Seasoned Pro: Fannie Mae’s Phyllis Klein Shares Her Market Insights

Phyllis Klein

A conversation with Phyllis Klein quickly reveals a true professional with a deep understanding of the senior living business. Her hands-on knowledge of the industry has been well earned during her 16-year career at Fannie Mae, a stable and crucial source of permanent financing for seniors housing.

NIC’s chief economist Beth Burnham Mace recently interviewed Klein to get her perspective on the dramatic growth of the industry over the course of her career, and the outlook for the sector ahead. What follows is an edited transcript of the conversation. [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

Mace: Can you briefly explain your job responsibilities?

Klein: I’m vice president of Customer Engagement at Fannie Mae. We’re a government-sponsored enterprise and one of the largest purchasers of mortgages in the secondary market. In my role, I’m responsible for borrower relationships, our seniors housing business, and marketing strategies and communications, including responsibility for all our national customer sales initiatives.

Mace: How much did Fannie Mae lend for multifamily projects in 2016, and so far in 2017?

Klein: In 2016, we had a record year in multifamily lending, totaling $55.3 billion. Through July 2017, we’ve had $36.2 billion in production. Seniors housing, which is part of the multifamily business, totaled about $2 billion through the second quarter of 2017, compared to $1.5 billion for all of 2016. So seniors housing has already exceeded last year’s numbers.

Mace: Why the increase for seniors housing?

Klein: This year we’ve had several large transactions that grew our seniors housing business total compared to other years. However, we’ve done $1.5 billion or more in production each of the last four years.

Mace: Does Fannie Mae have a limit on deal size?

Klein: There is no limit on deal size. Our transactions range from $5 million to nearly $1 billion. A big competitive advantage is our Seniors Housing Credit Facility. It’s a flexible financing tool that allows borrowers to manage their debt across portfolios with the ability to combine fixed- and floating-rate debt, add properties, substitute properties and re-lever a portfolio through what’s called a borrow-up. It’s really a portfolio management tool.

Mace: Do you lend through partners?

Klein: Yes, we rely on Delegated Underwriting and Servicing lenders, known as DUS® lenders. We have 25 DUS lenders that are pre-approved and are given the authority to underwrite and service loans that meet our standards. We use a risk-sharing model with our lenders. It’s the only proven risk-sharing model in the country and has a very long track record of success.

Mace: Have you made any changes in last two years to speed closings?

Klein: Our delegated model is the cornerstone of how we work. We continue to work on ways to expand the delegation to our lenders which gives them the ability to provide faster solutions for borrowers. In the seniors housing space this year, we rolled out some increased delegation to our lenders so they can advance the business with a real market-driven time frame.

Mace: Fannie Mae has an excellent track record with defaults close to zero. Why is that?

Klein: Seniors housing is a complex business. We assess seniors housing transactions focusing on the sponsor and operator. Of course, we also look at asset quality, strength of the market, overall credit quality, debt coverage, and occupancy. But the sponsors and operators must be experienced in seniors housing and have strong financial capabilities.

Mace: How do you price the deals?

Klein: It depends whether the borrower picks a fixed- or variable-rate loan. We offer both executions. In combination with our pricing desk, we look at credit risk and where market clearing levels are on a deal-by-deal basis. We also look at the experience of the sponsor and the operator and their market strength to determine pricing.

Mace: Is there a specific product you prefer or try to avoid?

Klein: We offer financing through the breadth of acuity. That includes independent living, assisted living, memory care, and any combination of those products. We also finance continuing care communities and some facilities with a limited number of skilled nursing units. We do not finance properties that are 100 percent skilled nursing.

Mace: Do you lend for development, acquisition, or re-capitalization?

Klein: We do not offer construction financing. We only offer permanent financing, typically acquisitions and refinances.

Mace: Can you tell us about the “green” initiative you recently launched?

Klein: We were innovators in the area of “green” financing in the multifamily market. We have “Green Rewards” and “Green Building Certification” loan products. These products are having a positive and measurable impact on the environment. Properties financed with our “Green Rewards” loan product through the second quarter of 2017 are projected to save 57 million kilowatt hours of electricity. To put that in perspective, that’s the equivalent of powering 29 million cell phones. We are also saving 932 million gallons of water, which is real savings felt by the borrower and the resident.

Mace: Are the “green” loan products available in seniors housing?

Klein: Yes, absolutely.

Mace: Does Fannie Mae have other new products?

Klein: We’re always innovating and trying to think of new things. We don’t have any new products, but we have innovations such as an expansion and conversion program for seniors housing. If a property has undergone a change in acuity and units need to be converted to a different level of care, or a borrower wants to add new units, we can accommodate that through our asset management unit in conjunction with our DUS lenders.

