NIC MAP Data Reveals Quarterly Rent Growth Reaches 2%

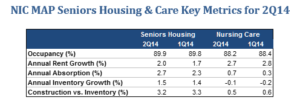

ANNAPOLIS, Md. –The average occupancy rate for seniors housing properties in the second quarter of 2014 was 89.9% overall, an increase of 0.1 percentage points from the prior quarter and a 1.0 percentage point increase from a year earlier. As of the second quarter of 2014, occupancy was 3.0 percentage points above its cyclical low of 86.9% during the first quarter of 2010.

The occupancy rate for independent living properties and assisted living properties averaged 90.5% and 89.0%, respectively, during the second quarter of 2014. When compared to the prior quarter, independent living occupancy increased by 0.3 percentage points, while assisted living occupancy decreased by 0.1 percentage points. The occupancy rate for independent living is now 3.7 percentage points above its cyclical low, while the occupancy rate of assisted living is 2.4 percentage points above its respective cyclical low.

During the second quarter of 2014, the rate of seniors housing annual asking rent growth accelerated to 2.0% from 1.7% in the prior quarter, and was 0.2 percentage points below its pace one year earlier during the second quarter of 2013.

“The improving job market as well as gains in household confidence may be factors supporting demand for seniors housing” says Beth Mace, NIC’s chief economist. She noted that jobs have finally reached their pre-recession peak levels and that the unemployment rate, at 6.1%, is now at its lowest level since September 2008.

Seniors housing annual absorption was 2.7% as of the second quarter of 2014, compared to 2.3% during the first quarter of 2014 and 1.8% during the second quarter of 2013.

In the second quarter of 2014, the seniors housing annual inventory growth rate was 1.5%, an increase of 0.1 percentage points from the prior quarter. Current construction as a share of existing inventory for seniors housing was 3.2%, which is 0.1 percentage points below that of the previous quarter.

“The overall moderate rate of seniors housing construction was again sustained,” says Chuck Harry, NIC’s managing director and director of research and analytics. “But the resulting rates of inventory growth for independent living and assisted living are quite different—annual inventory growth for independent living registered only 0.5%, while assisted living’s inventory grew by 3.1% and marks its fastest rate of growth ever within the NIC MAP® time series which dates back to 2007.”

The nursing care occupancy rate was 88.2% in the second quarter of 2014, a decrease of 0.2 percentage points from the first quarter of 2013.

Nursing care annual inventory growth was -0.1% in the second quarter of 2014, continuing the established trend of slightly declining inventory growth. Nursing care annual absorption was 0.7% in the second quarter of 2014. Private pay rents for the sector grew 2.7% year-over-year this quarter, which is 0.1 percentage points below the pace of the prior quarter.

About NIC

The National Investment Center for the Seniors Housing & Care Industry (NIC) is a 501(c)(3) organization whose mission is to facilitate informed investment in the industry. NIC’s NIC MAP® Data and Analysis Service tracks more than 13,000 properties on a quarterly basis in the largest metropolitan markets. Proceeds from NIC’s national conference and other events are used to fund data and research on issues of importance to lenders, investors, providers, developers, and others interested in meeting the housing and care needs of America’s seniors. For more information, visit www.NIC.org or call (410) 267-0504.

# # #