Sabra Turns the Page on the Pandemic: A Conversation with Rick Matros

Positive industry news may be scarce, but Rick Matros has seen some hopeful signs lately.

Positive industry news may be scarce, but Rick Matros has seen some hopeful signs lately.

As CEO and Chairman at Sabra Health Care REIT, Inc., (Nasdaq: SBRA), Matros notes that government assistance has helped to bolster the industry. Operators are better prepared to treat patients and control infections.

Skilled nursing Medicare mix payments are rising as elective surgeries resume. And recognition is growing that the sector is a critical component of the healthcare continuum.

NIC Senior Principal Bill Kauffman recently talked with Matros about Sabra’s pandemic response and his outlook for the industry. Here’s a recap of their conversation.

Kauffman: How are things going in general?

Matros: On the skilled nursing side, Medicare and Medicaid provided a lot of financial assistance which has helped. On the seniors housing side, our portfolio has not taken that big a hit because we’re in smaller markets where there’s been less of an outbreak. The American Health Care Association (AHCA) took up the mantle to advocate for the industry, and we’re optimistic that more government assistance will be provided.

Kauffman: How is your portfolio structured now?

Matros: We have a little more than 600 properties. Half are skilled nursing; 10% are specialty, behavioral and children’s hospitals and addiction treatment centers; and the remainder are seniors housing properties.

Kauffman: Did you have a particular property allocation target before COVID-19? If so, has that changed?

Matros: Private equity firms have bid up the prices on seniors housing. We’ve had better opportunities in skilled nursing. When we merged with Care Capital Properties (CCP) in 2017, we went from about 55% skilled nursing to 73% skilled nursing. Some thought we were becoming a skilled nursing REIT, but the transaction was a means to an end. We were back down to 60% skilled nursing quickly. We go where there are opportunities.

Kauffman: How has COVID-19 impacted your portfolio occupancy in both private pay seniors housing and skilled nursing?

Matros: Our skilled nursing occupancy is down about 800 basis points over the last five months which is about the industry average. (See skilled nursing occupancy data through June in the NIC MAP® Monthly Skilled Nursing Data Report.) But our skilled Medicare mix is almost 200 basis points higher than pre-COVID-19. We are not aligned with traditional long-term care operators that serve extremely high acuity residents. The waiver of the three-day in-patient hospital stay, along with the end of the 2% government sequestration, has helped Medicare revenues. Our senior housing operated portfolio (SHOP) occupancies are down about 400 basis points over five months, but they’ve been flat the last four to five weeks. Our triple-net senior housing portfolio occupancy is down 130-140 basis points over five months. We hit a low of 200 basis points and then popped up almost 80 basis points at the end of July, though COVID-19 cases are spiking again in some places. Specialty hospitals have a dynamic population that goes up and down, and they’re not really affected by COVID-19.

Kauffman: What has caused the stabilization in skilled nursing?

Matros: We follow the Centers for Disease Control and Prevention (CDC) protocols, though there is still a lack of adequate testing and problems in all asset classes with personal protective equipment (PPE), especially gloves and gowns. The need for one-to-one service has driven up labor costs. In the absence of widespread and effective antibody tests, we know we’ve had scores of people who have had the virus. But we’ve taken care of them, and they have gotten through it. Early on before guidelines became consistent, our operators restricted non-essential visitors and screened employees. It was hard on residents, but it slowed the virus. If you look at states with mandatory testing, we’re seeing more facilities with positive cases but almost no breakouts. That’s what we were hoping for.

Kauffman: Why were skilled nursing properties impacted more so than other healthcare settings?

Matros: Residents in skilled nursing are sicker than those in assisted and independent living. The number of employees per patient is higher in skilled nursing than in assisted and independent living. Residents were contracting the virus from people coming into the facility. The chances of getting an infection is that much greater in the skilled setting. It’s compounded by inadequate or poor-quality PPE and not enough testing. It wasn’t until nine to ten weeks into the pandemic that the government sent PPE to nursing homes. Half of it was flawed, and there was price gouging. One of the things we’ve been doing as a REIT is working to source as much PPE as we can for our operators. Our peers are doing that as well.

Kauffman: How did Sabra approach the initial onset of COVID-19?

Matros: We have a deep operating bench. We surveyed operators and connected them with each other to share best practices. And then we talked to major vendors to source PPE and other supplies. When the Coronavirus Relief and Economic Security Act (CARES) went into effect, we analyzed the details and helped our operators access those funds. We researched which banks were doing a better job of distributing the funds and connected our operators to them.

Kauffman: What are the main challenges now with staff and labor?

Matros: The main challenge is in markets where there are still breakouts, and we need more staff to handle the one-on-one activities, including meals. We all know staff was not plentiful to begin with, but, in certain markets, that is easing off. The other problem in areas with breakouts is that more younger people are getting COVID-19. That’s impacting the ability of our employees to come to work. The retail sector may not come back all the way, which could be a permanent positive for our industry because we keep hiring. The other thing that has helped is the universal worker’s program. With eight hours of training, personal care attendants can perform extra duties. It would not surprise me to see that become permanent as well. A proposed rule by the Centers for Medicare & Medicaid Services (CMS) would cut the reimbursement rates for therapy, and it would allow therapy assistants to do more non-direct care. Another positive is that skilled nursing and seniors housing have always been on the periphery of the healthcare system. Now we see that narrative changing as we are seen as a critical component of the healthcare continuum.

Kauffman: How are operators working to navigate the challenges?

Matros: There has been a lot of creativity to mitigate the isolation of residents. We’ve had window and virtual activities. We even had a wedding on the lawn outside of a resident’s room. We’ve been giving virtual tours. I’d like to emphasize the importance of investments in information technology. Independent living operators had no healthcare infrastructure when the pandemic first hit, which concerned me. But our operator Holiday Retirement jumped right in and offered free telehealth to all residents. That created a connection between the residents and their caregivers outside the facility. I think the operators that have done things to help residents feel safer will recover more quickly. The reputation of the community is all important.