Mace: A number of markets we’re tracking appear to be oversupplied. Do you tell your DUS lenders to stay away from certain markets?

Klein: We’re a national lender in every market, every day. We look closely at how NIC views markets in terms of our analysis of individual transactions, but we do not have criteria for specific markets. We do not have the same leverage point in every market.

Mace: Some people expect a bust in the market. Do you have any concerns about the market in the near term?

Klein: Based on recent history and current market conditions, we expect seniors housing to grow to serve the needs of an older population that’s expanding. Rent growth was positive in the second quarter of 2017 in the 31 primary markets, marking the 8th consecutive quarter of rent growth. Solid results can be attained even when new supply results in rising inventories and softening occupancies. We’re feeling pretty positive as long as the national economy remains fairly stable.

Mace: What is greatest challenge facing the seniors housing and care sector?

Klein: Affordability. The lack of available, affordable seniors housing properties with service components is a concern. That is part of our mission. We want to be part of that solution.

Mace: There’s still talk about Fannie Mae and Freddie Mac and how the government could change the agencies. Is there any reason borrowers should have concerns about Fannie Mae’s future?

Klein: We have been operating since 2008 under government conservatorship, which was established to provide liquidity and stability to the mortgage market in the wake of the financial crisis. We continue to be committed to seniors housing, a unique sector of the multifamily market. We understand that seniors housing serves a very critical need for our country’s aging population. We have a $12.7 billion book of business and, as demand grows, we will continue to successfully innovate and serve seniors housing.

The commitment to seniors housing is at every level of our company from the CEO on down. We have 20-plus years of experience in seniors housing, and we are close to many of the large industry players. We were the first agency in this space, and we have done a great job with it. We look forward to many new opportunities in the future.

[/expand]

Popular “NIC Talks” Returns to NIC 2017 Fall Conference “Tell Me Something I Don’t Know about Aging”

Disruptive innovation has become a familiar concept in daily life.

Uber has changed the way we think about personal transportation. Amazon has forever upended well-established retail models. Airbnb has impacted the way we travel.

Meet Ted Fischer, a disruptor who’s turning toys for children into a real source of comfort for lonely seniors.

Fischer works at Hasbro, Inc., the giant toy and entertainment company. As vice president of business development, he leveraged some out-of-the-box thinking and launched a brand for seniors called, “Joy for All.” Its first products are realistic animatronic pets that offer a bit of needed companionship to the elderly.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

“There’s so much focus on the negative part of aging,” said Fischer, from the company’s headquarters in Pawtucket, R.I. “We wanted to focus on the aspirational and joyful aspects of aging.”

Fischer is one of nine speakers for the popular “NIC Talks” series at the 2017 NIC Fall Conference, September 26-28. Inspired by the well-known and hugely successful “TED Talks” format, “NIC Talks” is designed as a provocative forum to challenge conventional thinking about senior living. This year’s theme is “Tell Me Something I Don’t Already Know about Aging.”

Fischer’s presentation, “Ageless Play,” will focus on how Hasbro has used consumer insights, market research, and design and product expertise to create the new “Joy for All” brand. It was started in response to consumer comments on animatronic toys designed for kids that were being used to help ease the loneliness of aged loved ones. “We saw an opportunity,” said Fischer.

In 2015, the brand launched its first product, a robotic cat with life-like moves that mews and provides interactive companionship. A golden retriever pup was introduced last year.

With innovative products for seniors as a backdrop, Fischer will discuss the difficulties of establishing a start-up within a large organization like Hasbro. “Senior living organizations are trying to innovate,” said Fischer. “But that’s a challenge.”

Session attendees will take away lessons from Fischer on how to innovate while still respecting internal business processes. Everyone talks about innovation until it bumps up against the process, he said. Stakeholders are incentivized to execute their roles with efficiency and changing that process can be painful.

Fischer will present a different approach for senior living executives to consider. “It’s a way to make it good for everyone,” he said.

Speaker line-up

Presentations by a handful of other speakers at “NIC Talks” should spark new thinking among attendees. Here’s a sample of what else to expect on several timely topics:

Ageism

Age equality seems like a utopian goal. But what would it look like? Activist and author Ashton Applewhite will discuss the root of ageism and how myths and stereotypes cripple the way our brains and bodies function.

Kim Campbell, wife of recently deceased music legend Glen Campbell, will offer her thoughts on the challenges of Alzheimer’s disease. Kim supported her husband through the hardships of the disease and continues to honor his request to educate others about the stigma that accompanies an Alzheimer’s diagnosis.

