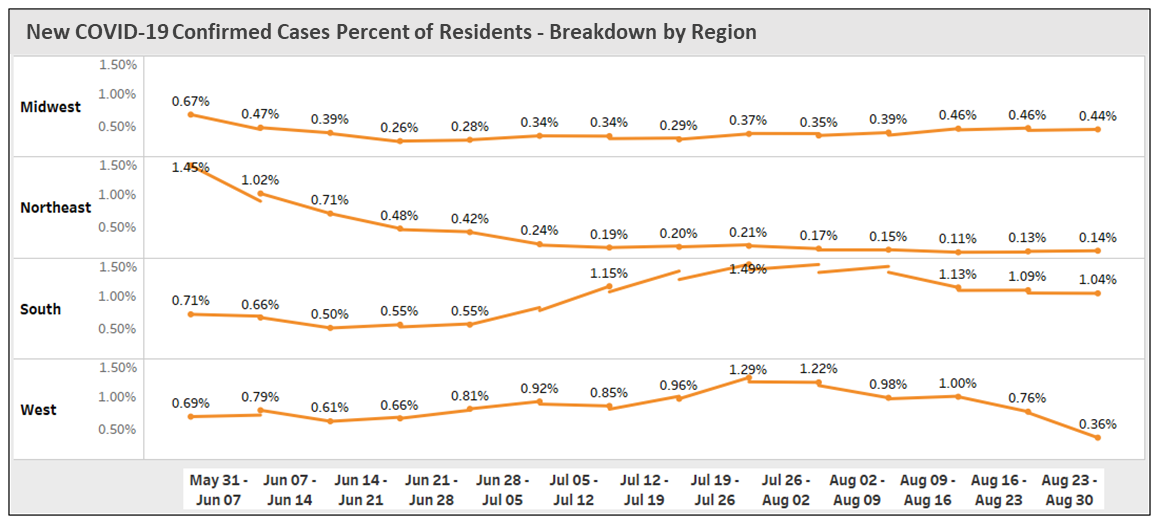

In late May, the reported CMS case figures depicted in Exhibit 3 show that the number of new cases was highest in the Northeast with 1.45% of residents infected and was more than double that of the South (0.71%). This very high level of incidence in the Northeast can be attributed to the severity of the pandemic within that region in the early days of COVID-19 and the relatively higher number of cases compared to all other regions. Skilled nursing properties in the West and Midwest reported 0.69% and 0.67% rates of new cases among residents, respectively.

EXHIBIT 3

*Exhibit 3 – Source: NIC Skilled Nursing COVID-19 Tracker

By August 30, the Skilled Nursing COVID-19 Tracker shows that the highest rate of new confirmed cases occurred in the South, which represented 1.04% of residents tested positive, equivalent to 3,973 new confirmed cases across 4,995 properties, followed by the Midwest (0.44%), West (0.36%), and Northeast (0.14%).

The peak rate of new confirmed cases within skilled nursing properties occurred in the South for the reporting week of July 26 at 5,826, which represented 1.49% of residents, the highest level recorded since May 31 across all four regions. The West region reported 1.29% of new residents infected on July 26, an unprecedented number of new cases of 1,979 since May 31.