Kauffman: What is the status on testing at skilled nursing properties?

Matros: CMS just rolled out point-of-care testing to the 2,000 nursing homes with the biggest outbreaks. As of last week, 1,000 facilities had received those tests. We have not heard about the accuracy of those tests or the turnaround time, but we appreciate the effort by CMS. They have been fantastic. CMS Administrator Seema Verma has been the brightest light in this whole pandemic. She has partnered with the industry and completely gets it. Beyond efforts by CMS, operators have been working with private labs to conduct testing. The ultimate answer is to have rapid testing available. That’s the best way for operators to get their arms around the virus and help everyone feel safer.

Kauffman: Do you find that the industry is improving in terms of handling the pandemic?

Matros: Before Memorial Day, I felt that, if we flattened the curve and the infections started to decline, we would be much better off to handle a second wave, because operators would have protocols in place. Once you operationalize protocols, they become part of what you do every day. In those markets where the curve is coming down, our operators are building up PPE, and they are in a little better shape. Pricing for PPE is still higher than before the pandemic, but not as high as at first. There was some thought that flu season will not be as bad this year because of all the precautions taken with COVID-19. But the first wave hasn’t abated, though some states have done better than others. Skilled nursing took the biggest occupancy hit, and we will continue to be more dependent on federal assistance because we’re not getting that recovery time between the first and second waves.

Kauffman: How are the debt markets? Is there plenty of liquidity?

Matros: The debt markets are good. We reissued all our debt last year. We have no maturities coming up before 2024. We came into 2020 stronger than we’ve ever been. As of June 30, our liquidity was $955.3 million. That helped with our operators.

Kauffman: Credit spreads have not come back to where they were pre-COVID-19, but interest rates have come down. Is that a factor?

Matros: Yes, rates have come down. A 10-year note at 5% may be 100 basis points higher than pre-COVID-19, but from an historical perspective 10-year paper at 5% is fairly good.

Kauffman: The acquisitions market has slowed. Do you see opportunities for acquisitions?

Matros: We have acquisitions of almost $600 million in the pipeline, mostly seniors housing and skilled nursing properties. Seniors housing pricing is still elevated, and skilled nursing owners are still expecting buyers to completely discount the impact of COVID-19. We are looking at one-off properties, primarily in skilled nursing. Portfolios aren’t getting any traction. A lot of skilled nursing is being sold at a 10% cap rate, which is on the high side. At some point, skilled nursing owners may have to sell, and then we’ll see some flexibility in pricing.

Kauffman: Over the long-term, how does the industry recover from this unprecedented challenge?

Matros: I don’t worry about the long-term so much because the slowdown was caused by the cessation of elective surgeries. Those started coming back in July, and some of our operators have increases in occupancies, just not enough to impact the whole portfolio. But we think we will be admitting people who are a lot sicker. If you need a knee surgery at a younger age, you can delay it. But an 87-year-old who delays surgery probably has more medical issues. We’ve already seen length of stay in memory care come down because families are keeping their relatives home longer. I think COVID-19 will exacerbate this trend. There is pent-up demand, but occupancies will climb back slowly, especially in assisted living. Operators that show how they’ve created a safe environment during the pandemic will bounce back faster than others.

Kauffman: How will a vaccine impact the market?

Matros: We seem to be on track to develop a vaccine faster than ever before. But disseminating a vaccine is as big an issue as developing one. We have a small number of syringes in this country. How do we administer a vaccine to 100 million people? No one is addressing that issue. Normally we would get supplies from China, but that is not happening now.

Kauffman: Sometimes challenges bring opportunity. What, if any, opportunities does skilled nursing have in these challenging times?

Matros: There will be more buying opportunities for investors. Prior to the new Patient Driven Payment Model (PDPM), we thought there would be more buying opportunities since about 40% of the skilled nursing industry consists of mom-and-pop long-term care facilities reimbursed by Medicaid. Adding the pandemic on top of PDPM gave these owners one more thing to deal with. These owners are waiting for stabilization to maximize their profits. But there will be more defaults that will create opportunities. Lenders cannot hold on to these assets. But lenders will be careful about who takes over the property and evaluate how well they handled the pandemic.

Kauffman: Are there any opportunities from the operational perspective?

Matros: We saw rent coverage improve because of PDPM prior to the pandemic. The stage was set, and I think there will be an increased focus on infection control and disaster preparedness. Acuities have been going up. The combination of the pandemic and PDPM has shown operators that they can take that acuity level even higher.

Kauffman: Does this permanently increase costs for infection control? Or is this a one-time hit?

Matros: I think it’s more of a one-time hit. It’s a function of building up PPE inventory and then spending will become more normalized. Staffing will come down too. We should be able to get back to group and concurrent therapy, which will help. Also, I think the medical model will become more important in assisted and independent living as acuities among residents continue to rise.

The Essential Virtual Experience Approaches. Here’s What to Expect.

By the time of this writing, hundreds of decision makers across the seniors housing and care sector have already registered (at low early bird rates which end September 8) to attend its premier annual event, the 2020 NIC Fall Conference. Readers of the NIC Insider already know that the event, which will be hosted on an advanced virtual technology platform, features many of the attractions of its traditional predecessors, while boasting a host of new advantages, including convenience and lower pricing.

Perhaps the greatest draw for the event, however, is its timing. ‘The NIC’ comes at a time of immense change, intense public scrutiny, and uncertainty for the future. Amidst a pandemic that impacts frail elders disproportionately, major policy shifts, the rise of new technologies and standards, economic and social turmoil, and with a critically important national election only weeks away, the opportunity to gain the latest data, insights, thought-leadership, and to connect with experts, peers, prospects, and old friends, is more valuable than ever.