Longevity

Will the quality of life be the same as life expectancy grows? Laura L. Carstensen, director of the Stanford Center on Longevity, will present research on the unexpected bonus of aging that brings happiness and contentment.

Dan Buettner will discuss his observations on longevity. He is National Geographic Fellow and author of “The Blue Zones,” a popular book on the five places in the world where people live the longest and are the healthiest.

Dr. David B. Nash, dean of the Jefferson College of Population Health, Thomas Jefferson University, will present his take on how care quality impacts longevity. He is recognized for his work in public accountability for health outcomes, physician leadership and quality-of-care improvement.

Dr. Joon Yun will discuss the $1 million Palo Alto Longevity Prize that he launched with his wife Kimberly in 2013 to reverse the aging process. He is currently managing partner and president of Palo Alto Investors, LLC, a hedge fund with $2 billion in assets invested in health care.

Artificial Intelligence/Internet of Things

Robotics is radically transforming healthcare. Susann Keohane, global research leader for the Aging Initiative at IBM, will discuss how products and technology-enabled services will impact how we age.

Speaker Robert (Bob) Hillis, president and CEO of Direct Supply, a large provider to healthcare networks, was an online pioneer. He formed Direct Supply DSSI, the nation’s first healthcare cloud e-commerce network. Since then, Direct Supply has launched Aptura, a full-service developer that is helping to change the face of senior living. Direct Supply’s latest venture is TELS, an industry leading mobile building management platform.

[/expand]

Seniors Housing: A Favored Investment Choice

Key Takeaways from the 2017 NREI/ NIC Senior Housing Market Study

The National Investment Center for Seniors Housing & Care (NIC) and the National Real Estate Investor (NREI) recently conducted the fourth annual NREI/NIC Seniors Housing Market Study from June 28-July 17. The goal of the online survey was to gauge attitudes and opinions regarding the state of the seniors housing sector. There were 153 respondents. Penton Research conducted the research and the methodology conforms to accepted marketing research methods, practices and procedures. Results of the survey are summarized below: [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

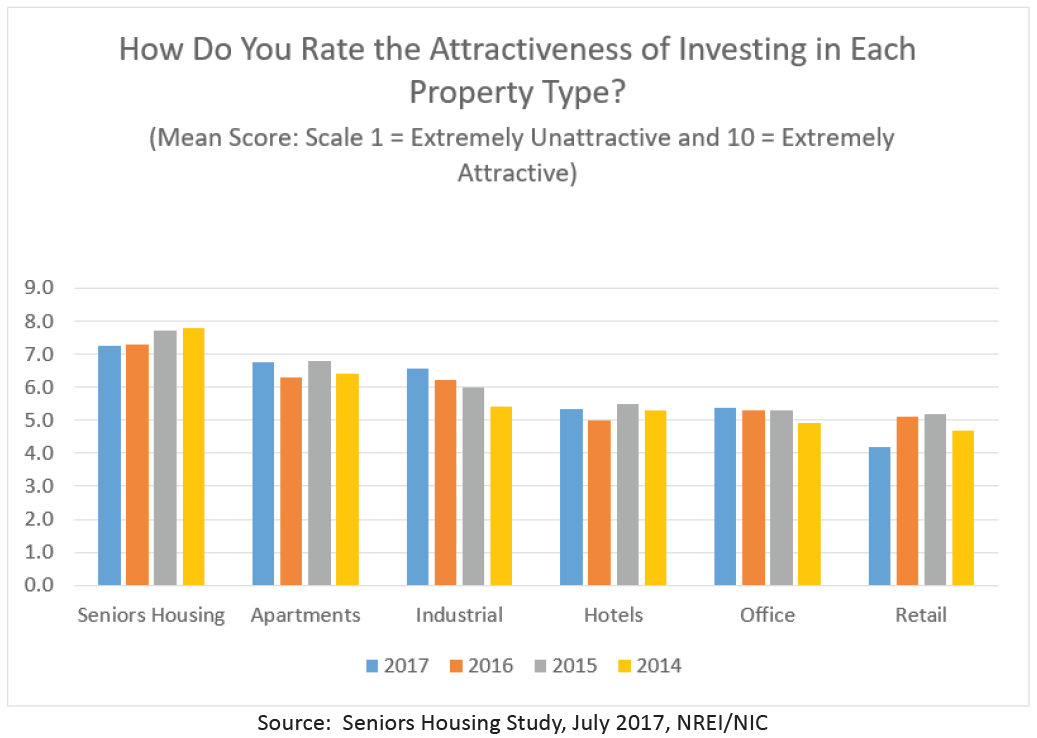

- Respondents favored seniors housing over other commercial real estate asset types for investment for the fourth year in a row. Following seniors housing were apartments, industrial, office and hotels. Retail continued to be the laggard asset type for investment choice.

