Third quarter 2019 sets record for greatest net new unit demand, and construction slowdown may be near.

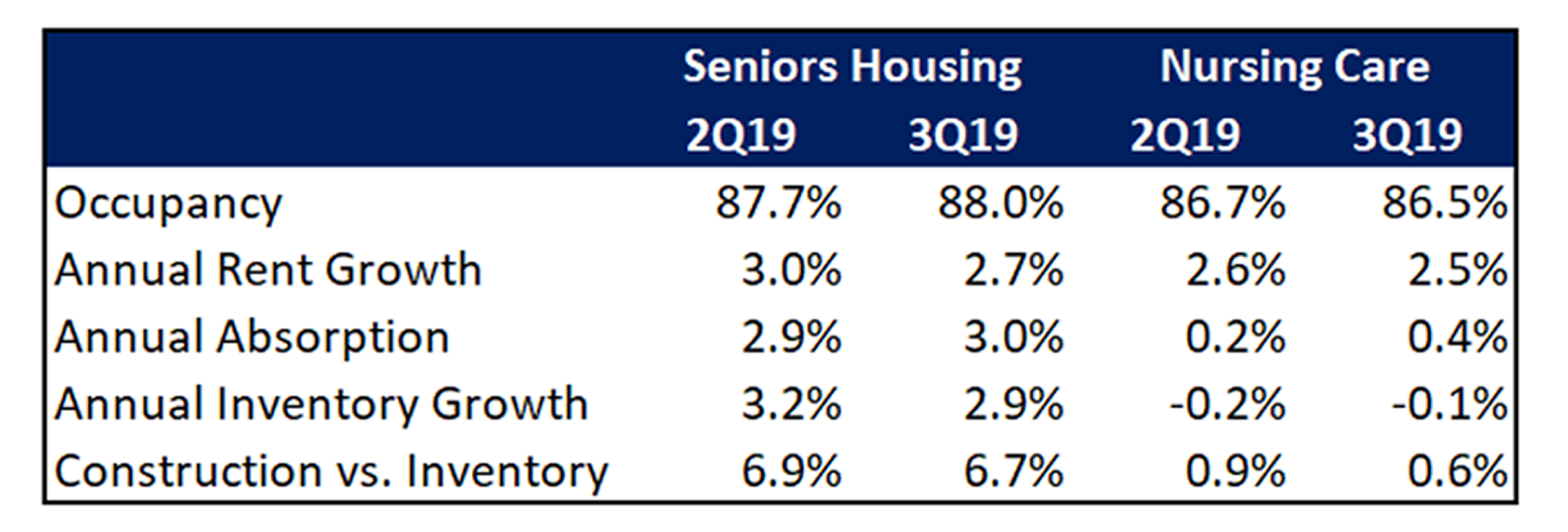

ANNAPOLIS, Md. (October 10, 2019)— Senior housing occupancy increased to 88.0 percent in the third quarter of 2019 from its lowest level in eight years (87.7%) recorded during the previous quarter, according to new data from the National Investment Center for Seniors Housing & Care (NIC).

Of the 31 metropolitan markets that comprise NIC’s Primary Markets, San Jose (95.5%) and Minneapolis (91.3%) experienced the highest occupancy rates in the third quarter. Las Vegas (82.3%) and Houston (81.5%) recorded the lowest occupancy rates.

San Antonio experienced the largest occupancy increase from a year ago, rising from 80.2 percent to 84.6 percent. Baltimore saw the largest year-over-year decrease, falling from 92.5 percent to 90.6 percent.

“San Jose retains the distinction of having the highest occupancy rate of any major market in the country, as significant barriers to entry constrain development,” said Chuck Harry, NIC’s head of research and analytics. “Houston, on the other hand, places fewer restrictions on development, which is pressuring occupancy.”

During the quarter, net new unit demand totaled 4,977 units, the greatest number of new units in any quarter since NIC began reporting the data in 2006. At the same time, the quarterly change in the number of units added to existing inventory slowed to 3,832 units, the fewest since mid-2016. The data suggest a possible slowdown in new senior housing construction.

NIC data also show that assisted living occupancy increased to 85.4 percent in the third quarter, from a previous record low of 85.1 percent for the past three quarters as relatively robust demand outpaced new inventory growth. The occupancy rate for independent living increased to 90.2 percent in the third quarter, 10 basis points higher than year-earlier levels, but below its rate earlier in 2019.

“The data suggest strong consumer demand for assisted living and independent living, which supported the overall increase in the national occupancy rate that we’ve experienced,” said Beth Burnham Mace, NIC’s chief economist. “Meanwhile, the construction starts data suggest a slowdown in development activity, especially for assisted living. This should lay the groundwork for improving sector performance, provided there are no significant hiccups that could affect demand, such as drop in consumer confidence, a crash in the stock market, or a broad-based economic recession.”

NIC’s Primary Markets saw 17,932 new construction starts in the last four quarters, the fewest new starts since 2014. These construction starts amounted to 2.8 percent of total existing senior housing inventory, down from 4.0 percent a year ago and 4.6 percent in late 2017.

To learn more about NIC quarterly senior housing and skilled nursing data, please visit NIC.org.

A summary of the NIC MAP Data Market Fundamentals for 3Q19 is below.

# # #

For more information and to speak with an expert, please contact Rachel Griffith at 202-868-4824, RGriffith@MessagePartnersPR.com.

[Note: For the latest NIC MAP data specific to your local metro market, please refer to the regional key metrics charts.]

The National Investment Center for Seniors Housing & Care (NIC) is a 501(c)3 organization established in 1991 whose mission is to enable access and choice by providing data, analytics, and connections that bring together investors and providers in independent living, assisted living, memory care, skilled nursing and post-acute care. Through its industry leading annual conferences, NIC MAP® Data Service, research, analytics and sector outreach, NIC serves as an indispensable resource for the seniors housing and care sector. For more information, visit natinvcenterdv.wpengine.com and follow NIC on Twitter.