At such a critical moment for the industry, with so many factors potentially impacting its future, leaders and their management teams are seeking the clarity, vision, and power to convene and connect, for which ‘the NIC’ has deservedly earned a reputation. Recognizing the need to deliver on these, NIC has developed a powerful, innovative, and impactful program for attendees from every corner of the sector. Here’s an outline of what you and your team can expect:

- Education Week | Tuesday, October 6 to Thursday, October 8

- Connections Week | Tuesday, October 13 to Thursday, October 15

Unmatched Thought Leadership

Over the first week, Education Week, attendees will gain access to over 30 informative, relevant, and thought-provoking sessions, featuring over 50 experts and business leaders. In addition to attending the sessions during their scheduled times, most will be available for on-demand access, both during and after the event. NIC Fall Conference veterans who may have had to choose between important sessions and networking or meeting opportunities in the past, will appreciate this level of access and flexibility.

In sessions, attendees will hear focused, up-to-the-minute thinking from industry leaders such as Bre Grubbs, Partner & SVP, Leisure Care. In separate sessions dedicated to seniors housing and skilled nursing, respectively, Grubbs will cover public relations issues, balancing sales needs with operational risks, overcoming sales and marketing challenges in the COVID era, and addressing evolving perceptions among consumers.

Susan Barlow, Co-Founder & Managing Partner, Blue Moon Capital Partners, will discuss how community culture leads to positive outcomes for staff, residents, and investors. In this session, attendees will hear operators discuss how the right culture can lead to staff retention and growth, higher satisfaction for residents and families, and meet revenue and expense models.

Of course, ‘the NIC’ wouldn’t be ‘the NIC’ without a session on property valuations. Ryan Maconachy, Vice Chairman, Healthcare & Alternative Assets, Newmark Knight Frank, will lead this year’s discussion on the ever popular and now particularly sensitive topic. The session will cover the market’s current velocity and liquidity, who’s buying and selling today, and when to expect transaction activity to pick up. The session will also address how valuation methodologies have changed, and why, as well as whether cap rates have changed.

Many other industry leaders and experts will bring their insights to bear in a three-track program designed to cater to a variety of roles across the sector. NIC subject-matter experts, such as NIC Chief Economist Beth Burnham Mace, will provide insights derived from the latest NIC MAP® data, along with practical implications and potential impacts across the entire industry.

Main Stage sessions will, as always, feature figures of national prominence, discussing issues of the highest relevance to the industry. Only weeks ahead of a critical election, attendees will be focused on what the potential outcomes will mean for their businesses. Decision makers will not want to miss the insights of panelists whose understanding of the political and business implications is unequalled.

Award-winning journalist Soledad O’Brien, who currently hosts “Matter of Fact,” will moderate a discussion with Mark Parkinson, President & CEO, American Health Care Association (AHCA) and National Center for Assisted Living (NCAL), and Andy Slavitt, Senior Advisor for The Bipartisan Policy Center and former Acting Administrator of the Centers for Medicare and Medicaid Services. From the vantage point of four weeks out from the general election, the panel will help attendees understand the potential policy impacts and what’s at stake for their businesses.

Also focusing on the election and associated political realities, household names David Gergen and David Brooks will turn their considerable expertise and experience – and wit – to shed light on the factors to consider as November 3 approaches. This election has the potential to impact the seniors housing and care sector both directly and indirectly, and many attendees will be watching the discussion closely.

NIC Talks

Our popular NIC Talks series returns—featuring another group of uniquely qualified, passionate thought leaders, including business leaders, academicians, and leading advocates, sharing their perspectives on the question “How will COVID-19 impact the future of aging and aging services?”

In the style of “TED Talks,” these popular presentations often pack a powerful punch. Attendees can look forward to viewing the presentations (available on-demand for convenience) in the first ’Education’ week of the conference. In the second ‘Connections’ week, attendees can participate in Zoom calls, led by some of the NIC Talks presenters, for interactive group discussions.

This year’s speakers include Dr. Louise Aronson, Professor, UCSF Division of Geriatrics, who will address “Ageism and COVID-19: Opportunities to Create a Better Future.” Dan Cincelli, Principal, Perkins Eastman, will provide the most recent thinking on architectural and community design innovation, in “How will disruptive forces like COVID-19 impact the design of senior living?” Krista Drobac, Executive Director, Alliance for Connected Care, will bring her audience up to date on one of the most widespread innovations to take root during the pandemic, in “Telehealth Beyond COVID-19, A Bigger Leap Ahead.” Another major driver of change in seniors housing and care is in the delivery of healthcare for a population that, due to their frailty and vulnerability, can, in many places, no longer be routinely transported to clinics and hospitals. Dr. Tim Ferris, CEO, Mass General Physicians Organization and Professor, Harvard Medical School, will cover the deep and lasting implications of this development, in “Impact of COVID-19 on Healthcare Delivery.”

Jo Ann Jenkins, the CEO of AARP, the world’s largest nonprofit, nonpartisan membership organization, will also present a NIC Talk, from the broader perspective of 100 million Americans who are 50 and older, who wish to achieve health security, financial resilience and personal fulfillment.

Still the Best Networking Opportunity in the Sector

Although nothing can replace in-person networking, the 2020 NIC Fall Conference offers the most connectivity available in today’s environment. A variety of live networking events will present opportunities to interact with peers, experts, and attendees interested in focused discussions.

Several platforms, including the new NIC Community ConnectorTM, offer powerful tools to interact with other attendees, and even speakers and experts, whether to discuss business opportunities, gain insights, or just break the ice with a cocktail.

The NIC Community ConnectorTM

All attendees who complete a registration form gain exclusive, complimentary access to NIC’s new networking platform, the NIC Community Connector. The innovative online platform provides a means to search for potential new contacts, and to communicate directly with decision-makers across the industry. It was custom designed to suit the needs of capital providers, owners, operators, service providers, and other stakeholders across the seniors housing and care sector.

This groundbreaking new tool will reshape how the industry connects capital, operators, and individuals, in a world where traditional networking is on hold – and may be changed forever.

While launching in parallel with the 2020 NIC Fall Conference, the complimentary NIC Community Connector will remain accessible to all attendees through the end of the 2020 calendar year. Conference attendees will retain their access to a powerful set of tools that will streamline efforts to identify financing partners, seek property transactions, and build and grow networks. Beyond launch, NIC will continue to refine and expand the NIC Community Connector, which will provide subscribers with year-round networking capabilities.