Seniors Housing Market Fundamentals

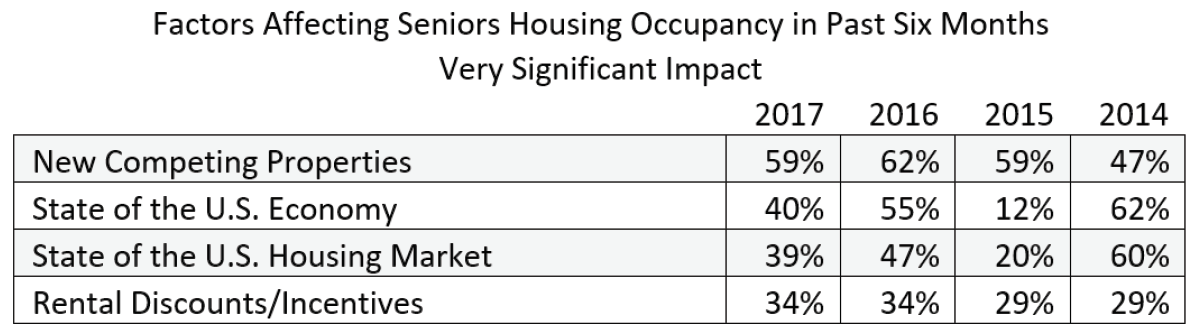

- Survey respondents viewed new competing properties as more of a threat to occupancy than the state of the U.S. economy, the U.S. housing market or rental discounts and incentives. It’s interesting to note that in 2014, the state of the S. economy and its housing markets were viewed as greater threats.

- Capital Markets and TransactionsRoughly 59% of respondents expect to see an increase in seniors housing construction starts over the next 12 months. This compares with 45% in 2016, 69% in 2015 and 72% in 2014. Of the 2017 respondents that expect to see an increase in starts, 20% expect new construction to result in overbuilding.

- A little more than 65% of respondents anticipate occupancy rates to rise in the coming 12 months versus 56% in 2016 survey.

- Nearly 78% of the survey respondents expect rents to rise by roughly 1 percentage point, nearly the same as in 2016.