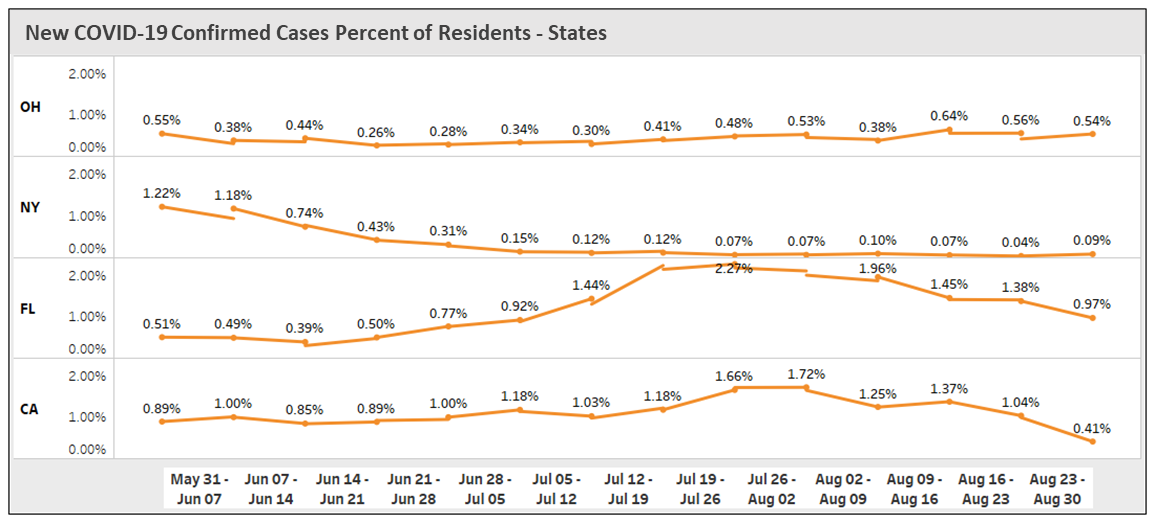

By state, New York skilled nursing properties had very high new confirmed cases as a share of residents for the reporting weeks of May 31 (1.22%) and June 07 (1.18%). As time went on, this was first surpassed by California on July 21 and one week later by Florida. Both states recorded the highest new confirmed cases as a percent of residents on July 26, 2.29% and 1.66%, respectively. This drove region high rates as well.

EXHIBIT 4

*Exhibit 4 – Source: NIC Skilled Nursing COVID-19 Tracker

While there were signs that Ohio’s rate of new cases was slowing down, the new infections surged to reach a new high of 0.64% of residents on August 16.

Exhibits 3 and 4 demonstrate how the coronavirus hot spots are changing over time within the nation. The U.S. map in Exhibit 5 below shows the week-over-week change rate at which the virus was spreading within skilled nursing properties by state between May 31 and August 30.

EXHIBIT 5

*Exhibit 5 – Source: NIC Skilled Nursing COVID-19 Tracker

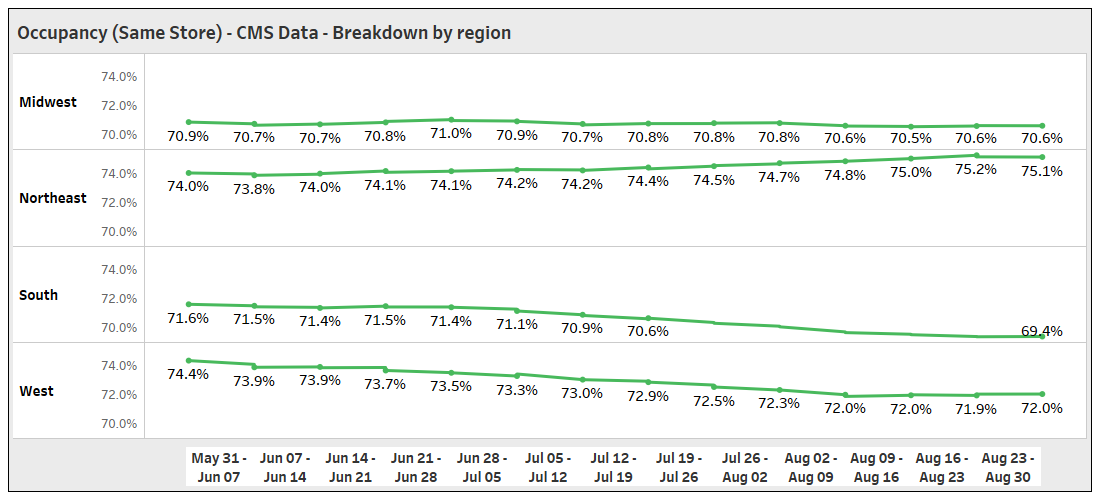

Occupancy (Same Store) – CMS data as of August 31, 2020

EXHIBIT 6

*Exhibit 6 – Source: NIC Skilled Nursing COVID-19 Tracker

CMS data depicted in Exhibit 6 show that skilled nursing occupancy (same store) fell 0.9 percentage point between May 31 and August 9, falling from 72.3% to 71.3%; since then, occupancy has remained low, but stable at 71.3%.