BraindatesTM

In the second week, Connections Week, attendees will be able to connect with each other via braindateTM, which NIC rolled out for the 2020 NIC Spring Conference. The platform facilitates focused, issue-specific discussions 1-on-1 or in small groups. As many who attended the 2020 NIC Spring Conference already know, the braindate platform offers both the intimacy of a small group discussion on a pre-determined topic of shared interest (which can be defined by participants), and the efficiency and convenience of scheduled online meeting times.

Peer-to-Peer Connections

Throughout the event, attendees will be presented with numerous opportunities to participate in live Zoom meetings with experts and peers. Some live meetings will be focused on social networking, with happy hours, and even live entertainment on tap. Other Zoom meetings will be oriented to discussions on the most important and relevant issues, as session participants address the challenges and opportunities of today’s marketplace, and help each other, as they plan for the future. During these sessions, NIC will facilitate ‘breakout rooms’ via Zoom, designed to allow for more intimate, focused discussions.

A Personal Touch

As with all NIC events, attendee experiences will include opportunities for some personal and professional development, or to take a break to enjoy live entertainment with their peers. ‘The NIC’ will continue to offer a LinkedIn help desk, helping attendees update their profiles and learn the latest tips and techniques for staying connected and visible in the leading social networking platform for professionals. Videos and presentations, primarily available on-demand, will be available for attendees who wish to take a break with a selection of personal development and wellness programming.

Many attendees are NIC MAP® Data Service clients, or may wish to learn how the leading provider of data and analysis for seniors housing and care can help their businesses. NIC will offer a number of opportunities for existing users and those interested in learning more to access NIC MAP staff expertise. In Peer-to-Peer sessions, existing data users can dive a little deeper into effective applications of the platform, what its latest updates have to offer, and how to get the most out of the many available tools at their disposal.

The Most Accessible NIC Conference, Ever

Aside from the obvious cost-savings that come with a virtual platform, such as the elimination of travel and hotel costs, this year’s attendees will enjoy a time-savings by staying at home or in the office, while participating over two convenient weeks and, for most education sessions, by accessing content on-demand, both during and after the event. The online platform introduces the possibility that many more team members within a given organization can participate.

Early Bird pricing, which is available through September 8, reduces already low pricing an additional 20 percent. This, and the fact that NIC offers even lower bundled pricing, should encourage leaders to seize this unprecedented opportunity to expand staff access to all that the sector’s premiere event has to offer. Now is the time to provide key managers and rising leaders, who might otherwise not attend a NIC event, with all the insight, up-to-the-minute discussion, and relationship-building potential available at the 2020 NIC Fall Conference, during this time of intense change and uncertainty.

Thoughts from NIC’s Chief Economist

By Beth Burnham Mace

The need for high frequency data—be it on the economy, the incidence of the coronavirus, COVID-19 testing results from residents and staff, or the broader effects of the virus on the seniors housing sector—has been heightened since March as we all try to get a pulse on the impact of the pandemic on our lives and businesses. Jim Bianco, a bond market analyst, tracks several high frequency statistics for real time insights. In his view and given the influence of COVID on all aspects of our lives these days, foremost among these indicators is the daily infection count of COVID. This is because this metric is a strong predictor of consumer behavior and their decisions on how much to be engaged in the broader economy outside of their homes, as well as government policy makers’ or businesspersons’ decisions to open or close economies and roll back or accelerate re-openings. As he stated in a recent conference call, “Economic decisions are being driven by the raw case count.” Said another way, a resurgence in case counts in any part of the country is a good predictor of a forthcoming slowdown in that local economy as businesses and households shift into a lockdown mentality.

The need for high frequency data—be it on the economy, the incidence of the coronavirus, COVID-19 testing results from residents and staff, or the broader effects of the virus on the seniors housing sector—has been heightened since March as we all try to get a pulse on the impact of the pandemic on our lives and businesses. Jim Bianco, a bond market analyst, tracks several high frequency statistics for real time insights. In his view and given the influence of COVID on all aspects of our lives these days, foremost among these indicators is the daily infection count of COVID. This is because this metric is a strong predictor of consumer behavior and their decisions on how much to be engaged in the broader economy outside of their homes, as well as government policy makers’ or businesspersons’ decisions to open or close economies and roll back or accelerate re-openings. As he stated in a recent conference call, “Economic decisions are being driven by the raw case count.” Said another way, a resurgence in case counts in any part of the country is a good predictor of a forthcoming slowdown in that local economy as businesses and households shift into a lockdown mentality.

High Frequency Economic Indicators. The impact of this causal relationship and the recent resurgence of COVID in parts of the country, is evident in a host of statistics that show a pause in recent economic activity. One such indicator is data from OpenTable which shows that the number of restaurant reservations in the U.S. fell by 100 percent from year-earlier levels in the middle of March and then recovered by June to being down by about 50 to 60 percent, where it has since remained. Credit card and debit card sales data from Affinity Solutions show similar trends that consumer purchases and expenditures have started to go sideways. Apple data on mobility activity as measured by how many people are asking for maps and locations, as tracked on their Apple devices, show mass transit activity has flattened, as does data from TSA regarding air travel throughput. Other less traditional sources of economic indicators include data on trucking activity, traffic congestion indices, gasoline demand, and residential real estate activity.

More traditional indicators of economic activity are also sputtering to some degree. Initial filings for unemployment insurance—among the timeliest labor market indicator—have certainly improved after having reached the nose-bleedingly and shockingly-high levels in the immediate aftermath of the pandemic in March (more than six million per week in those heady days) to a much lesser pace. However, initial filings seem to be stuck again. As the pandemic enters its sixth month, claims remained uncomfortably high at more than 1 million in the week ending August 22, after having fallen earlier in August. For perspective, while improved, one million new claims per week is still far higher than at any time prior to COVID-19. Moreover, more than 27 million persons were still collecting unemployment insurance in the week ending on August 8 including those who are collecting benefits under expanded pandemic assistance. And, unfortunately, even as businesses have reopened and jobs have returned, others are being laid off as virus-related business interruptions continue. As time goes on, many of those same workers are learning that temporary layoffs are turning into permanent company closures and job losses. The risk of permanent damage to the labor market remains high which will slow the pace of recovery.