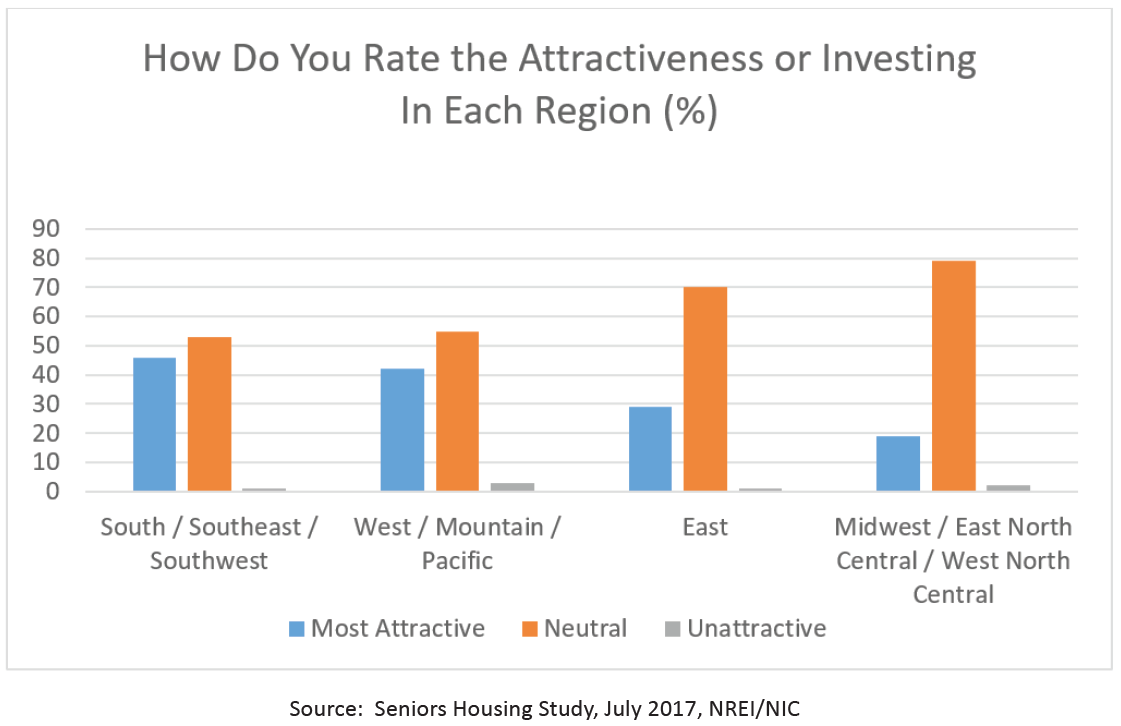

- The West and South continue to be favored regions for investing in seniors housing. Most respondents were “neutral” with regard to the East and Midwest (see below).

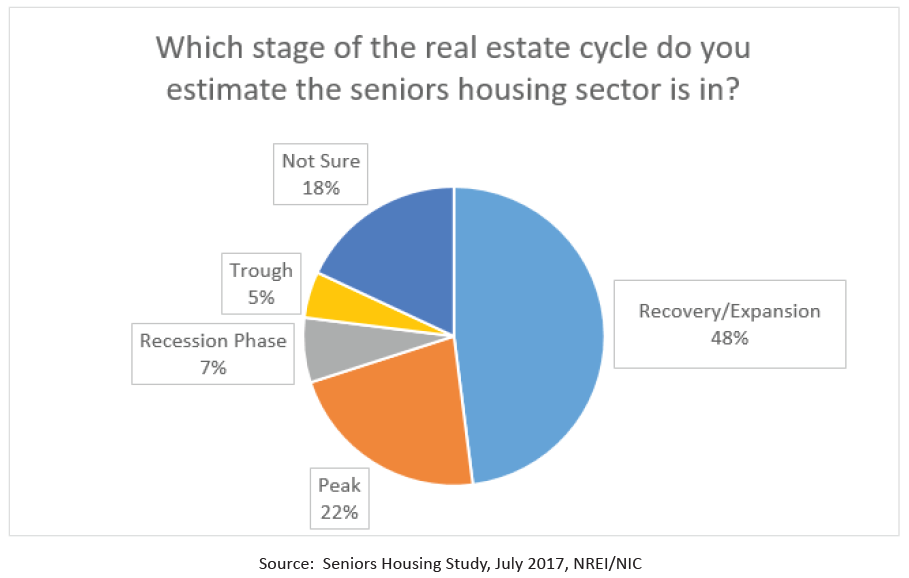

- Most respondents thought the market was in a recovery /expansion phase, although nearly one in five thought the market was at its peak (see below).

- REITs, HUD and institutional lenders were considered to be the most significant sources of debt capital in 2017 among the survey respondents. This compares with HUD, Fannie/Freddie and local/regional banks in 2016.

- Debt market conditions are projected to be tighter in 2017 than in 2016.

- Transaction volumes in 2017 are anticipated to be the same as in 2016, with the time it takes to close a deal unchanged.

- More respondents anticipate buying properties than selling properties.

- A cap rate increase of 15 basis points is anticipated by the 52% of respondents that anticipate higher cap rates; this compares to 11 basis points in 2016 survey.

- Few respondents anticipated a decrease in the risk premium for investing in seniors housing (i.e., the spread between the risk-free 10-year Treasury yield and seniors housing cap rates).

In wrapping up, seniors housing continues to be a favored property type among investors. Generally positive perspectives surround questions related to improving market fundamentals, access to capital and the transactions pipeline. Development and new supply remain concerns among industry participants, however. [/expand]

How to Benefit from the Program of All-Inclusive Care for the Elderly ("PACE")

Part I of a two-part series

The Program of All-Inclusive Care for the Elderly (PACE) which integrates care delivery can be a win for many seniors housing providers. What follows is the first part of a two-part series that explains the program and why partnerships with PACE providers are worthy of consideration. This series was compiled by the following members of the NIC Future Leaders Council, along with input from the national PACE organization: Susannah Myerson, Vice President of Senior Housing Finance, Wells Fargo Bank; Andrew Smith, Director of Strategy & Innovation, Brookdale Senior Living; Derek Zeller, Director, BMO Harris Bank; Morgin Morris, Vice President of Mortgage Banking, KeyBank Real Estate Capital [expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