EXHIBIT 7

*Exhibit 7 – Source: NIC Skilled Nursing COVID-19 Tracker

While the South had an occupancy rate of 69.4% on August 30, the lowest rate seen since May 31, the West region’s occupancy rate experienced the largest decline, with a 2.4 percentage points drop in occupancy since May 31 as occupancy fell to 72.0% by August 30.

Overall, skilled nursing properties in the Midwest maintained their weekly occupancy levels between 70.5% and 71.0% over the past three months.

Largely because of the deceleration in new cases of COVID-19 and the week-over-week increase in occupied beds (move-ins), the occupancy rate in the Northeast showed a slight improvement of 1.1 percentage points and has been steadily increasing since May 31. This allowed the Northeast region to come out on top with the highest occupancy rate of 75.1% on August 30.

The U.S. map below shows week-over-week occupancy changes in same store skilled nursing properties by state between the reporting weeks of May 31 and August 30.

EXHIBIT 8

*Exhibit 8 – Source: NIC Skilled Nursing COVID-19 Tracker

Although some communities, counties, and states have been able to bend the curve of new cases, the U.S. is still far from winning the war. Until a vaccine is developed and widespread deployment occurs, the COVID-19 pandemic will continue to impact the sector as well as the broader economy.

It is also important to note that data is critically important and that all efforts that improve transparency and support the reporting of reliable data are laudable. It is through reliable data that an accurate narrative of the impact of the pandemic on the seniors housing and care sector will be created and appropriate plans for future care for seniors can be better determined.

To gain in-depth insights and track the week-over-week change rate for new resident cases of COVID-19 within skilled nursing properties, visit nic.org/SNF-covid-tracker. You can also access the Skilled Nursing COVID Tracker along with a rich trove of analysis and insight on the NIC COVID-19 Resource Center.

For more reading on the effects of COVID-19 in long term care, see the following research articles:

*CMS data – As of August 30, 2020 | Updated September 10, 2020

¹Only those properties that submitted data for the reporting week and passed the CDC’s Quality Assurance checks, are included. Additionally, properties that did not provide total number of beds or occupied beds or where occupied number of beds were greater than total number of beds were excluded.

²Results calculated using “same store” methodology. This methodology includes only those properties that have reported in both comparison time periods (week-over-week). Properties reporting in one but not both weeks are removed from the analysis. Total count using same-store metrics will vary from total geographic count provided directly in CDC data.

³Data is derived from the Nursing Home COVID-19 Public File, the most comprehensive and timely set of data available, as captured by the CDC and reported out by the Centers for Medicare & Medicaid Services (CMS).

Labor and Operating Efficiencies

By Spencer Smith, Chief Financial Officer, Sentio Investments

Typical private pay senior housing communities have significant fixed costs, and operating margins for stabilized assisted living communities usually run in the 25% to 35% range. These communities are highly operationally leveraged, which causes profitability and operating margins to fluctuate significantly with changes in census and revenue. These impacts are particularly acute when increasing expenses are not commensurately supported by higher revenues – such has been the recent trend with labor expenses and asking rents.

Typical private pay senior housing communities have significant fixed costs, and operating margins for stabilized assisted living communities usually run in the 25% to 35% range. These communities are highly operationally leveraged, which causes profitability and operating margins to fluctuate significantly with changes in census and revenue. These impacts are particularly acute when increasing expenses are not commensurately supported by higher revenues – such has been the recent trend with labor expenses and asking rents.