Regionally, and according to an analysis by Moody’s Analytics, recent data on state nonfarm payrolls from the Bureau of Labor Statistics show that since employment levels collapsed in the immediate aftermath of the pandemic, only 22 states have recouped more than 50% of their losses. Many states have either stopped or reversed their re-openings. Four states—North Dakota, Hawaii, Alaska, and New Mexico—and the District of Columbia have failed to recover 25% of their pandemic job losses as of July. These four states stand out because of their economic reliance on pandemic-sensitive sectors such as energy or tourism. A few states that were early hot spots for COVID-19, such as California, New York and Illinois, have also recouped below-average shares of payroll losses, but other states that were hit early and hard, such as Washington, have fared better.

Broadly, these patterns indicate that, until a vaccine is discovered and becomes widely distributed, there will be a limit to the economy’s recovery. In my view, the long sought-after and highly desired V-shape recovery is not likely to occur. As the Fall approaches, we will have more clarity on whether COVID will uniformly re-appear strongly across the nation, continue to shift its destruction from one part of the country to another, or start to diminish. The pandemic itself will determine the degree that further shutdowns are needed and the near-term economic outlook.

High Frequency Seniors Housing Data

While long held as an aspiration, the COVID-19 pandemic created an urgency to report the NIC MAP® data at a higher frequency. As a principle tenet of NIC, we have always understood that transparency, accuracy, and timeliness are key factors for data-informed decisions. With full throttle, and starting in May 2020, the NIC MAP® Data Service began to report at a monthly frequency key concepts. The data represents performance for the three most recent months, labeled as the final month for the reported period, i.e., the rolling period reported for July 2020 is May-June-July 2020.

The new data provides a closer look at the pattern of total and stabilized occupancy, among other concepts. For example, the new Intra-Quarterly database shows that the largest decline in assisted living stabilized occupancy occurred early during the second quarter in the April reporting period, the first full month of the COVID-19 pandemic in the US. In the April reporting period (defined as the February-March-April rolling period), occupancy for assisted living for the Primary Markets fell 1.8 percentage points to 86.0%. The decline in May was less at 0.8 percentage point (to 85.2%), and the decline in June was even less at 0.6 percentage point (to 84.6%). However, in July, the drop in occupancy accelerated to a full 1.7 percentage points to push the overall rate to 82.9%. Total occupancy was even lower at 80.5%, a new record low. This decline, after two months of seemingly better occupancy patterns, likely reflects the recent growth in COVID-19 cases in many parts of the country.

In another new initiative, NIC recently launched its Skilled Nursing COVID-19 Tracker that shows the week-over-week change rate for new resident cases of COVID-19 within skilled nursing properties on a per-property basis, by geography. The data, based on CMS reports, is displayed in an easy-to-use interactive dashboard that allows analysis down to the county level. The interactive dashboard provides an indicator on the rate of virus spread within skilled nursing communities by geographic location, offering a way to better understand where cases are spreading, slowing, or remaining flat. Data show incremental confirmed cases week-over-week on a per-property basis, percent of residents with newly confirmed cases, and occupancy changes (based on CMS data) in same store skilled nursing properties. Please check it out!

And with that and as always, I appreciate and welcome your comments, thoughts, and feedback.

Executive Survey Insights | Wave 10: July 20 – August 2, 2020

By Lana Peck, Senior Principal, NIC

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector.

NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector.

This Wave 10 survey sample includes responses collected July 20 to August 2, 2020 from owners and executives of 73 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Key Takeaways

