Independent Living Construction Starts Climb and Surpass Assisted Living Starts

FOR IMMEDIATE RELEASE: Wednesday, July 6, 2016

Contact: Biba Aidoo, 443-926-3181 or communications@nic.org

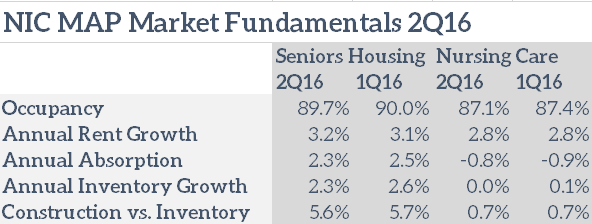

ANNAPOLIS, Md. – The average occupancy rate for seniors housing properties in the second quarter of 2016 was 89.7%, as net additions in inventory outpaced absorption of units. This represented a decrease of 0.3 percentage point from the prior quarter, and was unchanged from year-earlier levels. During the past three years, occupancy has averaged 89.8%. As of the second quarter of 2016, occupancy was 2.8 percentage points above its cyclical low of 86.9% during the first quarter of 2010.

The occupancy rates for independent living properties and assisted living properties averaged 91.0% and 88.0% respectively during the second quarter of 2016. When compared to the prior quarter, the occupancy rate for independent living was down 0.3 percentage point and down 0.4 percentage point from its eight-year high in the fourth quarter of 2015. Occupancy for independent living was unchanged from year-earlier levels. The occupancy rate for assisted living was down 0.2 percentage point from the first quarter, but up 0.1 percentage point from year-earlier levels.

During the second quarter of 2016, the rate of seniors housing’s annual asking rent growth was 3.2%, which was 0.1 percentage point above the prior quarter’s pace and 0.8 percentage point above its pace one year earlier during the second quarter of 2015. This was the fastest growth rate since the second quarter of 2008.

Seniors housing annual absorption was 2.3% as of the second quarter of 2016, compared to 2.5% during the first quarter of 2016 and 2.1% one year earlier during the second quarter of 2015. Seniors housing annual inventory growth rate in the second quarter of 2016 was 2.3%, down 0.3 percentage point from the prior quarter.

“By property type, it is notable that independent living’s annual absorption rate slowed, while its annual rate of inventory growth is accelerating,” said Beth Burnham Mace, chief economist for NIC. “The annual absorption and inventory growth rates for assisted living are decelerating, although the pace of activity is still stronger for assisted living. If this pattern continues, it suggests that there will be additional downward pressure on occupancies for independent living in the near future.”

Current construction as a share of existing inventory for seniors housing slowed 0.1 percentage point to 5.6% as of the second quarter of 2016, though it is still up 0.5 percentage point from the second quarter of 2015.

Seniors housing construction starts during the second quarter of 2016 preliminarily totaled 3,657 units, comprised of 1,890 independent living units and 1,767 assisted living units. On a four-quarter basis, starts totaled 18,022 units, the weakest pace since the fourth quarter of 2014.

“This construction cycle had been dominated by starts of assisted living units until this quarter,” noted Chuck Harry, NIC’s chief of research and analytics. “During the second quarter, starts of independent living units doubled from that of the prior quarter and surpassed assisted living unit starts, which declined by roughly one-third from their level during the prior quarter.”

The nursing care occupancy rate decreased 0.3 percentage point to 87.1% during the second quarter of 2016.

The nursing care annual inventory growth rate was zero in the second quarter of 2016, while annual absorption was down 0.8%. Private pay rents for the sector grew 2.8% year over year this quarter, the same rate as the prior quarter.

[Note: For 2Q16 NIC MAP data specific to your local metro market, please refer to the regional key metrics charts.]

About NIC

The National Investment Center for Seniors Housing & Care (NIC) is a 501(c)(3) organization whose mission is to advance the quality and availability of seniors housing and care options—from independent living, assisted living, and memory care, to skilled nursing and post-acute care. NIC provides research, education, and increased transparency that facilitate leadership development, quality outcomes, and informed investment decisions with respect to seniors housing and care.

Since 1991, NIC has been the leading source of research, data, and analytics for owners, operators, developers, capital providers, researchers, academics, public policy analysts, and others interested in meeting the housing and care needs of America’s seniors. NIC has proudly sponsored the Seniors Housing & Care Journal, a peer-reviewed journal for applied research in the seniors housing and care field, since 1993. One of NIC’s major initiatives to further its mission is the NIC MAP® Data Service (NIC MAP). NIC MAP’s web-based suite of research and analytic tools track and report seniors housing and care data for more than 14,000 properties within 140 U.S. metropolitan markets. Established in 2004, NIC MAP creates transparency for seniors housing and care by offering accurate, unbiased, and actionable market-level data on all of the sector’s property types and care segments, including independent living, assisted living, memory care, and nursing care, as well as continued care retirement communities (CCRCs). Our data is updated quarterly, monthly, and weekly, and is inclusive of property-level inventory by unit type, sales transactions, properties under construction and in the planning phase, aggregated occupancy and rent comparables, demographics, and much more. For more information, visit natinvcenterdv.wpengine.com or call 410-267-0504.

###