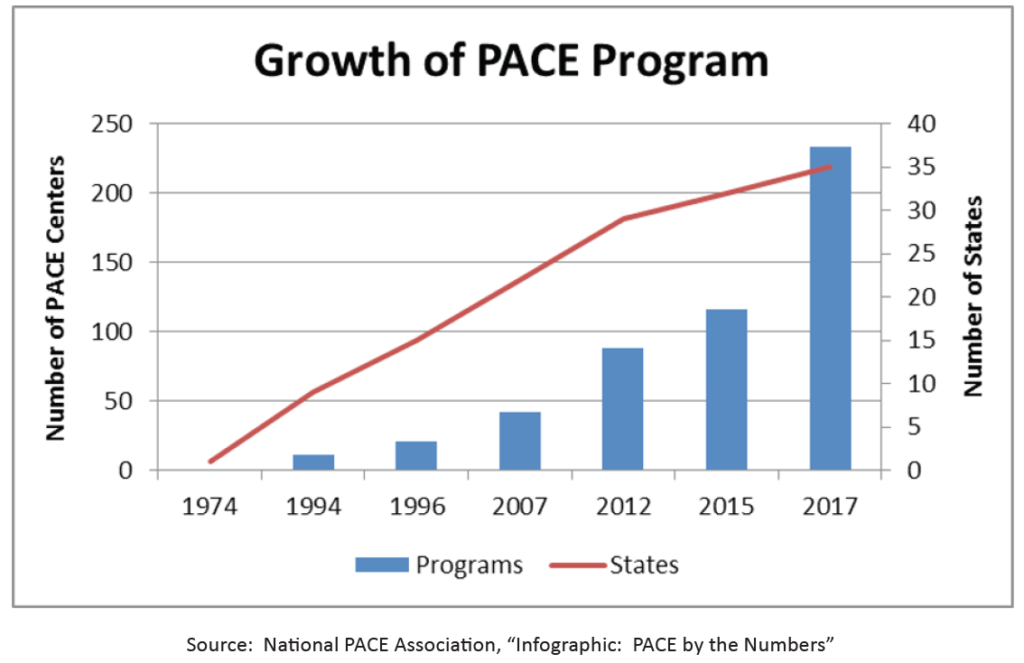

PACE began as a small community-based program in San Francisco in the 1970s. The idea was to keep frail, lower-income older adults out of nursing homes and provide services in their homes and in local adult-day centers. The program (operated as On Lok Senior Health Services) provided medical care and social support to local residents and received reimbursement from Medicare. Based on the success of the program, other groups established similar programs throughout the 1980s, and the balanced budget act of 1997 established PACE as a permanent provider under the Medicare program and made it an option under the Medicaid program. Since 1997, the number of PACE provider organizations has grown dramatically. In 2015, further growth occurred when the program was expanded to allow private, for-profit firms to become PACE providers; up until then, a requirement was that the providers be operated as non-profit organizations.

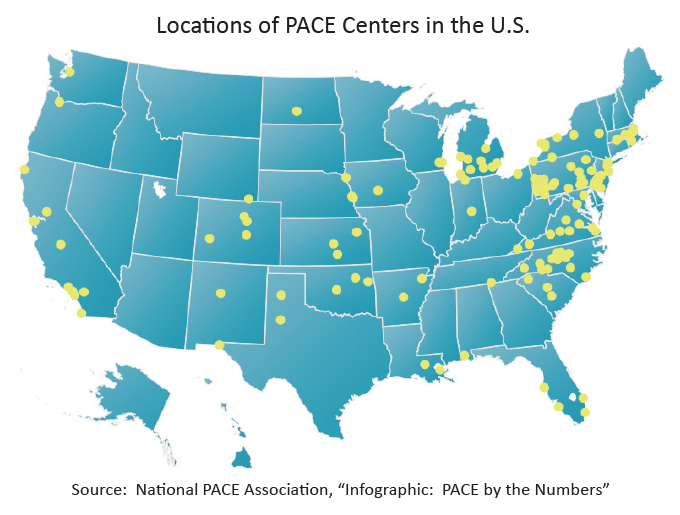

As of March 2017, there are 122 sponsoring organizations (operating 233 PACE centers) in 35 states serving over 40,000 beneficiaries.[1]

What is PACE and how does it work?

PACE is a program designed to keep people at home and deliver coordinated services, rather than have them move to a nursing home. PACE programs deliver services at the resident’s home, a provider’s office, or at a local PACE center. To qualify for PACE, an individual must meet the following criteria:

- Be over 55 years old

- Live in the service area of a PACE provider

- Need a nursing home level of care (as certified by the state of residence)

- Be able to live safely in the community with support from PACE

Among the current PACE enrollment of 40,000+, approximately 70% of the members are women, the average age is 77 years old, and 60% of members need help with 3 or more ADLs.[2]

Once an individual becomes a PACE member, her care will be coordinated and delivered by an inter-disciplinary health care team. The PACE program includes frequent monitoring and use of electronic medical records. Services provided through PACE may include primary care visits, physical/occupational/recreational therapy, dentistry, prescription drugs, emergency services, hospital care, and lab/x-ray services. In addition to these medical needs, PACE programs can also provide meals, transportation, counseling, and social services.