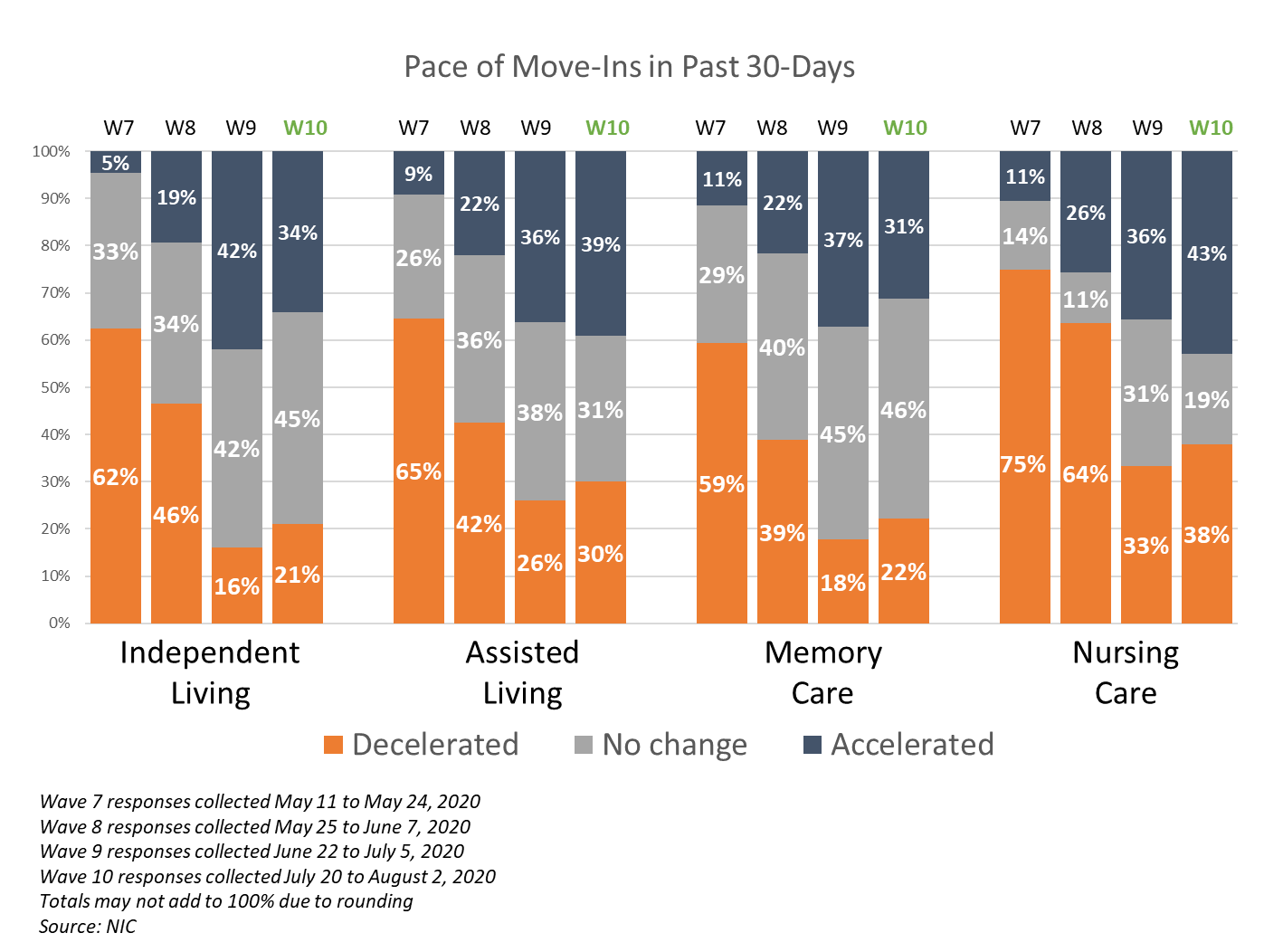

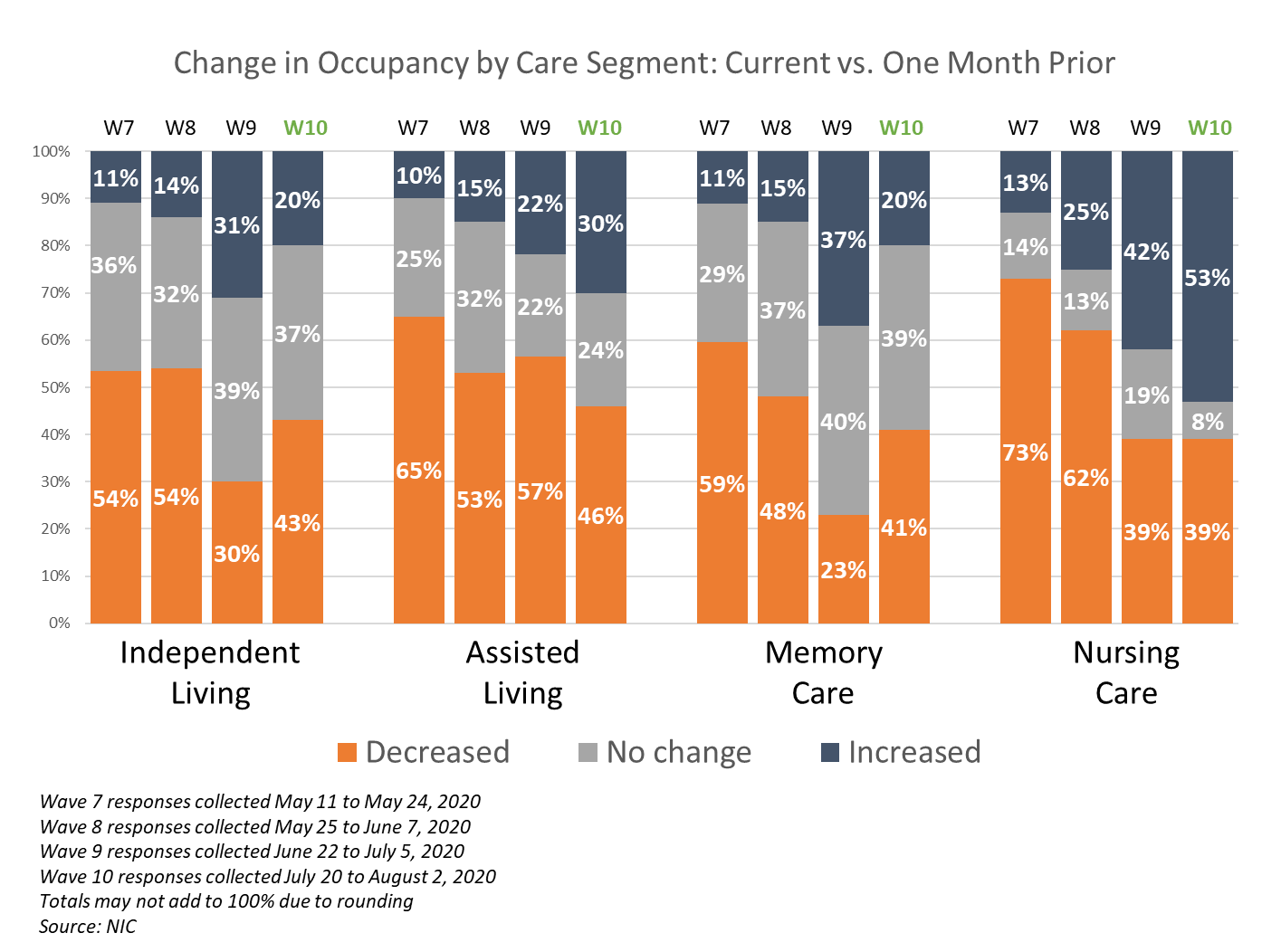

- The nursing care and assisted living segments continued to see the highest shares of organizations reporting an acceleration in move-ins and upward movement in occupancy rate changes since the survey began. However, the Wave 10 survey revealed a slight deterioration in the pace of move-ins, specifically in the independent living and memory care segments, resulting in downward changes in occupancy rates month-over-month and week-over-week for these care segments.