Employee wages are the single biggest expense item on a community’s income statement. Historically, wages and rates largely moved together, allowing operators to preserve margin and grow net operating income by increasing asking rates as employee wages increased. However, for the past three years, wage growth has significantly outpaced rate growth. Given recent COVID-related shifts in the labor markets, the rate of hourly wage growth for assisted living employees may moderate, but the data through second quarter 2020 have not yet proven that hypothesis.

During the same period, new supply has outpaced demand, which has driven competition between communities for new move-ins. The trend in new construction activity has shown signs of reversal in recent quarters, which should help moderate the imbalance of supply and demand. However, in the wake of the ongoing COVID-19 pandemic and resulting occupancy declines, the competition for new residents likely will persist. This will further limit the ability of operators to offset expense increases through increased rental rates and care fees in the near-term.

Additionally, NIC and other organizations have highlighted the need for more affordable senior living options to serve the needs of the middle market. Some of those proposed solutions include models that don’t include care, such as active adult and senior apartments. But, in order to have viable operations for residents who need assisted living services, middle market assisted living communities will need to solve the tension between growing labor expenses and more moderate rental rates.

So where are there opportunities to address the cost of labor in a constrained rate environment?

Ultimately, improvements in labor efficiency and reductions in non-critical tasks will drive middle market feasibility and industry profitability. To date, there does not seem to be a singular technology or staffing strategy to drive labor efficiency, but there are a number of examples of operating modifications that can control labor costs without sacrificing resident care. Operators must remain vigilant with respect to risk-management issues by ensuring that communities are sufficiently staffed to meet resident needs. While these modifications may come with some trade-offs as compared to a resident experience in a high-touch assisted living setting, they can provide cost controls necessary to run a more moderately priced community.

- Shared staff across communities – Certain operators have moved to a model of sharing certain functions such as a marketing director, business office manager, or maintenance director across multiple assets. For example, rather than hiring a full-time maintenance director at each building, managers can cover two or three buildings with a single position. A portion of the total cost of the employee is then allocated to each project. This is particularly true for portfolios of smaller communities and for roles that do not involve hands-on care. A shared staffing model requires a certain amount of scale and functions most seamlessly when there is geographic concentration. Operators also highlight that standardizing processes, such as tracking of routine maintenance tasks and closing out work-orders, is critical to the success of driving efficiency through a shared position.

- Multi-tasked employees – Labor efficiency can also be improved by using the same employees to do multiple tasks. The concept of the “universal worker” has been around for decades, but in many communities, operators prefer that each function has its dedicated staff. There are servers, housekeepers, and caregivers that only provide those services. However, if a caregiver can multitask as a server, or the receptionist can function as the activity coordinator, the community can often reduce the total headcount of employees. Multi-tasking though can come with trade-offs. For example, if the community offers “all day dining,” it is important to have a dedicated staff of servers that are able to facilitate meals at any time. However, if meals are served only at set times, residents will lose some flexibility. That trade-off allows caregivers to work in the dining room as servers or in resident rooms as housekeepers during those set meal times.

- Limited services – Another layer of labor efficiency can come through focusing on critical tasks and reducing non-critical functions and amenities in the community. Providing high quality nutrition to residents is a critical task at any assisted living community but offering an extensive variety of options at each meal is an added amenity that often requires additional kitchen staff. Kitchens can often operate with fewer staff if the cooks can execute on a smaller number of options at each meal. Transportation is another area that can often be covered part-time by an activity director. However, the number and timing of trips needs to be managed more closely to ensure that the part-time driver has sufficient time to complete their other jobs around the community.

Given the trajectory of labor expenses and the current market constraints on rental rate increases, senior living operators need to focus on getting the most out of their most important resources. There are often trade-offs with respect to resident flexibility and amenities, but ultimately, these efficiencies will be necessary in order for the industry to continue to offer critical assisted living services at attainable price points.

Stay current on the most up-to-date labor and staffing trends as well as the impact of seniors housing’s new reality on the middle market by registering now for the 2020 NIC Fall Conference.