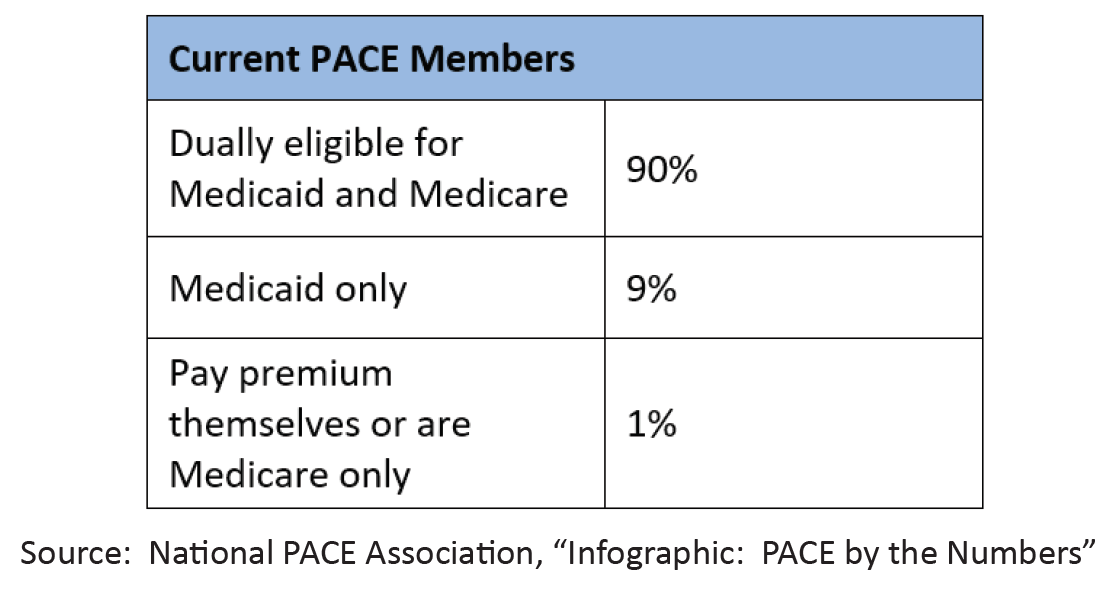

Who pays for PACE?

The answer depends on a member’s eligibility. PACE providers charge a fixed rate per month (per member) to provide an array of health care and ancillary services to each member. Individuals who are Medicaid eligible do not pay any monthly premium to participate in the PACE program; it is fully covered by Medicaid. Individuals with Medicare pay a portion of the monthly premium to cover the long-term care portion of the PACE program and a premium for Medicare Part D drugs. Individuals with neither Medicare nor Medicaid can pay for PACE privately.

Among the current members, 90% are dually eligible under Medicare and Medicaid.

PACE outcomes

Since the first pilot program more than 40 years ago, PACE has been the subject of nearly 100 health care studies and articles. Researchers have determined that[3]:

- PACE is effective and efficient in treating individuals with multiple and complex health care needs

- Caregivers and participants rate PACE high in satisfaction

- PACE participants rate that they are healthier, happier, and more independent than counterparts in other care settings

- PACE participants live longer than enrollees in a home- and community-based waiver program

- PACE reduces the need for costly, long-term nursing care

- PACE prevents and/or significantly reduced preventable hospitalizations

- PACE produces Medicare savings

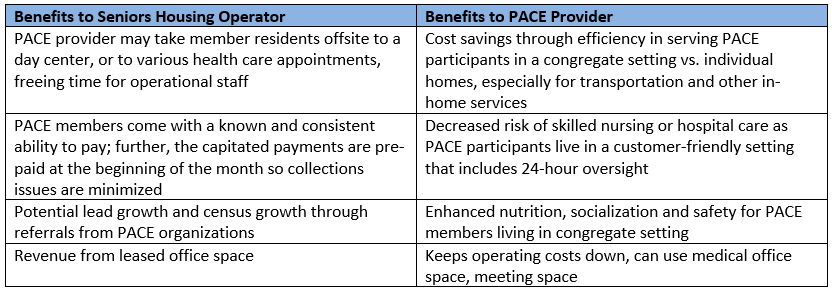

Is PACE a friend or foe to seniors housing?