- While, in each of the past four waves of the survey, roughly two-thirds to three-quarters of organizations cited increased resident demand (many due to pre-COVID-19 planned move-ins resuming) as a reason for acceleration in move-ins., the majority of the Wave 10 survey respondents indicated that they do not have a backlog of residents waiting to move in. And, despite continuing occupancy challenges, two-thirds of organizations report they are not currently offering rent concessions to attract new residents.

- Regarding reasons for a deceleration in move-ins, most organizations continued to cite a slowdown in leads conversions/sales, while considerably more in Wave 10 than in Wave 9 cited resident or family member concerns (60% in Wave 10 vs. 38% in Wave 9), presumably due to the increase of COVID-19 cases in many areas of the country since June and July.

- Comparing Wave 10 responses (July 20 to August 2, 2020) to Wave 3 responses (April 13 to 19, 2020), more respondents in the Wave 10 survey expect an increase in their development pipelines going forward (30% vs. 15%), and more are tapping agency or temp staff to fill staffing vacancies (42% vs. 36%).

Nursing Care Move-Ins Continue to Accelerate

At this point in the pandemic, most organizations are easing move-in restrictions, but others are increasing move-in restrictions. About half of organizations with more than one property in Wave 10 of the survey are easing move in restrictions in some or all geographies (53%), while about one in five are increasing move-in restrictions in some or all geographies (21%). Among single-site organizations, most (42%) are easing move-in restrictions, while about a quarter (26%) are increasing move-in restrictions at this time.

In Wave 10 of the survey, 43% of organizations with nursing care beds and 39% of organizations with assisted living units noted a continuing upward trend in move-ins in the past 30-days—the highest shares achieved by these segments in the survey time series. However, fewer organizations with independent living and memory care units reported an acceleration in move-ins than in Wave 9 of the survey.

Organizations with any nursing care beds cited hospital placement as a reason for an acceleration in move-ins more frequently than in the prior three waves of the survey. Other reasons cited included properties being re-opened for tours, current and new residents feeling more comfortable about moving-in, and seniors in the lead pipelines ready to move-in. Nevertheless, as of Wave 10, about two-thirds of organizations report they are not currently offering rent concessions to attract new residents. Similarly, 70% indicate they do not have a backlog of new residents waiting to move in.

The nursing care segment continued to have the largest shares of organizations with increasing occupancy rates. In Wave 10, approximately half (53%) reported an upward change in month-over-month occupancy—the highest in the survey time series for the nursing care segment—likely a result of more hospitals around the country resuming greater amounts of elective surgeries that require post-acute care rehabilitation, and/or seniors housing residents moving to higher levels of care.

Time Frames for Receiving COVID-19 Test Results Must Improve

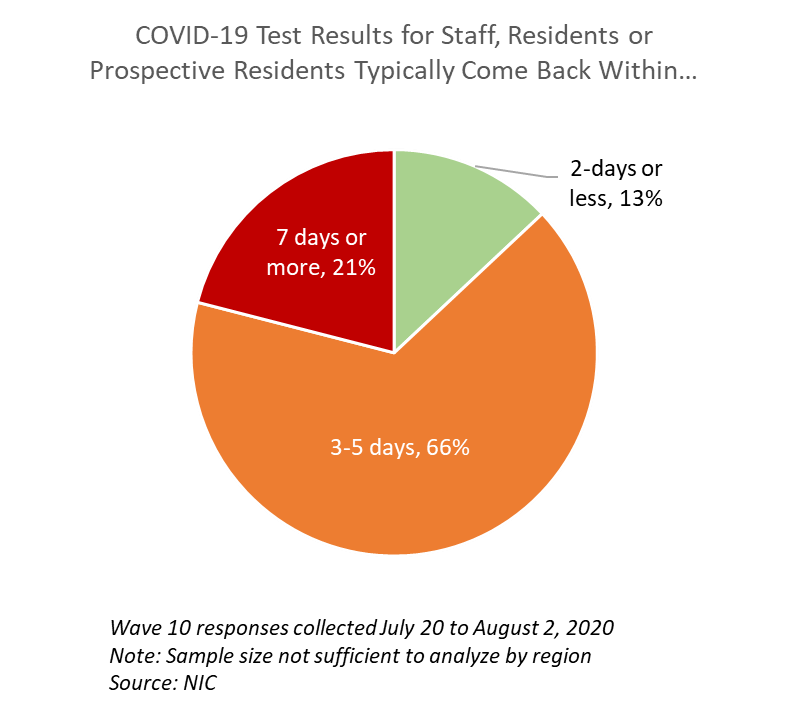

Two-thirds of organizations reported that COVID-19 test results for staff, residents or prospective residents are typically available in three to five days (66%). However, one in five say it is taking seven or more days to receive results (21%). This is problematic. Real time testing with results for seniors housing operators is critical if making decisions based on the presence of COVID-19. According to the Wave 10 Executive Survey, just 13% of operators said they are getting COVID-19 test results back within 48 hours.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are rapidly changing. The results of our joint efforts to provide timely and informative data to the market in this challenging time have been significant and noteworthy.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the upcoming Executive Survey: Market Fundamentals, please send a message to insight@nic.org to be added to the email distribution list.

Capex in Seniors Housing

By Dennis Murphy, Senior Director of Investments, Benchmark Senior Living

Seniors housing, as a property type, has a shorter history in comparison to other commercial real estate property types among institutional investors. As a result, many seniors housing operators have not had to weigh the decision of whether to invest a significant amount of capital expenditure (capex) dollars in order to remain competitive. The strong financial performance experienced in seniors housing properties over the last decade has attracted more capital to the market and resulted in a major influx of new construction for those looking to make opportunistic returns. The number and wealth of the baby boomer population offer a compelling thesis for outsized future demand and likely continued construction in most markets. However, the increased competition associated with the significant recent new inventory has begun to take a toll in the form of reduced occupancy and stagnant rate growth for those older, less updated properties in the market. With so many of the nation’s seniors housing communities approaching 20-plus years old, the question of when and how much capex should be put into older seniors housing properties to remain competitive in today’s environment is being debated across the industry.