PACE can be a win for many seniors housing providers. PACE providers are essentially managed care plans that integrate care delivery of Medicaid and Medicare covered benefits. It is much like a third party service that can be offered to residents and that can provide reimbursement for care. Having a partnership with a PACE provider (including leasing space to one on-site) can benefit both the seniors housing provider and the PACE provider.

Part two of the series will appear in the next issue of the Insider. It will explore lender and equity investor considerations, and the future growth potential of the PACE program.

[1] Source: National Pace Association, “Infographic: PACE by the Numbers”

[2] Source: National Pace Association, “Infographic: PACE by the Numbers”

[3] See details on each research report cited here: https://www.npaonline.org/policy-advocacy/state-policy/research [/expand]

Staffing Challenges Demand Creative Solutions

By Jerry Taylor, Director of Business Development, National Health Investors, Member of the Future Leaders Council (FLC)

One of the hot topics in seniors housing today is the impact of labor pressures on both operators and investors. Many different variables are contributing to staffing issues, including minimum wage legislation, the increased supply of seniors housing, and changes in the labor pool.

To understand some of these challenges, I met with several top operators throughout the country. We discussed continuing to provide quality care in light of labor pressures, while maintaining a strong operating margin to meet the return expectations of their capital partners.[expand title=”Read More” trigpos=”below” tag=”div” trigclass=”nic-read-more”]

On April 1, 2015, a new minimum wage ordinance went into effect in the city of Seattle that will drive the minimum wage to $15 an hour over the next five years. While Seattle is one of the first cities to implement these changes, many other cities are looking to pass similar legislation in the near future.

This change has not impacted the entire industry, but it has played a role in how several regional operators look at staffing projections and operational budgets. The average community line staff member makes between $9.50 and $12 an hour, depending on market and location. Labor and wage costs account for 40% to more than 50% of the expenses in an average-sized assisted living and memory care community.

Increasing a single community’s wages to $15 an hour can potentially cause a decrease in margin of 10% or more. “It is important to remember that a pay increase, such as the $15 minimum wage, does not only impact your line staff but it has a direct impact on your management level staff as well,” said Adam Kaplan, founder and CEO of Solera Senior Living.

Considering the impact of wage hikes, operators have had to get creative in order to offset these expenses. Not all the expenses incurred can be passed directly through to the resident by increasing rents; so many operators have had to focus on efficiencies within their current staffing model.

More operators have begun utilizing a universal staffing system, which assigns care staff for dining or activities, whatever is needed. The system even shares management level staff among multiple properties run by operators with a large market presence. While these wage changes have not been in place for long, the industry is engaging to find other operational efficiencies.

In addition to the minimum wage changes seen in certain parts of the country, the growing supply of new seniors housing in certain areas also has impacted the labor pool and the availability of care staff. Attracting new young talent has been an ongoing challenge within the industry for years.

The lack of new talent coupled with the maturity of the current care staff has caused operators to compete for the same workers in some markets. This has driven up the average wage in many of these markets as staffers jump from community to community and operators elect to raise their compensation packages to fill their staffing needs.

Many operators have begun utilizing resources outside of the industry to strengthen and enrich their job fulfillment and employee engagement programs. Community operations, particularly caregiving, is an extremely mission driven career. Creating a culture and environment that allows care staff to connect with their passion has helped increase employee retention and limit the risk of losing quality staff members.

Operators remain focused on creating well-positioned communities, with strong cultures and quality facilities that the staff can be proud of. Not only is it important for employees to find satisfaction in their jobs, but they hopefully are proud of the community where they work.

These changes in the labor market have not only impacted operators, as investors have also taken notice. The industry has started to see changes in how investors are underwriting deals, often underwriting wage increases of up to 10% to ensure the projects attract quality staff and can offset unforeseen labor issues.

When looking at both acquisitions and new developments, we are seeing prospective buyers spending more time on labor studies and educating themselves on the political environment of the respective state in order to anticipate any labor hurdles now and in the future. It is also clear that the investors and capital providers, which previously focused much of their due diligence on financials, are now more concerned about operations and spend more time educating themselves on the day-to-day property business.

“With many of the changes taking place in the labor market, we make sure to spend extra time with the operator to get comfortable with company culture and employee hiring processes to eliminate unnecessary labor expenses such as overtime and agency staffing,” said Eric Mendelsohn, CEO of National Health Investors.

Looking ahead, staffing and labor will continue to have an impact on the seniors housing industry. But the top operators agreed that the challenges of the current labor market can be overcome with quality operations.[/expand]