Seniors housing, as a property type, has a shorter history in comparison to other commercial real estate property types among institutional investors. As a result, many seniors housing operators have not had to weigh the decision of whether to invest a significant amount of capital expenditure (capex) dollars in order to remain competitive. The strong financial performance experienced in seniors housing properties over the last decade has attracted more capital to the market and resulted in a major influx of new construction for those looking to make opportunistic returns. The number and wealth of the baby boomer population offer a compelling thesis for outsized future demand and likely continued construction in most markets. However, the increased competition associated with the significant recent new inventory has begun to take a toll in the form of reduced occupancy and stagnant rate growth for those older, less updated properties in the market. With so many of the nation’s seniors housing communities approaching 20-plus years old, the question of when and how much capex should be put into older seniors housing properties to remain competitive in today’s environment is being debated across the industry.

In order to understand how much capex should be invested, an understanding of how to categorize the various forms of capex is key. Investors and operators typically separate capex into a few buckets:

- Room Turns

- Common Areas/Customer Facing Furniture, Fixtures, and Equipment (FF&E)

- Back-of-the-House Mechanicals

- Information Technology

Room turns capex is the area with the best opportunity to realize meaningful return of your capex investment through the ability to increase market room rates for new residents. The differential you can charge for new, updated units versus older units should drive your decision on how much to invest. Additionally, many markets have new competition, which can give you a general idea of what consumers in that market are willing to pay. NIC launched the Actual Rates Initiative to help operators and capital partners determine what rates are actually achieved in certain markets covered by NIC MAP®. Prior to this information becoming available, operators utilized the local knowledge of their sales teams in order to understand competitor pricing. The sales teams can often collect market rates vs achieved rates, which can be misleading if heavy discounting is occurring at competitive communities.

Room turns capex varies by market and is closely tied to the acuity of the product. Independent living units typically have an average length of stay of five to eight years and, therefore, do not frequently require room turns. This long length of stay helps mitigate capex costs in independent living communities, however unit sizes are larger, require full kitchens and, in some markets, call for higher end finishes to attract prospective residents. These independent living prospective residents are typically more lifestyle focused than needs-driven, and therefore the bells-and-whistles of the unit can often sway the move in decision. Upgrades like stainless steel appliances, built-out closets, lighting and technology packages are all important to the consumer. Unit turn capex investment decisions for entrance fee properties are easier when the renovation/upgrade costs can be built into the initial entrance fee pricing, whereas rental products often require similar cost outlays but with a much longer period of time for generating return on the investment.

Rental product returns will depend on your ability to increase pricing and typically will not be fully realized until the exit of the property. Newer product in the market with proven higher rates can help justify such an investment. Both return on cost and IRR calculations are utilized to determine the potential value creation associated with capex investment.

This same methodology applying to rental unit capex also applies to assisted living and memory care units, with some differences. Since these units are smaller than independent living units and rarely include a full kitchen, renovation costs are typically much lower. On the flipside, with an average length of stay of only 18-24 months, the frequency of room turns is much higher than in independent living.

Given the higher turnover, suppliers have been improving the durability of products in assisted living and memory care to reduce the need for full replacement for every room turn. The choice of carpet, appliances, and counter tops are all important and should be carefully selected to meet current and future customer expectations, as well as hold up with the increased wear-and-tear associated with higher acuity. Suppliers have partnered with designers and operators to assist in making these decisions effectively.

In markets where unit turn upgrades do not yield a higher rental rate, minimizing cost is essential. In these cases, the argument needs to be made that without at least some unit upgrade, those units would otherwise remain vacant and the reduced occupancy/net operating income (NOI) that would otherwise be experienced would justify the investment. This type of defensive capex can be a tough sell to capital partners but can be justifiable.

Once you have determined the scope of room turns capex and the market rent premium associated with the unit turn, you can begin looking at customer facing FF&E enhancements. Some of the premium on newer units will apply to those common area renovations required to remain competitive. Many operators have gathered customer insight to determine the most desired amenities, such as secondary dining venues, spa and fitness areas, gardening space, etc. These updated amenity spaces would replace underutilized areas in existing buildings such as theater rooms. To understand what is attractive in the market, operators can look at newer product and determine if the amenities offered are worth considering in their own buildings. Operators can also conduct focus groups to understand what prospective residents and their families are truly looking for in a senior living community.

Next and often the most neglected area of capex investment, is the back-of-the-house mechanicals. If repairs can be made to avoid large capex expenses, often investors and operators will naturally opt for the cheaper repair. However, you should consider the cost-benefit of potential continued repair costs versus the larger capex investment that will minimize such repair costs for years to come. This category is usually non-return on investment (ROI) generating and just a cost of doing business, but can sometimes see expense reductions through more energy efficient systems. In addition, COVID-19 has made operators review HVAC systems to ensure resident safety. When purchasing older assets, investors and operators should carefully inspect these systems to determine life expectancy, and build replacement and/or repair costs into the underwriting. Many back-of-the-house investments occur at the sale of an asset, when the buyer has been able to set aside a capex allowance for new systems, a roof, or other mechanicals as part of the transaction.

Information technology (IT) capex historically has not been significant, but IT has since become increasingly critical over the last decade. Given the need for reliable internet connectivity for applications like electronic health records (EHR), IT investment is now essential. For buildings requiring a Wi-Fi retrofit, this can be a very expensive proposition before even beginning to consider spending requirements for future applications such as EHR. The use of improved technology in buildings is not just for the needs of the operator but also the demand of residents who now video chat with loved ones, stream video and have social media accounts. For these reasons, many operators will be forced to make IT improvements in order to remain competitive. Some operators have begun to charge ’technology fees‘ to residents in an effort to recoup some of these new expenses.

By separating capex into these buckets, operators can begin to evaluate those generating the best returns and build strategic capex plans for older assets in order to remain competitive.